Gold, XAU/USD, Treasury Yields, Technical Analysis – Briefing:

- Gold prices evaporated intraday gains on hawkish Fedspeak

- 10-year Treasury yield on longest weekly streak since 1955

- XAU/USD eyeing Fed’s Williams and Evans before weekend

Recommended by Daniel Dubrovsky

Get Your Free Gold Forecast

Gold prices were lead a wild ride on Thursday as the yellow metal evaporated all its intraday gains to wrap up the trading session. Once again, XAU/USD succumbed to rising Treasury yields and a turnaround in the US Dollar.

The 10-year Treasury yield rallied today following still-hawkish commentary from Federal Reserve officials. Philadelphia President Patrick Harker noted that they will likely raise rates to “well above” 4 percent this year, opening the door to doing more as needed.

Over a weekly basis, the 10-year rate is looking at its longest consecutive rally since 1955! Today was also the first time since May that markets began pricing more than 2 hikes in 2023. All of this does not bode well for gold ahead, likely explaining the turnaround in prices overnight.

The economic docket is fairly light heading into the remainder of the week. More Fedspeak is due at 13:10 and 13:40 GMT from New York president John Williams and Chicago chief Charles Evans, respectively. Ongoing hawkish remarks will likely continue weighing on gold.

Gold Technical Analysis

Gold prices are nearing key support at 1614 after the falling trendline from March reinstated the downside focus. Confirming a breakout under that price, which is also the September low, exposes the 123.6% Fibonacci extension at 1562. That would open the door to downtrend resumption.

Recommended by Daniel Dubrovsky

How to Trade Gold

XAU/USD Daily Chart

Chart Created Using TradingView

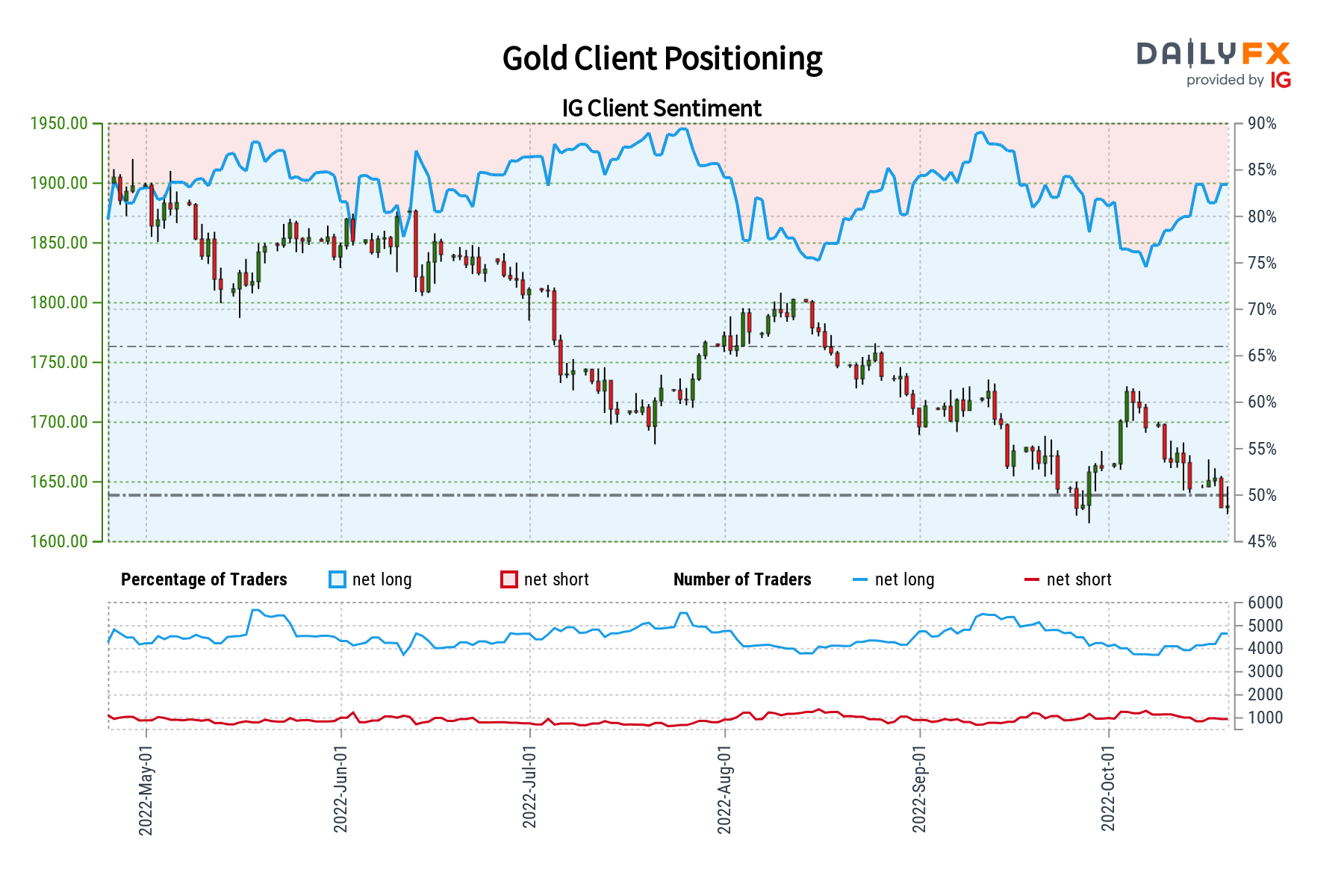

Gold Sentiment Analysis – Bearish

Meanwhile, IG Client Sentiment (IGCS) shows that about 82% of retail traders are net-long gold. That means that for every person short XAU/USD, about 4.5 are long. IGCS tends to function as a contrarian indicator. Downside exposure has decreased by 0.62% and 3.21% compared to yesterday and last week, respectively. This does not bode well for the anti-fiat yellow metal.

— Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or@ddubrovskyFXon Twitter