Boarding1Now

Two days ago, easyJet reported its year-end trading update. There are many positive signs of recovery with annual results revised upwards that are benefitting the whole sector. Even in a depressed market with a scenario of economic recession, there are companies that are able to see positive improvements. This is what is happening to the air transport sector, which after having suffered in the past, is now seeing glimmers of recovery. The reversal trend in bookings is a positive trend for the next quarter, especially for the Christmas period. Despite the economic constraints that require a reduction in consumption, low-cost sectors, including that travel, food, and clothing, are the one that suffer the less. From easyJet’s annual result, disclosed by the CEO, emerges that the losses at the end of the year will be “much lower than 12 months ago“, mainly thanks to the turnover boost expected in Q1 2023 and in the Christmas period (much higher compared to the levels at pre-COVID-19 crisis). According to easyJet’s (OTCQX:EJTTF) (OTCQX:ESYJY) preliminary data, the annual pre-tax loss is expected to be between £170 million and £190 million, in line with consensus estimates and much lower than last year’s loss of £1.14 billion. Numbers in hand, in the last quarter, the English carrier doubled its turnover and for the full financial year, easyJet expects sales of around £5.77 billion from £1.46 billion achieved in 2021. “Despite the difficulties families are facing, holidays and travel continue to be a priority” emphasized the CEO, adding also that “this does not mean that there are no uncertainties and economic difficulties“.

Ryanair implication and Conclusion

The easyJet case is not an isolated one. Ryanair (NASDAQ:RYAAY) (OTCPK:RYAOF) also expects higher bookings compared to the pre-COVID-19 period for the weeks of the Christmas holidays (despite higher-than-expected tariff increases). The same IAG, the holding company that controls British Airways Iberia and Air Lingus, has announced that expects a better quarter with a positive outlook for the year-end results. The recovery is not only valid for Europe. Among US airlines, American Airlines (AAL) revised its year-end forecasts upwards while Delta Air Lines (DAL), publishing its third-quarter results, asserted that the negative impacts of inflation and economic recession are not discouraging travel.

However, Ryanair’s number one, Michael O’Leary is more cautious, pointing out that demand is still supported by the savings accumulated during the pandemic and it is unknown how long this effect will last. He then added that he expects a reduction in the availability of spending due to increases in interest rates and the cost of living.

Why are we still positive?

- At the moment, Ryanair is able to contain fuel increases thanks to its hedging contracts until 2024. This is a clear advantage over the competition that makes the low-cost operator able to offer lower rates. This year, the average ticket price was €40 and we are forecasting an average gradual increase to €50 over the next five years;

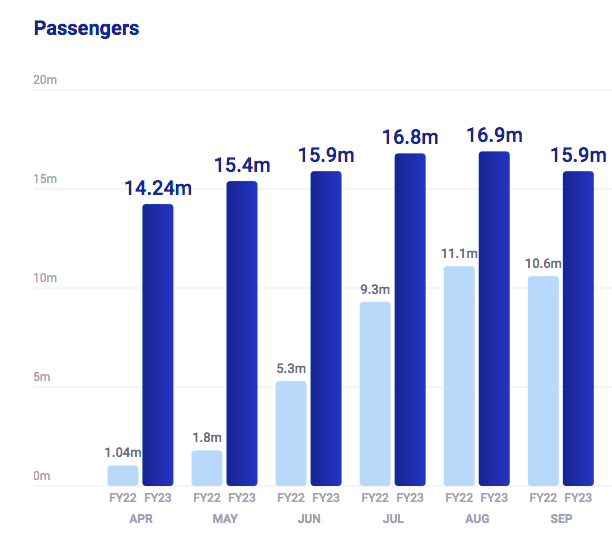

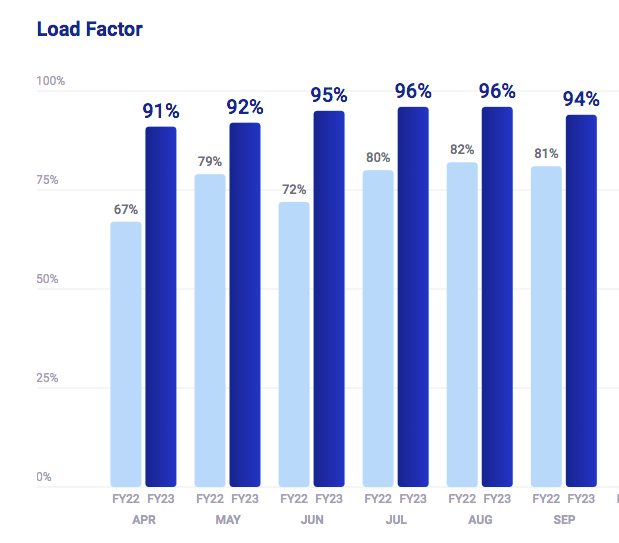

- Related to point 1), we are forecasting a higher load factor compared to its EU competitors (Wizz (OTCPK:WZZAF) (OTCPK:WZZZY) and easyJet); we already commented on the strong results in August, and as we can see, the September load factor was strong (fig 1 and 2);

- As in previous recessions, people are switching from high-fare airlines to low-cost ones such as Ryanair in an effort to keep costs down. Ryanair’s game-changer strategy is still valid. Our conclusion still holds: “more seats, less fuel consumption, higher capacity loads, lower tariffs, and consequently more customers that equal more profit“;

- Italy has become the second market for Ryanair (after Spain), surpassing the UK. Ryanair expects to transport 56 million passengers to 30 airports, many more than the 39 million passengers in the pre-COVID. Important to note is that the latest problem with airports has been limited mainly to England and some European hubs such as Munich and Amsterdam. In Italy, there were no problems.

- Related to point 4), Ryanair managed to contain the cuts to flights thanks to its Boeing 737 Max fleet which carry 4% more passengers and consume 16% less fuel.

easyJet’s numbers were very supportive, Ryanair is a better-managed company with lower costs and a competitive advantage in fuel hedging. Having said that, we confirm our thesis and Mare Evidence Lab’s valuation at €19 per share, with a forecast of one billion in net profit for 2022.

Ryanair Load Factor (Ryanair Corporate Website | Traffic (Fig 1))

Ryanair Passengers number (Ryanair Corporate Website | Traffic (Fig 2))