S&P 500 OUTLOOK:

- U.S. stocks mount a remarkable turnaround after a sharp sell-off in early trading sparked by hotter-than-expected U.S. inflation data

- The S&P 500 advances 2.0% after tumbling as much as 2.5% at the cash open

- The market’s attention will now turn to corporate earnings, with major financial institutions such as JP Morgan Chase, Wells Fargo and Citigroup set to report their third quarter results on Friday

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read: S&P 500, Nasdaq 100 & Dow After the CPI Print. What is Price Action Signaling?

It was a wild and volatile day on Wall Street following the release of the September U.S. inflation report. Hotter-than-expected data, which showed core CPI accelerating to a four-decade high of 6.6% y-o-y, sparked a brutal sell-off at the cash open, sending the S&P 500 down more than 2.4% on the back of a surge in U.S. Treasury yields.

However, the negative reaction in the equity space was completely reversed in a remarkable turnaround, possibly due to short covering, as the market has become extremely bearish of late, with thin liquidity and low positioning amplifying directional moves.

When it was all said and done, the S&P 500 ended the day up 2.6% at 3,669 after managing to bounce off the 50% Fibonacci retracement of the March 2020/January 2022 rally near the 3,500 area, a sign of strong technical support around those levels. If bullish momentum extends into Friday’s session, the next resistance to consider appears around 3,815 as seen in the weekly chart below.

Recommended by Diego Colman

Get Your Free Equities Forecast

S&P 500 WEEKLY CHART

S&P 500 Chart Prepared Using TradingView

Looking ahead, equities will remain in a vulnerable position, as the Fed is likely to forge ahead with its hawkish hiking cycle in the face of stubbornly high inflationary pressures. With financial conditions expected to tighten further, economic growth will continue to downshift, depressing risk appetite and creating a hostile environment for stocks.

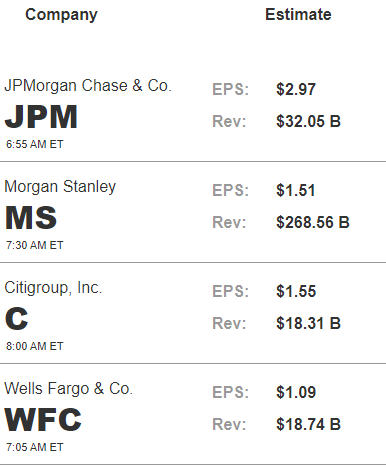

Focusing on the very short term, the third-quarter earnings season, slated to start in earnest on Friday, may still the limelight in the coming days. That said, JPMorgan Chase (JPM), Wells Fargo (WFC) , Citigroup (C) and Morgan Stanley (MS) are set unveil results tomorrow morning.

Commercial and investment banks, as lenders and deal-making institutions in the capital markets, have a front-row view of the economy, so traders should watch their bottom- and top-line figures, but more importantly, their forward guidance amid growing economic challenges.

The table below shows what Wall Street expects in terms of earnings for these companies

Source: Earnings Whisper

| Change in | Longs | Shorts | OI |

| Daily | -9% | 2% | -5% |

| Weekly | 1% | -14% | -5% |

EDUCATION TOOLS FOR TRADERS

- Are you just getting started? Download the beginners’ guide for FX traders

- Would you like to know more about your trading personality? Take the DailyFX quiz and find out

- IG’s client positioning data provides valuable information on market sentiment. Get your free guide on how to use this powerful trading indicator here.

—Written by Diego Colman, Market Strategist for DailyFX