BRENT CRUDE OIL (LCOc1) TALKING POINTS

- Long bets increase on Brent crude oil.

- Supply cuts by OPEC+ still at the forefront of market participants.

- Light economic calendar with Fed speakers under the spotlight.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

BRENT CRUDE OIL FUNDAMENTAL BACKDROP

Brent crude oil held its gains from last week despite a beat on the U.S. Non-Farm Payroll (NFP) print which saw a rallying USD. The decision by OPEC+ to cut production output is clearly outweighing dollar strength for now and is reflected in market positioning – see graphic below. Long positioning on Brent crude oil has increased by roughly 24000 lots since the prior read and is likely to be even higher now post OPEC+.

Recommended by Warren Venketas

Get Your Free Oil Forecast

ICE BRENT CRUDE OIL CFTCF POSITIONING – TOTAL OVERNIGHT INTEREST

Source: Refinitiv

Historically, October has been a net positive month for Brent prices and looks likely to follow the trend once more up around 12% already. While the current environment favors elevated crude prices, the souring relationship between OPEC+ and the U.S. is one to look out for. In addition, a global slowdown due to rampant inflation and hawkish central banks could limit brent upside while dollar strength looks unlikely to subside short-term. On the economic calendar, Fed officials are scheduled to speak later this afternoon (see economic calendar below). A change in the aggressive narrative is doubtful leaving the dollar exposed to further upside. Later this week, U.S. inflation data will be in focus as markets look for clarification after better than expected labor data.

ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

Foundational Trading Knowledge

Commodities Trading

Recommended by Warren Venketas

TECHNICAL ANALYSIS

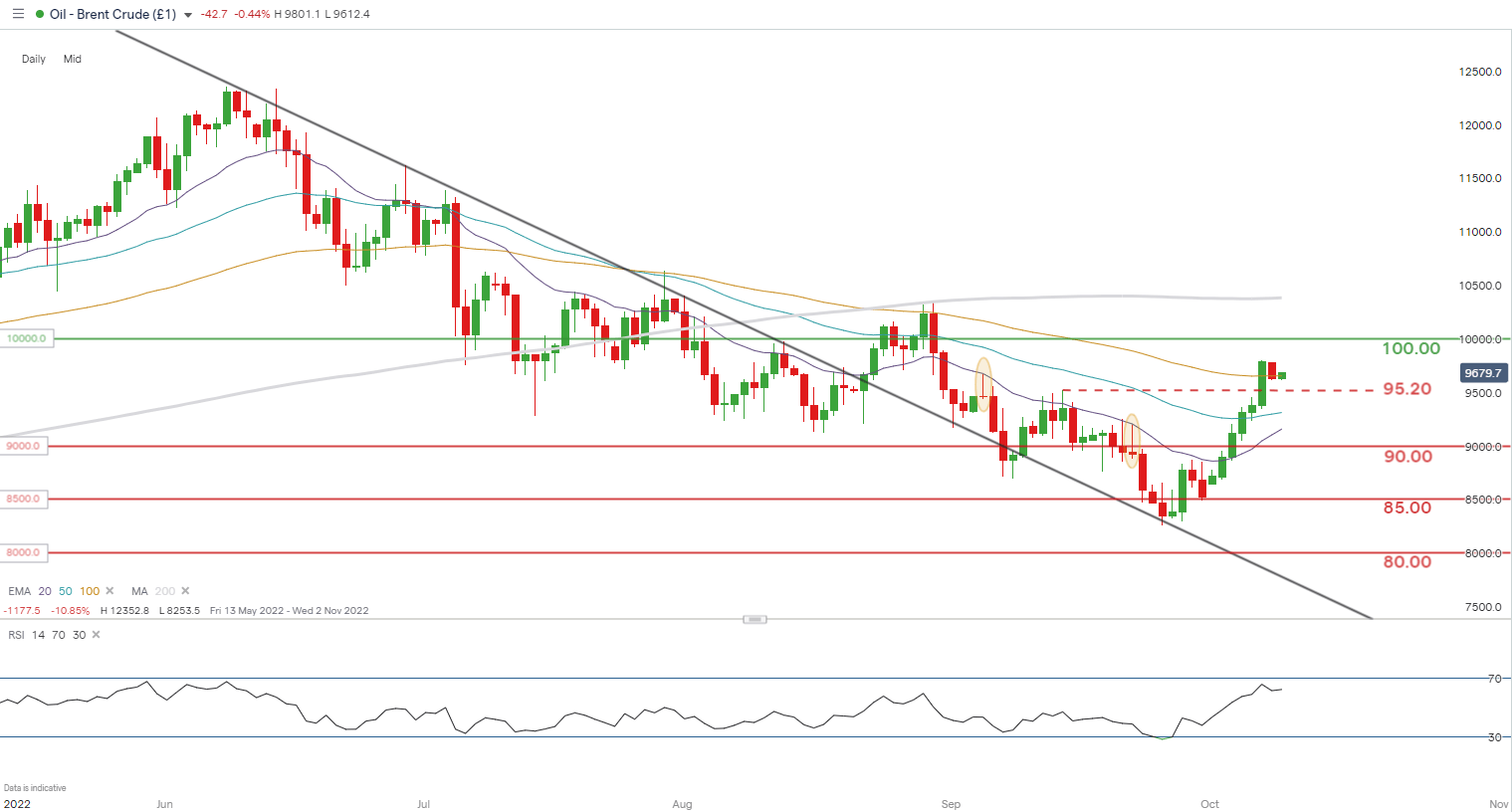

BRENT CRUDE (LCOc1) DAILY CHART -UNDATED

Chart prepared by Warren Venketas, IG

Brent crude daily price action shows the September 14th swing high at 95.20 confirmed as short -term support while prices hover around the 100-day EMA (yellow). Bulls may use this as a springboard towards the 100.00 psychological resistance handle and may coincide with an overbought reading on the Relative Strength Index (RSI).

Key resistance levels:

- 100.00

- 100-day EMA (yellow)

Key support levels:

- 95.20

- 50-day EMA (blue)

- 20-day EMA (purple)

- 90.00

IG CLIENT SENTIMENT: BULLISH

IGCS shows retail traders are NET SHORT on crude oil, with 51% of traders currently holding short positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment resulting in a short-term upside bias.

Contact and followWarrenon Twitter:@WVenketas