EUR/USD Rate Talking Points

EUR/USD trades near last week’s high (0.9854) on the back of US Dollar weakness, but the recent rebound in the exchange rate appears to be stalling ahead of the former support zone around the July low (0.9952) as it struggles to extend the series of higher highs and lows from last week.

EUR/USD Rate Rebound Struggles Ahead of Former Support Zone

EUR/USD appears to have reversed course following the failed attempt to test the June 2002 low (0.9303) as the Relative Strength Index (RSI) recovers from oversold territory, and the exchange rate may attempt to test the 50-Day SMA (1.0016) if it manages to push back above the former support zone around the July low (0.9952).

However, EUR/USD may continue to track the negative slope in the moving average as the Federal Reserve pursues a restrictive policy, and the European Central Bank’s (ECB) September meeting may do little to influence the exchange rate as the Governing Council “frontloads the transition from the prevailing highly accommodative level of policy rates towards levels that will ensure the timely return of inflation to our two per cent medium-term target.”

The comments suggest the ECB will normalize monetary policy at a slower pace as the central bank acknowledges that “risks to growth are primarily on the downside,” but the larger-than-expected rise in the Euro Area Consumer Price Index (CPI) may force President Christine Lagarde and Co. to deliver another 75bp rate hike at the next meeting on October 27 as the Governing Council pledges to “follow a meeting-by-meeting approach.”

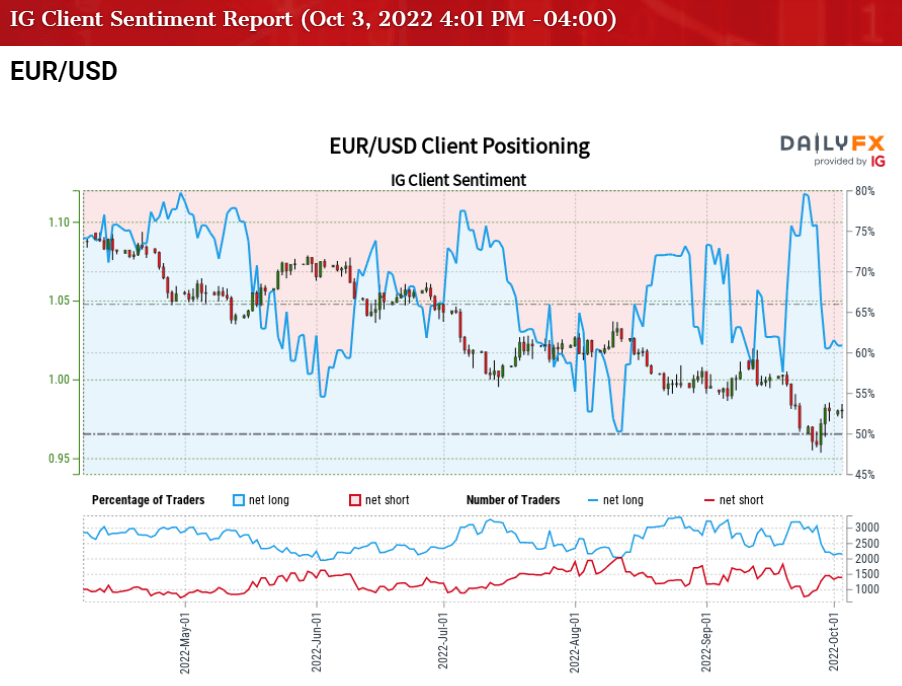

Until then, EUR/USD may struggle to retain the rebound from the yearly low (0.9536) if the former support zone around the July low (0.9952) acts as resistance, while the tilt in retail sentiment looks poised to persist as traders have been net-long the pair for most of the year.

The IG Client Sentiment report shows 59.33% of traders are currently net-long EUR/USD, with the ratio of traders long to short standing at 1.46 to 1.

The number of traders net-long is 3.83% higher than yesterday and 22.54% lower from last week, while the number of traders net-short is 9.45% higher than yesterday and 57.57% higher from last week. The decline in net-long interest has helped to alleviate the crowding behavior as 74.79% of traders were net-long EUR/USD last week, while the jump in net-short position comes as EUR/USD struggles to extends the series of higher highs and lows from last week.

With that said, the account of the ECB meeting may do little to influence the near-term outlook for EUR/USD as the Governing Council shows limited interest in carrying out a restrictive policy, and the rebound from the yearly low (0.9536) may end up being short-lived if the former support zone around the July low (0.9952) acts a resistance.

Introduction to Technical Analysis

Market Sentiment

Recommended by David Song

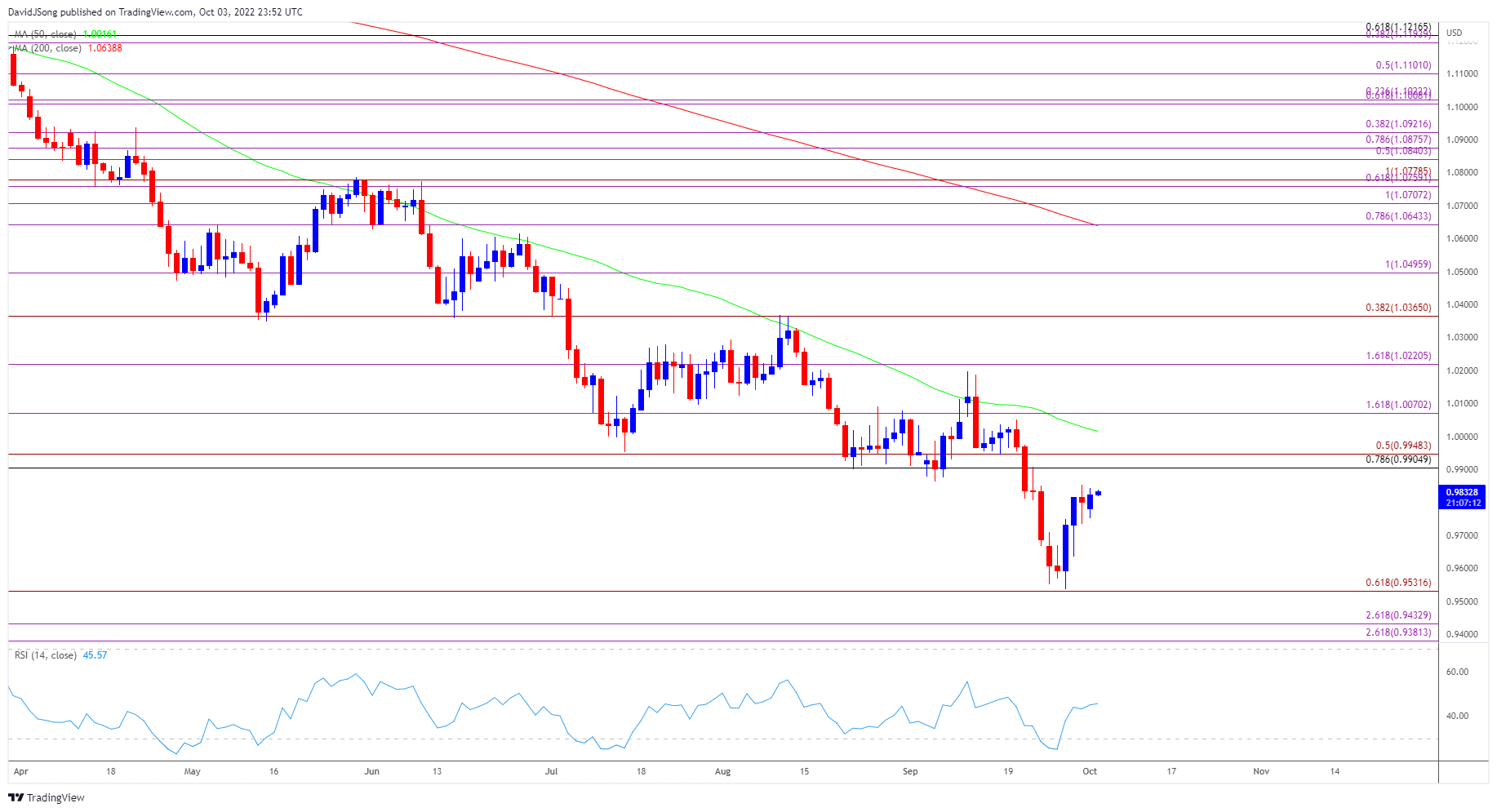

EUR/USD Rate Daily Chart

Source: Trading View

- EUR/USD appears to have reversed course ahead of the June 2002 low (0.9303) amid the failed attempt to break/close below the 0.9530 (61.8% expansion) area, with the Relative Strength Index (RSI) highlighting a similar dynamic as it recovers from oversold territory.

- A move above the 0.9910 (78.6% retracement) to 0.9950 (50% expansion) region may push EUR/USD towards the 50-Day SMA (1.0016), but the exchange rate may track the negative slope in the moving average if the if the former support zone around the July low (0.9952) acts a resistance.

- Lack of momentum to push back above the 0.9910 (78.6% retracement) to 0.9950 (50% expansion) region may lead to another run at 0.9530 (61.8% expansion) area, with a break/close below the Fibonacci overlap around 0.9380 (261.8% expansion) to 0.9430 (261.8% expansion) bringing the June 2002 low (0.9303) on the radar.

Trading Strategies and Risk Management

Becoming a Better Trader

Recommended by David Song

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong