onurdongel

Back in July of this year when the market looked as if it was starting to recover from the June swoon and was showing signs of improvement, I wrote about a pipeline and MLP CEF, Tortoise Pipeline & Energy Fund (NYSE:TTP). At the time, the fund was trading at a -15% discount to NAV and was offering investors a 9% yield on the distribution. The TTP fund was offering the best YTD total return of several MLP funds that I analyzed and was up 19% based on the 1-year total return at the time.

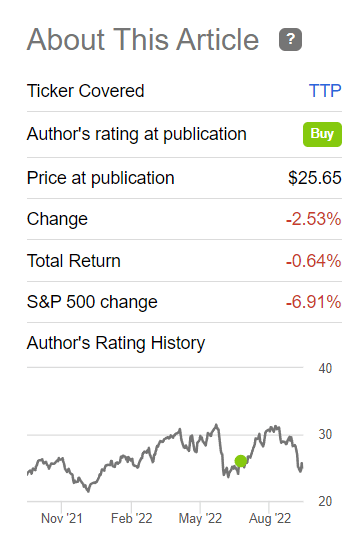

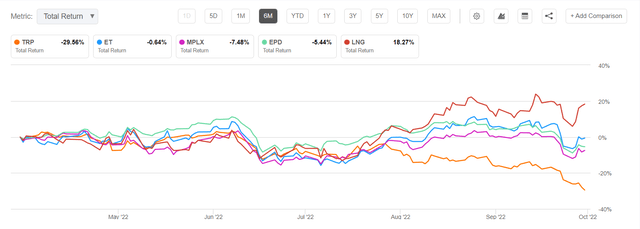

Since that article was published, TTP has a -0.64% total return compared to the S&P 500 return of -6.9%.

Seeking Alpha

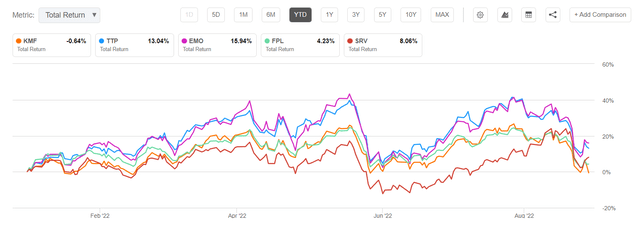

The YTD total return is 13% which is currently still one of the best of the 5 that I looked at with only one fund showing better YTD total returns. To recap, I decided to compare TTP to 4 other MLP and pipeline funds.

For purposes of this comparison, I wanted high yield distributions of at least 6% and a similar size (under $350M in AUM) to TTP. The four that I chose to compare include ClearBridge Energy MLP Opportunity Fund Inc. (EMO), Cushing MLP & Infrastructure Total Return Fund (SRV), First Trust New Opportunities MLP & Energy Fund (FPL), and Kayne Anderson NextGen Energy & Infrastructure, Inc. (KMF).

Currently, EMO has a slightly better YTD total return at 15.94% while the other three are at least 5 percentage points behind TTP.

Comparison of YTD total returns for several MLP funds (Seeking Alpha)

As of 9/30/22 at a closing price of $25.02, the discount sits at -14.29% based on the NAV of $29.19. The current distribution rate is 9.43% based on a quarterly payout of $0.59. The distribution was set at $0.59 at the beginning of 2022 after it was raised from $0.37 in the previous quarter. As of 8/31/22, the fund’s total assets were valued at $97.1 million with 2.23 million shares outstanding and leverage of 23.5%. The management fee is relatively low for an actively managed CEF at 1.1%.

Tender Offer

Because the fund has been trading at a discount of more than -10%, Tortoise declared their intent to conduct a tender offer. The offer was announced initially on August 10 and was revised on August 23. The text of the announcement describes the details of the offer:

August 23, 2022 – Tortoise and the Board of its closed-end funds previously announced its approval of conditional tender offers as part of the discount management program. A Fund would conduct a tender for 5% of the Fund’s outstanding shares of common stock at a price equal to 98% of net asset value (NAV) if its shares trade at an average discount to NAV of more than 10% during either of the designated measurement periods. The first measurement period for 2022 ended on July 31, 2022 and it has been determined that a tender offer will be executed in each fund. The tender offers are expected to commence on or around October 3, 2022. The Funds will issue a press release announcing the tender offers on the day the tenders commence. The Funds’ portfolio managers, officers and Board of Directors will not tender their shares. The second conditional tender offer measurement period is from August 1, 2022 through July 31, 2023.

The intent of the tender offer is to narrow the discount and improve the fund’s share price by buying back shares at a higher price than the current market price. That should also lead to current investors realizing a higher total return over time while encouraging new investors to consider buying into the fund while it still trades at a discount. Of course, it remains to be seen whether the tender offer will have the desired effect. As a current shareholder, I am encouraged by the potential of the tender offer to provide some catalysts to lift the price above the $25 level where I consider it a strong buy.

Fund Holdings

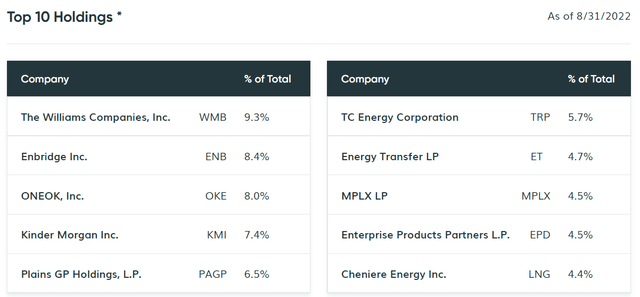

The majority of the fund’s holdings includes natural gas pipelines (61%) followed by liquids infrastructure (32%) and about 8% renewables and power infrastructure. The top 10 holdings represent more than 63% of the total portfolio value.

Top 10 holdings (fund website)

Looking at each of the top 10 reveals some interesting trends.

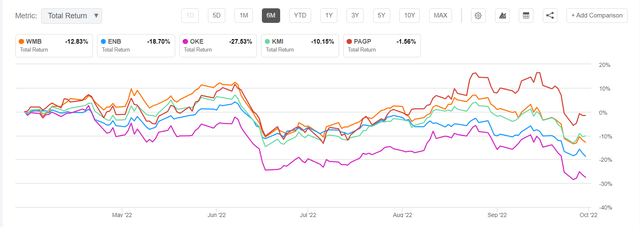

Seeking Alpha

First, the top 5 have all seen negative total returns over the past 6 months, although Plains GP Holdings (PAGP) has been nearly flat at -1.56%. PAGP is rated a Buy on SA and by Wall Street and offers a 7.3% yield. Enbridge (ENB) is also rated a Buy by SA authors and Wall Street and offers a 7% yield. Williams (WMB) pays 5.9% and is also rated a Buy by SA authors and Wall Street. A recent article from Samuel Smith discusses the merits of both WMB and ENB and makes a case for buying both for passive income.

ENB has a slightly stronger balance sheet and a better diversified asset portfolio. Moreover, its track record for generating total returns and dividend growth crushes WMB’s. Its dividend yield is also 110 basis points superior to WMB’s.

That said, WMB is considerably cheaper on an EV/EBITDA and P/DCF basis, it benefits from being a pureplay in natural gas, and its balance sheet is still in fine shape. On top of that, its dividend is covered more than 2x by distributable cash flows, giving it a very conservative dividend profile.

Of the next 5 largest holdings, all are showing negative 6-month total returns except for Cheniere Energy (LNG), which is up 18% and trending upward.

Seeking Alpha

LNG is rated a Buy by SA authors and Strong Buy by Wall Street analysts. The company recently announced their 20/20 Vision capital plan that projects $20B of available cash through 2026, raised guidance for 2022, increased the dividend by 20%, and announced a share buyback plan. TC Energy (TRP) is rated a Buy by SA authors and a Hold by Wall Street and offers a 6+% yield. ET offers a 9% yield, is rated a Buy by SA authors and Strong Buy by Wall Street. MPLX is also rated Buy by both SA and Wall St and offers a 10% yield. A recent article by Jonathan Weber compares MPLX and ET. He likes both for different reasons and explains his take on them in his conclusion.

MPLX looks like the better choice for more conservative investors due to its stronger balance sheet and more predictable income stream that was maintained and even grown during the pandemic.

ET is less predictable and riskier due to a more leveraged balance sheet. Its past dividend cut has shown that it’s a less reliable income investment. That being said, it would not be surprising to see ET grow its dividend more over the next year, as management seeks to reinstate the dividend to pre-pandemic levels. Its lower valuation also means that ET might have more upside potential once the market turns more bullish again.

Managed Distributions

An advantage to holding MLPs in a closed end fund is the ability of the fund to manage distributions. While each MLP may decide to increase or cut its quarterly distribution, the CEF can manage the distributions based on a percentage of NAV, mixing in capital gains and other sources of income. The MDP (Managed Distribution Policy) for TTP is explained on the company website.

Annual distribution amounts are expected to fall in the range of 7% to 10% of the average week-ending net asset value (“NAV”) per share for the prior fiscal semi-annual period. Distribution amounts will be reset both up and down to provide a consistent return on trailing NAV. Under the MDP, distribution amounts will normally be reset in February and August, with no changes in distribution amounts in May and November.

The fund may designate a portion of its distributions as capital gains and may also distribute additional capital gains in the last quarter of the year to meet annual excise distribution requirements.

Past Performance is no Guarantee of Future Results

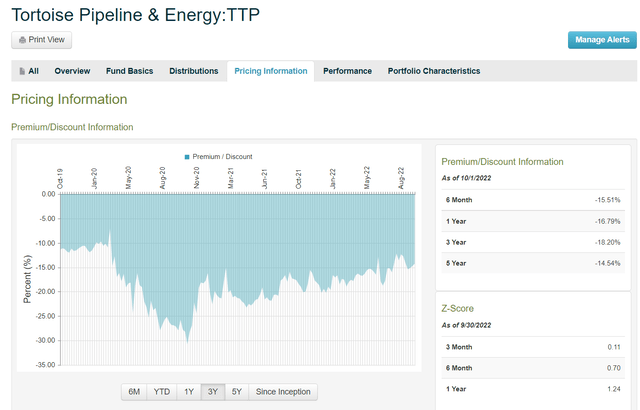

While TTP has traded at a large discount for most of the past 3 years, the fund managers at Tortoise are taking steps to change that by announcing the tender offer. While the announcement itself did not seem to have the desired effect, the overall market downturn in the past month has not helped.

CEFconnect

The trend does appear to be moving in the right direction with the discount narrowing slightly to 14%, less than the 6-month average of -15.5%. And if the overall market does begin to recover in the 4th quarter of 2022 or in early 2023, then I would expect that NAV will begin to rise quickly and the discount is likely to narrow even further, enhancing future total returns for investors who are buying shares for around $25 where it is trading currently.

Pipeline and MLP stocks are seeing a resurgence in value in 2022 and are likely to continue to benefit from rising oil prices as long as we do not enter an even more severe recession than what we are already experiencing. Given that all 10 of the top holdings have Buy ratings and are paying out distribution yields in excess of 7% for the most part, I believe that there is little downside risk in this fund. On the other hand, there is very good upside potential for capital appreciation and a steady income distribution for investors who seek long-term reliable income streams.

I am long TTP and will be looking to add more if the price drops below $25 again. Your investment objectives and risk tolerance may differ from mine, so do your own due diligence if you like what you read here.