Daniel Wright

Investment Thesis

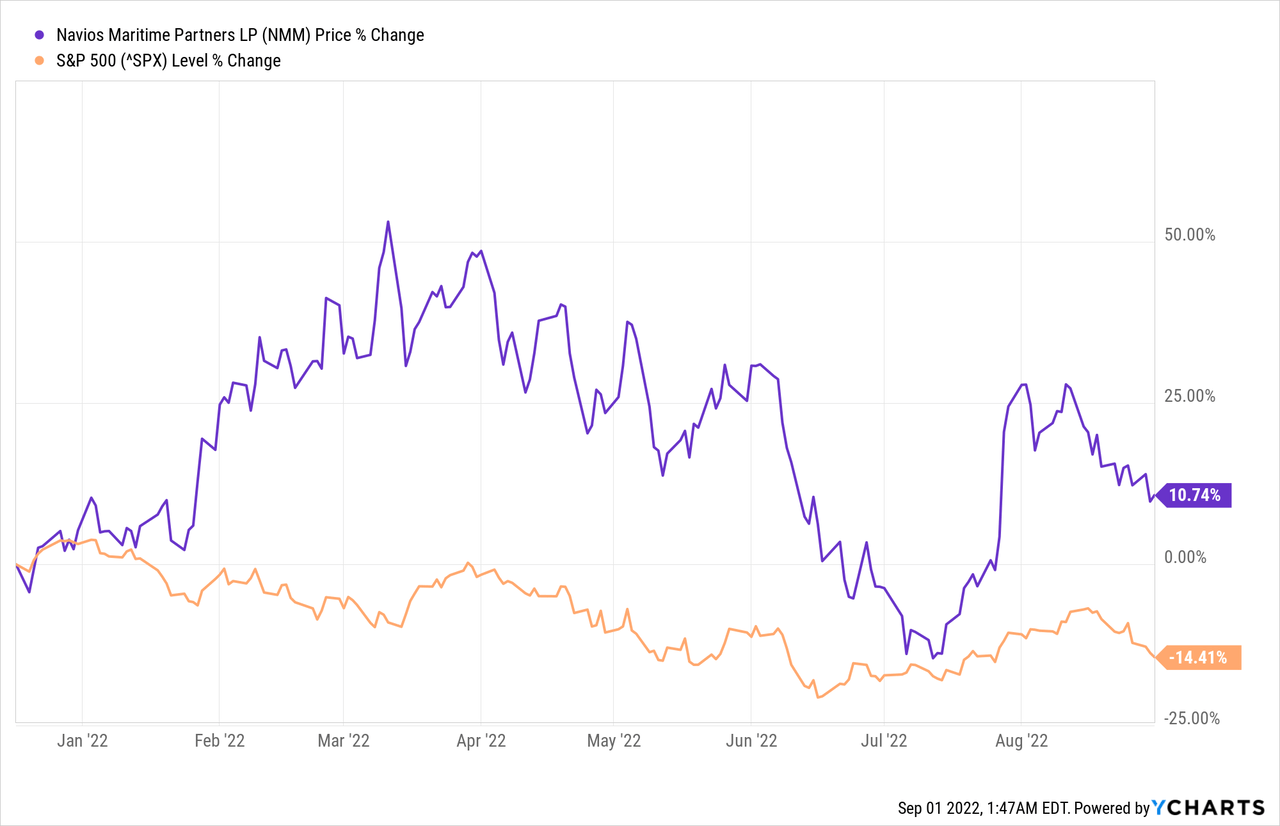

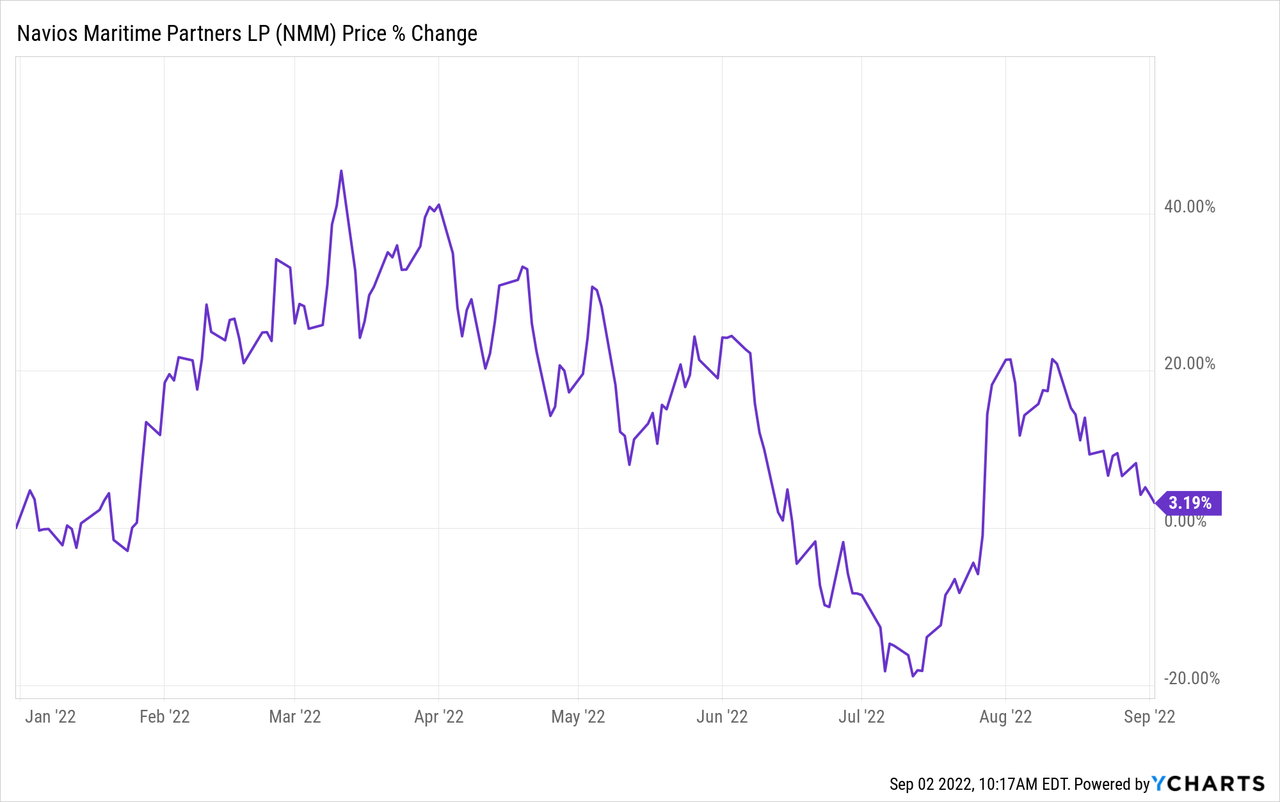

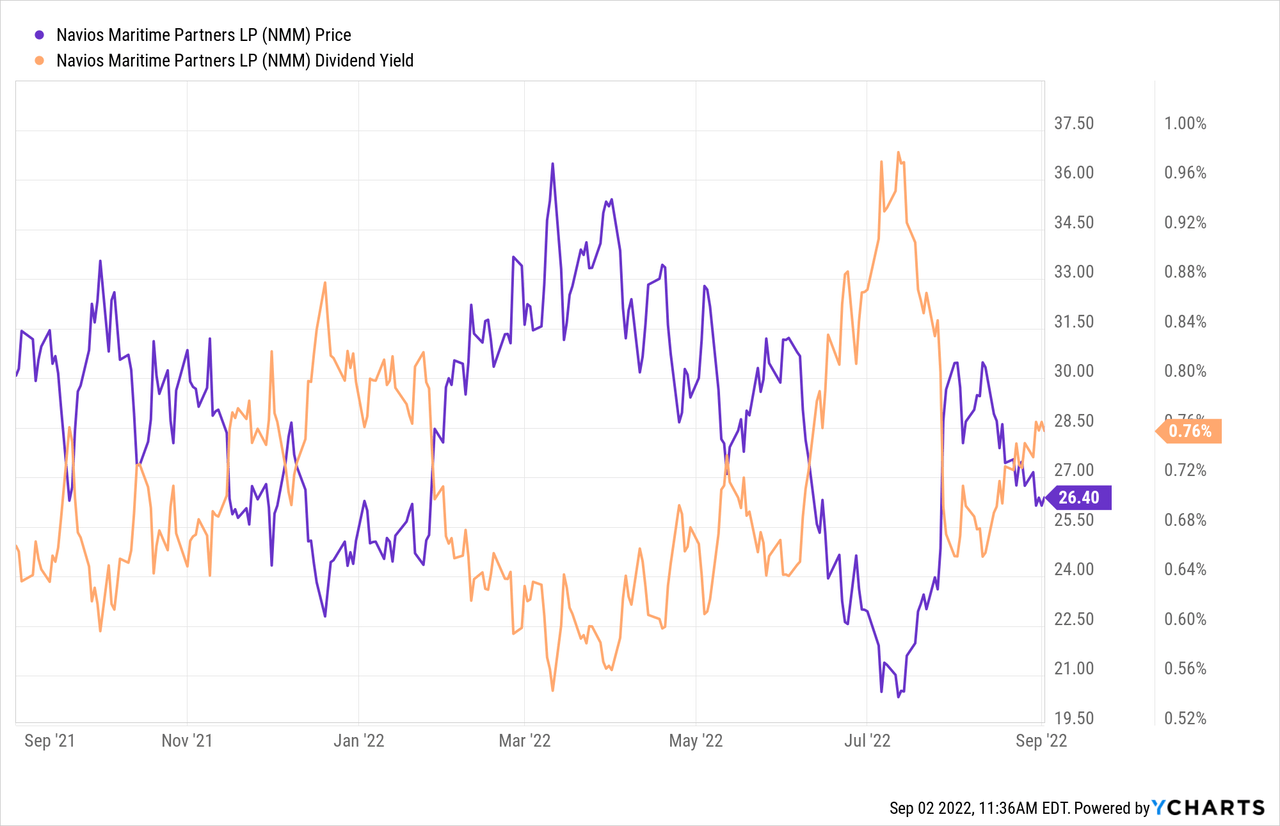

Navios Maritime Partners (NYSE:NMM) has gained almost 11% since I last covered it in Dec 2021, compared to a loss of almost 14.5% by the market. Despite a 35% share value loss in Q2 2022, largely attributable to systemic risks, the company recouped in Q3, with a 15% gain since July, but is still far from being fairly valued.

The company’s massive fleet of 188 vessels, including 90 dry bulk vessels, 49 containerships, and 49 tankers, make it a multi-pronged maritime play. The 3 segments make NMM highly diversified, with over 16 vessel types serving over 10 end markets.

Despite being the largest US shipping company by fleet size with diversified revenue streams, the company continues to trade at a significant discount to its fair value and competitors. The company’s net vessel equity value of $4.2 billion far outweighs its market cap of almost $800 million, exposing this massive undervaluation.

This discount was probably one of the decisive factors in the management’s current $100 million share repurchase program authorization, covering about 17% of its public float, significantly contributing to the stock price gain after its publication of MRQ earnings.

I am bullish on the stock because of the massive undervaluation despite the significant upside embedded in the stock through the tanker segment.

Dry Bulk: Short-term Headwinds

The dry bulk segment accounts for almost 48% of the company’s fleet, including its recent acquisition of 36 dry bulk vessels from Navios Maritime Holdings (NM) with a 3.9 MW capacity, which increased its dry bulk fleet by 67% and total fleet by 24%.

Navios Q2 Presentation

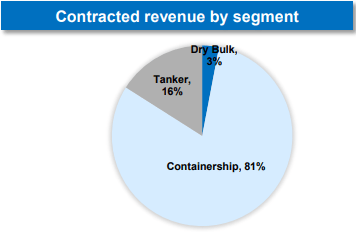

Despite such a large share of its fleet, the dry bulk segment accounts for only 3.3% of NMM’s contracted revenue. This is to leverage the inflated spot rates in the market, which had skyrocketed in the post-pandemic market, as evident by this segment accounting for almost half of all available days in H2 2022.

Even though the freight rates are now showing a downtrend with a significant decline from their recent highs, the new “normal” rates set in the market will remain at a much higher level than the pre-pandemic levels, and the market will stabilize in the upcoming years toward its new long-term path.

Accordingly, IHS Markit forecasts the dry bulk market demand to grow slower than the 2.2% growth in 2021, with 0.2% in 2022 and 1.7% in 2023. This 1.7% is assumed to be a great ballpark figure for the new normalcy.

The risks posed by the stunted Chinese economy, the Russia-Ukraine conflict, and higher domestic mineral production will likely further deteriorate market freight rates as supply and demand are strained in 2022. This is in line with the marginal sector growth and is factored into the slow but steady future growth of the dry bulk rates.

Even though the company’s decision to increase its dry bulk portfolio during the declining rate trend is scrutinized by investors because of its likelihood to falter the company’s near-term profitability, the long-term prognosis remains positive.

Containerships: Long-term Stability

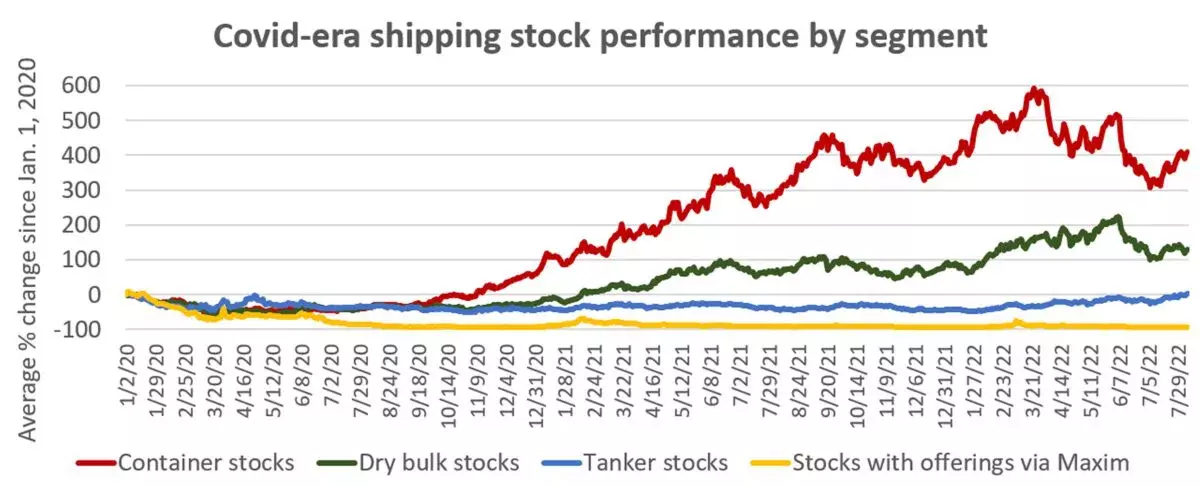

Since the pandemic, containership stocks have gained over 400% share value, outpacing other maritime stocks, despite an unimpressive performance during 2022.

Freight Waves

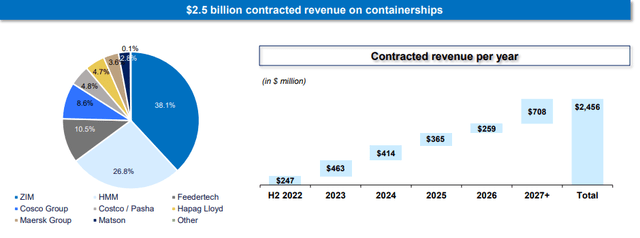

NMM’s containership segment accounts for almost 81% of its $3 billion contracted revenue despite accounting for only 26% of its fleet. As such, 98.9% of its available days in H2 2022 are already fixed under long-term charters.

The containership charter rates are still hovering at their all-time highs, over 5 times higher than their 5-year average. According to the latest earnings call, almost 50% of the company’s contracted revenue is due to be realized within the coming 2.5 years, of which about $1.12 billion is attributable to the containership segment.

Navios Q2 Presentation

The segment realized a 37.4% higher YoY TCE containership rate of $29,417 because of the US container imports, which grew by 1.3% in 2022, compared to the global containerized export volume decline of 1.2%. The growth is slow compared to 13% in 2021 but is expected to progress gradually at 4% through 2023 and 2024.

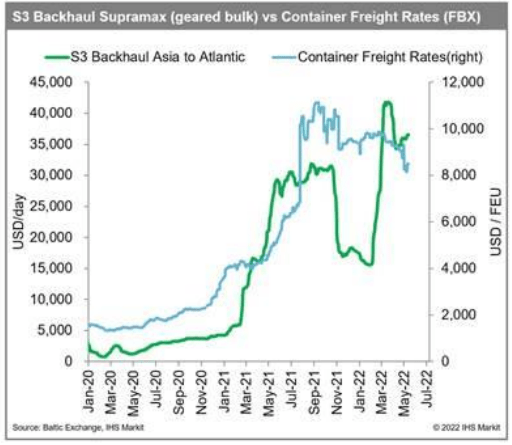

IHS Markit

The containership market is also likely to soften up like the dry bulk market in H2 2022, triggered by macroeconomic pressures, including high inflation, a recessionary environment, and new building investments as shippers transition toward carbon-efficient ships.

Generally, the third quarter is the year’s peak season, and the freight rates will float during Q3 but are likely to settle down during Q4 and follow the slow and steady growth pattern elaborated in the previous paragraph.

Tankers: At the Base of Undervaluation

The company’s tanker fleet accounts for 26% of its total fleet, 16.3% of its NAV, and 16% of its contracted revenue, with almost 62% of its H2 2022 available days fixed under contracts.

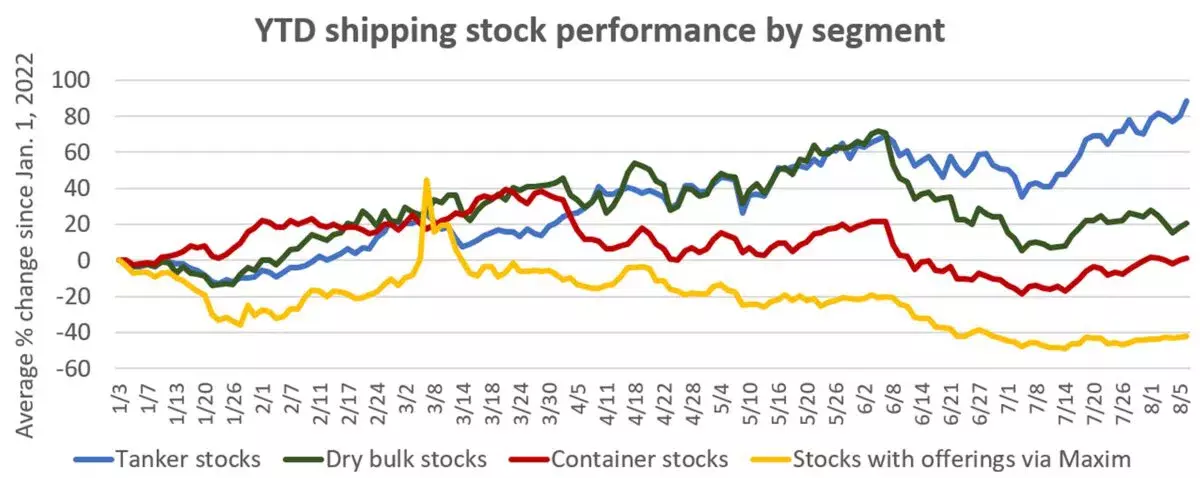

Given the significant contribution of tankers in the company’s portfolio, it appears that NMM is not being valued as a tanker stock, which have by far outperformed other shipping stocks, gaining 88% YTD, largely because of the high demand, which has also resulted in high freight rates.

Freight Waves

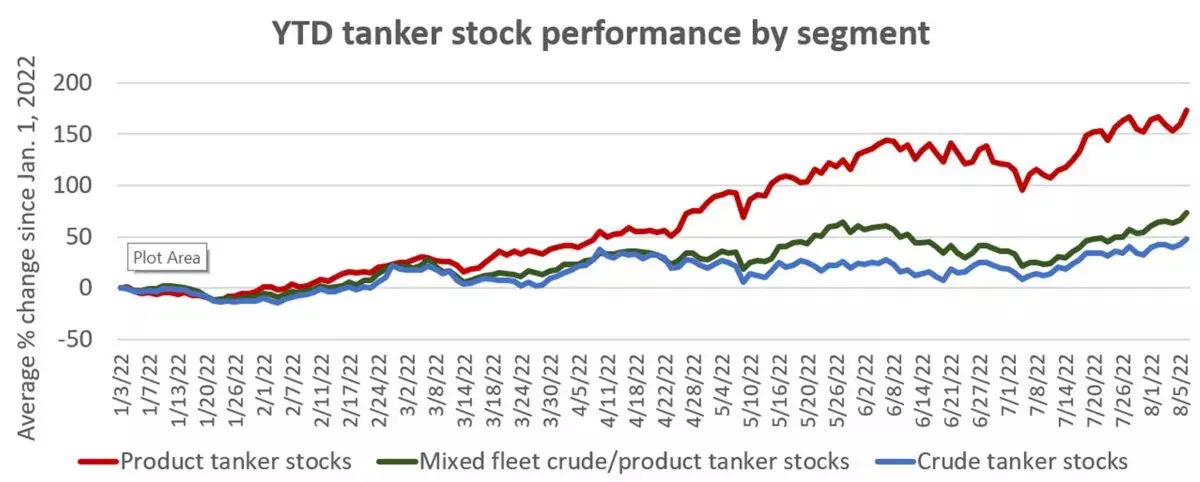

Further, over 71% of NMM’s tanker fleet is composed of product tankers, which have even outperformed other tanker stocks during the year, gaining a phenomenal 173% YTD with mixed fleet owners, including crude and product tankers, up by 73% and pure crude-tanker owners up by 47%.

Freight Waves

Despite the above, NMM stock is up merely 3% YTD. The current share price of $25.74 is significantly lower than its book value of $63.94 per share, and its market cap of around $800 million is significantly lower than its net vessel equity value of over $4.2 billion. This makes it evident that not only is the stock undervalued compared to other tanker stocks but also relative to its own metrics.

Dividends and Share Buybacks

Historically, the company’s CEO has been constantly scrutinized for keeping resources inside the business when they could be used for generating shareholder returns through distributions or share repurchase programs, directly increasing the total returns for retail investors.

Even though the stock has been paying a consistent quarterly dividend since 2018, it was suddenly slashed by 83.4% in mid-2019 from $0.3 per share per quarter to $0.05 per share per quarter. The dividend currently yields less than 1%, despite a high operating earnings yield of over 50% and an FCF yield of 8.5%.

The company has recently announced a share repurchase program of $100 million. Still, it seems unlikely to start buying back its shares in the current year, given the macroeconomic uncertainties and the company’s historical record.

The CEO is renowned for defending this strategy as a safeguard against dark times, but this undoubtedly diminishes potential investor returns, leaving the investors frustrated.

Conclusion

Navios Maritime Partners has systematically merged with its sister concerns through meticulous financial and operational performance for over a decade and has turned into a multi-pronged diversified maritime behemoth.

The company’s operations in dry bulk, containership, and tanker segments are all driving significant business for the company on multiple fronts. This is key for mitigating risks and maximizing returns by leveraging multiple end markets and global supply chains.

Despite the value accumulation, investors have been distraught by NMM’s reluctance to share its earnings with them through share buybacks and dividends while failing to generate satisfactory price returns. This is being hinted at to change by the company as it announced the share repurchase plan, but given the current circumstances, it seems unlikely to happen during the year.

However, the basis of my long-term buy rating for the stock stems from its massive undervaluation, which exhibits that if the market prices in the fair value of the stock, based on any of its metrics, it will likely show massive gains.

The CEO’s perceived detachment toward its retail investors significantly affects the current mispricing. Still, if the market starts placing its confidence in the company, as it has shown upon the publication of its share repurchase plan, the gains will be substantial.

For long-term investors, this is bound to happen sooner or later. Any potential investors who buy this shipping giant’s stock at the current, massively undervalued levels will be smiling ear-to-ear down the road!