Susan Vineyard

ONEOK, Inc. (NYSE:OKE) (“Oneok”) is an American natural gas company focused on NGL, which are overwhelmingly produced from natural gas. The company is one of the largest players in the space, with a distributed asset portfolio, that stands to benefit from rising volumes. However, the company does also have a reliance on continued growth to justify its valuation.

Oneok Business Performance

Oneok’s overall business performed well during the quarter with respectable volume growth.

Oneok Investor Presentation

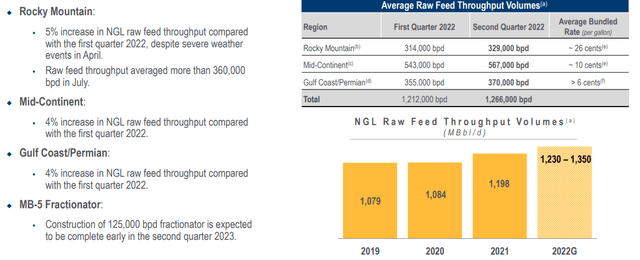

Oneok saw strong performance across its business with high single-digit volume growth across the business. The company’s Rocky Mountain business has by far the highest margins and saw reasonable growth, and across the company’s business it saw growth in every single market. In July, the company announced that numbers are looking dramatically better.

There’s been a lot of talk about how the Permian Basin’s proximately to export markets makes it the next big NGL market, however, the increased competition has also stressed margins in the region. The Gulf Coast/Permian Basin has less than 25% the margins of the Rocky Mountain region. The company is also expanding potential volumes through new fractionators.

Oneok Opportunity

Oneok has substantial opportunity assuming volumes continue to recover, from built-in spare capacity.

Oneok Investor Presentation

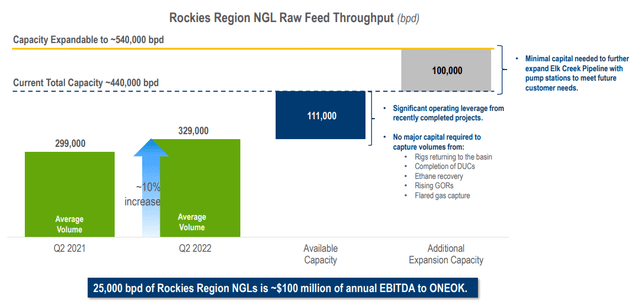

The company has seen volumes in the Rockies region grow from 299 thousand barrels/day to 329 thousand barrels/day. That represents roughly 10% YoY growth resulting in more than $100 million EBITDA growth for Oneok. However, the true story here is growth. The company has more than 200 thousand barrels/day of spare capacity with minimal capital.

That spare capacity could add a massive $800 million in annual EBITDA, or 25% EBITDA growth, but the company has provided no guidance as to whether or not there exists the demand for the volumes. Given that prices have tapered down, we expect some use of available capacity, but not significant growth beyond that.

However, this does go to highlight that as volumes continue to grow the company can earn high-volume cash flow.

Oneok Financial Guidance

Oneok’s overall financial guidance is respectable, but shows the company needs to focus on growth to justify its valuation.

Oneok Investor Presentation

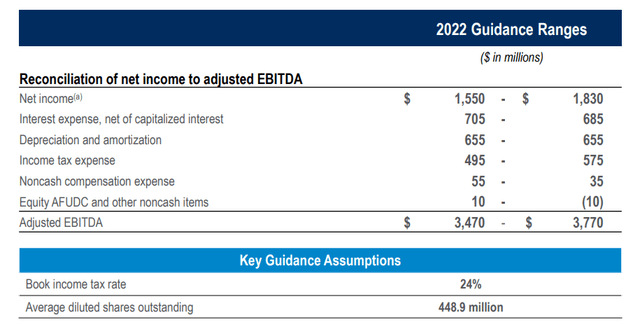

Oneok is forecasting roughly $1.7 billion in net income, or a P/E of <16. From this the company has several different expenses including $700 million in annual interest from its $14 billion in net debt along with taxes and depreciation / amortization expenses. However, many of those numbers don’t scale with EBITDA.

That means that should the company increase its EBITDA from other sources, it will more directly go to net income. That financial strength will support continued earnings.

Oneok Shareholder Returns

Oneok has a consistent history of shareholder rewards that we expect can grow from its current levels.

Oneok Investor Presentation

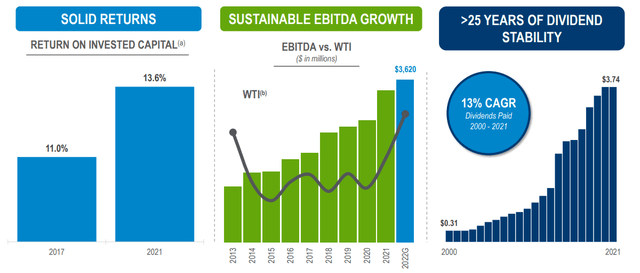

Oneok has a large history of shareholder returns. The company’s return on invested capital has expanded substantially from 2017. The company has managed to grow EBITDA in a variety of WTI crude oil prices, and now that prices have recovered substantially, we expect the rate of the company’s growth to continue. That continued EBITDA growth will help improve the valuation.

The company has a long history of reliable shareholder returns, with >25 years of dividend stability. The company’s dividend has a 13% historic growth rate and its debt to EBITDA is not overwhelming enough to restrict that in the future. As a result, we expect that as long as EBITDA continues to grow so too will the company’s shareholder returns.

Thesis Risk

The largest risk to our thesis is two-fold. First, NGL usage is mostly domestic with exports growing but still minimal. That makes Oneok more susceptible to domestic market fluctuations. Second, Oneok needs volumes to continue growing, with minimal capital cost, to justify its valuation. Whether that continues depends on overall market strength.

Conclusion

Oneok has an impressive portfolio of NGL assets with a dividend yield of more than 6%. The company has a low double-digit P/E and its growth has increased substantially over the most recent quarters. The company is already guiding for strong volumes in July that we expect can continue increasing in the upcoming quarters.

The company has fixed expenses that result in a net income conversion rate of roughly 40% from adjusted EBITDA. That means that as the company’s adjusted EBITDA grows it’ll see much more than a 40% conversion rate to net income. That continued growth will support faster growth in shareholder rewards, making the company a valuable investment as long as growth continues.