Published on August 5th, 2022 by Josh Arnold

Berkshire Hathaway (BRK.B) has an equity investment portfolio worth more than $360 billion, as of the end of the first quarter of 2022, making it one of the largest investors in the world.

Berkshire Hathaway’s portfolio is filled with high-quality stocks, and generally ones that have stable earnings profiles, and pay dividends. However, in recent years, Buffett has proven willing to go outside the typical list of companies for Berkshire to buy. Indeed, the company now owns some high-growth names, including tech stocks, which Buffett famously eschewed for decades.

You can learn from Warren Buffett’s stock picks to find ones for your own personal portfolio. That’s because Buffett (and other institutional investors) are required to periodically show their holdings in a 13F Filing.

You can see all Warren Buffett stocks (along with relevant financial metrics like dividend yields and price-to-earnings ratios) by clicking on the link below:

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

As of March 31st, 2022, Berkshire owned over six million shares of Snowflake (SNOW), for a market value approaching a billion dollars. That makes Berkshire a ~2% owner of Snowflake, although the position is just 0.3% of the company’s total equity investment portfolio.

In this article, we’ll examine the business of Snowflake, as well as its future growth prospects and expected total returns in what is a very unusual stock pick for Buffett.

Business Overview

Snowflake is a cloud-based data platform that is based in the US, but has a list of international customers. The company’s platform allows customers to consolidate data into a single source that has several benefits. First, it takes various data sources and combines them into one place that is much easier for customers to navigate. Second, it allows customers to then use the data to drive insights, build data-driven applications, and share data across teams and businesses in ways they could not without the consolidated source of data.

Source: Investor presentation, page 13

As we can see in this illustration, the idea of the platform is to take disparate data sources and applications and combine them into a single source, making insights, predictions, and monetization far easier. Snowflake aims to solve the age-old enterprise problem of teams and applications being housed in silos in the organization, and seeks to combine them for greater data efficiency.

Snowflake was founded in 2012, should generate about $2 billion in revenue this year, and trades with a market cap of $51 billion.

The company’s most recent earnings report was released on May 25th, 2022, for fiscal Q1 results. Results were mixed as revenue beat estimates by $9 million, soaring 84% year-over-year to $422 million. However, the company posted a bigger than expected loss at 53 cents per share.

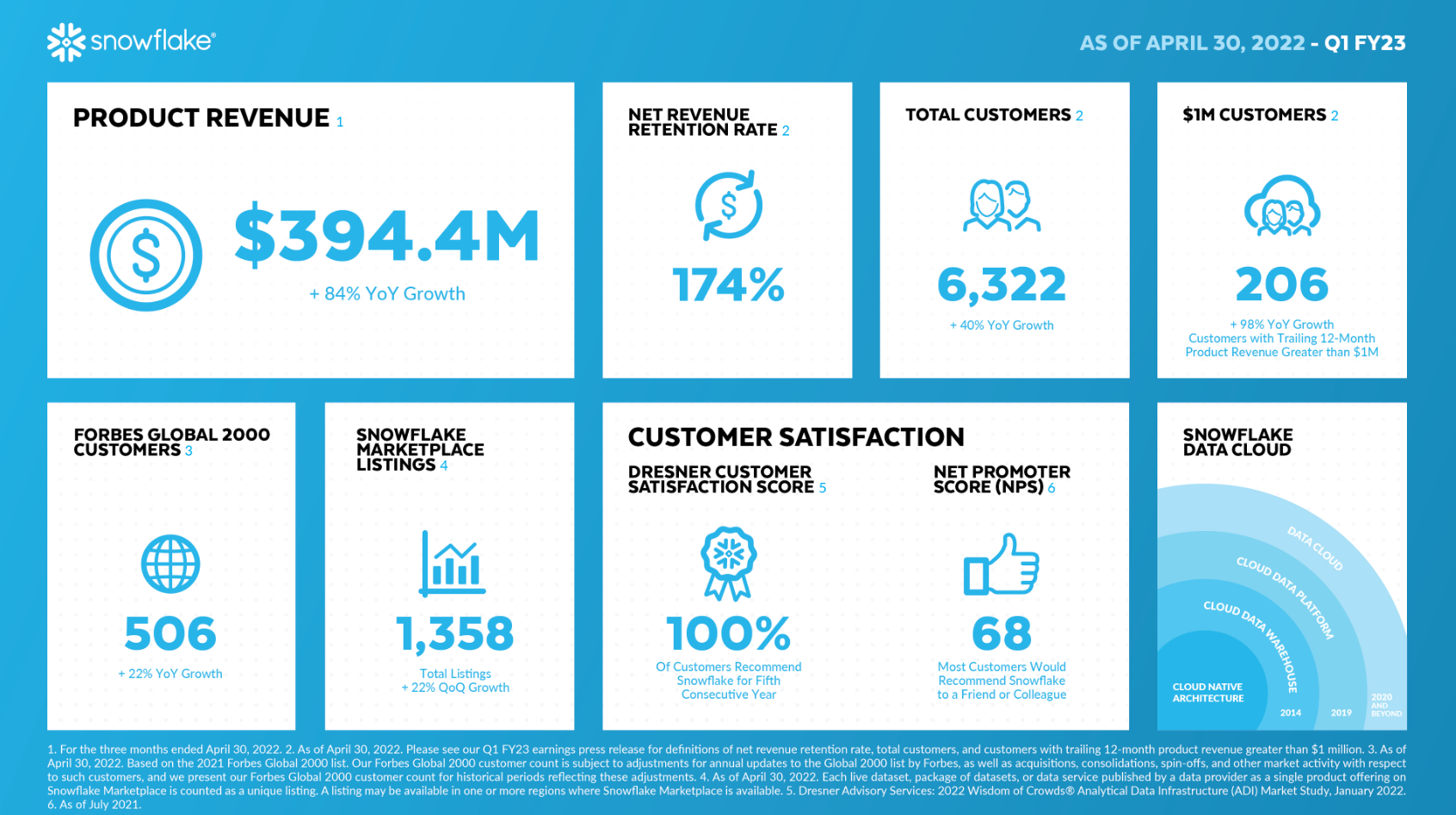

Source: Company Website

Snowflake isn’t profitable yet, so investors tend to focus on customer and revenue growth metrics instead. We can see the first quarter saw revenue nearly double year-over-year, as total customers were up 40%. In addition, Snowflake doubled the number of $1+ million annual revenue customers from the prior year period. Finally, Snowflake’s net revenue retention rate is critical given it is building its business out, and at 174%, it means that not only is Snowflake retaining all prior period revenue, but is growing per-customer revenue by leaps and bounds.

The company guided for second quarter product revenue to be in the range of $435 million to $440 million, which would represent ~72% year-over-year growth, while operating margin is expected to be -2% of revenue. For the year, Snowflake guided for revenue of ~$1.9 billion, which would be up ~66%, with product gross margin of 74.5%, operating margin of 1%, and adjusted free cash flow margin of 16%.

Those growth values spooked investors and analysts, however, despite the eye-popping year-over-year gains expected, and shares fell following the report.

Let’s now turn our attention to the company’s growth prospects, which are robust to say the least.

Growth Prospects

Snowflake’s growth in the past few years has been otherworldly. Since fiscal 2019, its average revenue growth rate has been 113%. In other words, Snowflake has more than doubled revenue, on average, for each of the past four years. The company has been scaling product revenue extremely quickly through both new customers, and higher per-customer revenue. We expect those factors to continue to contribute to revenue growth going forward, but the ever-higher revenue base will become more difficult to grow from.

Still, analysts currently expect Snowflake’s medium-term average revenue growth to be in the neighborhood of 50% annually.

Source: Investor presentation, page 70

The company’s long-term forecast shows fiscal 2029 target revenue of $10 billion, which is ~5X what it should be this year. In addition, the company believes it will still be growing revenue at ~30% annually by then, but with operating income of ~20% of revenue. These are lofty targets, but given the company’s growth trajectory, they look feasible.

The two main catalysts are the company’s ability to add new customers, which it is doing at a very fast rate, as well as its net revenue retention rate. Combined, we think Snowflake can hit ~50% revenue growth annually for the foreseeable future, and that would actually mark a sizable slowdown in revenue growth from historical levels.

Competitive Advantages & Recession Performance

Snowflake’s competitive advantage is in its first-mover position in using a cloud platform to consolidate disparate data sources into one. The mega-trend of using data in the cloud for a variety of applications from merchandising to cybersecurity to operational metrics is only beginning to gain steam, and Snowflake is primed to take full advantage in the years to come.

Snowflake didn’t exist the last time the US had a meaningful recession, but we have to assume its business would suffer. Snowflake’s customers are enterprises of all shapes and sizes, so while its customers are sticky given the immense switching cost, some would inevitably be unable to continue to pay Snowflake during a harsh slowdown. Snowflake does not pay a dividend, and likely won’t for a very long time to come.

Valuation & Expected Returns

Given Snowflake doesn’t have any earnings, and earnings won’t be meaningful for some time to come, we’ll use the price-to-sales ratio to assess value. Shares of Snowflake have been very expensive since the initial public offering, and they remain highly-valued today. Shares go for ~25X estimated fiscal 2023 sales, which is tremendously high by any measure. However, Snowflake’s average price-to-sales ratio in its history as a publicly-traded company is 60. We don’t see that value as sustainable, however, and instead assess fair value at 8 times sales as a long-term multiple.

We expect 50% revenue growth for the foreseeable future, but the valuation could cause a ~20% headwind to total returns over time as it shrinks. Those offsetting factors would still mean we expect ~19% total annual returns in the years to come. The company does not pay a dividend so that does not factor into total returns.

Final Thoughts

Snowflake is a highly unusual stock pick for Warren Buffett, in that it does not pay a dividend, is not profitable, and is a hyper-growth tech stock. However, the company is a first mover in a mega-trend that is likely to persist for decades, and we see immense growth potential for Snowflake. The valuation is extremely high, however, and will likely offset some of the forecasted revenue growth. Still, with ~19% total expected annual returns, Snowflake is rated a highly speculative and volatile buy.

Other Dividend Lists

Value investing is a valuable process to combine with dividend investing. The following lists contain many more high-quality dividend stocks:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].