Up to date on February twentieth, 2026 by Nathan Parsh

Buyers in search of high-quality dividend progress shares ought to first take into account the Dividend Aristocrats. These are an unique listing of 69 shares within the S&P 500 Index with 25+ years of consecutive dividend will increase.

The Dividend Aristocrats are an elite group of dividend progress shares. Because of this, we created a full listing of all 69 Dividend Aristocrats.

You’ll be able to obtain your free copy of the Dividend Aristocrats listing, together with necessary metrics like dividend yields and price-to-earnings ratios, by clicking on the hyperlink under:

Disclaimer: Certain Dividend is just not affiliated with S&P International in any means. S&P International owns and maintains The Dividend Aristocrats Index. The data on this article and downloadable spreadsheet is predicated on Certain Dividend’s personal evaluate, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person buyers higher perceive this ETF and the index upon which it’s based mostly. Not one of the info on this article or spreadsheet is official knowledge from S&P International. Seek the advice of S&P International for official info.

T. Rowe Worth Group (TROW) has elevated its dividend for 40years in a row, due to its robust model, a extremely worthwhile enterprise, and future progress potential.

The inventory’s dividend yield is 5.5%, which is above the ~1.1% common dividend yield of the broader S&P 500 Index. Taken collectively, T. Rowe Worth inventory possesses lots of the qualities dividend progress buyers sometimes search for.

Enterprise Overview

T. Rowe Worth, Jr., based it in 1937. Within the eight a long time since, it has grown into one of many largest monetary companies suppliers in america. Immediately, the corporate has a market cap of ~$12 billion and spectacular belongings below administration.

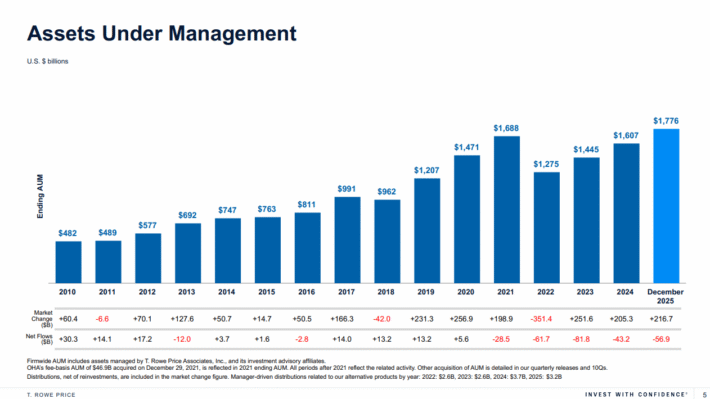

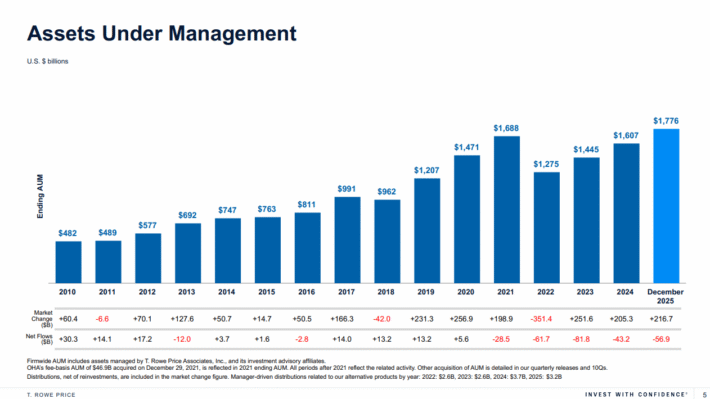

Supply: Investor Presentation

T. Rowe Worth ended 2025 with greater than $1.8 trillion in belongings below administration.

The corporate supplies mutual funds, advisory companies, and individually managed accounts for people, institutional buyers, retirement plans, and monetary intermediaries. T. Rowe Worth has a various consumer base by way of belongings and consumer sort.

This can be a difficult local weather for asset managers. Some buyers have grown weary of upper buying and selling prices and annual charges. The onset of low-cost exchange-traded funds, or ETFs, has efficiently lured consumer belongings away from conventional mutual funds which have greater charges. This has brought about brokers to decrease commissions and charges to retain consumer belongings.

Nevertheless, firm has robust progress potential within the years forward.

Progress Prospects

On February 4th, 2026, T. Rowe Worth introduced its fourth quarter and full-year outcomes for the interval ending December thirty first, 2025.

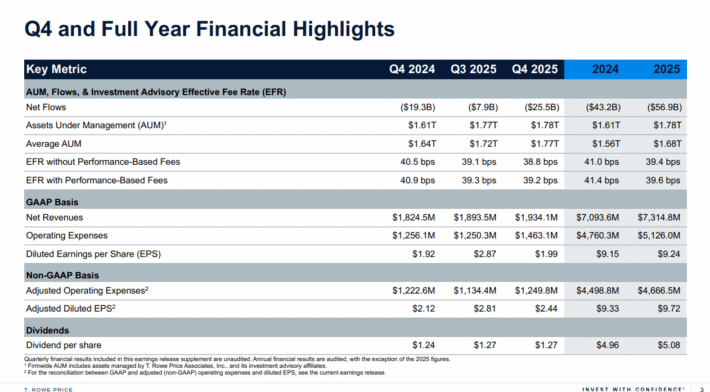

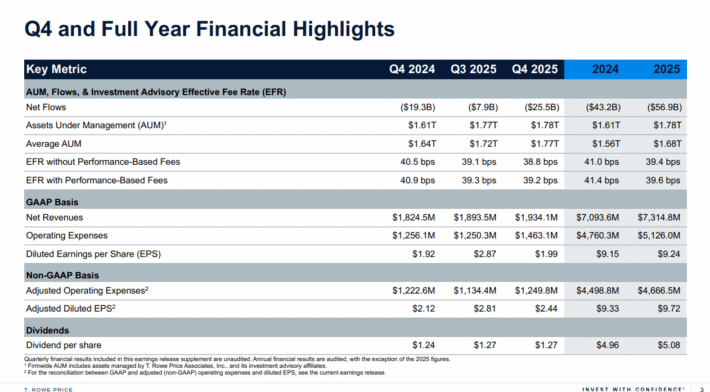

Supply: Investor Presentation

For the quarter, income grew 6.0% to $1.93 billion, however this was $10 million lower than anticipated. Adjusted earnings-per-share of $2.44 in contrast favorably to $2.12 within the prior yr, however missed estimates by $0.02.

For the yr, income grew 3.1% to $7.3 billion whereas adjusted earnings-per-share of $9.72 in comparison with $9.33 in 2024.

Through the quarter, AUMs totaled $1.77 trillion, which represented progress of 8.3% year-over-year and a 3.0% enchancment quarter-over-quarter. Market appreciation of $33.9 billion was offset by web money outflows of $25.5 billion. Working bills of $1.46 billion elevated 16.5% year-over-year and 17% quarter-over-quarter.

Since 2016, the corporate has grown earnings-per-share by a median compound fee of 8.1% yearly. Furthermore, the corporate carried out properly in 2020.

T. Rowe Worth has a number of catalysts for future progress.

Asset managers like T. Rowe have low variable prices. In consequence, greater revenues, pushed primarily by growing belongings below administration, permit for margin growth and engaging earnings progress charges.

Belongings below administration develop in two fundamental methods: elevated contributions and better underlying asset values. Whereas asset values are finicky, the development is upward over the long run. As well as, T. Rowe has one other progress lever within the type of share repurchases. The corporate has shrunk its share rely by an annual fee of 1.3% during the last decade.

Aggressive Benefits & Recession Efficiency

T. Rowe Worth’s aggressive benefit comes from its model recognition and experience. The corporate enjoys repute within the monetary companies business. This helps generate charges, a major driver of income. It has constructed this repute via robust mutual fund efficiency.

T. Rowe Worth considers its staff to be its Most worthy belongings. There’s a good purpose for this, It’s important for an asset administration firm to have certified consultants and retain high expertise. This concentrate on constructing a robust model offers the corporate aggressive benefits, primarily the power to maintain current shoppers and herald new ones.

T. Rowe Worth didn’t carry out properly in the course of the Nice Recession:

- 2007 earnings-per-share of $2.40

- 2008 earnings-per-share of $1.82 (24% decline)

- 2009 earnings-per-share of $1.65 (9% decline)

- 2010 earnings-per-share of $2.53 (53% enhance)

As could possibly be anticipated, T. Rowe Worth skilled a pointy decline in earnings-per-share in 2008 and 2009. When inventory markets decline, fairness buyers sometimes withdraw funds to boost money.

Thankfully, the corporate remained worthwhile all through the recession, permitting it to boost its dividend every year. T. Rowe Worth shortly recovered within the aftermath of the Nice Recession. Earnings elevated considerably in 2010 and reached a brand new excessive by 2011.

Valuation & Anticipated Returns

We anticipate T. Rowe Worth to provide adjusted earnings-per-share of $10.07 for 2026. Utilizing the latest share value of ~$95, the inventory has a price-to-earnings ratio of 9.4. Now we have a goal price-to-earnings ratio of 13, which is in-line with each the medium- and long-term common price-to-earnings ratios of 13.0 and 13.4, respectively. If the inventory’s valuation returns to the truthful worth estimate, then a number of growth would add 6.6% to annual returns over the subsequent 5 years.

The corporate does have a robust model, with pretty constant profitability and earnings progress. Even higher, the inventory seems undervalued in the present day. We see earnings-per-share growing at a fee of three% yearly via 2031 on account of a mixture of the sheer variety of AUM and share repurchases.

Due to this fact, whole returns would encompass the next:

- 3% earnings progress

- 5.5% dividend yield

- 6.6% a number of growth

T. Rowe Worth is anticipated to return 13.7% yearly via 2031. T. Rowe Worth is a very engaging inventory for dividend progress. The corporate has raised its dividend for 40years in a row. And the dividend within reason safe, with an anticipated payout ratio under 52% for this yr.

Ultimate Ideas

Buyers scanning the monetary sector for dividend shares might naturally land on the large banks.

In truth, most Dividend Aristocrats within the monetary sector come from the insurance coverage and funding administration industries. This speaks volumes concerning the stability of their enterprise fashions.

T. Rowe Worth is an business chief and will proceed growing its dividend yearly. The concentrate on decrease charges will proceed to be a headwind for the business. That stated, shares of T. Rowe Worth earn a purchase ranking on account of anticipated annual returns and a stable dividend threat rating of “B”.

Moreover, the next Certain Dividend databases comprise probably the most dependable dividend growers in our funding universe:

If you happen to’re in search of shares with distinctive dividend traits, take into account the next Certain Dividend databases:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].