You possibly can discuss as a lot negativity about buying and selling methods with averaging as you want, however they nonetheless frequently characteristic on the prime of alerts providers and MQL Market showcases. That is most certainly as a result of most individuals aren’t suited to buying and selling in its traditional kind (extended drawdowns, months with out a new excessive). It is far more satisfying to see a brand new account stability most each day, whatever the threat of your complete deposit. A technique or one other, “Averaging” as a capital administration technique continues to be very a lot alive in 2026.

A 12 months in the past, I made a decision to tidy up my indicator assortment. Within the course of, it turned clear that many instruments wanted to be mixed right into a single indicator. That is how essentially the most multifunctional and highly effective twin transferring common indicator was born: Shifting Common Cross Sign . The MQL group offers us all lots, and creating it’s our shared objective! The indicator is freely obtainable: https://www.mql5.com/en/market/product/148478

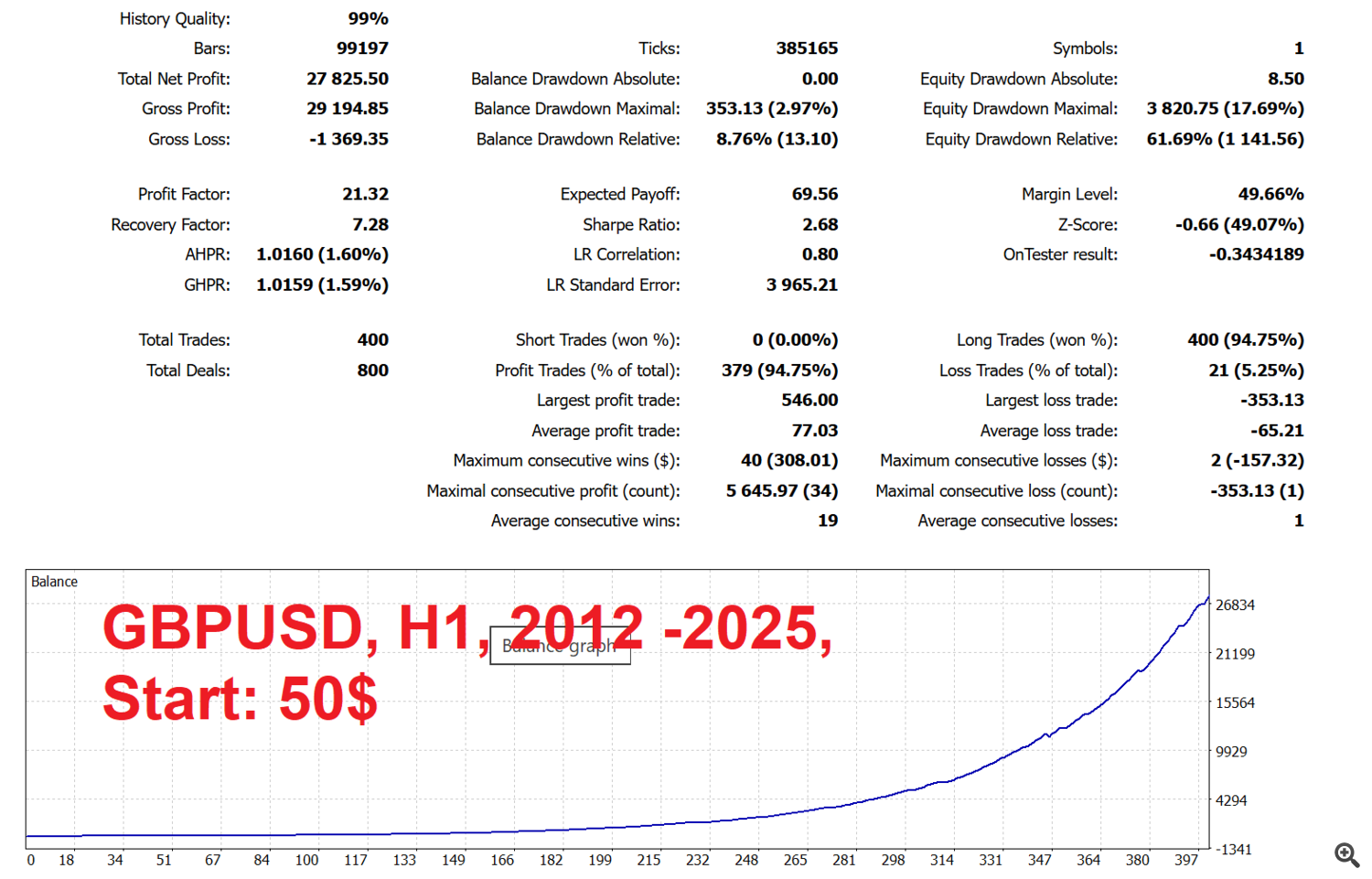

I’ve solely simply now gotten round to combining averaging and the Shifting Common Cross Sign . The knowledgeable advisor continues to be in its infancy and solely opens lengthy positions. However the potential of this mix is already evident. I’ve arrange the parameters for GBPUSD H1. The benefits embrace beginning with a really small deposit of $50 and a interval with out a new excessive of lower than every week.

Obtain EA

To make use of the Professional Advisor, it’s good to obtain the free “Shifting Common Cross Sign” indicator from the MQL Market and preserve it within the MQL Market. The indicator file needs to be situated within the “Indicators/Market” folder.

The knowledgeable advisor is configured for the British Pound (GBPUSD) on the H1 (1 hour) timeframe. Nevertheless, you should utilize the knowledgeable advisor on any image and timeframe by adjusting the parameters your self.

New promising approaches to averaging

On the identical time, a number of new fashions for growing place quantity have been developed. The “GridMode” parameter within the knowledgeable advisor is chargeable for this.

“GridMode” = 0 – the previous traditional methodology, the place every new place in a sequence is opened with an elevated quantity. The amount multiplier is about by the “KLot” parameter .

“GridMode” = 2 – a brand new improvement!!! TakeProfit for a sequence of orders is about on the pattern reversal degree as a proportion. The amount is calculated based mostly on this. The space is about utilizing the “ TP_Grid” parameter.

Conclusions on the “Averaging + Shifting Common Cross Sign” challenge

The introduced challenge clearly demonstrates the evolution of the grid buying and selling strategy, reworking it from a dangerous roulette right into a extra systematic methodology. Listed here are the important thing factors:

-

Psychological victory over classical buying and selling. The principle cause for the persistence of averaging will not be its mathematical superiority, however that it satisfies a dealer’s fundamental psychological want: to see common account progress. By promising “a interval with out a new excessive in lower than every week,” the knowledgeable immediately appeals to this, providing a “authorized” approach to obtain what they need, however with an analytical foundation.

-

Averaging turns into a device, not a method. That is a very powerful conceptual breakthrough. As a substitute of blindly opening orders at mounted intervals, The Shifting Common Cross Sign indicator’s major sign . Averaging is now a capital administration tactic. inside A pattern commerce geared toward strengthening a place and accelerating profitability throughout a correction. This modifications the anticipated return of the system.

-

Progressive methodology GridMode = 2 – “sensible” averaging. This is not only a new possibility, however a step towards automated threat administration. Algorithmic quantity choice for a given take-profit degree ( TP_Grid ) is an try calculate the exit state of affairs upfront for your complete grid. This strategy is doubtlessly simpler than traditional geometric progress ( GridMode = 0 ), because it goals to optimize deposit utilization for particular market situations (anticipated pullback).

-

Accessibility and synergy. The mix of a free, highly effective indicator and an knowledgeable advisor with a minimal deposit of $50 creates a low entry barrier. This enables a variety of merchants to check the hybrid strategy in observe, which is effective for the event of the group.

-

Prospects and progress areas. Huge potential can be unlocked with:

-

Addition symmetric logic for gross sales .

-

Implementation dynamic ranges of safety (for instance, turning off the grid when the indicator sign is in the wrong way).

-

Prolonged modes GridMode , bearing in mind volatility (ATR).

-