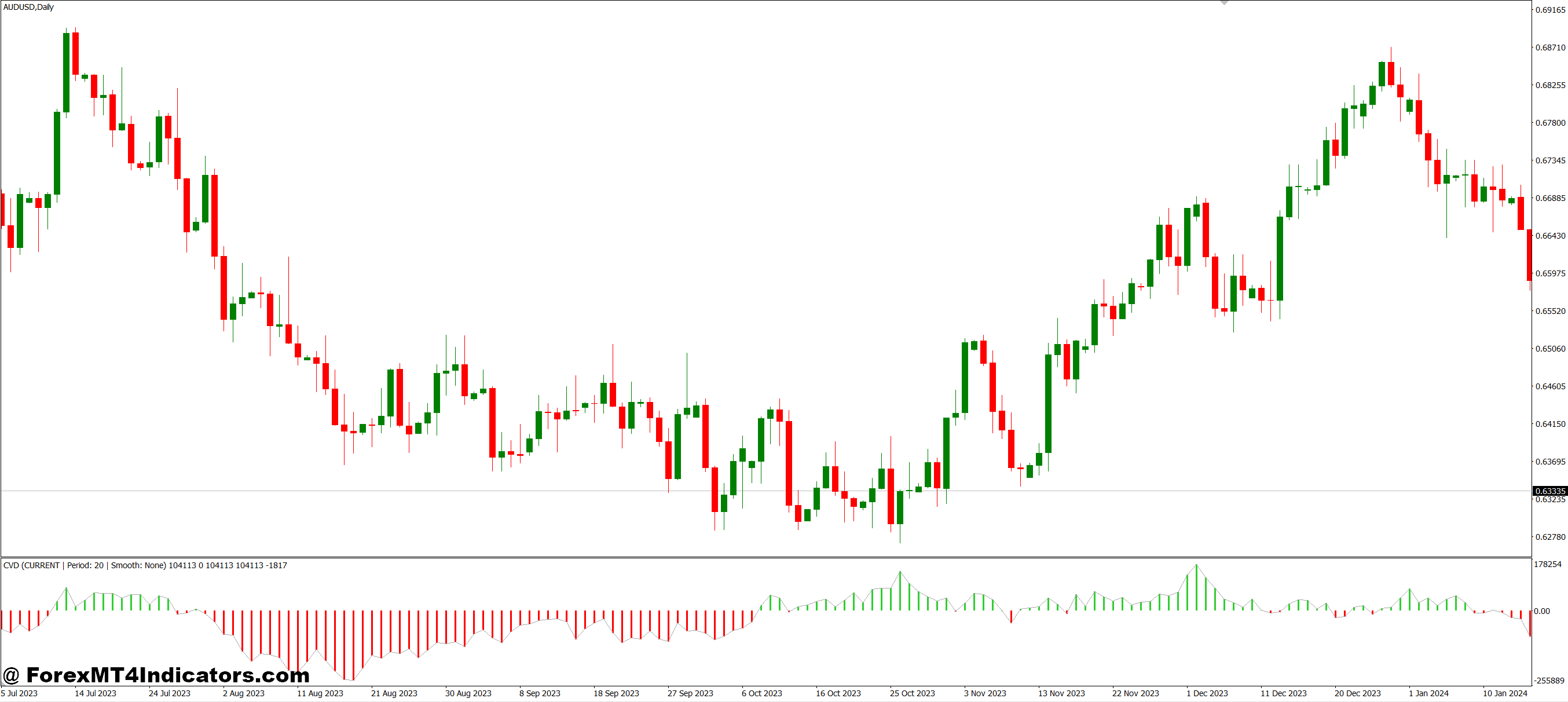

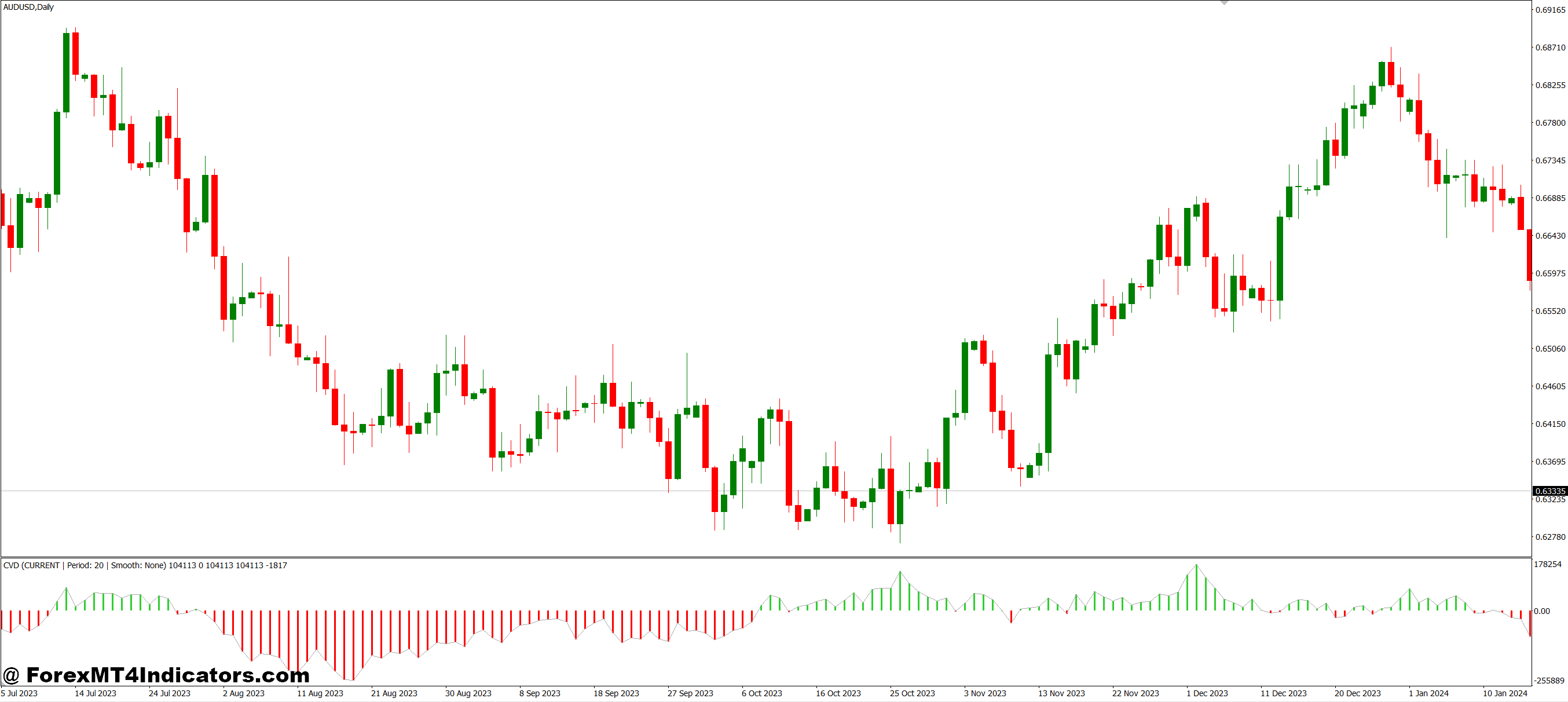

The CVD MT4 Indicator works by calculating the distinction between shopping for quantity and promoting quantity over time. Each time a commerce occurs on the ask value, it’s counted as shopping for quantity. When a commerce occurs on the bid value, it’s promoting quantity. The indicator provides up these variations repeatedly, making a working whole that reveals whether or not consumers or sellers have been extra aggressive. When the CVD line goes up, consumers are in management. When it drops, sellers are taking up. This straightforward visible makes it means simpler for merchants to grasp what’s actually taking place beneath the floor of value motion.

Recognizing Divergences for Higher Trades

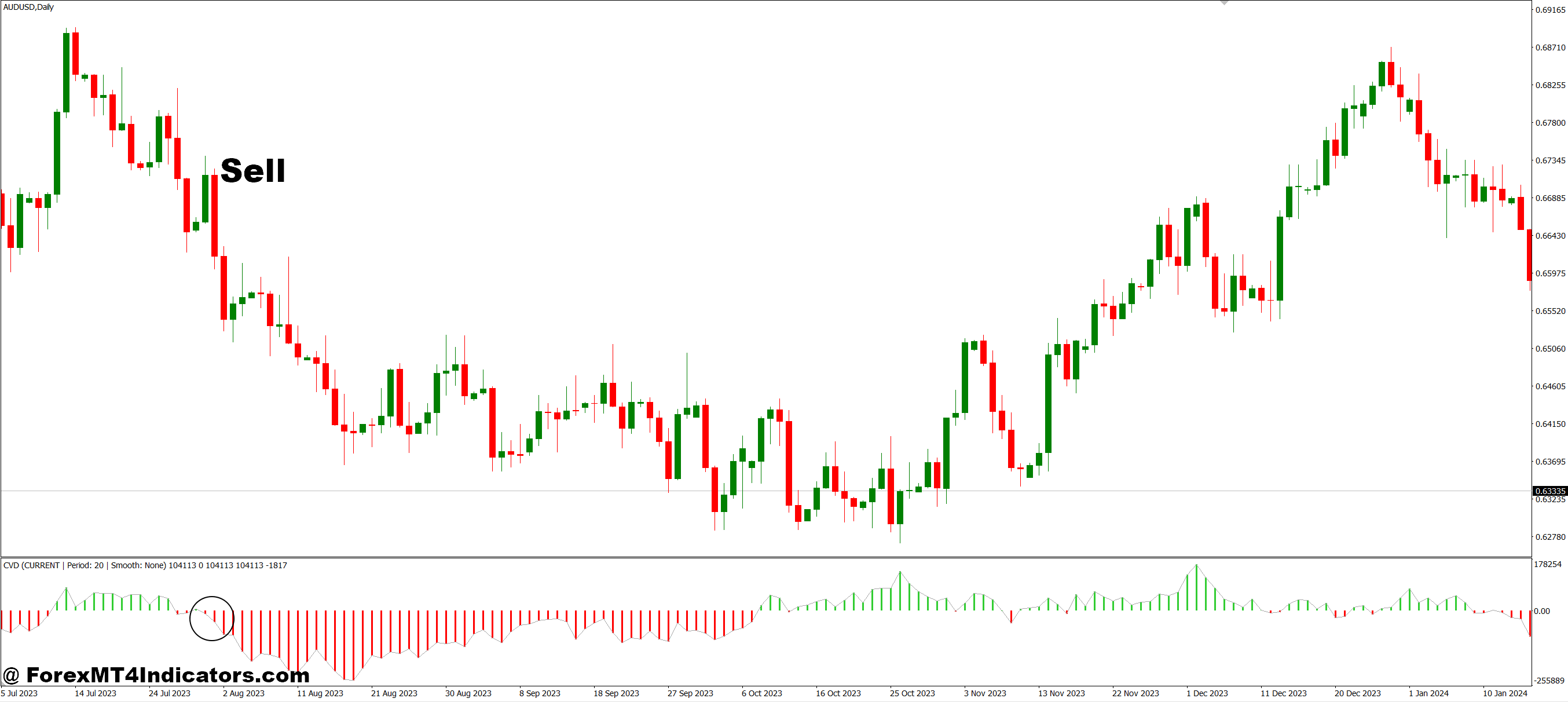

What makes this indicator so precious is the way it helps merchants spot divergences. Generally the value retains climbing increased, however the CVD begins falling. That’s a purple flag. It means fewer consumers are supporting the transfer, and the rally is perhaps working out of steam. The alternative works too—if the value drops however CVD rises, it suggests sellers are dropping power and a reversal might be coming. These divergences give merchants an early warning system that value charts alone simply can’t present. It’s like having X-ray imaginative and prescient into market sentiment.

Simple Setup and Customization

Establishing the CVD indicator on MT4 is fairly easy. Merchants obtain the indicator file, drop it into their indicators folder, and restart their platform. As soon as it’s loaded on a chart, they will customise the settings to match their buying and selling type. Day merchants may use shorter timeframes to catch fast strikes, whereas swing merchants follow longer intervals for the larger image. The indicator works on any forex pair, inventory, or commodity that reveals quantity information. Many merchants mix it with different instruments like help and resistance ranges or shifting averages to create a whole buying and selling system.

Combining CVD with Value Motion

The true energy comes from utilizing CVD alongside value motion. Let’s say a dealer sees the value breaking above a key resistance degree. They verify the CVD indicator and see it’s surging upward too. That confirms robust shopping for stress, making the breakout extra dependable. On the flip facet, if the value breaks out however CVD stays flat or drops, that breakout might be weak and may fail rapidly. This affirmation course of helps merchants keep away from fake-outs and give attention to high-probability setups. It turns guesswork right into a extra calculated method the place the amount information backs up what the value is doing.

Commerce with CVD MT4 Indicator

Purchase Entry

- CVD line crosses above zero – When the indicator strikes from destructive to constructive territory, it reveals consumers are beginning to take management of the market

- Bullish divergence seems – Value makes a decrease low, however CVD makes the next low, signaling that promoting stress is weakening and a reversal upward is perhaps coming.

- CVD confirms an uptrend – The CVD line retains making increased highs together with the value, confirming robust shopping for momentum that merchants can journey.

- Sharp upward spike in CVD – A sudden soar within the CVD line signifies aggressive shopping for exercise, typically earlier than a major value transfer increased.

- CVD breaks above earlier resistance – When the indicator pushes previous its latest excessive level, it reveals renewed purchaser power price leaping on.

- Value pullback with rising CVD – When value dips barely however CVD retains climbing, it suggests consumers are accumulating, and the dip is a shopping for alternative.

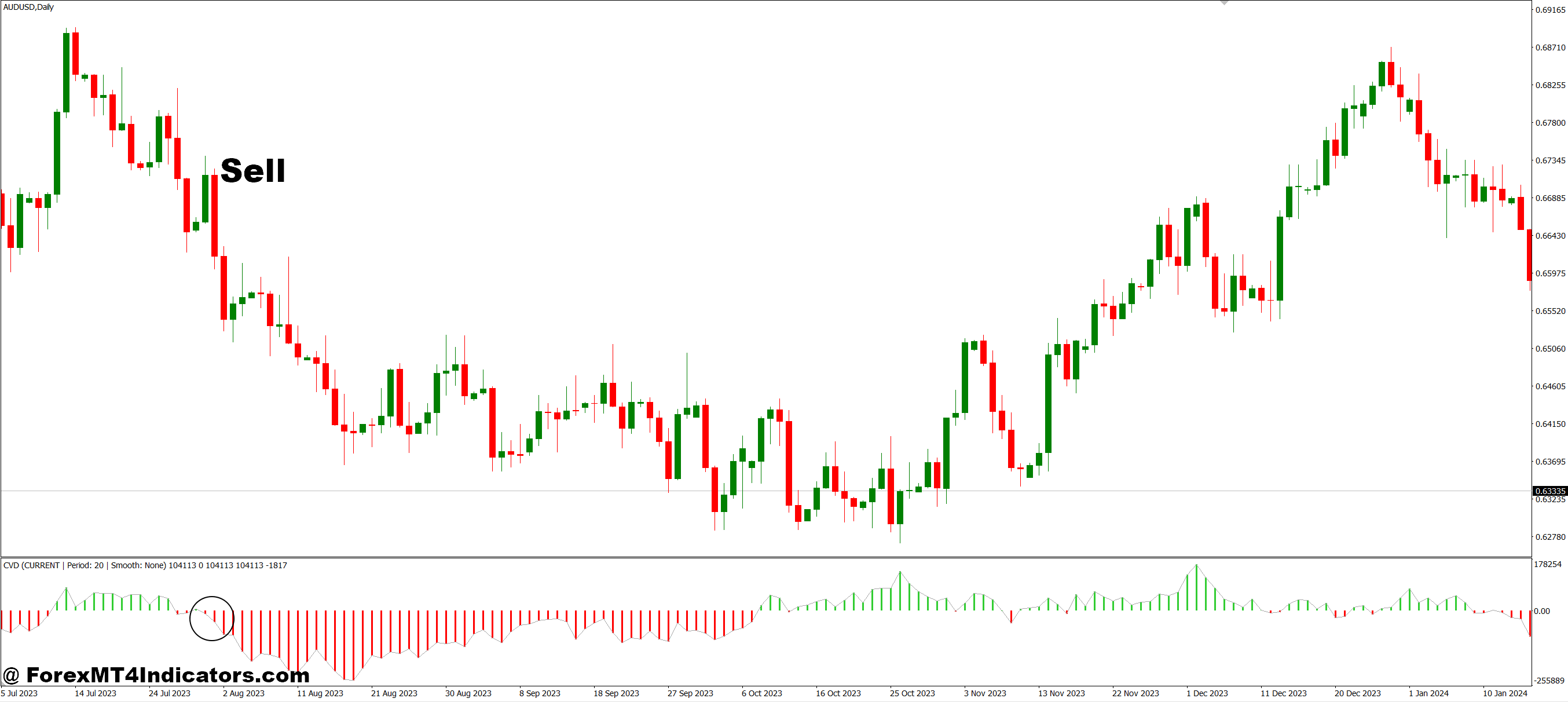

Promote Entry

- CVD line crosses under zero – When the indicator drops from constructive to destructive, it means sellers are gaining management and pushing the market down.

- Bearish divergence reveals up – Value makes the next excessive, however CVD makes a decrease excessive, warning that the uptrend is dropping steam and a reversal might occur quickly.

- CVD confirms a downtrend – The CVD line retains making decrease lows alongside falling costs, proving robust promoting stress is in cost.

- Sharp downward drop in CVD – A fast plunge within the CVD line reveals aggressive promoting exercise, normally earlier than a significant value drop.

- CVD breaks under earlier help – When the indicator falls previous its latest low, it indicators elevated vendor dominance and a superb alternative to go quick.

- Value rally with falling CVD – When value strikes up barely however CVD retains dropping, it suggests sellers are distributing, and the rally is a promoting alternative.

Conclusion

The CVD MT4 Indicator provides merchants one thing they desperately want—readability. As an alternative of guessing whether or not consumers or sellers are successful, they will see the proof proper on their charts. It helps them catch divergences earlier than reversals occur, affirm breakouts earlier than leaping in, and perceive the actual power behind value actions. For anybody uninterested in getting caught on the improper facet of trades, this indicator affords a sensible technique to learn market stress and make extra knowledgeable selections. It’s not magic, however it’s positively a type of instruments that may degree up somebody’s buying and selling recreation.

Really useful MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Extra Unique Bonuses All through The 12 months

- Unique 90% VIP Money Rebates for all Trades!

>> Signal Up for XM Dealer Account right here with Unique 90% VIP Money Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Companion Code: VIP90