Revealed on October sixteenth, 2025 by Bob Ciura

Investing in high-quality dividend progress shares may not be essentially the most thrilling thought. However for dividend progress traders, shopping for “boring” shares generally is a good factor.

Sure market sectors, akin to client staples, utilities, and well being care, comprise many high quality dividend shares. These sectors have confirmed that typically slow-and-steady wins the race for long-term traders.

Not surprisingly, many high quality dividend payers in these defensive industries have elevated their dividends for many years on finish.

With this in thoughts, we created a listing of all of the Dividend Kings, a gaggle of simply 56 shares with 50+ consecutive years of dividend will increase.

You possibly can see the total downloadable spreadsheet of all 56 Dividend Kings (together with essential monetary metrics akin to dividend yields, payout ratios, and price-to-earnings ratios) by clicking on the hyperlink beneath:

For traders primarily all in favour of earnings, additionally it is helpful to rank the Dividend Kings in accordance with their dividend yields.

This text will checklist 10 “boring” shares that function in recession-resistant market sectors, with 50+ years of dividend will increase.

Desk of Contents

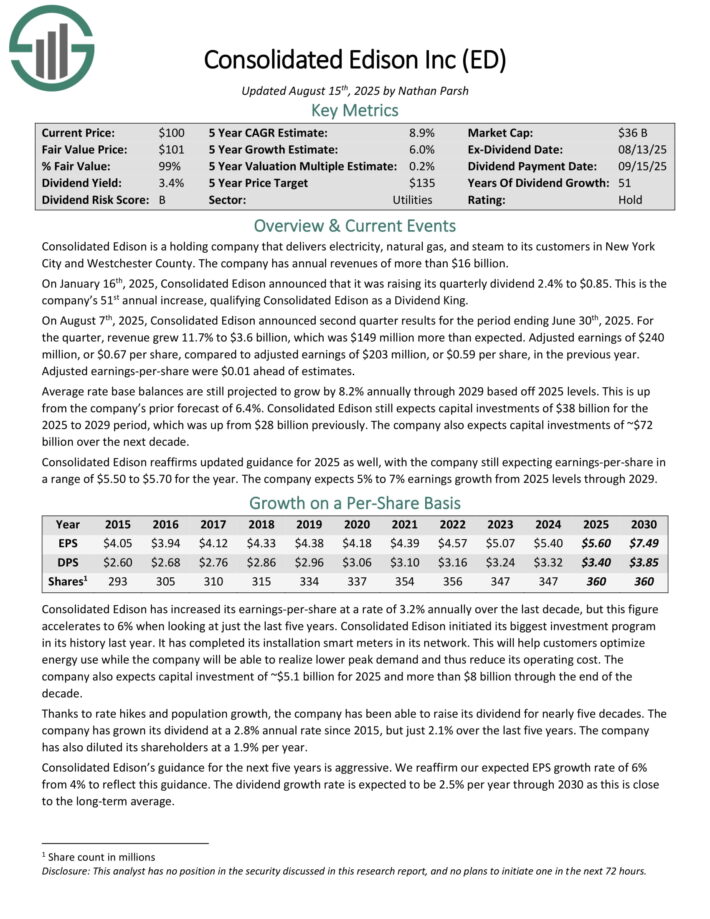

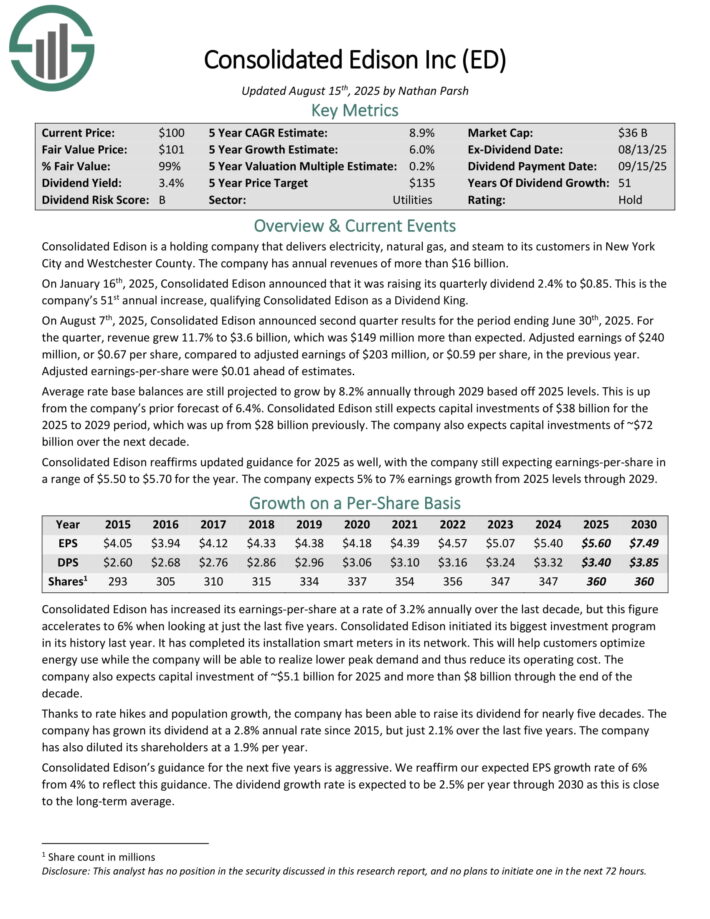

Boring Dividend Inventory: Consolidated Edison (ED)

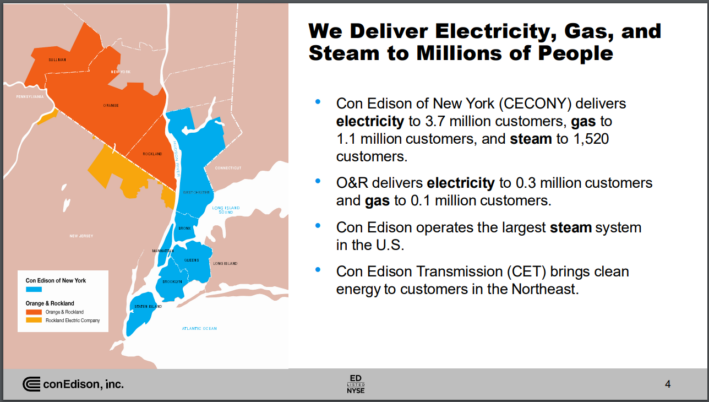

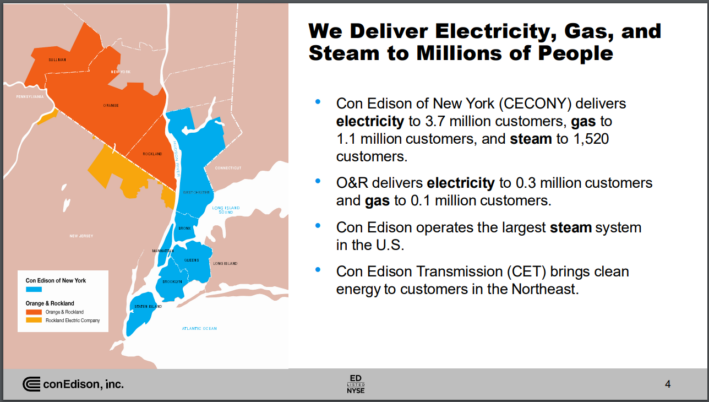

Consolidated Edison is a large-cap utility inventory. The corporate generates roughly $15 billion in annual income. The corporate serves over 3 million electrical clients, and one other 1 million gasoline clients, in New York.

It operates electrical, gasoline, and steam transmission companies.

Supply: Investor Presentation

On Could 2nd, 2025, Consolidated Edison reported first quarter outcomes for the interval ending March thirty first, 2025. For the quarter, income grew 12.1% to $4.8 billion, which beat estimates by $346 million.

Adjusted earnings of $792 million, or $2.26 per share, in comparison with adjusted earnings of $742 million, or $2.15 per share, within the earlier 12 months.

Adjusted earnings-per-share have been $0.07 higher than anticipated. Common fee base balances are nonetheless projected to develop by 8.2% yearly by 2029 primarily based off 2025 ranges. That is up from the corporate’s prior forecast of 6.4%.

Click on right here to obtain our most up-to-date Certain Evaluation report on ED (preview of web page 1 of three proven beneath):

Boring Dividend Inventory: Black Hills Company (BKH)

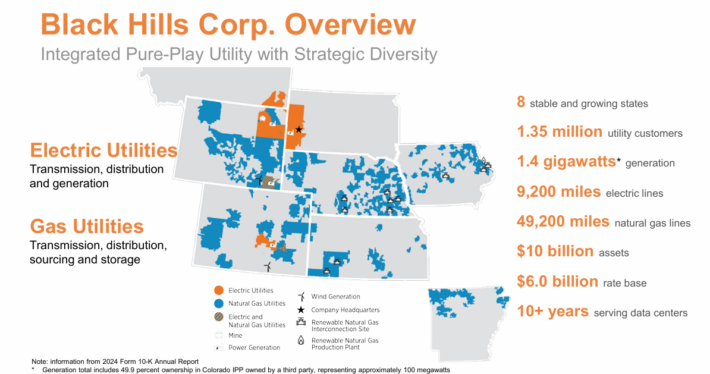

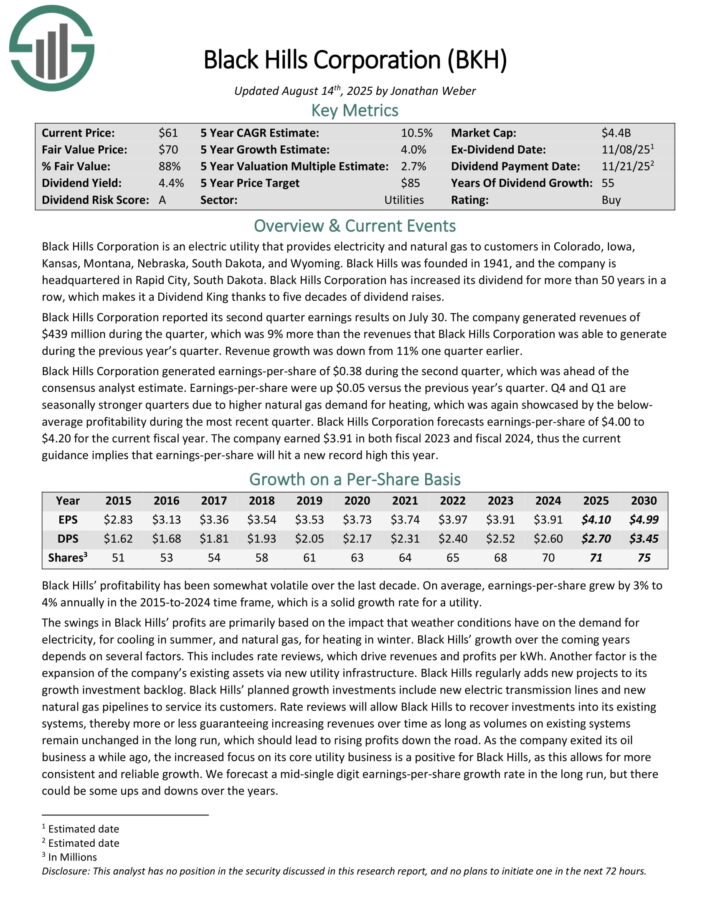

Black Hills Company is an electrical utility that gives electrical energy and pure gasoline to clients in Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, and Wyoming.

The corporate has 1.35 million utility clients in eight states. Its pure gasoline property embody 49,200 miles of pure gasoline strains. Individually, it has ~9,200 miles of electrical strains and 1.4 gigawatts of electrical era capability.

Supply: Investor Presentation

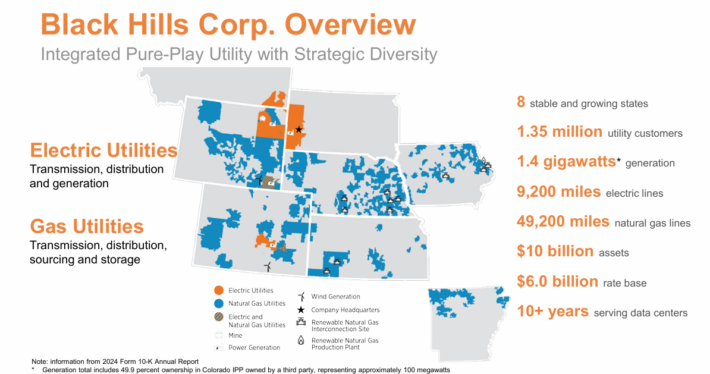

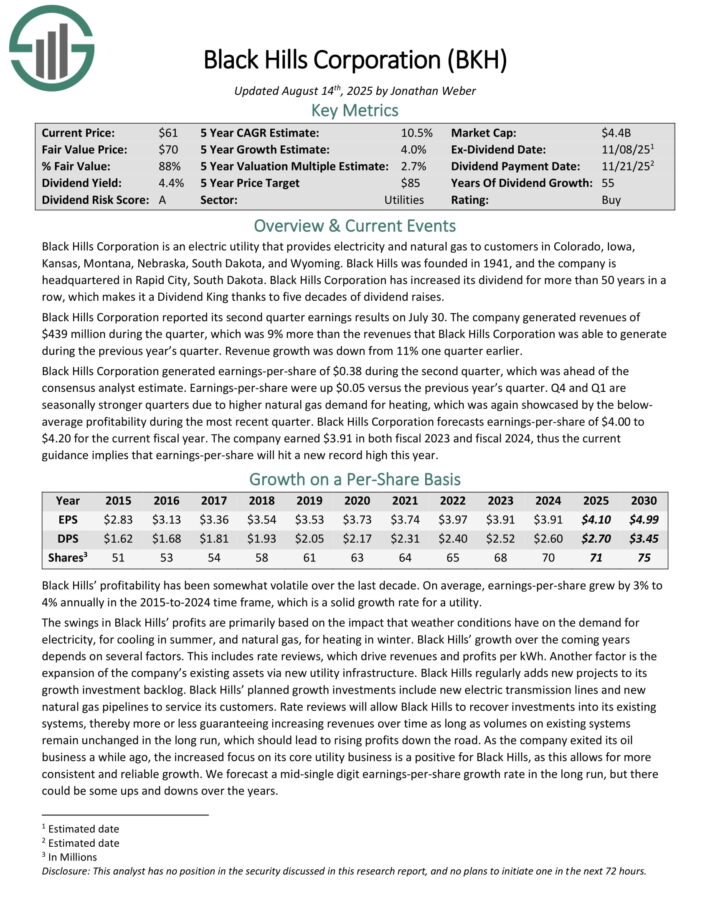

Black Hills Company reported its second quarter earnings outcomes on July 30. The corporate generated revenues of $439 million in the course of the quarter, up 9% year-over-year.

Black Hills Company generated earnings-per-share of $0.38 in the course of the second quarter, which was forward of the consensus analyst estimate.

Earnings-per-share have been up $0.05 versus the earlier 12 months’s quarter. This autumn and Q1 are seasonally stronger quarters attributable to larger pure gasoline demand for heating.

Black Hills Company forecasts earnings-per-share of $4.00 to $4.20 for the present fiscal 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on BKH (preview of web page 1 of three proven beneath):

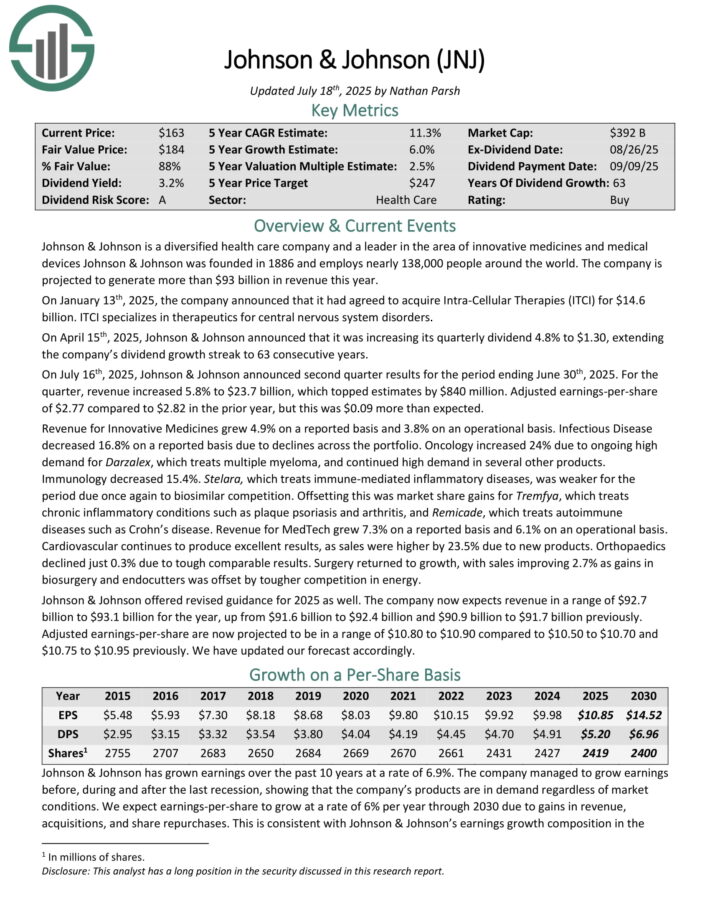

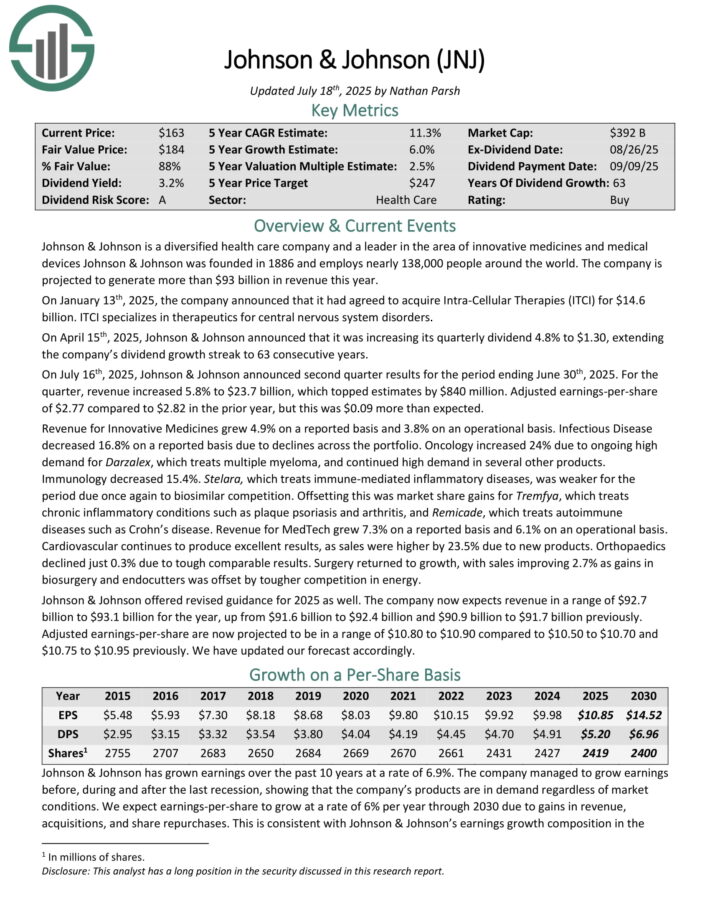

Boring Dividend Inventory: Johnson & Johnson (JNJ)

Johnson & Johnson is a diversified well being care firm and a frontrunner within the space of progressive medicines and medical gadgets Johnson & Johnson was based in 1886.

On July sixteenth, 2025, Johnson & Johnson introduced second quarter outcomes for the interval ending June thirtieth, 2025. For the quarter, income elevated 5.8% to $23.7 billion, which topped estimates by $840 million.

Adjusted earnings-per-share of $2.77 in comparison with $2.82 within the prior 12 months, however this was $0.09 greater than anticipated.

Income for Revolutionary Medicines grew 4.9% on a reported foundation and three.8% on an operational foundation. Infectious Illness decreased 16.8% on a reported foundation attributable to declines throughout the portfolio.

Oncology elevated 24% attributable to ongoing excessive demand for Darzalex, which treats a number of myeloma, and continued excessive demand in a number of different merchandise.

Johnson & Johnson supplied revised steering for 2025 as properly. The corporate now expects income in a spread of $92.7 billion to $93.1 billion for the 12 months, up from $91.6 billion to $92.4 billion and $90.9 billion to $91.7 billion beforehand.

Adjusted earnings-per-share are actually projected to be in a spread of $10.80 to $10.90.

Click on right here to obtain our most up-to-date Certain Evaluation report on JNJ (preview of web page 1 of three proven beneath):

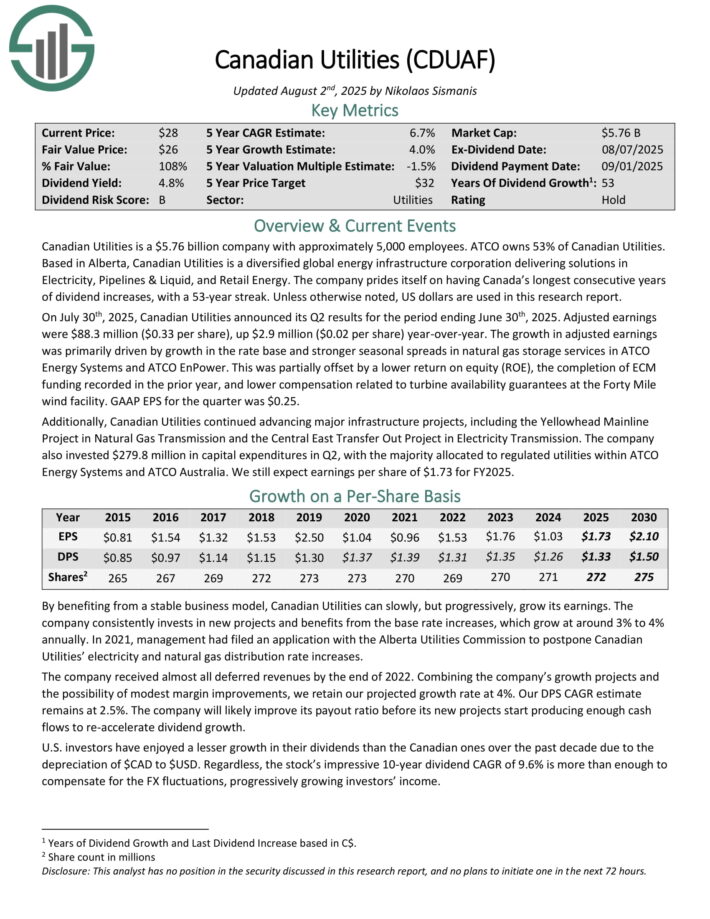

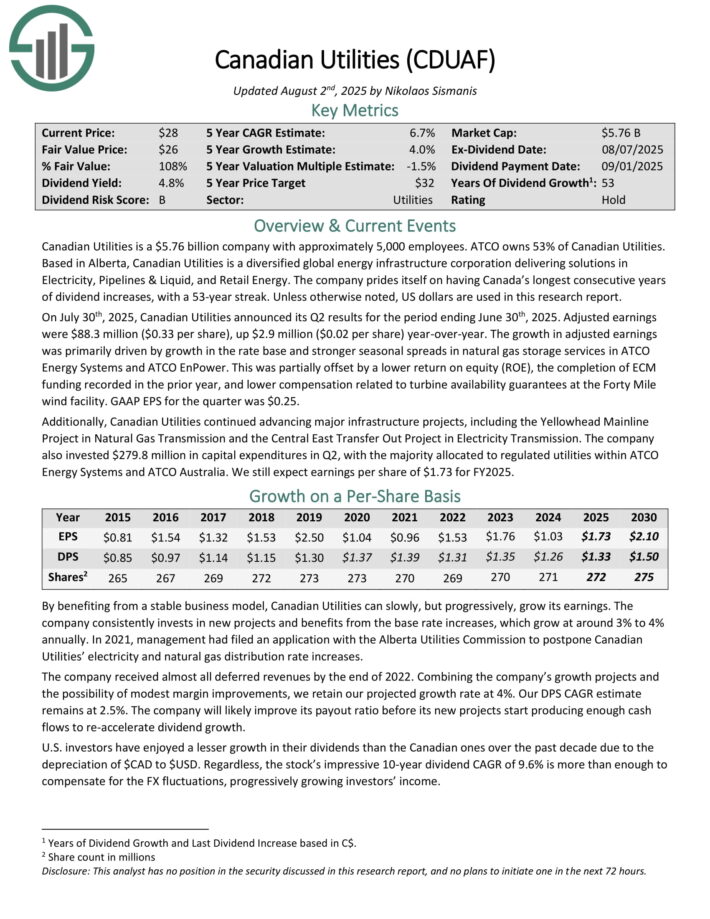

Boring Dividend Inventory: Canadian Utilities (CDUAF)

Canadian Utilities is a utility firm with roughly 5,000 staff. ATCO owns 53% of Canadian Utilities. Primarily based in Alberta, Canadian Utilities is a diversified world power infrastructure company delivering options in Electrical energy, Pipelines & Liquid, and Retail Vitality.

On July thirtieth, 2025, Canadian Utilities introduced its Q2 outcomes for the interval ending June thirtieth, 2025. Adjusted earnings have been $88.3 million ($0.33 per share), up $2.9 million ($0.02 per share) year-over-year.

The expansion in adjusted earnings was primarily pushed by progress within the fee base and stronger seasonal spreads in pure gasoline storage providers in ATCO Vitality Programs and ATCO EnPower.

This was partially offset by a decrease return on fairness (ROE), the completion of ECM funding recorded within the prior 12 months, and decrease compensation associated to turbine availability ensures on the Forty Mile wind facility. GAAP EPS for the quarter was $0.25.

Click on right here to obtain our most up-to-date Certain Evaluation report on CDUAF (preview of web page 1 of three proven beneath):

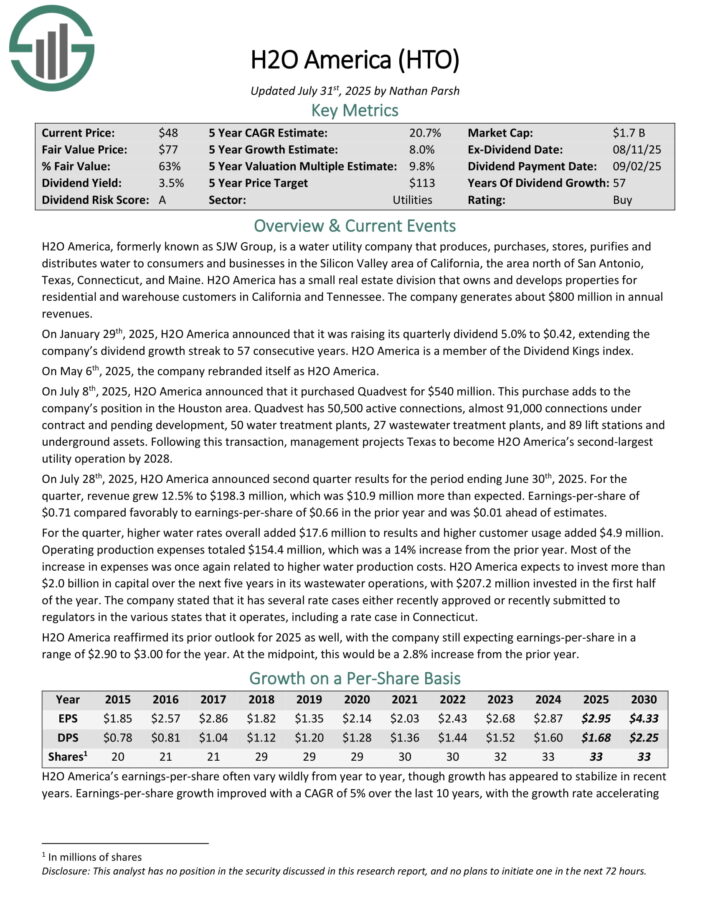

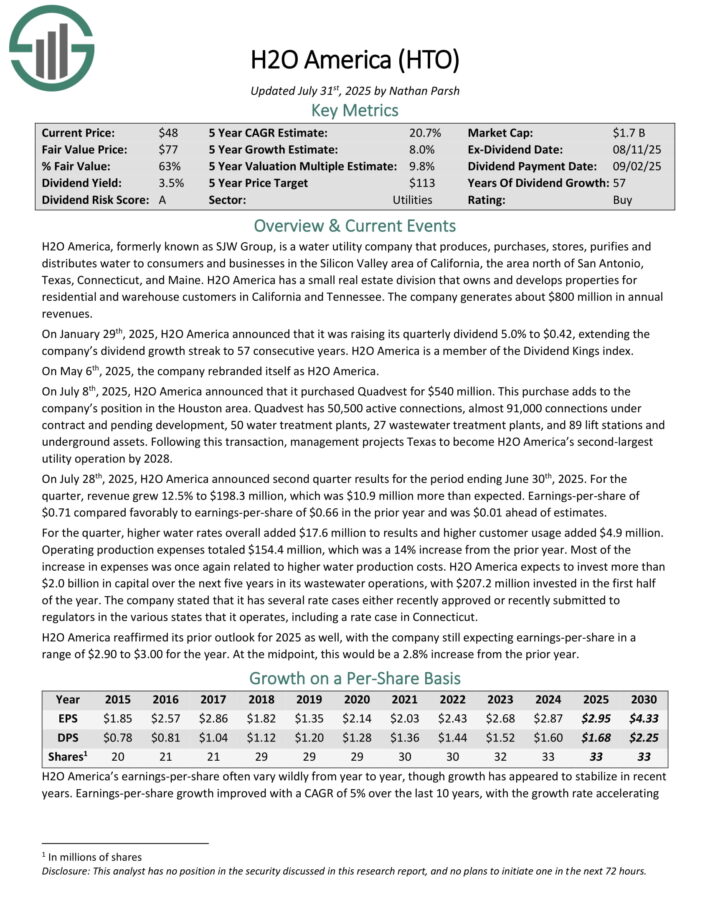

Boring Dividend Inventory: H2O America (HTO)

H2O America, previously referred to as SJW Group, is a water utility firm that produces, purchases, shops, purifies and distributes water to customers and companies within the Silicon Valley space of California, the realm north of San Antonio, Texas, Connecticut, and Maine.

It additionally has a small actual property division that owns and develops properties for residential and warehouse clients in California and Tennessee. The corporate generates about $670 million in annual revenues.

On July eighth, 2025, H2O America introduced that it bought Quadvest for $540 million. This buy provides to the corporate’s place within the Houston space.

Quadvest has 50,500 energetic connections, nearly 91,000 connections underneath contract and pending improvement, 50 water therapy vegetation, 27 wastewater therapy vegetation, and 89 raise stations and underground property.

On July twenty eighth, 2025, H2O America introduced second quarter outcomes for the interval ending June thirtieth, 2025. For the quarter, income grew 12.5% to $198.3 million, which was $10.9 million greater than anticipated.

Earnings-per-share of $0.71 in contrast favorably to earnings-per-share of $0.66 within the prior 12 months and was $0.01 forward of estimates.

For the quarter, larger water charges general added $17.6 million to outcomes and better buyer utilization added $4.9 million. Working manufacturing bills totaled $154.4 million, which was a 14% improve from the prior 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on HTO (preview of web page 1 of three proven beneath):

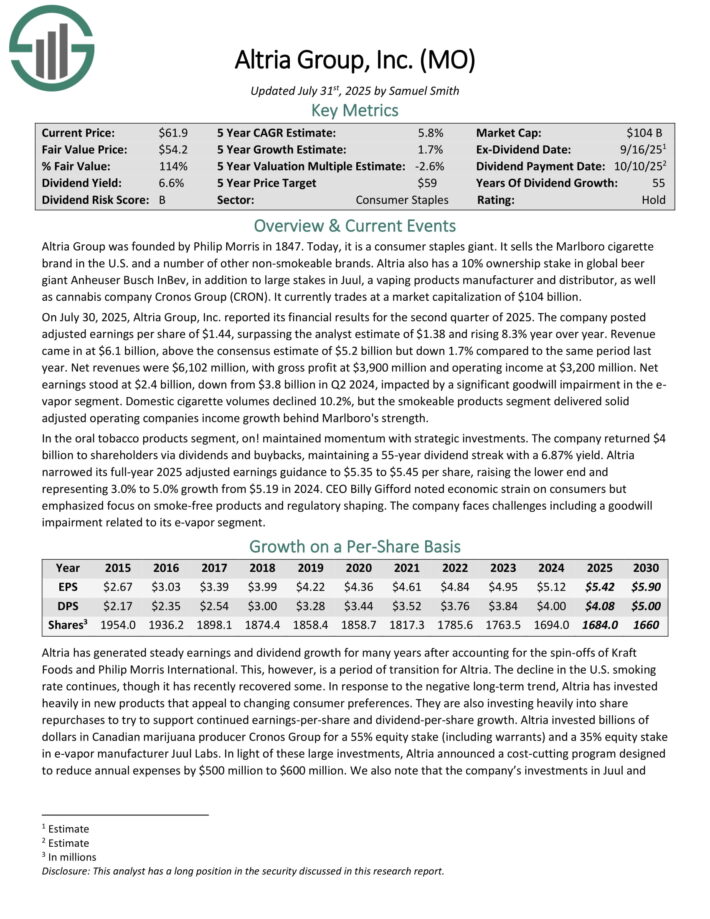

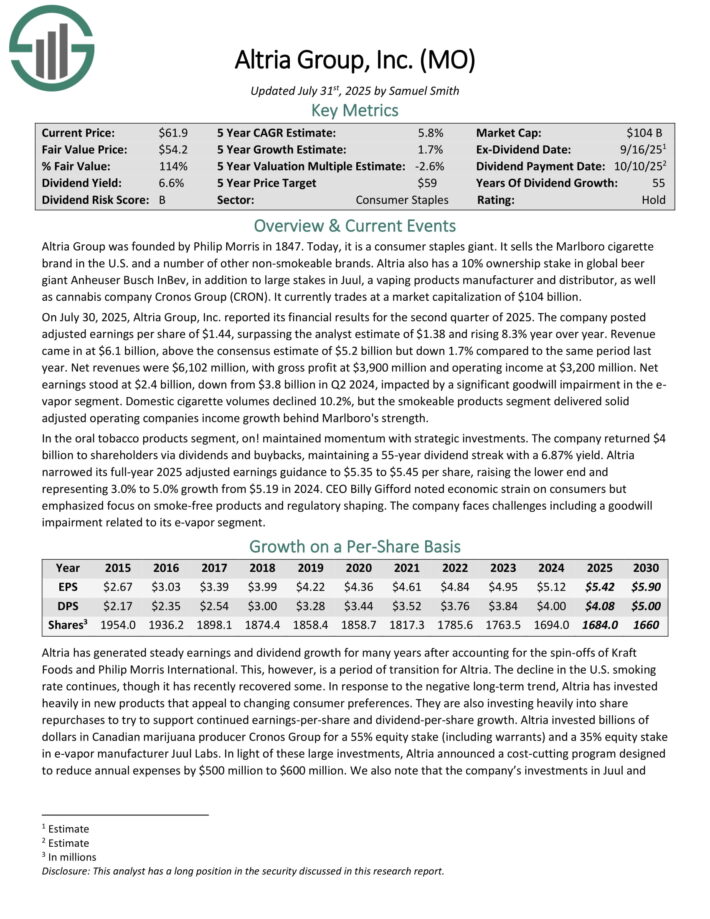

Boring Dividend Inventory: Altria Group (MO)

Altria is a tobacco inventory that sells cigarettes, chewing tobacco, cigars, e-cigarettes, and extra underneath quite a lot of manufacturers, together with Marlboro, Skoal, and Copenhagen, amongst others.

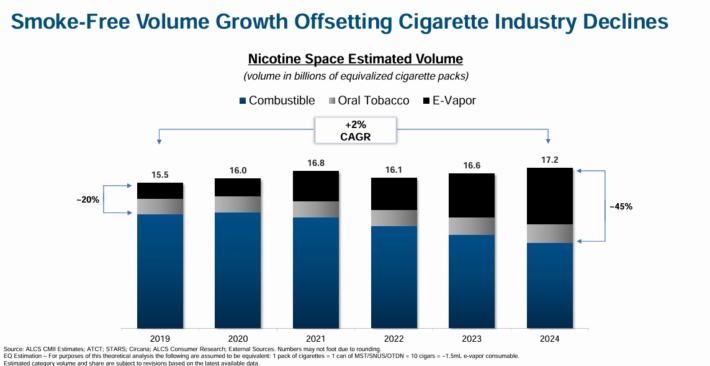

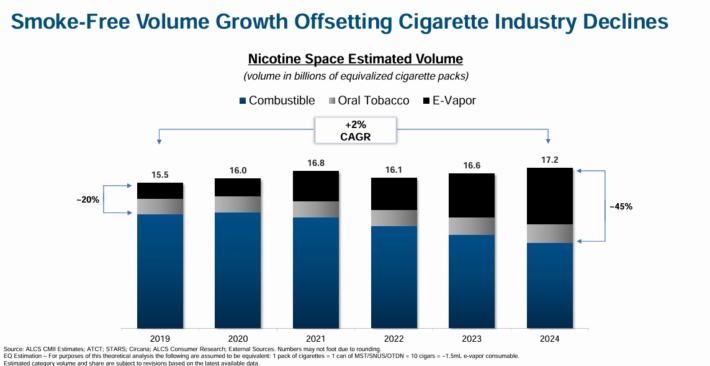

It is a interval of transition for Altria. The decline within the U.S. smoking fee continues. In response, Altria has invested closely in new merchandise that attraction to altering client preferences, because the smoke-free class continues to develop.

Supply: Investor Presentation

The corporate additionally has a 35% funding stake in e-cigarette maker JUUL, and a forty five% stake within the Canadian hashish producer Cronos Group (CRON).

On July 30, 2025, Altria Group, Inc. reported its monetary outcomes for the second quarter of 2025. The corporate posted adjusted earnings per share of $1.44, surpassing the analyst estimate of $1.38 and rising 8.3% 12 months over 12 months.

Income got here in at $6.1 billion, above the consensus estimate of $5.2 billion however down 1.7% in comparison with the identical interval final 12 months. Internet revenues have been $6,102 million, with gross revenue at $3,900 million and working earnings at $3,200 million.

Internet earnings stood at $2.4 billion, down from $3.8 billion in Q2 2024, impacted by a big goodwill impairment within the e-vapor phase.

Home cigarette volumes declined 10.2%, however the smokeable merchandise phase delivered strong adjusted working firms earnings progress behind Marlboro’s power.

Click on right here to obtain our most up-to-date Certain Evaluation report on Altria (preview of web page 1 of three proven beneath):

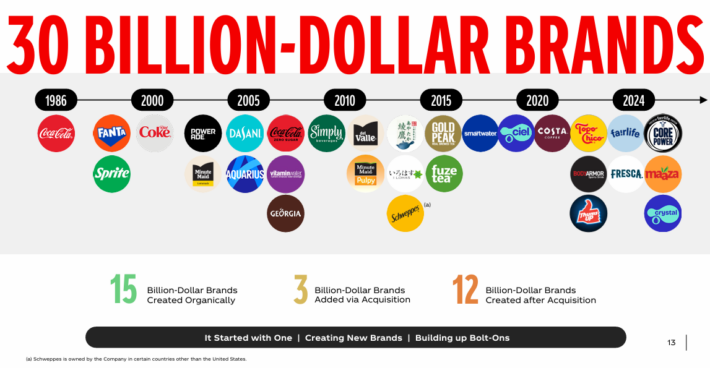

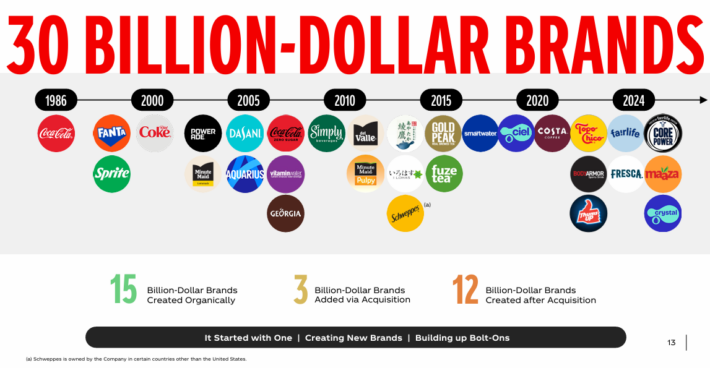

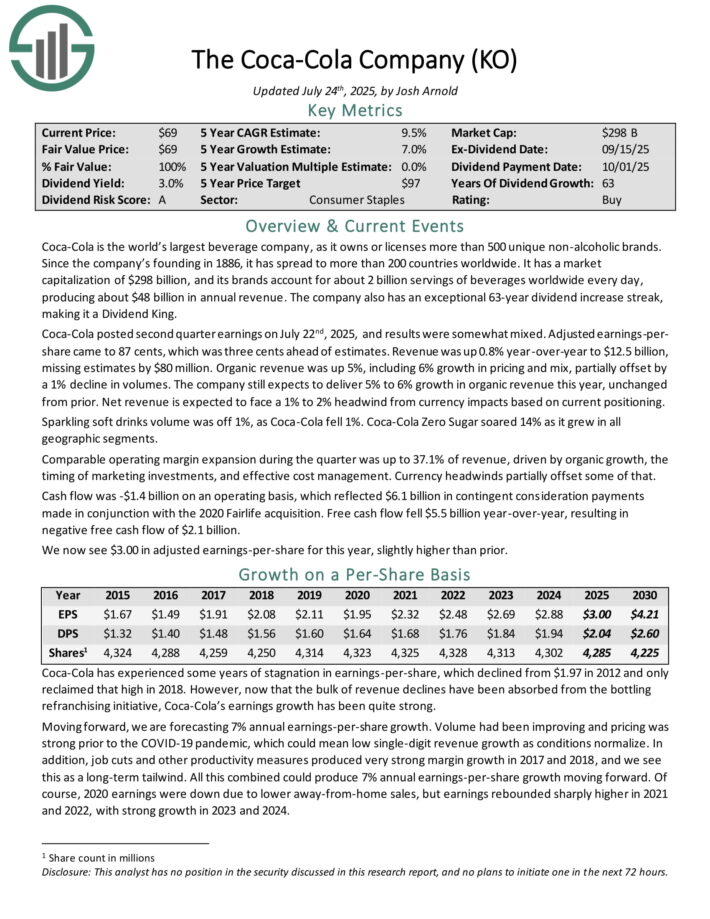

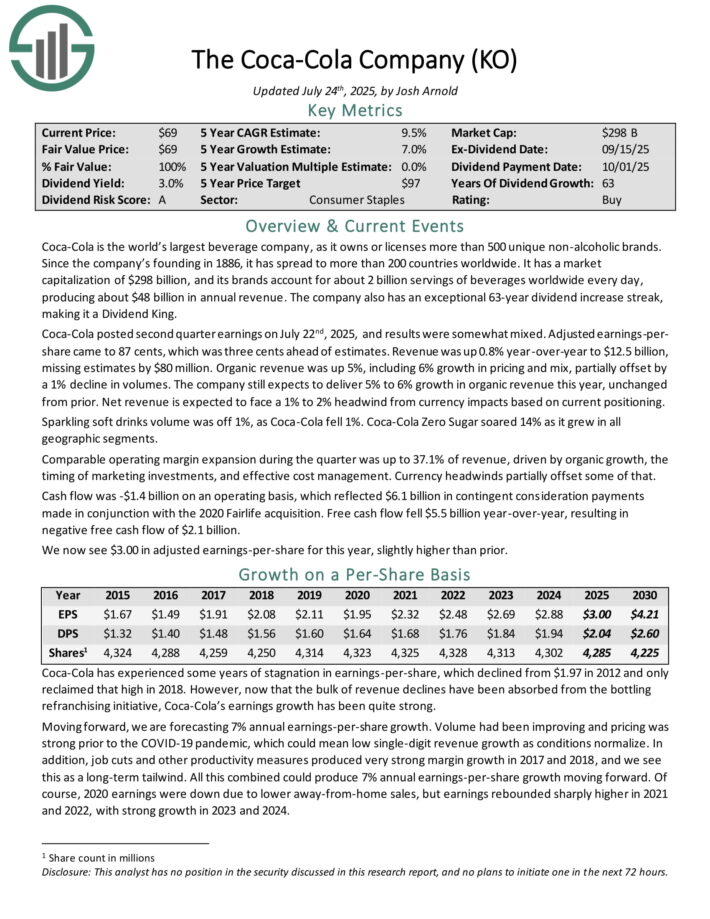

Boring Dividend Inventory: Coca-Cola Co. (KO)

Coca-Cola is the world’s largest beverage firm, because it owns or licenses greater than 500 distinctive non–alcoholic manufacturers. For the reason that firm’s founding in 1886, it has unfold to greater than 200 nations worldwide.

Coca-Cola now has 30 billion-dollar manufacturers in its portfolio, which every generate at the least $1 billion in annual gross sales.

Supply: Investor Presentation

Coca-Cola posted second quarter earnings on July twenty second, 2025, and outcomes have been considerably blended. Adjusted earnings-per-share got here to 87 cents, which was three cents forward of estimates. Income was up 0.8% year-over-year to $12.5 billion, lacking estimates by $80 million.

Natural income was up 5%, together with 6% progress in pricing and blend, partially offset by a 1% decline in volumes. The corporate nonetheless expects to ship 5% to six% progress in natural income this 12 months, unchanged from prior. Internet income is anticipated to face a 1% to 2% headwind from forex impacts primarily based on present positioning.

Glowing delicate drinks quantity was off 1%, as Coca-Cola fell 1%. Coca-Cola Zero Sugar soared 14% because it grew in all geographic segments. Comparable working margin growth in the course of the quarter was as much as 37.1% of income, pushed by natural progress, the timing of selling investments, and efficient price administration.

Click on right here to obtain our most up-to-date Certain Evaluation report on KO (preview of web page 1 of three proven beneath):

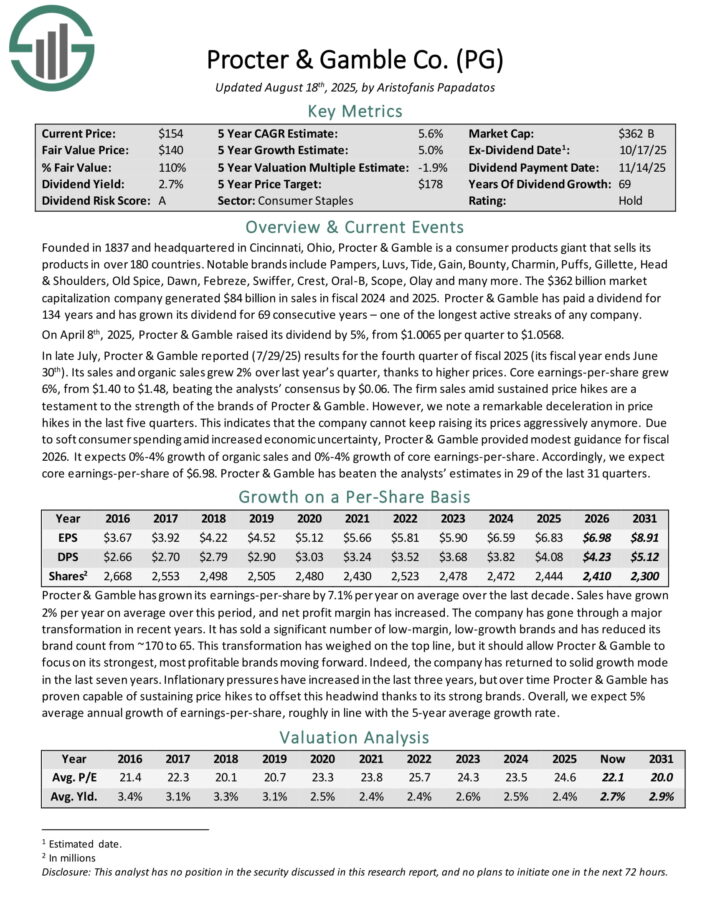

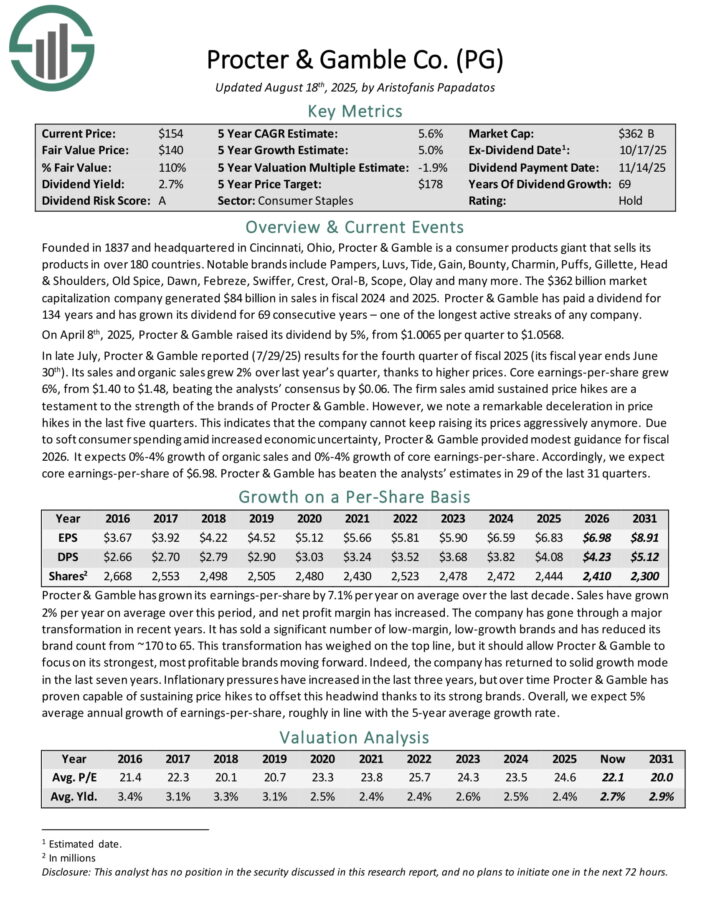

Boring Dividend Inventory: Procter & Gamble (PG)

Procter & Gamble is a client merchandise big that sells its merchandise in over 180 nations. Notable manufacturers embody Pampers, Luvs, Tide, Achieve, Bounty, Charmin, Puffs, Gillette, Head & Shoulders, Outdated Spice, Daybreak, Febreze, Swiffer, Crest, Oral-B, Scope, Olay and plenty of extra.

The corporate generated $84 billion in gross sales in fiscal 2024 and 2025. Procter & Gamble has paid a dividend for 134 years and has grown its dividend for 69 consecutive years – one of many longest energetic streaks of any firm.

In late July, Procter & Gamble reported (7/29/25) outcomes for the fourth quarter of fiscal 2025 (its fiscal 12 months ends June thirtieth). Its gross sales and natural gross sales grew 2% over final 12 months’s quarter, because of larger costs. Core earnings-per-share grew 6%, from $1.40 to $1.48, beating the analysts’ consensus by $0.06.

The agency gross sales amid sustained value hikes are a testomony to the power of the manufacturers of Procter & Gamble. Nonetheless, we notice a outstanding deceleration in value hikes within the final 5 quarters. This means that the corporate can not hold elevating its costs aggressively anymore.

Because of delicate client spending amid elevated financial uncertainty, Procter & Gamble offered modest steering for fiscal 2026. It expects 0%-4% progress of natural gross sales and 0%-4% progress of core earnings-per-share.

Click on right here to obtain our most up-to-date Certain Evaluation report on PG (preview of web page 1 of three proven beneath):

Boring Dividend Inventory: Colgate-Palmolive (CL)

Colgate-Palmolive has been in existence for greater than 200 years, having been based in 1806. It operates in lots of client staples markets, together with Oral Care, Private Care, House Care, and extra just lately, Pet Vitamin.

These segments afford the corporate simply over $20 billion in annual income. Colgate-Palmolive has elevated its dividend for 64 consecutive years.

Colgate posted second quarter earnings on August 1st, 2025, and outcomes have been higher than anticipated on each the highest and backside strains. Adjusted earnings-per-share got here to 92 cents, which was three cents forward of estimates.

Income was up 1% year-over-year to $5.11 billion, beating estimates however $80 million. Internet gross sales have been up 1%, with natural income up 1.8%, together with a 0.6% unfavorable influence from decrease non-public label pet gross sales.

Gross revenue was down 50 foundation factors to 60.1% of earnings, whereas adjusted gross revenue was down 70 foundation factors to 60.1% of income. Gross margin was impacted by uncooked materials inflation and tariffs, though administration famous these impacts have been barely lessened within the second quarter.

Internet money offered by operations was $1.48 billion for the primary six months of the 12 months. The crucial Hill’s enterprise, which has fueled a lot of Colgate’s progress in recent times, was up 5% on an natural foundation, together with 2% quantity features and three% value will increase.

Click on right here to obtain our most up-to-date Certain Evaluation report on CL (preview of web page 1 of three proven beneath):

Additional Studying

If you’re all in favour of discovering high-quality dividend progress shares and/or different high-yield securities and earnings securities, the next Certain Dividend sources might be helpful:

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].