Japanese funding firm Metaplanet at present introduced that it’s quickly pausing its inventory acquisition rights. In response to information from Coingecko, the agency at the moment holds 30,823 BTC on its steadiness sheet.

Metaplanet Pauses Inventory Sale, Dedicated To Shopping for Bitcoin

In response to an announcement made earlier at present, one of many main Bitcoin treasury corporations, Metaplanet, is poised to droop the train of its twentieth to twenty second sequence of inventory acquisition rights. These rights, also called Transferring Strike Warrants, can be in suspension from October twentieth to November seventeenth.

For the uninitiated, Transferring Strike Warrants are monetary devices that give traders the appropriate, however not the duty, to purchase or promote an organization’s inventory at a strike value that adjusts over time, often based mostly on the inventory’s market value or different metrics.

As we speak’s announcement implies that Metaplanet is actually quickly halting the sale of frequent inventory to fund extra BTC purchases. Seeing the corporate’s inventory’s latest efficiency, this could hardly come as a shock.

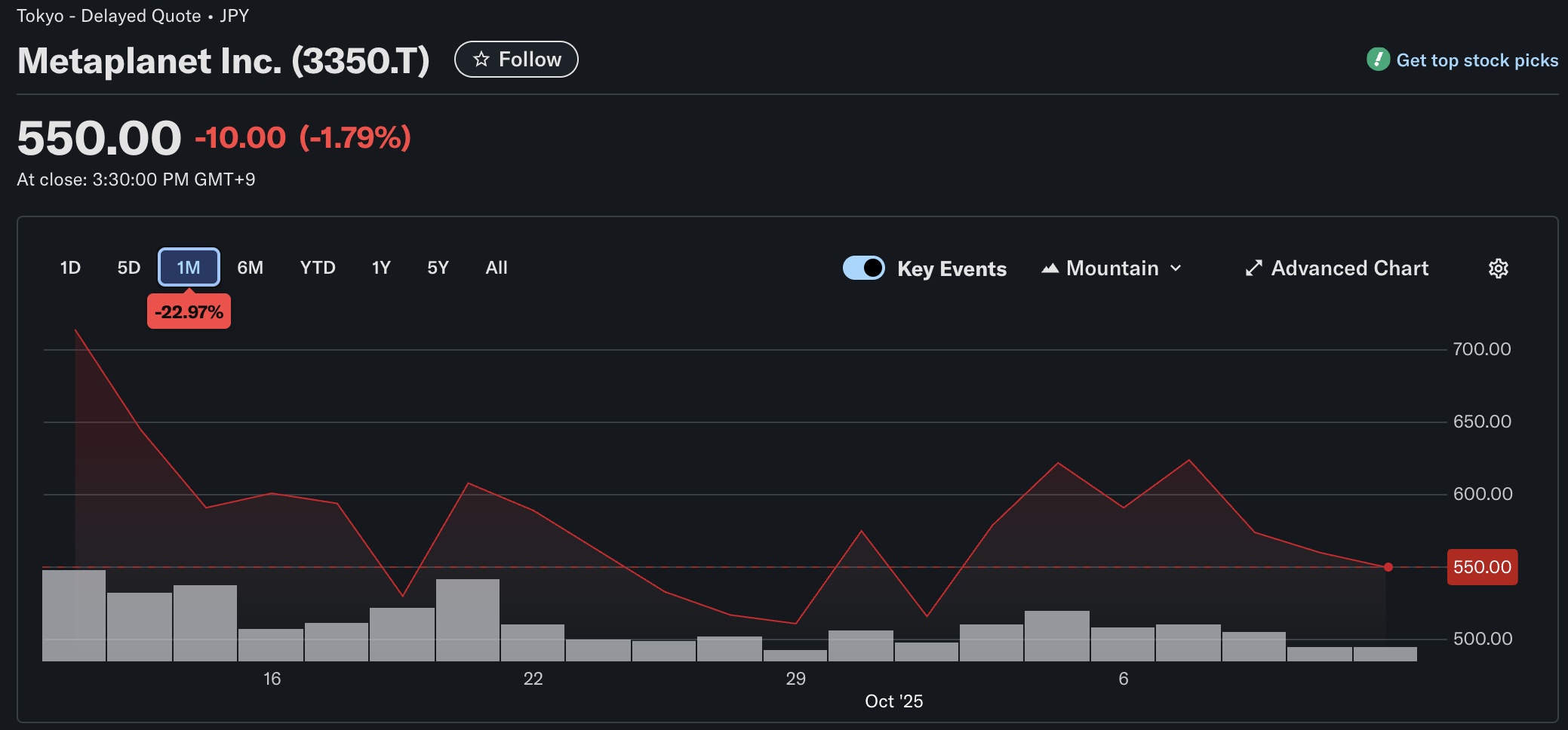

Metaplanet’s shares have collapsed a large 70% from their June highs. The next chart exhibits how Metaplanet’s inventory is down greater than 22% over the previous month, buying and selling at $550 on the time of writing.

Apart from the depressed value motion, Metaplanet’s valuation now stands at 1.05x Internet Asset Worth (NAV), the bottom studying for the reason that agency launched its Bitcoin treasury technique. Metaplanet’s complete share worth is now simply barely above the whole worth of BTC it holds.

The choice to quickly halt extra share sale is probably going taken to keep away from additional dilution of shareholders’ worth. The seemingly incongruent conduct between rising BTC value and falling Metaplanet inventory just isn’t out of the abnormal.

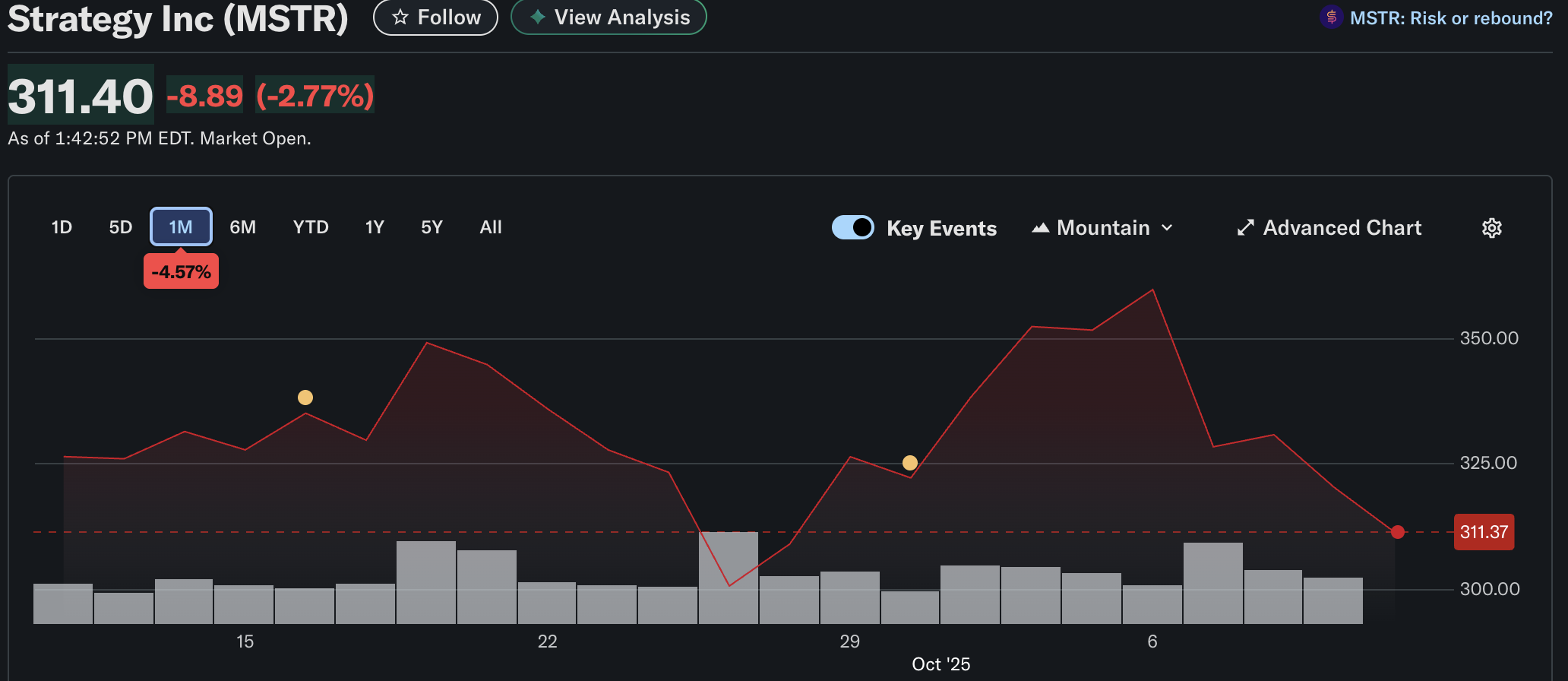

As an illustration, Michael Saylor-led Technique – regardless of being the most important public firm by way of BTC held on its steadiness sheet – has needed to wrestle over the previous few months. MSTR shares have tumbled over 4.5% over the previous month.

That mentioned, Metaplanet reiterated that it stays dedicated to purchasing extra BTC sooner or later. In its official announcement, the corporate mentioned:

We stay dedicated to our mission of increasing Bitcoin holdings and maximizing BTC Yield for the good thing about our shareholders. In help of this mission, we’re additionally creating new monetary devices and advancing the sophistication of our capital coverage.

Crypto Adoption Continues To Develop

Whereas Metaplanet quickly halting inventory gross sales may spook some BTC bulls, the general development of company adoption of cryptocurrencies continues to develop. For instance, NYSE-listed CleanCore just lately revealed that its treasury now holds 710 million DOGE.

Equally, MARA Holding just lately elevated its company treasury by 373 BTC, surpassing $6 billion in holdings. Nation-states look like becoming a member of the bandwagon too, as Luxembourg acknowledged that its sovereign wealth fund is about to spend money on Bitcoin exchange-traded funds (ETFs).

That mentioned, some business consultants argue that the latest surge in company adoption of digital property is not totally natural. At press time, BTC trades at $117,672, down 2.7% prior to now 24 hours.

Featured picture from Unsplash.com, charts from Yahoo! Finance and TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.