Revealed on September twenty third, 2025 by Bob Ciura

Dividend investing is finally about changing your working revenue with a passive revenue stream for a safe retirement and monetary freedom.

The truth of inflation means your revenue stream can’t simply be static. It have to be perpetually rising.

To construct your perpetual dividend machine, you should put money into a fairly diversified basket of revenue securities which have the next traits:

- Pay dividends (create revenue), the upper the yield the higher

- Are more likely to develop their funds, the quicker the higher

- Have protected dividends, so you’re more likely to see secure or higher revenue throughout a recession

Dividend investments ought to be protected, rising revenue securities with a minimum of respectable yields.

With this in thoughts, we created a downloadable record of over 130 Dividend Champions.

You’ll be able to obtain your free copy of the Dividend Champions record, together with related monetary metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the hyperlink beneath:

The Dividend Champions have raised their dividends for over 25 years in a row.

It’s no small feat to spice up a dividend year-after-year for many years at a time, even via financial downturns.

Because of this, longer streaks are most well-liked as a result of they present an organization can enhance dividends over a variety of financial and aggressive environments. Additionally they present proof of a sturdy aggressive benefit.

The next 10 U.S.-based dividend shares have elevated their payouts for over 25 years, putting them on the Dividend Champions record. Additionally they have excessive yields greater than double present S&P 500 common yield of 1.15%.

Lastly, they’ve our prime Dividend Danger Scores of ‘A’ or ‘B’, to give attention to the shares most probably to keep up their dividends, even in a recession.

Because of this, they might be thought of to be prime shares for constructing a perpetual revenue machine.

Desk of Contents

The ten shares beneath are ranked by present dividend yield, from lowest to highest.

Perpetual Revenue Inventory: Northwest Pure Holding (NWN)

NW Pure was based in 1859 and has grown from only a handful of consumers to serving greater than 760,000 immediately. The utility’s mission is to ship pure fuel to its prospects within the Pacific Northwest.

The corporate’s areas served are proven within the picture beneath.

Supply: Investor Presentation

On August 7, 2025, Northwest Pure Holding Firm reported outcomes for the second quarter ended June 30, 2025, displaying regular progress in buyer base and charge restoration regardless of seasonal weak spot typical of hotter months.

The corporate recorded internet revenue of $7.4 million, or $0.19 per diluted share, in contrast with $5.8 million, or $0.16 per share, in the identical quarter final 12 months. Working income totaled $219.6 million, barely down from $222.3 million within the prior 12 months, as decrease fuel utilization from delicate climate offset the advantage of charge will increase and buyer progress.

Working revenue was $28.9 million, up from $25.7 million, reflecting disciplined price management and contributions from utility margin enchancment. The fuel distribution phase added practically 11,000 new prospects year-over-year, sustaining annual progress of about 1.4%, whereas infrastructure providers contributed modestly to earnings.

Click on right here to obtain our most up-to-date Certain Evaluation report on NWN (preview of web page 1 of three proven beneath):

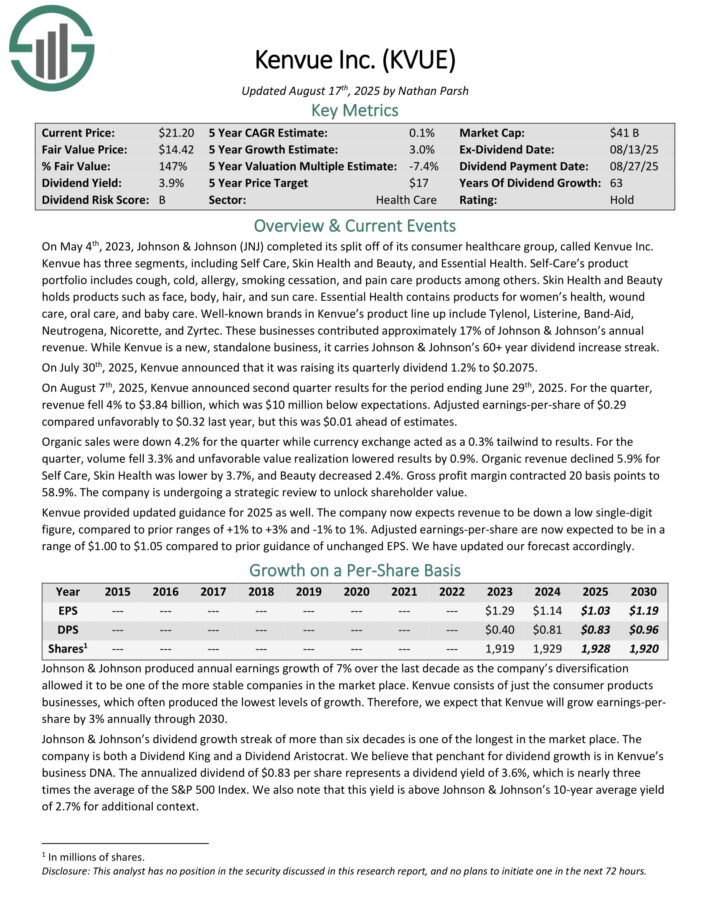

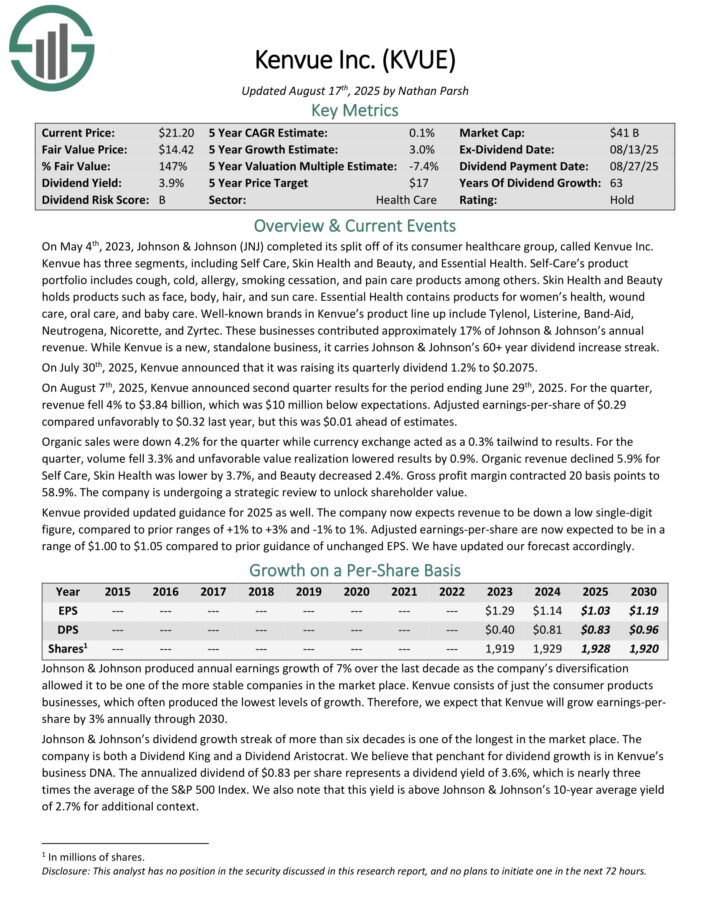

Perpetual Revenue Inventory: Kenvue Inc. (KVUE)

Kenvue was spun off from Johnson & Johnson (JNJ) in 2023. It has three segments, together with Self Care, Pores and skin Well being and Magnificence, and Important Well being.

Self-Care’s product portfolio contains cough, chilly, allergy, smoking cessation, and ache care merchandise amongst others. Pores and skin Well being and Magnificence holds merchandise reminiscent of face, physique, hair, and solar care. Important Well being accommodates merchandise for girls’s well being, wound care, oral care, and child care.

Effectively-known manufacturers in Kenvue’s product line up embrace Tylenol, Listerine, Band-Help, Neutrogena, Nicorette, and Zyrtec. These companies contributed roughly 17% of Johnson & Johnson’s annual income.

On August seventh, 2025, Kenvue introduced second quarter outcomes for the interval ending June twenty ninth, 2025. For the quarter, income fell 4% to $3.84 billion, which was $10 million beneath expectations. Adjusted earnings-per-share of $0.29 in contrast unfavorably to $0.32 final 12 months, however this was $0.01 forward of estimates.

Natural gross sales had been down 4.2% for the quarter whereas foreign money change acted as a 0.3% tailwind to outcomes. For the quarter, quantity fell 3.3% and unfavorable worth realization lowered outcomes by 0.9%.

Natural income declined 5.9% for Self Care, Pores and skin Well being was decrease by 3.7%, and Magnificence decreased 2.4%. Gross revenue margin contracted 20 foundation factors to 58.9%. The corporate is present process a strategic assessment to unlock shareholder worth.

Click on right here to obtain our most up-to-date Certain Evaluation report on KVUE (preview of web page 1 of three proven beneath):

Perpetual Revenue Inventory: Sonoco Merchandise (SON)

Sonoco Merchandise gives packaging, industrial merchandise and provide chain providers to its prospects. The markets that use the corporate’s merchandise embrace these within the home equipment, electronics, beverage, building and meals industries.

The corporate generates over $5 billion in annual gross sales. Sonoco Merchandise is now composed of two main segments, Shopper Packaging, and Industrial Packaging, with all different companies listed as “All Different”.

On April sixteenth, 2025, Sonoco Merchandise raised its quarterly dividend 1.9% to $0.53, extending the corporate’s dividend progress streak to 49 consecutive years.

On July twenty third, 2025, Sonoco Merchandise introduced second quarter outcomes for the interval ending June twenty ninth, 2025. For the quarter, income grew 17.9% to $1.91 billion, which was in-line with estimates. Adjusted earnings-per-share of $1.37 in comparison with $1.28 within the prior 12 months, however was $0.08 lower than anticipated.

Revenues and earnings benefited from the addition of Eviosys. For the quarter, Shopper Packaging revenues surged 110% to $1.23 billion, largely as a consequence of contributions from Eviosys.

Quantity progress was sturdy and favorable foreign money change charges additionally aided outcomes. Industrial Paper Packing gross sales fell 2% to $588 million as a result of impression of overseas foreign money change charges and decrease quantity following two plant divestitures in China final 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on Sonoco (SON) (preview of web page 1 of three proven beneath):

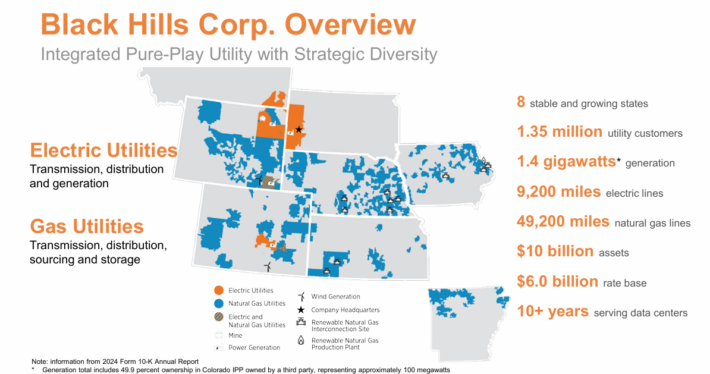

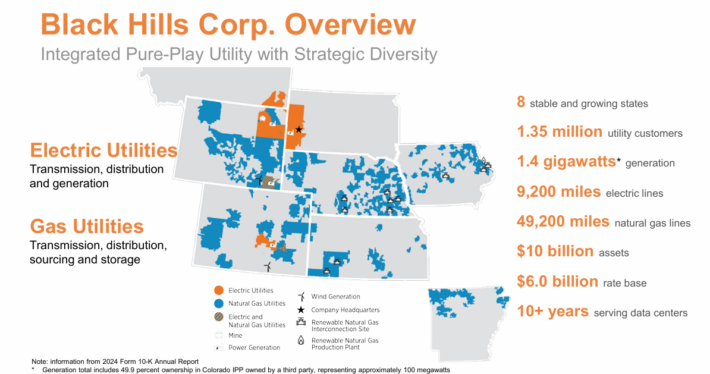

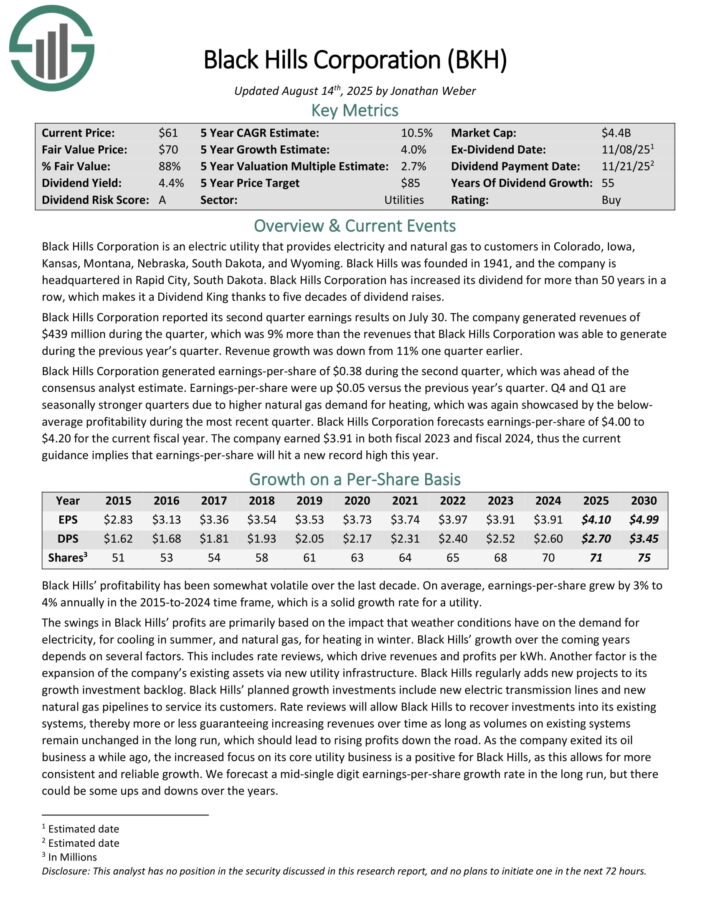

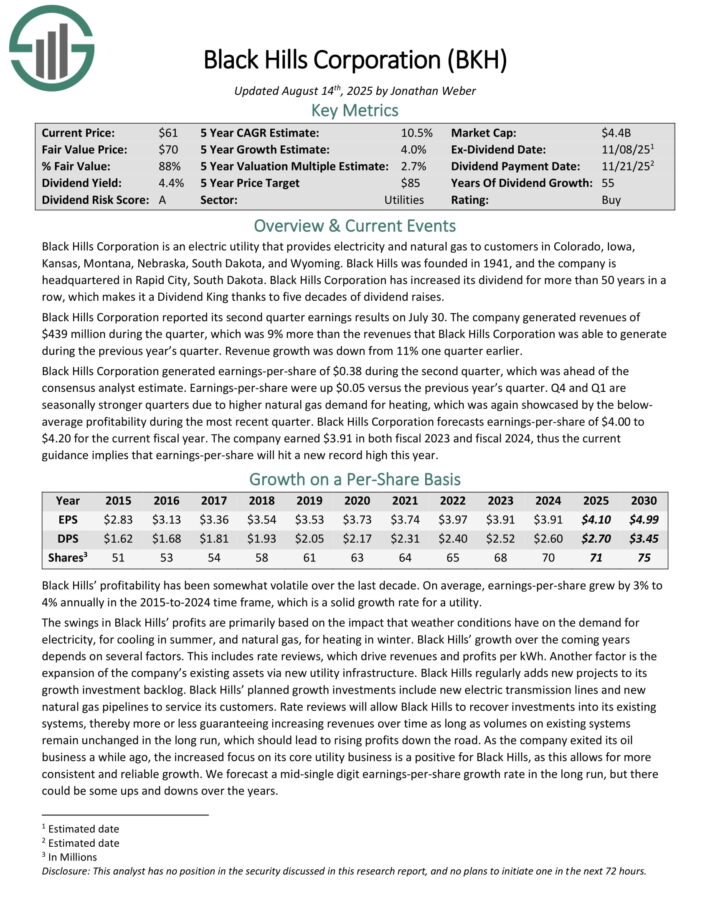

Perpetual Revenue Inventory: Black Hills Corp (BKH)

Black Hills Company is an electrical utility that gives electrical energy and pure fuel to prospects in Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, and Wyoming.

The corporate has 1.35 million utility prospects in eight states. Its pure fuel belongings embrace 49,200 miles of pure fuel traces. Individually, it has ~9,200 miles of electrical traces and 1.4 gigawatts of electrical era capability.

Supply: Investor Presentation

Black Hills Company reported its second quarter earnings outcomes on July 30. The corporate generated revenues of $439 million in the course of the quarter, up 9% year-over-year.

Black Hills Company generated earnings-per-share of $0.38 in the course of the second quarter, which was forward of the consensus analyst estimate.

Earnings-per-share had been up $0.05 versus the earlier 12 months’s quarter. This autumn and Q1 are seasonally stronger quarters as a consequence of greater pure fuel demand for heating.

Black Hills Company forecasts earnings-per-share of $4.00 to $4.20 for the present fiscal 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on BKH (preview of web page 1 of three proven beneath):

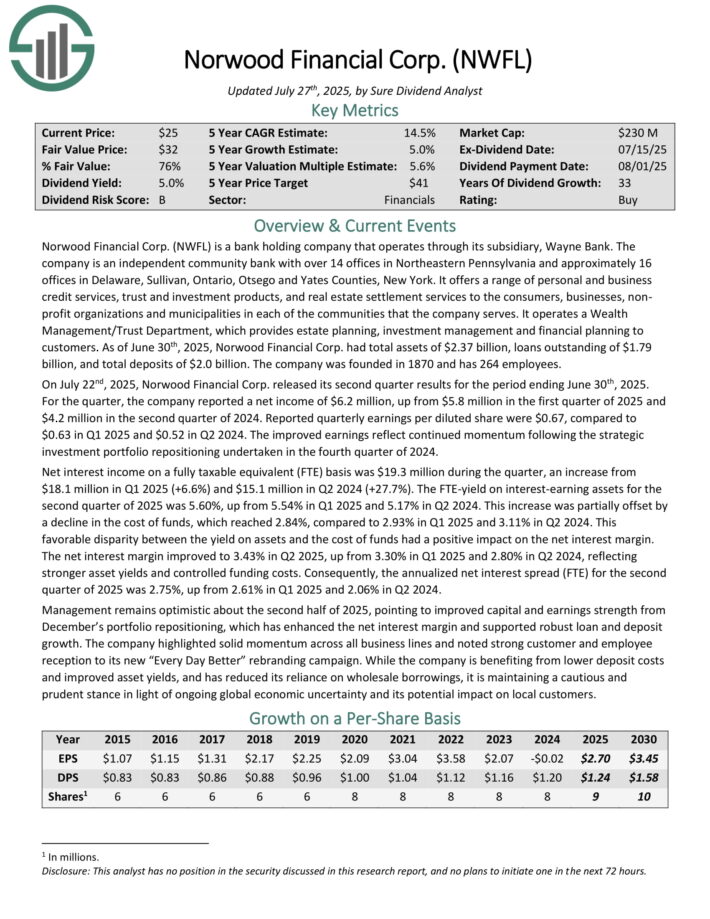

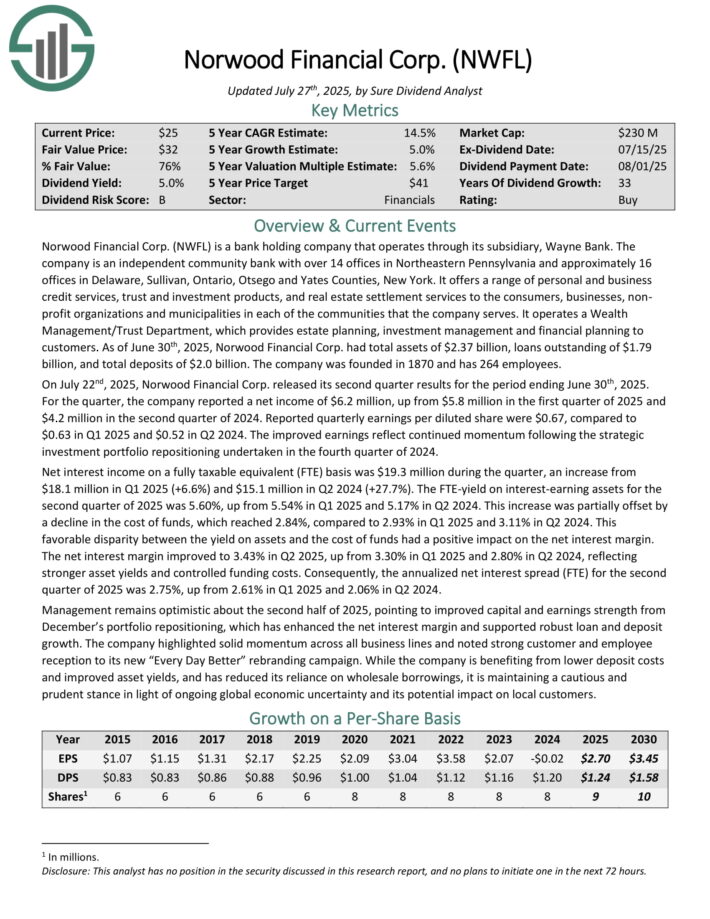

Perpetual Revenue Inventory: Norwood Monetary (NWL)

Norwood Monetary Corp. (NWFL) is a financial institution holding firm that operates via its subsidiary, Wayne Financial institution. The corporate is an unbiased neighborhood financial institution with over 14 places of work in Northeastern Pennsylvania and roughly 16 places of work in Delaware, Sullivan, Ontario, Otsego and Yates Counties, New York.

It gives a variety of private and enterprise credit score providers, belief and funding merchandise, and actual property settlement providers to the customers, companies, nonprofit organizations and municipalities in every of the communities that the corporate serves. It operates a Wealth Administration/Belief Division, which gives property planning, funding administration and monetary planning to prospects.

As of June thirtieth, 2025, Norwood Monetary Corp. had whole belongings of $2.37 billion, loans excellent of $1.79 billion, and whole deposits of $2.0 billion. The corporate was based in 1870 and has 264 workers.

On July twenty second, 2025, Norwood Monetary Corp. launched its second quarter outcomes for the interval ending June thirtieth, 2025. For the quarter, the corporate reported a internet revenue of $6.2 million, up from $5.8 million within the first quarter of 2025 and $4.2 million within the second quarter of 2024.

Reported quarterly earnings per diluted share had been $0.67, in comparison with $0.63 in Q1 2025 and $0.52 in Q2 2024. The improved earnings replicate continued momentum following the strategic funding portfolio repositioning undertaken within the fourth quarter of 2024.

Web curiosity revenue on a totally taxable equal (FTE) foundation was $19.3 million in the course of the quarter, a rise from $18.1 million in Q1 2025 (+6.6%) and $15.1 million in Q2 2024 (+27.7%). The FTE-yield on interest-earning belongings for the second quarter of 2025 was 5.60%, up from 5.54% in Q1 2025 and 5.17% in Q2 2024.

Click on right here to obtain our most up-to-date Certain Evaluation report on NWFL (preview of web page 1 of three proven beneath):

Perpetual Revenue Inventory: Hormel Meals (HRL)

Hormel Meals was based in 1891 in Minnesota. Since that point, the corporate has grown right into a juggernaut within the meals merchandise business with about $12 billion in annual income.

Hormel has stored its core competency as a processor of meat merchandise for effectively over 100 years however has additionally grown into different enterprise traces via acquisitions.

The corporate sells its merchandise in 80 international locations worldwide, and its manufacturers embrace Skippy, SPAM, Applegate, Justin’s, and greater than 30 others.

Hormel posted third quarter earnings on August twenty eighth, 2025, and outcomes had been very weak, together with disappointing steerage for the fourth quarter.

Adjusted earnings-per-share got here to 35 cents, which was six cents gentle of estimates. Income was up 4.5% year-over-year to $3.03 billion, beating estimates by $50 million. Natural internet gross sales had been up 6% year-over-year on quantity good points of 4%, with worth and blend comprising the opposite 2%.

The corporate additionally famous its price financial savings program is working and serving to save about $125 million yearly. Gross revenue was flat year-on-year, with inflationary headwinds offset by prime line good points. The corporate famous 400 foundation factors of uncooked materials price inflation, an enormous headwind to margins.

Money circulate from operations had been $157 million, whereas capex was $72 million, and dividends paid had been $159 million. Steerage for This autumn was for internet gross sales of ~$3.2 billion, about $50 million gentle of consensus. Earnings are anticipated at ~39 cents.

Click on right here to obtain our most up-to-date Certain Evaluation report on HRL (preview of web page 1 of three proven beneath):

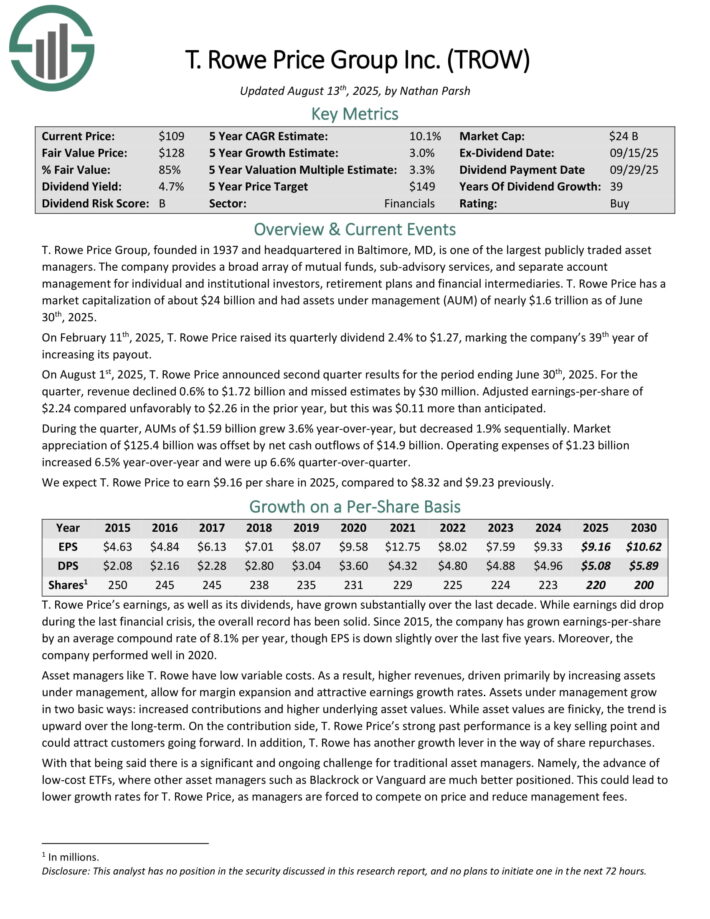

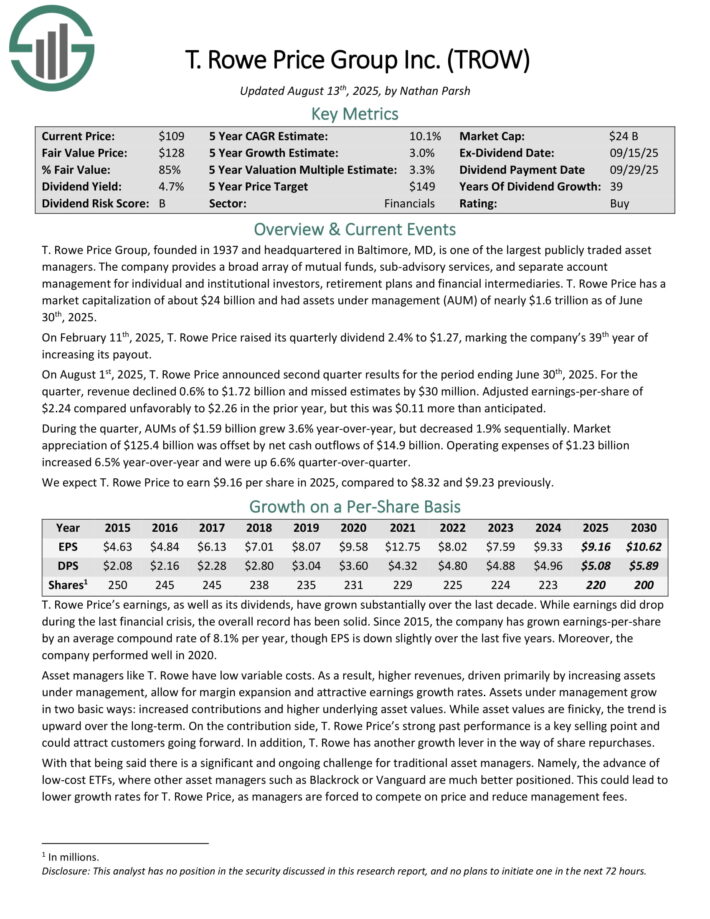

Perpetual Revenue Inventory: T. Rowe Worth Group (TROW)

T. Rowe Worth Group is without doubt one of the largest publicly traded asset managers. The corporate gives a broad array of mutual funds, sub-advisory providers, and separate account administration for particular person and institutional traders, retirement plans and monetary intermediaries.

T. Rowe Worth had belongings beneath administration (AUM) of practically $1.6 trillion as of June thirtieth, 2025.

On February eleventh, 2025, T. Rowe Worth raised its quarterly dividend 2.4% to $1.27, marking the corporate’s thirty ninth 12 months of accelerating its payout.

On August 1st, 2025, T. Rowe Worth introduced second quarter outcomes for the interval ending June thirtieth, 2025. For the quarter, income declined 0.6% to $1.72 billion and missed estimates by $30 million. Adjusted earnings-per-share of $2.24 in contrast unfavorably to $2.26 within the prior 12 months, however this was $0.11 greater than anticipated.

Through the quarter, AUMs of $1.59 billion grew 3.6% year-over-year, however decreased 1.9% sequentially. Market appreciation of $125.4 billion was offset by internet money outflows of $14.9 billion. Working bills of $1.23 billion elevated 6.5% year-over-year and had been up 6.6% quarter-over-quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on TROW (preview of web page 1 of three proven beneath):

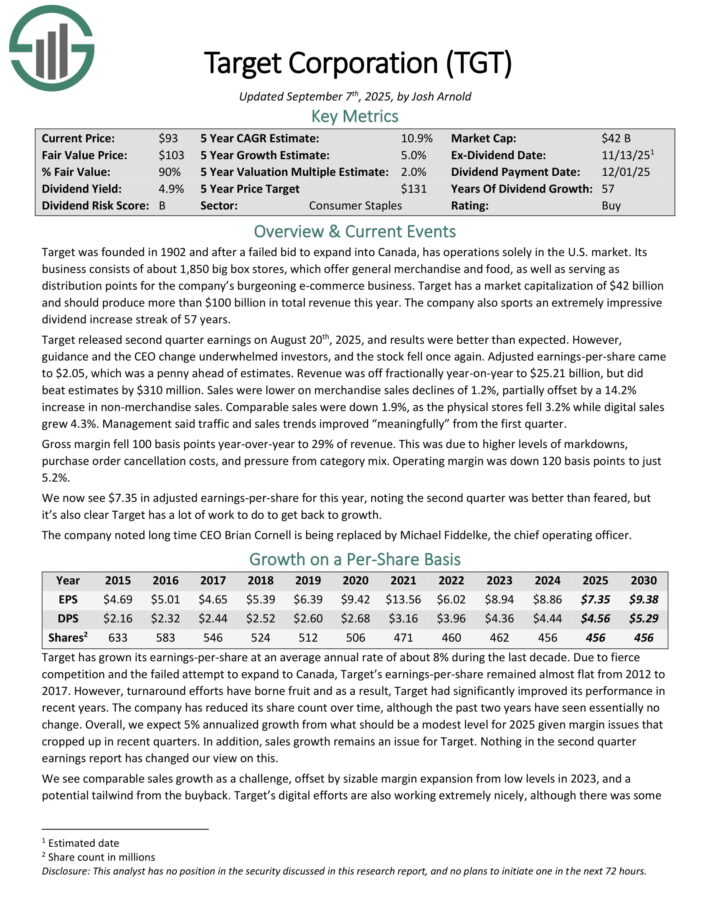

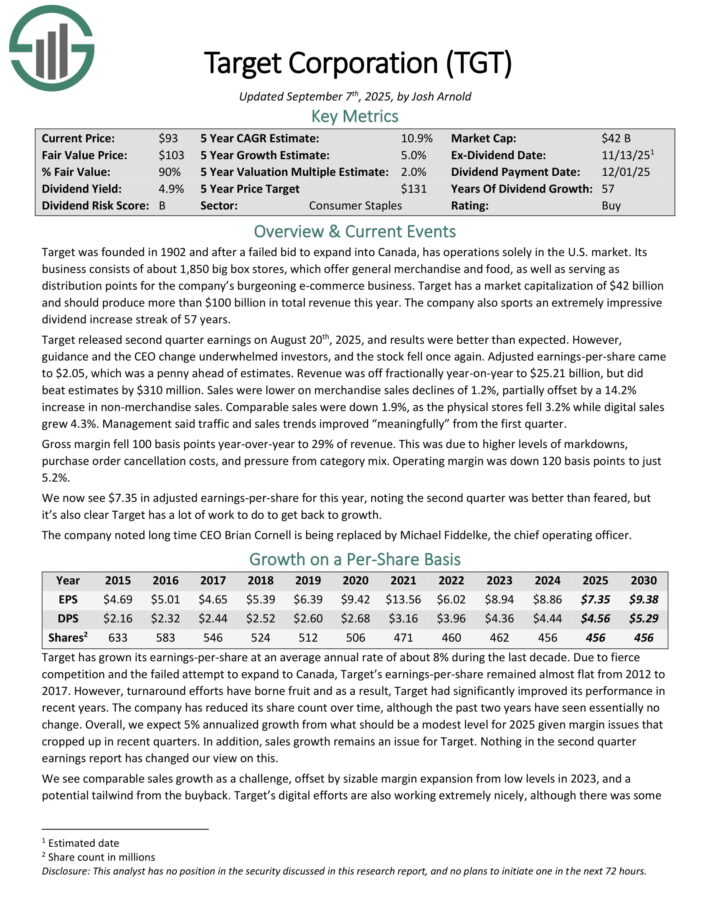

Perpetual Revenue Inventory: Goal Company (TGT)

Goal was based in 1902 and now operates about 1,850 huge field shops, which supply common merchandise and meals, in addition to serving as distribution factors for the corporate’s e-commerce enterprise.

Goal launched second quarter earnings on August twentieth, 2025, and outcomes had been higher than anticipated. Nonetheless, steerage and the CEO change underwhelmed traders, and the inventory fell as soon as once more.

Adjusted earnings-per-share got here to $2.05, which was a penny forward of estimates. Income was off fractionally year-on-year to $25.21 billion, however did beat estimates by $310 million. Gross sales had been decrease on merchandise gross sales declines of 1.2%, partially offset by a 14.2% enhance in non-merchandise gross sales.

Comparable gross sales had been down 1.9%, because the bodily shops fell 3.2% whereas digital gross sales grew 4.3%. Administration stated visitors and gross sales tendencies improved “meaningfully” from the primary quarter.

The corporate is investing closely in its enterprise with a purpose to navigate via the altering panorama within the retail sector. The payout is now 62% of earnings for this 12 months, which is elevated from historic ranges, however the dividend stays well-covered.

Click on right here to obtain our most up-to-date Certain Evaluation report on TGT (preview of web page 1 of three proven beneath):

Perpetual Revenue Inventory: Franklin Assets (BEN)

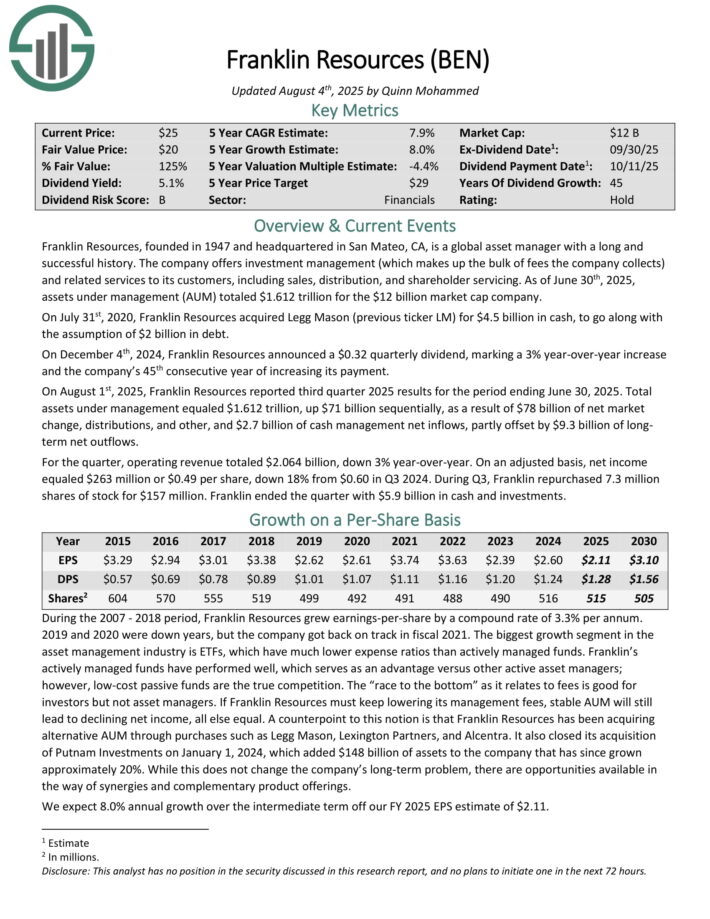

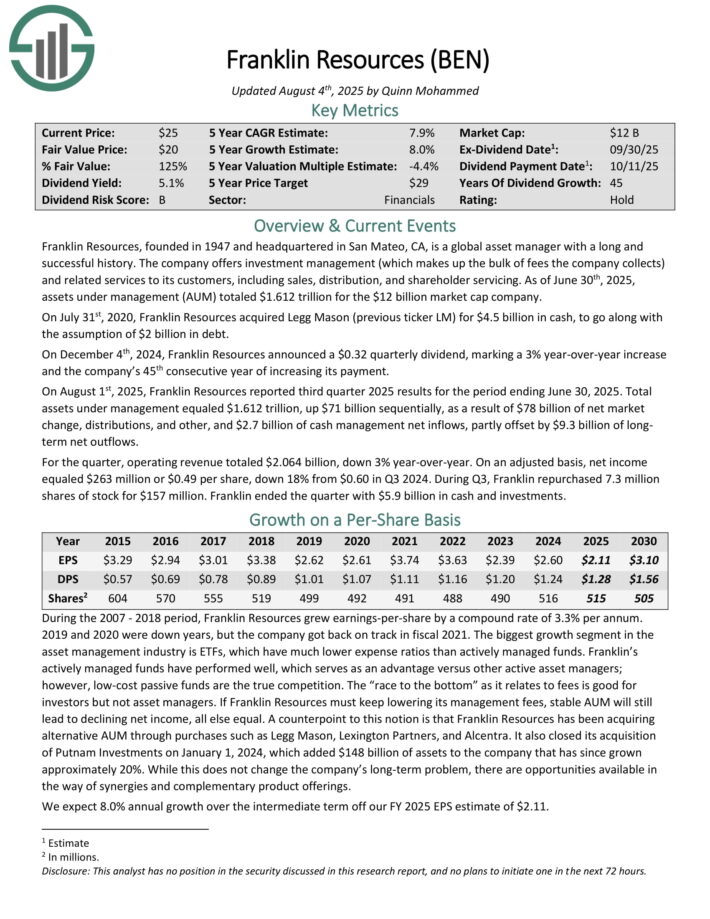

Franklin Assets, based in 1947 and headquartered in San Mateo, CA, is a worldwide asset supervisor with a protracted and profitable historical past. The corporate gives funding administration (which makes up the majority of charges the corporate collects) and associated providers to its prospects, together with gross sales, distribution, and shareholder servicing.

As of June thirtieth, 2025, belongings beneath administration (AUM) totaled $1.612 trillion for the $12 billion market cap firm.

On July thirty first, 2020, Franklin Assets acquired Legg Mason (earlier ticker LM) for $4.5 billion in money, to associate with the belief of $2 billion in debt.

On August 1st, 2025, Franklin Assets reported third-quarter 2025 outcomes for the interval ending June 30, 2025. Complete belongings beneath administration equaled $1.612 trillion, up $71 billion sequentially, because of $78 billion of internet market change, distributions, and different, and $2.7 billion of money administration internet inflows, partly offset by $9.3 billion of long-term internet outflows.

For the quarter, working income totaled $2.064 billion, down 3% year-over-year. On an adjusted foundation, internet revenue equaled $263 million or $0.49 per share, down 18% from $0.60 in Q3 2024. Throughout Q3, Franklin repurchased 7.3 million shares of inventory for $157 million. Franklin ended the quarter with $5.9 billion in money and investments.

Click on right here to obtain our most up-to-date Certain Evaluation report on BEN (preview of web page 1 of three proven beneath):

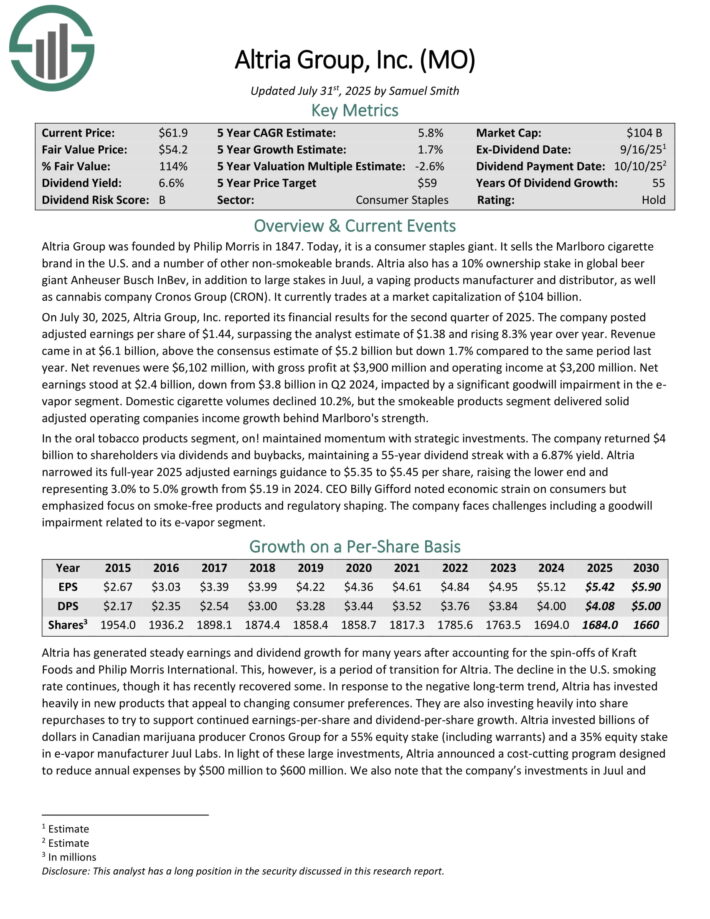

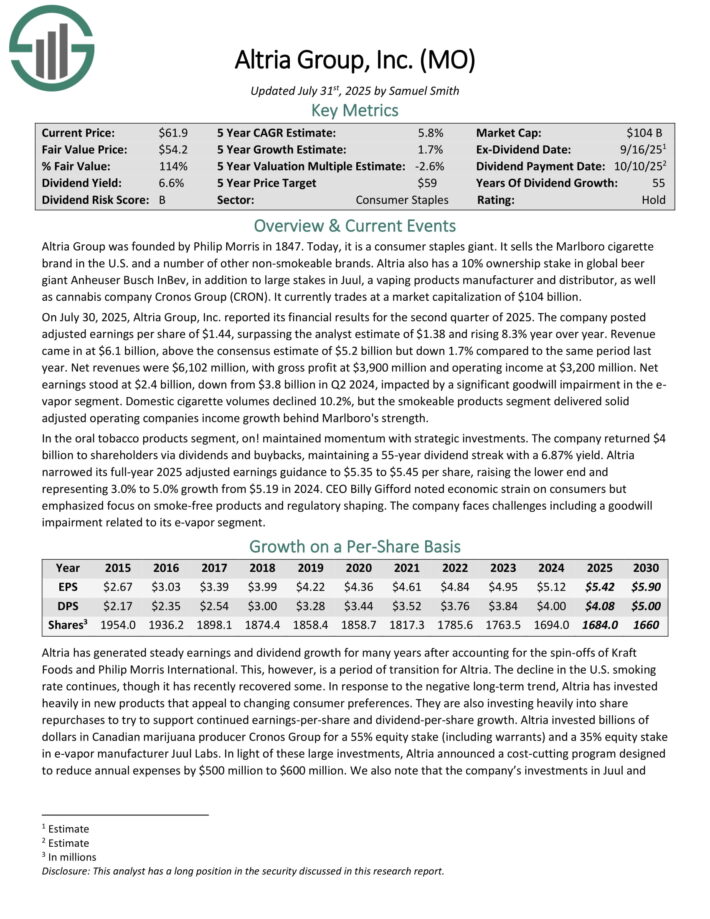

Perpetual Revenue Inventory: Altria Group (MO)

Altria is a tobacco inventory that sells cigarettes, chewing tobacco, cigars, e-cigarettes, and extra beneath a wide range of manufacturers, together with Marlboro, Skoal, and Copenhagen, amongst others.

It is a interval of transition for Altria. The decline within the U.S. smoking charge continues. In response, Altria has invested closely in new merchandise that enchantment to altering client preferences, because the smoke-free class continues to develop.

The corporate additionally has a 35% funding stake in e-cigarette maker JUUL, and a forty five% stake within the Canadian hashish producer Cronos Group (CRON).

On July 30, 2025, Altria Group, Inc. reported its monetary outcomes for the second quarter of 2025. The corporate posted adjusted earnings per share of $1.44, surpassing the analyst estimate of $1.38 and rising 8.3% 12 months over 12 months.

Income got here in at $6.1 billion, above the consensus estimate of $5.2 billion however down 1.7% in comparison with the identical interval final 12 months. Web revenues had been $6,102 million, with gross revenue at $3,900 million and working revenue at $3,200 million.

Web earnings stood at $2.4 billion, down from $3.8 billion in Q2 2024, impacted by a big goodwill impairment within the e-vapor phase.

Home cigarette volumes declined 10.2%, however the smokeable merchandise phase delivered stable adjusted working corporations revenue progress behind Marlboro’s power.

Click on right here to obtain our most up-to-date Certain Evaluation report on Altria (preview of web page 1 of three proven beneath):

Further Studying

The Dividend Champions record shouldn’t be the one technique to rapidly display screen for shares that often pay rising dividends.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].