Revealed on September seventeenth, 2025 by Bob Ciura

The concept behind worth investing is to purchase belongings for lower than they’re price. The bigger the discrepancy between worth and worth, the larger the margin of security.

Worth investing is easy to grasp, however not simple to follow.

Shares buying and selling at a reduction to their belongings normally accomplish that for a cause. They are typically out of favor and surrounded by unfavourable sentiment.

Sadly, undervalued shares don’t rebound simply since you purchase them. The market doesn’t care while you buy a safety.

Some worth securities might rebound to honest worth in a month, others might take years, or might by no means rebound in any respect. Ready in your worth shares to understand could be fraught with each nervousness and disappointment.

Due to this fact, we advocate combining investing in undervalued securities with investing in securities which have excessive and rising yields.

We outline shares which have elevated their dividends for 10+ years as blue-chip shares.

You possibly can obtain our free blue chip shares checklist with essential monetary metrics similar to dividend yields and price-to-earnings ratios, by clicking on the hyperlink beneath:

The mix of low valuations and excessive (and rising) yields may produce sturdy returns.

As an alternative of ready for a inventory to understand, you make investments to gather the revenue the worth inventory is producing.

If it takes a number of years to recuperate, you should have created rising money flows from the rising dividends on the inventory. You receives a commission to attend while you buy undervalued securities with excessive yields and rising dividends.

If the inventory worth recovers rapidly, then you may have fast capital appreciation.

If the inventory worth doesn’t recuperate rapidly, you then nonetheless profit from a excessive beginning yield on value, and rising revenue rolling in quarterly.

This text will talk about the ten blue-chip shares with the best projected return from valuation a number of growth.

The ten blue chip shares are sorted by annual anticipated valuation return, in ascending order.

Desk of Contents

The desk of contents beneath permits for straightforward navigation.

Blue Chip #10: Novo Nordisk (NVO)

- Annual Valuation Return: 8.6%

Novo Nordisk A/S ADR is a big world pharmaceutical firm headquartered in Denmark. The corporate focuses on two core enterprise segments: Diabetes & Weight problems Care and Uncommon Illnesses.

The Diabetes & Weight problems Care phase manufactures insulin, associated supply programs, oral anti-diabetic merchandise, and merchandise to deal with weight problems.

The Uncommon Illnesses phase manufactures merchandise for hemophilia and different persistent ailments. Novo Nordisk derives ~92% of income from diabetes and weight problems.

The corporate’s merchandise are marketed in 170 international locations however roughly 48% of web gross sales are from North America and the remaining is worldwide gross sales.1 Complete income was almost $40.7B in 2024.

Novo Nordisk reported strong H1 2025 outcomes on August sixth, 2025. Firm-wide gross sales had been up 16% in Danish kroner to 154,944M ($24,300M) from 133,409 ($20,922M) and diluted earnings per share rose 23% to 12.49 DKK ($1.96) from 10.17 DKK ($1.59) on a year-over-year foundation.

Diabetes & Weight problems gross sales elevated 16% to 145,406M DKK ($22,804M) pushed by will increase in Ozempic and Rybelsus (GLP-1), Wegovy (weight problems), long-acting insulin, and fast-acting insulin, offset by decrease gross sales for human insulin, Saxenda (weight problems), Victoza (GLP-1), and flat premix insulin.

The Uncommon Illness phase gross sales rose 14% to 9,538M DKK ($1,496M) brought on by rising uncommon blood and endocrine problems medicine.

The agency is increasing its blockbuster GLP-1 and weight problems medicine to different indications and dosing sizes. The corporate lowered its outlook to eight – 14% gross sales development and 10% – 16% working revenue development in 2025.

Click on right here to obtain our most up-to-date Positive Evaluation report on NVO (preview of web page 1 of three proven beneath):

Blue Chip #9: Sonoco Merchandise (SON)

- Annual Valuation Return: 8.8%

Sonoco Merchandise offers packaging, industrial merchandise and provide chain companies to its clients. The markets that use the corporate’s merchandise embody these within the home equipment, electronics, beverage, building and meals industries.

The corporate generates over $5 billion in annual gross sales. Sonoco Merchandise is now composed of two main segments, Client Packaging, and Industrial Packaging, with all different companies listed as “All Different”.

On April sixteenth, 2025, Sonoco Merchandise raised its quarterly dividend 1.9% to $0.53, extending the corporate’s dividend development streak to 49 consecutive years.

On July twenty third, 2025, Sonoco Merchandise introduced second quarter outcomes for the interval ending June twenty ninth, 2025. For the quarter, income grew 17.9% to $1.91 billion, which was in-line with estimates. Adjusted earnings-per-share of $1.37 in comparison with $1.28 within the prior 12 months, however was $0.08 lower than anticipated.

Revenues and earnings benefited from the addition of Eviosys. For the quarter, Client Packaging revenues surged 110% to $1.23 billion, largely attributable to contributions from Eviosys.

Quantity development was sturdy and favorable forex alternate charges additionally aided outcomes. Industrial Paper Packing gross sales fell 2% to $588 million as a result of impression of overseas forex alternate charges and decrease quantity following two plant divestitures in China final 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on Sonoco (SON) (preview of web page 1 of three proven beneath):

Blue Chip #8: Flowers Meals (FLO)

- Annual Valuation Return: 8.9%

Flowers Meals opened its first bakery in 1919 and has since change into one of many largest producers of packaged bakery meals in america, working 46 bakeries in 18 states.

Effectively-known manufacturers embody Surprise Bread, Dwelling Satisfaction, Nature’s Personal, Dave’s Killer Bread, Tastykake and Canyon Bakehouse.

The corporate operates in two segments: Direct-Retailer-Supply (DSD) and Warehouse Supply, with ~85% of the corporate’s product being delivered on to shops.

Contemporary breads, buns, rolls, and tortillas make up a few three-fourths of the enterprise, with gross sales channels for the corporate break up between Supermarkets, Mass Merchandisers, Foodservice, and Comfort Retailer.

On Might twenty second, 2025, Flower Meals elevated its quarterly dividend 3.1% to $0.2475, extending the corporate’s dividend development streak to 23 consecutive years.

On August fifteenth, 2025, Flowers Meals introduced second quarter outcomes for the interval ending July twelfth, 2025. For the quarter, income grew 0.8% to $1.24 billion, however missed estimates by $30 million. Adjusted earnings-per-share of $0.30 in comparison with $0.36 final 12 months, however this was $0.01 greater than anticipated.

For the quarter, Branded Retail gross sales improved 5% to $826.7 million as declines in pricing (-1.5%) and volumes (-1.3%) had been offset by a powerful contribution from Easy Mills (+7.8%).

Different gross sales decreased 4.8% to $416.1 million attributable to decrease volumes and weaker pricing and blend. Supplies, provides, labor, and different manufacturing prices accounted for 51.2% of gross sales in the course of the quarter, which was a 110 foundation level improve from the prior 12 months.

Flowers Meals offered an up to date outlook for 2025 as effectively. Adjusted earnings-per-share at the moment are anticipated to be in a variety of $1.00 to $1.10 for the 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on FLO (preview of web page 1 of three proven beneath):

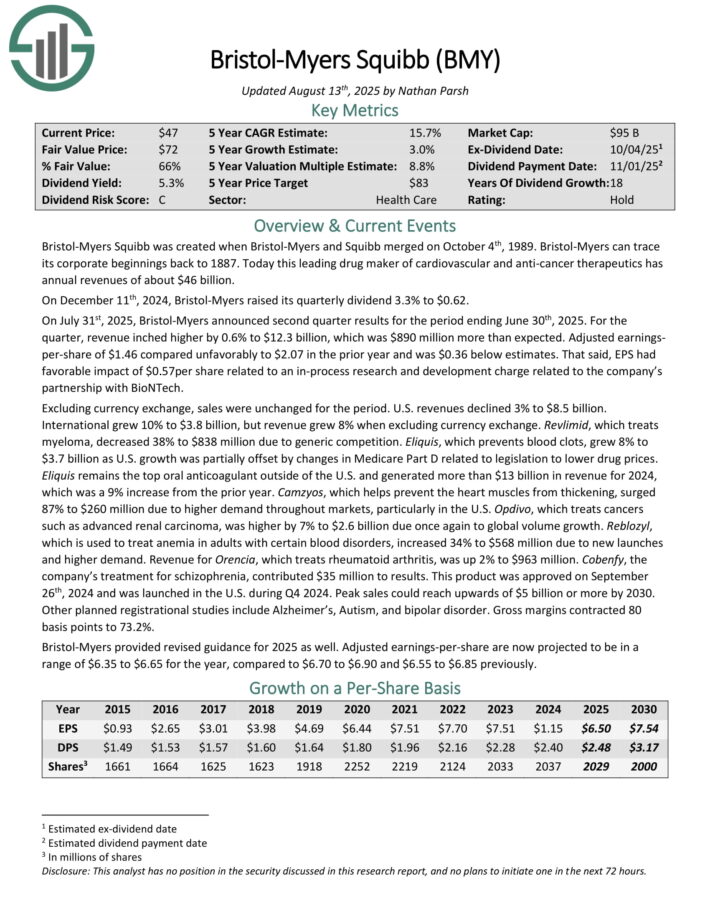

Blue Chip #7: Bristol-Myers Squibb (BMY)

- Annual Valuation Return: 9.2%

Bristol-Myers Squibb is a number one drug maker of cardiovascular and anti-cancer therapeutics has annual revenues of about $46 billion.

On July thirty first, 2025, Bristol-Myers introduced second quarter outcomes for the interval ending June thirtieth, 2025. For the quarter, income inched increased by 0.6% to $12.3 billion, which was $890 million greater than anticipated. Adjusted earnings-per-share of $1.46 in contrast unfavorably to $2.07 within the prior 12 months and was $0.36 beneath estimates.

That mentioned, EPS had favorable impression of $0.57per share associated to an in-process analysis and improvement cost associated to the corporate’s partnership with BioNTech.

U.S. revenues declined 3% to $8.5 billion. Worldwide grew 10% to $3.8 billion, however income grew 8% when excluding forex alternate. Eliquis, which prevents blood clots, grew 8% to $3.7 billion as U.S. development was partially offset by adjustments in Medicare Half D associated to laws to decrease drug costs.

Eliquis stays the highest oral anticoagulant exterior of the U.S. and generated greater than $13 billion in income for 2024, which was a 9% improve from the prior 12 months. Opdivo, which treats cancers similar to superior renal carcinoma, was increased by 7% to $2.6 billion due as soon as once more to world quantity development.

Bristol-Myers offered revised steering for 2025 as effectively. Adjusted earnings-per-share at the moment are projected to be in a variety of $6.35 to $6.65 for the 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on BMY (preview of web page 1 of three proven beneath):

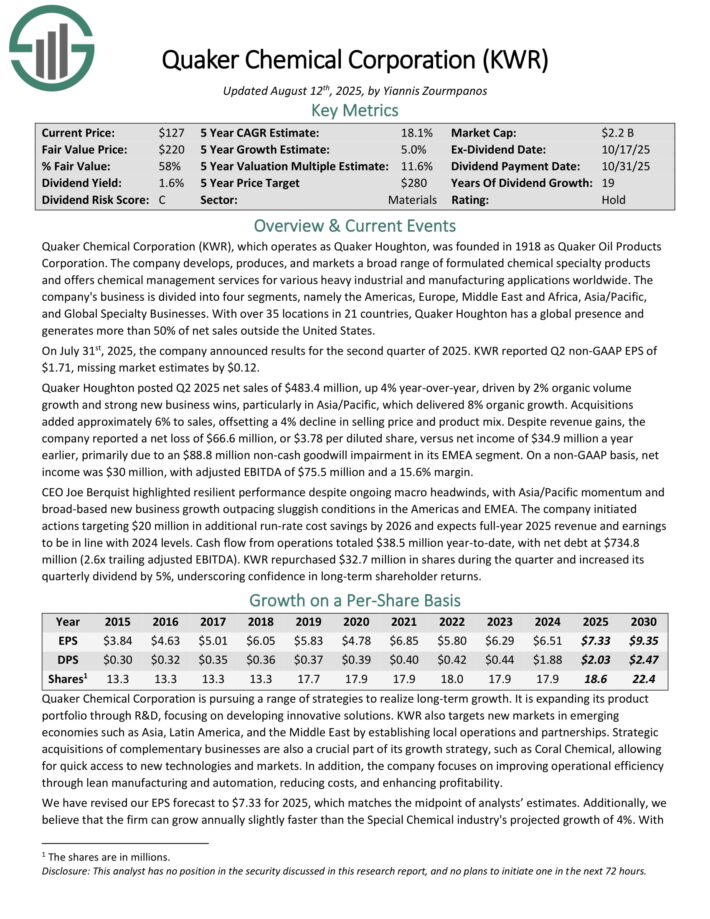

Blue Chip #6: Quaker Houghton (KWR)

- Annual Valuation Return: 9.5%

Quaker Chemical Company, which operates as Quaker Houghton, was based in 1918 as Quaker Oil Merchandise Company.

The corporate develops, produces, and markets a broad vary of formulated chemical specialty merchandise and affords chemical administration companies for varied heavy industrial and manufacturing purposes worldwide.

The corporate’s enterprise is split into 4 segments, particularly the Americas, Europe, Center East and Africa, Asia/Pacific, and International Specialty Companies.

With over 35 areas in 21 international locations, Quaker Houghton has a world presence and generates greater than 50% of web gross sales exterior america.

On July thirty first, 2025, the corporate introduced outcomes for the second quarter of 2025. KWR reported Q2 non-GAAP EPS of $1.71, lacking market estimates by $0.12.

Quaker Houghton posted Q2 2025 web gross sales of $483.4 million, up 4% year-over-year, pushed by 2% natural quantity development and powerful new enterprise wins, significantly in Asia/Pacific, which delivered 8% natural development.

Acquisitions added roughly 6% to gross sales, offsetting a 4% decline in promoting worth and product combine. Regardless of income good points, the corporate reported a web lack of $66.6 million, or $3.78 per diluted share, versus web revenue of $34.9 million a 12 months earlier, primarily attributable to an $88.8 million non-cash goodwill impairment in its EMEA phase.

On a non-GAAP foundation, web revenue was $30 million, with adjusted EBITDA of $75.5 million and a 15.6% margin.

KWR repurchased $32.7 million in shares in the course of the quarter and elevated its quarterly dividend by 5%.

Click on right here to obtain our most up-to-date Positive Evaluation report on KWR (preview of web page 1 of three proven beneath):

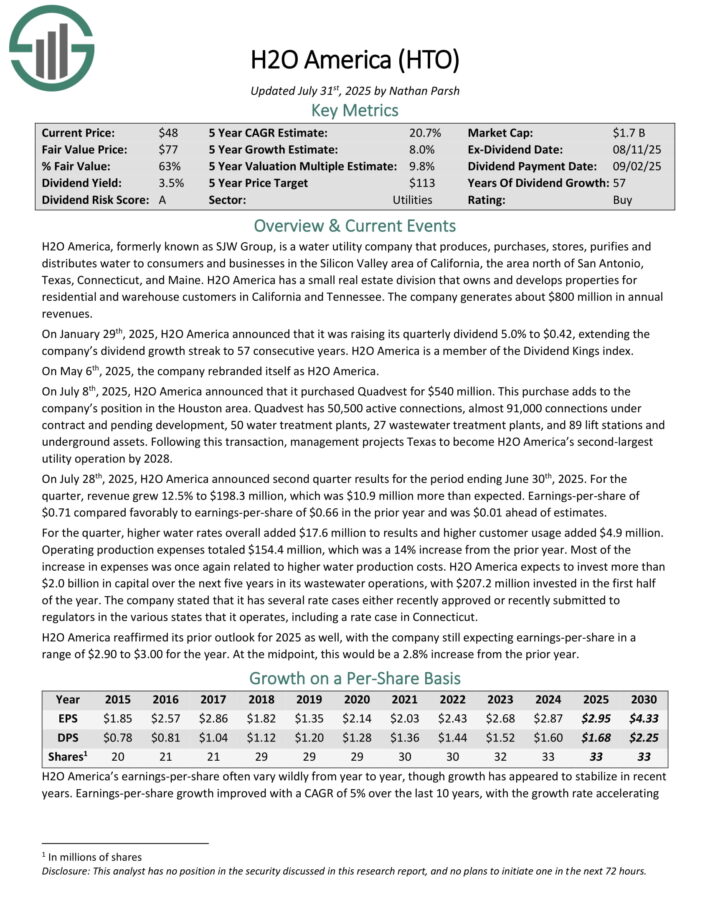

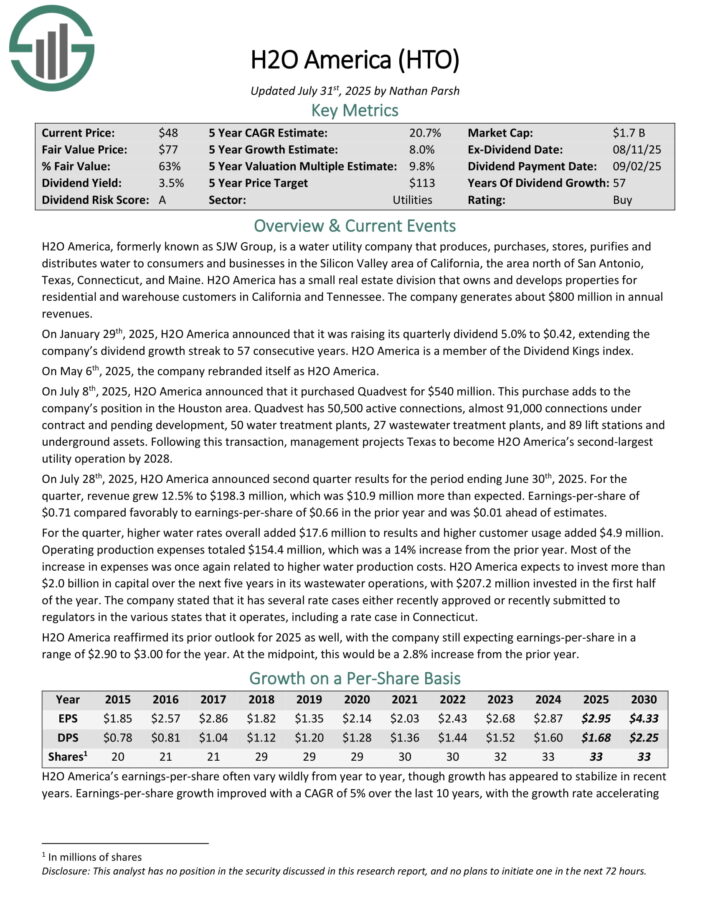

Blue Chip #5: H2O America (HTO)

- Annual Valuation Return: 9.8%

H2O America, previously often known as SJW Group, is a water utility firm that produces, purchases, shops, purifies and distributes water to customers and companies within the Silicon Valley space of California, the world north of San Antonio, Texas, Connecticut, and Maine.

It additionally has a small actual property division that owns and develops properties for residential and warehouse clients in California and Tennessee. The corporate generates about $670 million in annual revenues.

On July eighth, 2025, H2O America introduced that it bought Quadvest for $540 million. This buy provides to the corporate’s place within the Houston space.

Quadvest has 50,500 lively connections, virtually 91,000 connections underneath contract and pending improvement, 50 water remedy crops, 27 wastewater remedy crops, and 89 raise stations and underground belongings.

On July twenty eighth, 2025, H2O America introduced second quarter outcomes for the interval ending June thirtieth, 2025. For the quarter, income grew 12.5% to $198.3 million, which was $10.9 million greater than anticipated.

Earnings-per-share of $0.71 in contrast favorably to earnings-per-share of $0.66 within the prior 12 months and was $0.01 forward of estimates.

For the quarter, increased water charges general added $17.6 million to outcomes and better buyer utilization added $4.9 million. Working manufacturing bills totaled $154.4 million, which was a 14% improve from the prior 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on HTO (preview of web page 1 of three proven beneath):

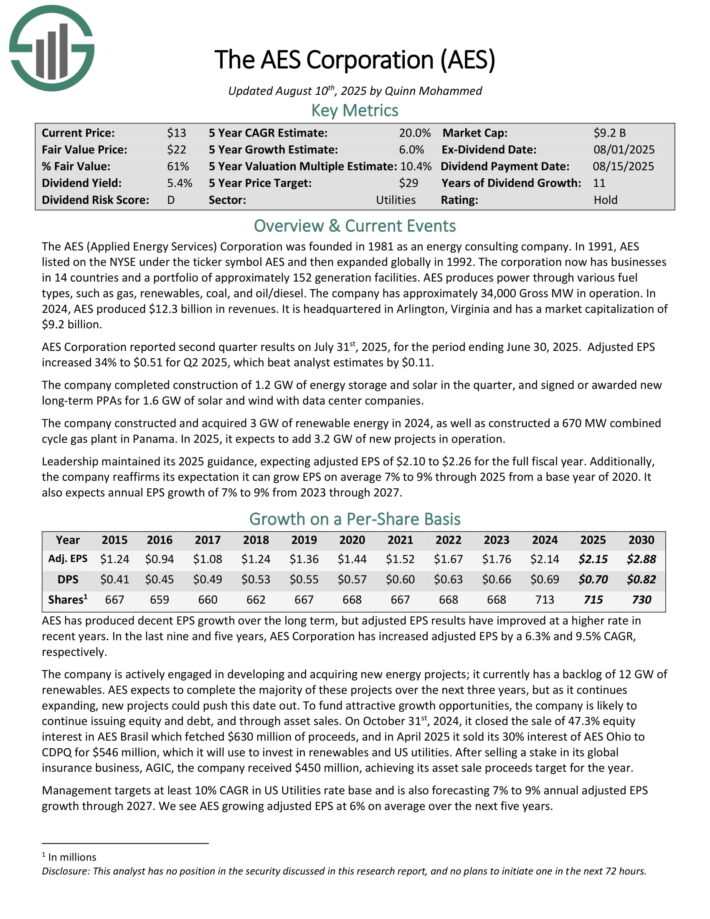

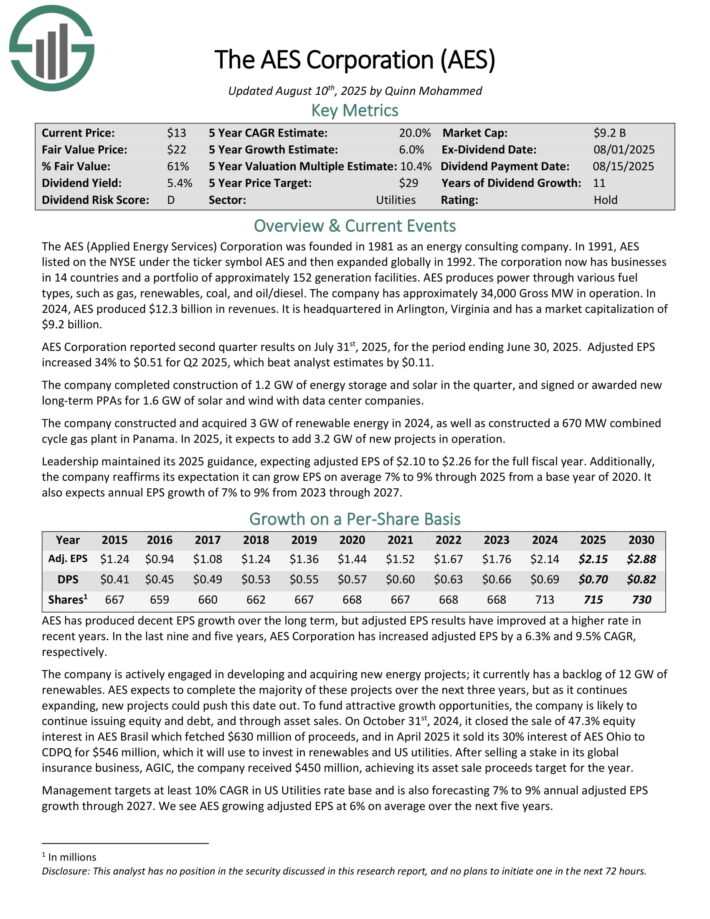

Blue Chip #4: AES Corp. (AES)

- Annual Valuation Return: 11.5%

The AES (Utilized Vitality Providers) Company has companies in 14 international locations and a portfolio of roughly 160 technology services. AES produces energy via varied gasoline varieties, similar to gasoline, renewables, coal, and oil/diesel.

The corporate has greater than 36,000 Gross MW in operation. In 2024, AES produced $12.3 billion in revenues.

AES Company reported second quarter outcomes on July thirty first, 2025, for the interval ending June 30, 2025. Adjusted EPS elevated 34% to $0.51 for Q2 2025, which beat analyst estimates by $0.11.

The corporate accomplished building of 1.2 GW of vitality storage and photo voltaic within the quarter, and signed or awarded new long-term PPAs for 1.6 GW of photo voltaic and wind with knowledge middle firms.

The corporate constructed and bought 3 GW of renewable vitality in 2024, in addition to constructed a 670 MW mixed cycle gasoline plant in Panama. In 2025, it expects so as to add 3.2 GW of recent tasks in operation. Management maintained its 2025 steering, anticipating adjusted EPS of $2.10 to $2.26 for the total fiscal 12 months.

Moreover, the corporate reaffirms its expectation it may well develop EPS on common 7% to 9% via 2025 from a base 12 months of 2020. It additionally expects annual EPS development of seven% to 9% from 2023 via 2027.

Click on right here to obtain our most up-to-date Positive Evaluation report on AES (preview of web page 1 of three proven beneath):

Blue Chip #3: Constellation Manufacturers (STZ)

- Annual Valuation Return: 12.3%

Constellation Manufacturers was based in 1945. The corporate produces and distributes alcoholic drinks together with beer, wine, and spirits. It’s the third largest beer firm within the U.S., and imports and sells beer manufacturers similar to Corona, Modelo Especial (the #1 Beer in U.S.), Modelo Negra, and Pacifico.

As well as, Constellation has many wine manufacturers together with Robert Mondavi and Kim Crawford, in addition to spirits manufacturers together with Casa Noble Tequila, and Excessive West Whiskey. The corporate additionally has a stake in hashish firm Cover Development.

In June 2025, Constellation accomplished its divestiture of a few of its wine and spirits manufacturers to The Wine Group. The manufacturers divested embody Woodbridge, Meiomi, Robert Mondavi Personal Choice, Prepare dinner’s, SIMI, and J. Roget glowing wine, in addition to its stock, services, and vineyards. Constellation retained its high-end wine and spirits manufacturers.

On July 1st, 2025, Constellation Manufacturers reported first quarter fiscal 2026 outcomes for the interval ending Might 31, 2025. For the quarter, the corporate recorded $2.52 billion in web gross sales, down 6% in comparison with the identical prior 12 months interval. Beer gross sales fell 2% year-over-year, whereas wine and spirits gross sales plunged 28%.

Comparable earnings-per-share equaled $3.22 for the quarter, which was 10% decrease in comparison with Q1 2025, and $0.07 behind analyst estimates.

Within the first quarter, Constellation Manufacturers repurchased $306 million of its shares and paid $182 million in dividends.

Click on right here to obtain our most up-to-date Positive Evaluation report on STZ (preview of web page 1 of three proven beneath):

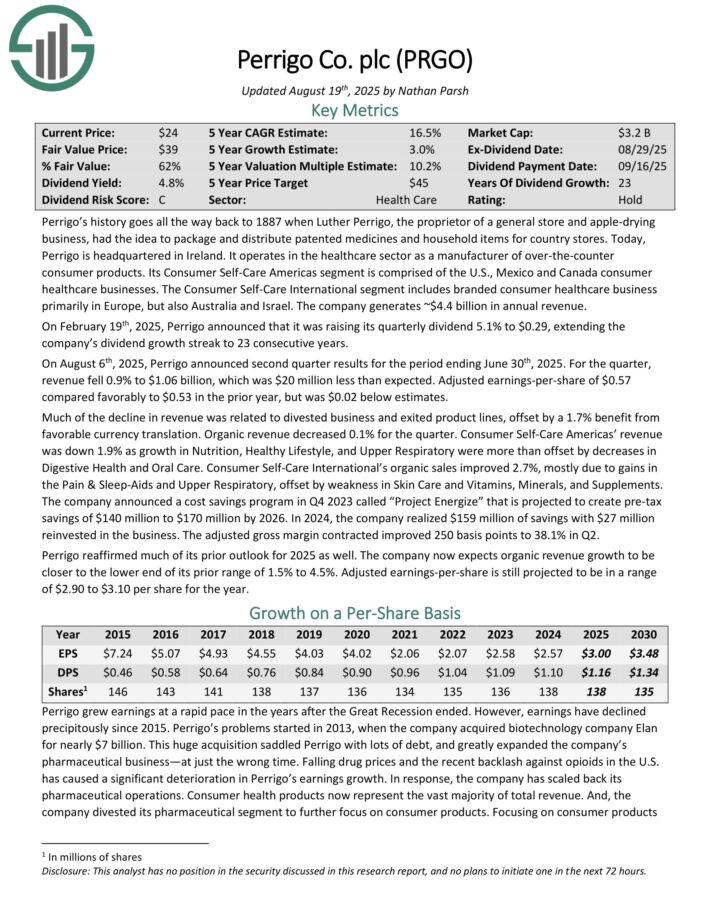

Blue Chip #2: Perrigo Firm plc (PRGO)

- Annual Valuation Return: 12.5%

Perrigo operates within the healthcare sector as a producer of over-the-counter client merchandise. Its Client Self-Care Americas phase is comprised of the U.S., Mexico and Canada client healthcare companies. The Client Self-Care Worldwide phase consists of branded client healthcare enterprise primarily in Europe, but additionally Australia and Israel. The corporate generates ~$4.4 billion in annual income.

On August sixth, 2025, Perrigo introduced second quarter outcomes. For the quarter, income fell 0.9% to $1.06 billion, which was $20 million lower than anticipated. Adjusted earnings-per-share of $0.57 in contrast favorably to $0.53 within the prior 12 months, however was $0.02 beneath estimates.

A lot of the decline in income was associated to divested enterprise and exited product traces, offset by a 1.7% profit from favorable forex translation. Natural income decreased 0.1% for the quarter.

Client Self-Care Americas’ income was down 1.9% as development in Vitamin, Wholesome Life-style, and Higher Respiratory had been greater than offset by decreases in Digestive Well being and Oral Care.

Client Self-Care Worldwide’s natural gross sales improved 2.7%, largely attributable to good points within the Ache & Sleep-Aids and Higher Respiratory, offset by weak spot in Pores and skin Care and Nutritional vitamins, Minerals, and Dietary supplements.

Perrigo reaffirmed a lot of its prior outlook for 2025 as effectively. The corporate now expects natural income development to be nearer to the decrease finish of its prior vary of 1.5% to 4.5%.

Adjusted earnings-per-share remains to be projected to be in a variety of $2.90 to $3.10 per share for the 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on PRGO (preview of web page 1 of three proven beneath):

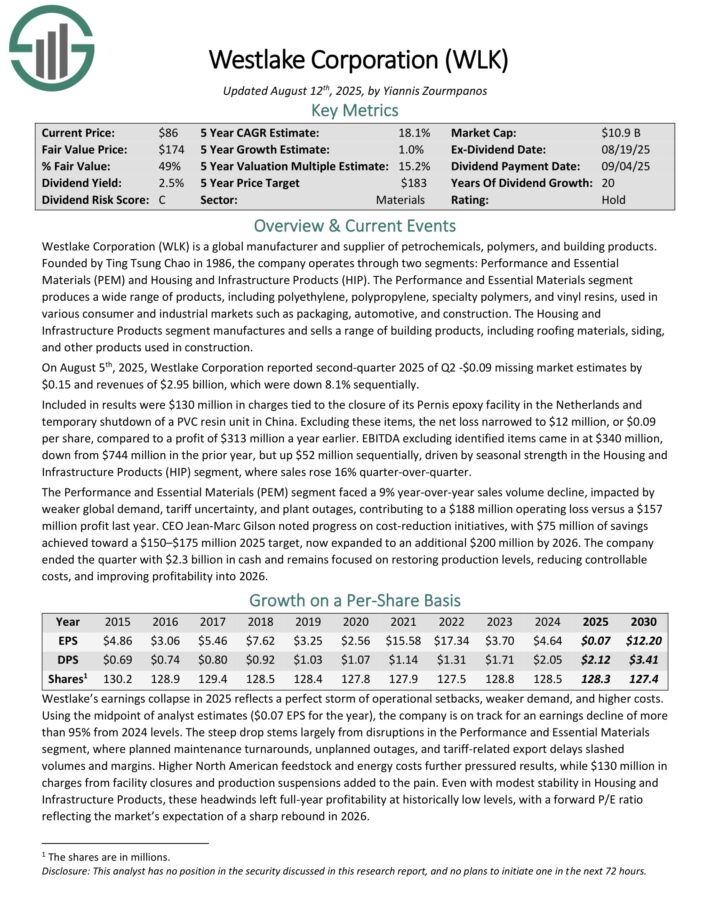

Excessive Yield Blue Chip #1: Westlake Company (WLK)

- Annual Valuation Return: 14.7%

Westlake Company is a world producer and provider of petrochemicals, polymers, and constructing merchandise. Based by Ting Tsung Chao in 1986, the corporate operates via two segments: Efficiency and Important Supplies (PEM) and Housing and Infrastructure Merchandise (HIP).

The Efficiency and Important Supplies phase produces a variety of merchandise, together with polyethylene, polypropylene, specialty polymers, and vinyl resins, utilized in varied client and industrial markets similar to packaging, automotive, and building.

The Housing and Infrastructure Merchandise phase manufactures and sells a variety of constructing merchandise, together with roofing supplies, siding, and different merchandise utilized in building.

On August fifth, 2025, Westlake Company reported second-quarter 2025 of Q2 -$0.09 lacking market estimates by $0.15 and revenues of $2.95 billion, which had been down 8.1% sequentially.

Included in outcomes had been $130 million in costs tied to the closure of its Pernis epoxy facility within the Netherlands and non permanent shutdown of a PVC resin unit in China. Excluding these things, the web loss narrowed to $12 million, or $0.09 per share, in comparison with a revenue of $313 million a 12 months earlier.

EBITDA excluding recognized gadgets got here in at $340 million, down from $744 million within the prior 12 months, however up $52 million sequentially, pushed by seasonal energy within the Housing and Infrastructure Merchandise (HIP) phase, the place gross sales rose 16% quarter-over-quarter.

The Efficiency and Important Supplies (PEM) phase confronted a 9% year-over-year gross sales quantity decline, impacted by weaker world demand, tariff uncertainty, and plant outages, contributing to a $188 million working loss versus a $157 million revenue final 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on WLK (preview of web page 1 of three proven beneath):

Extra Studying

If you’re curious about discovering different high-yield securities, the next Positive Dividend sources could also be helpful:

Excessive-Yield Particular person Safety Analysis

Different Positive Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].