The big picture: TSMC is still the undisputed industry leader of contract chip manufacturing, but Samsung just beat it in the race to produce the world’s most advanced chips yet. The company still has a lot to prove if it wants to woo TSMC’s regular customers, but it now has a real chance to gain access to more large chip orders.

Samsung has officially started mass production of chips at its Hwaseong facilities using a 3nm process node and gate-all-around transistors. In doing so, the Korean tech giant has managed to beat rival TSMC in the race to develop leading-edge manufacturing techniques for the growing performance and energy-efficiency demands of the hardware industry.

The company says the new fabrication process offers significant improvements when compared to its own 5nm node, such as increasing power efficiency by 45 percent, reducing area by 16 percent, and improving performance by as much as 23 percent.

A second-generation 3nm process is currently in development, which will reduce power consumption and area size by 50 percent and 30 percent, respectively. Performance should also see a 30 percent improvement, but there’s no word on yield and other important details.

The company says its existing 3nm capacity will be focused on the production of high-performance and specialized low-power computing applications. Later on, it will expand to mobile chipsets — an area where Samsung experienced some yield issues in the recent past. It’s not yet clear if this will happen before or after extending 3nm production to its new Pyeongtaek facility.

Samsung wants to chip away at TSMC’s market share in contract chip manufacturing, but it still has to fight an uphill battle against the latter’s appeal for big customers like Apple, Nvidia, and Qualcomm. Even MediaTek, which is loosening Qualcomm’s tight grip on the mobile market, has a long history of partnering with TSMC, and that is unlikely to change unless Samsung can demonstrate similar or better yield and cost-efficiency levels.

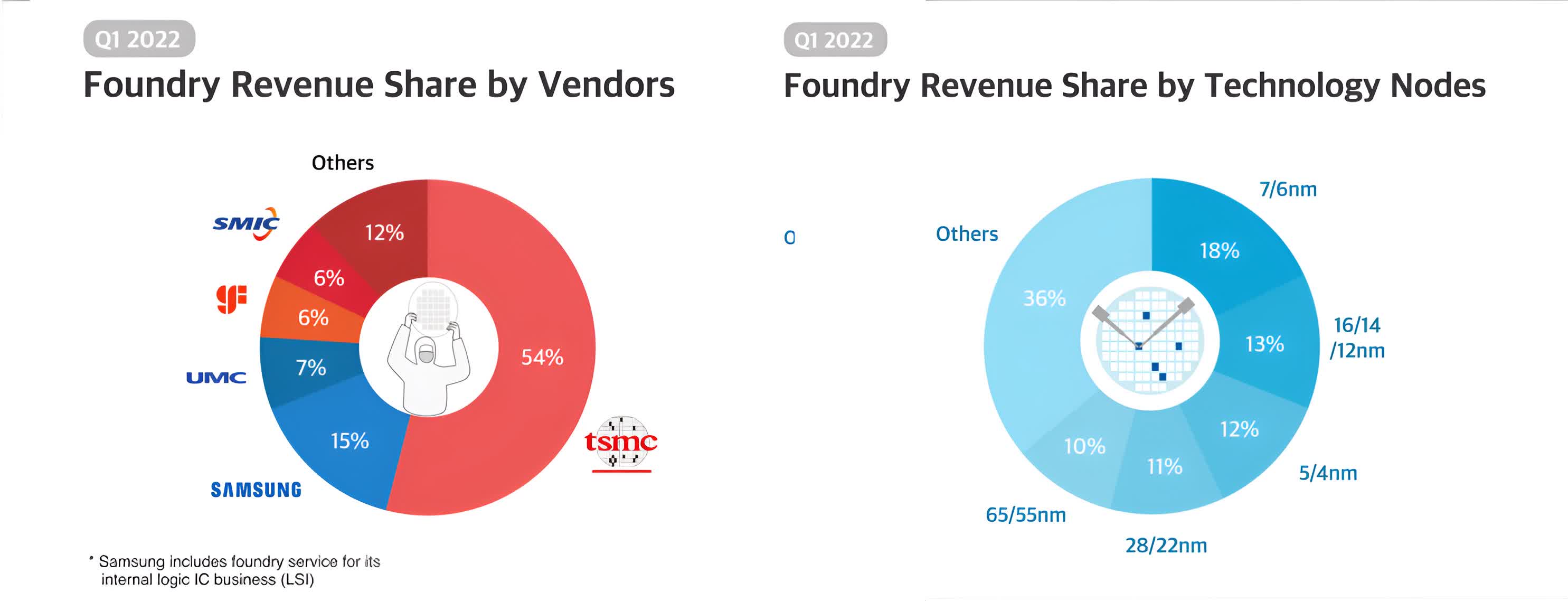

As of writing, TSMC controls around 54 percent of the global foundry capacity and soaks up two-thirds of the global chipmaking revenues. It’s also the point of contention between world leaders who are trying to bring more chipmaking capacity to their countries or to close strategic partners. China, the EU, and the US are all placing domestic chipmaking high on their list of priorities, and that means convincing semiconductor companies to expand beyond the existing hotspots.

Samsung is building a $17 billion chip fab in Texas, but it won’t be operational until 2024 at the earliest. In the meantime, the company’s looming problem is a chip supply glut in South Korea that signals a significant slowdown in demand for its offerings, particularly DRAM and NAND memory chips.

The possibility of a global recession reduced global consumer demand to the point where South Korea’s chip stockpile grew over 53 percent when compared to the same time last year. This puts downward pressure on memory prices, which is great for consumers, but it also has the potential to hit Samsung’s bottom line at a time when investor sentiment has been somewhat negative with respect to its future prospects.

Still, Samsung does have at least two things going for it that should put some of those concerns to rest. For one, the company just struck a deal with Dutch manufacturer ASML for the procurement of EUV lithography equipment, a crucial ingredient for Samsung Foundry’s aggressive $100 billion expansion plans. At the same time, Samsung may have found an unlikely partner in the fight against TSMC — the Pat Gelsinger-powered Intel.