Printed on August twenty fifth, 2025 by Bob Ciura

Dividend investing is in the end about changing your working earnings with a passive earnings stream for a financially free retirement (or early retirement).

The fact of inflation implies that your passive earnings stream can’t simply be static. It have to be perpetually rising.

To construct perpetually rising – lasting – retirement earnings, spend money on a fairly diversified basket of earnings securities which have the next traits:

- Pay dividends (the upper the yield the higher)

- Are prone to develop their funds (the sooner the higher)

- Have protected dividends so you’re prone to see steady or higher earnings throughout a recession (the safer the dividend, the higher)

Dividend investments ought to be protected, rising earnings securities.

In relation to protected and rising earnings, there are not any higher shares than the Dividend Kings. The Dividend Kings are the best-of-the-best in dividend longevity.

What’s a Dividend King? A inventory with 50 or extra consecutive years of dividend will increase.

You may see the complete downloadable spreadsheet of all 56 Dividend Kings (together with essential monetary metrics similar to dividend yields, payout ratios, and price-to-earnings ratios) by clicking on the hyperlink beneath:

The ten high retirement earnings shares beneath are Dividend Kings based mostly within the U.S., with present yields above 2.5%, equal to double the present dividend yield of the S&P 500 Index.

As well as, all of them have Dividend Danger Rating of ‘A’, indicating robust dividend security.

The ten shares are ranked by dividend yield beneath.

Desk of Contents

High Retirement Earnings Inventory: Coca-Cola Co. (KO)

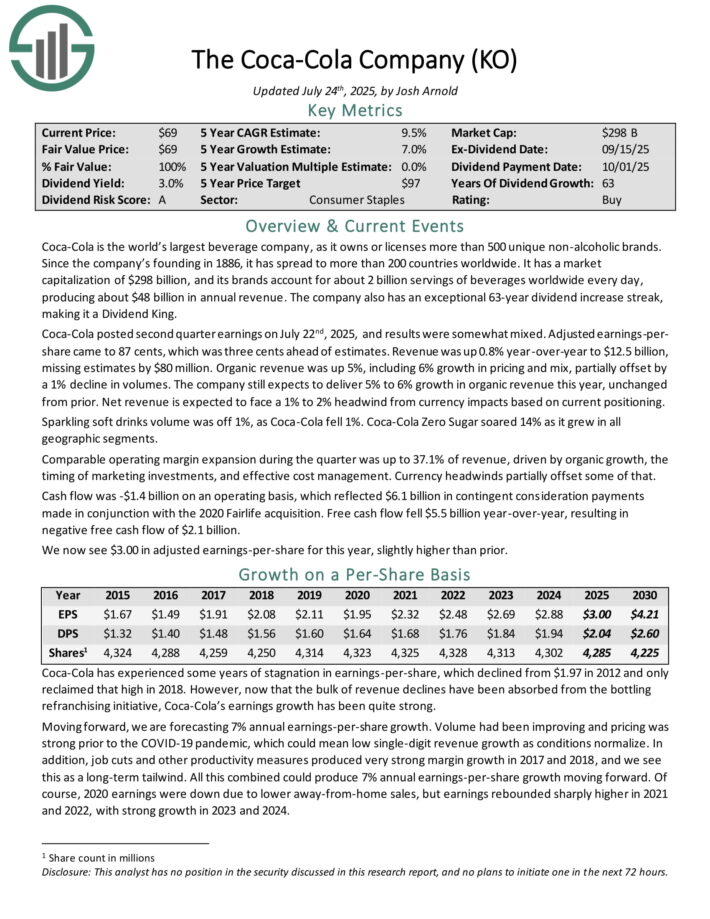

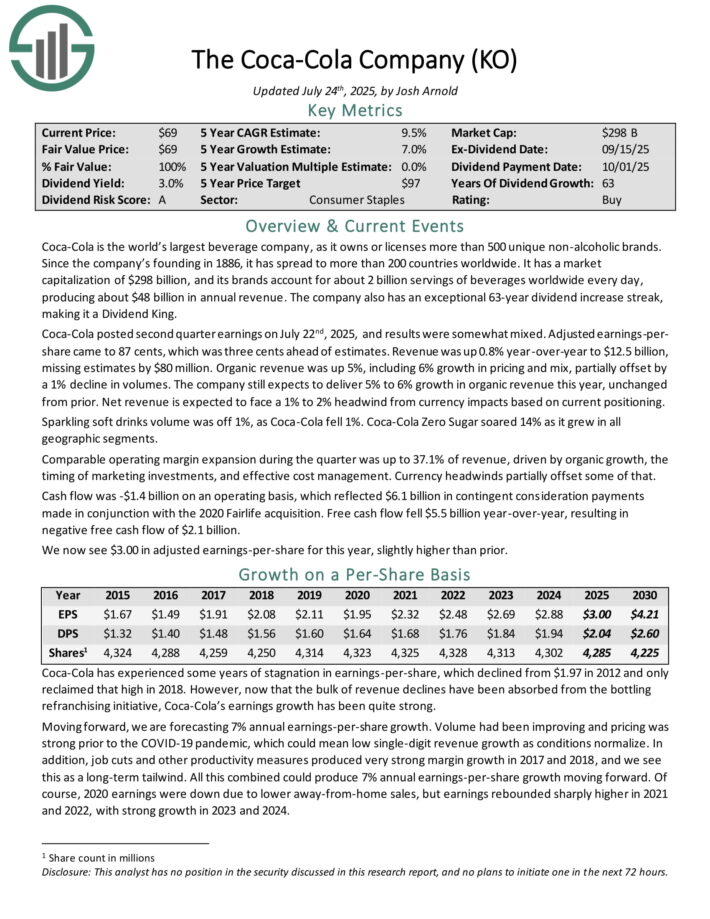

Coca-Cola is the world’s largest beverage firm, because it owns or licenses greater than 500 distinctive non–alcoholic manufacturers. For the reason that firm’s founding in 1886, it has unfold to greater than 200 nations worldwide.

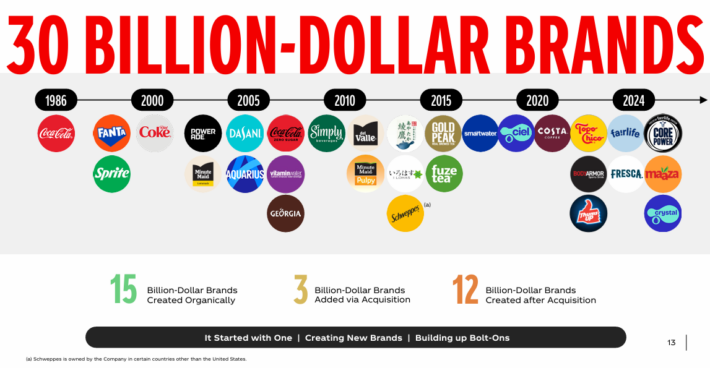

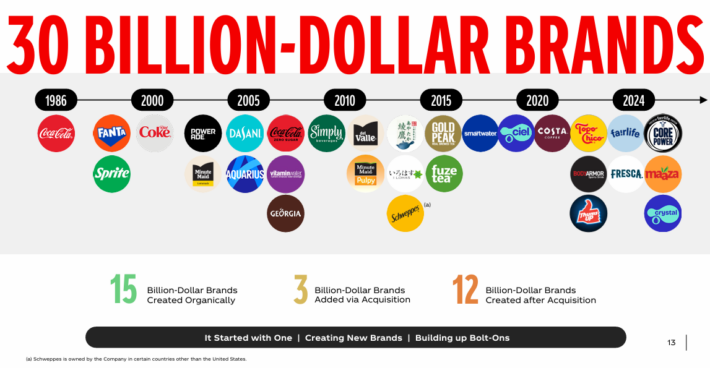

Coca-Cola now has 30 billion-dollar manufacturers in its portfolio, which every generate no less than $1 billion in annual gross sales.

Supply: Investor Presentation

Coca-Cola posted second quarter earnings on July twenty second, 2025, and outcomes have been considerably blended. Adjusted earnings-per-share got here to 87 cents, which was three cents forward of estimates. Income was up 0.8% year-over-year to $12.5 billion, lacking estimates by $80 million.

Natural income was up 5%, together with 6% development in pricing and blend, partially offset by a 1% decline in volumes. The corporate nonetheless expects to ship 5% to six% development in natural income this 12 months, unchanged from prior. Web income is predicted to face a 1% to 2% headwind from foreign money impacts based mostly on present positioning.

Glowing smooth drinks quantity was off 1%, as Coca-Cola fell 1%. Coca-Cola Zero Sugar soared 14% because it grew in all geographic segments. Comparable working margin growth in the course of the quarter was as much as 37.1% of income, pushed by natural development, the timing of promoting investments, and efficient price administration. Forex headwinds partially offset a few of that..

Click on right here to obtain our most up-to-date Certain Evaluation report on KO (preview of web page 1 of three proven beneath):

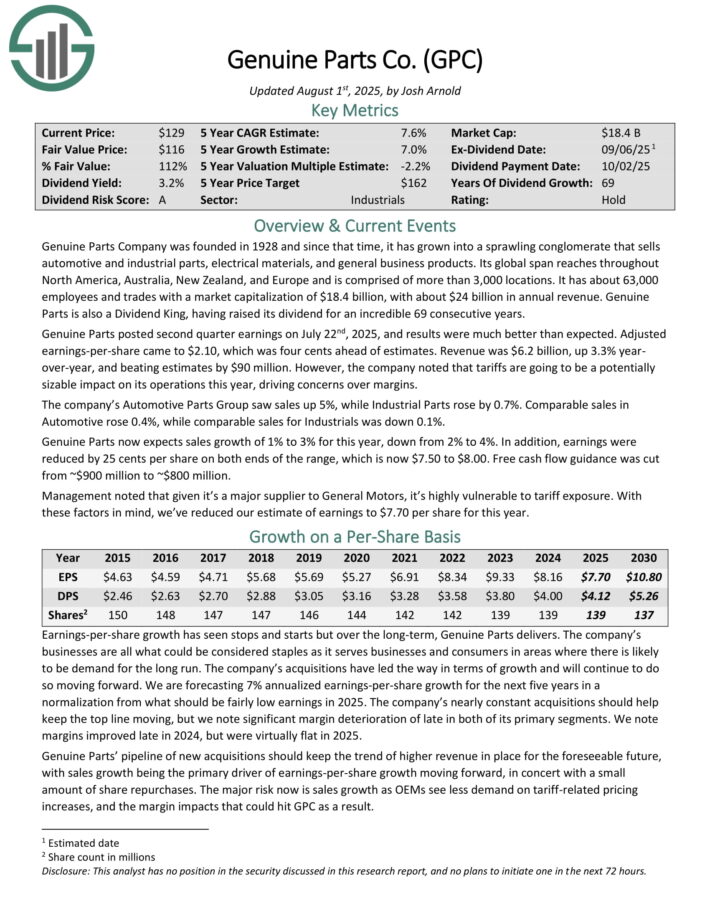

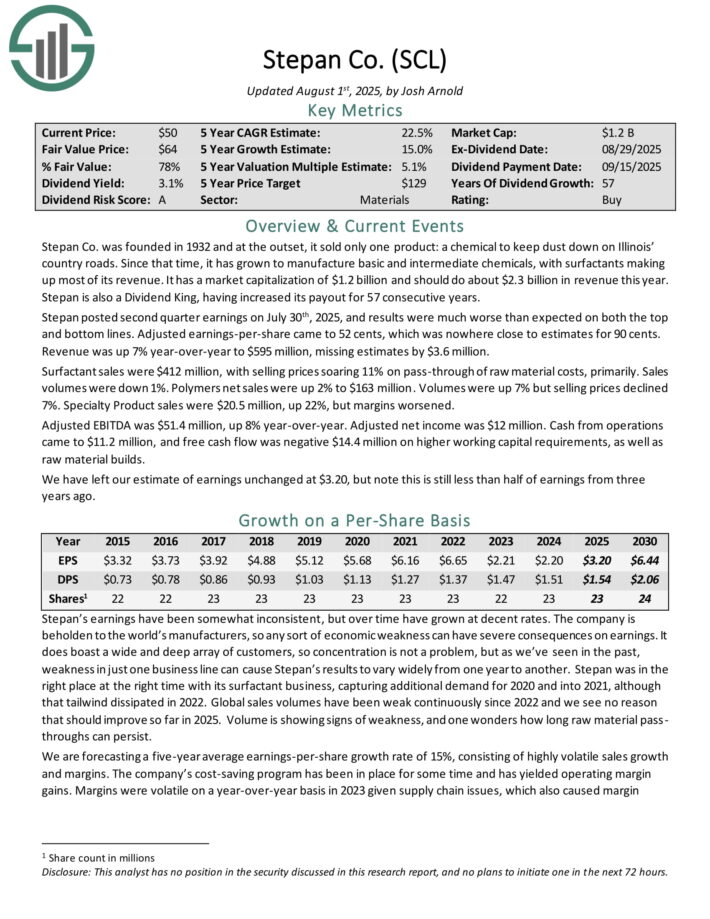

High Retirement Earnings Inventory: Real Components Co. (GPC)

Real Components has the world’s largest international auto components community, with greater than 10,800 areas worldwide. As a significant distributor of automotive and industrial components, Real Components generates annual income of almost $24 billion.

It operates two segments, that are automotive (consists of the NAPA model) and the economic components group which sells industrial substitute components to MRO (upkeep, restore, and operations) and OEM (authentic tools producer) prospects.

Real Components posted second quarter earnings on July twenty second, 2025, and outcomes have been a lot better than anticipated. Adjusted earnings-per-share got here to $2.10, which was 4 cents forward of estimates. Income was $6.2 billion, up 3.3% year-over-year, and beating estimates by $90 million.

The corporate’s Automotive Components Group noticed gross sales up 5%, whereas Industrial Components rose by 0.7%. Comparable gross sales in Automotive rose 0.4%, whereas comparable gross sales for Industrials was down 0.1%.

Real Components now expects gross sales development of 1% to three% for this 12 months, down from 2% to 4%. As well as, earnings have been lowered by 25 cents per share on each ends of the vary, which is now $7.50 to $8.00.

Click on right here to obtain our most up-to-date Certain Evaluation report on GPC (preview of web page 1 of three proven beneath):

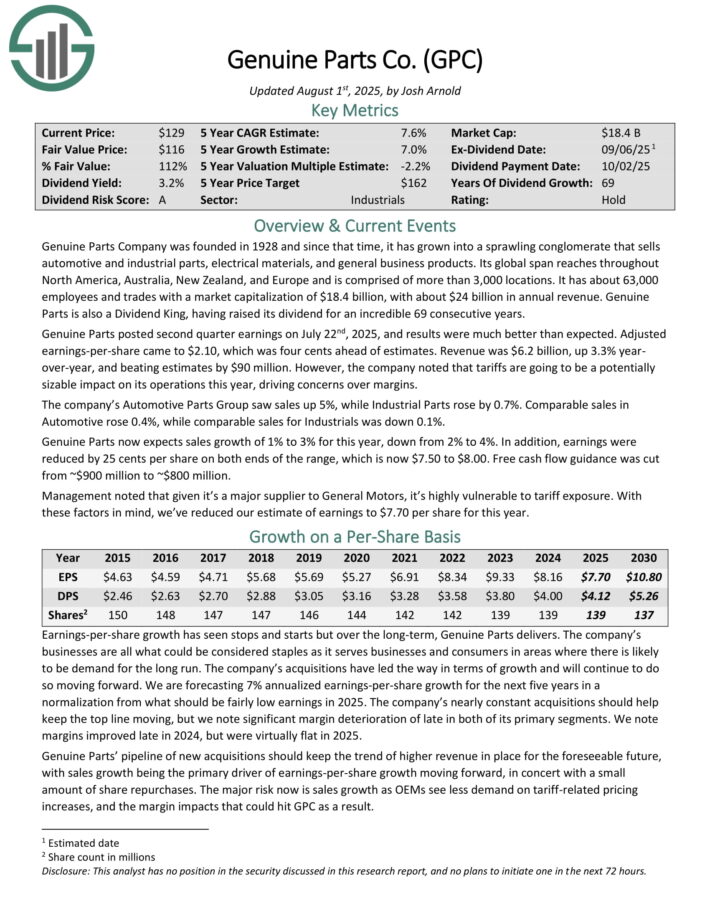

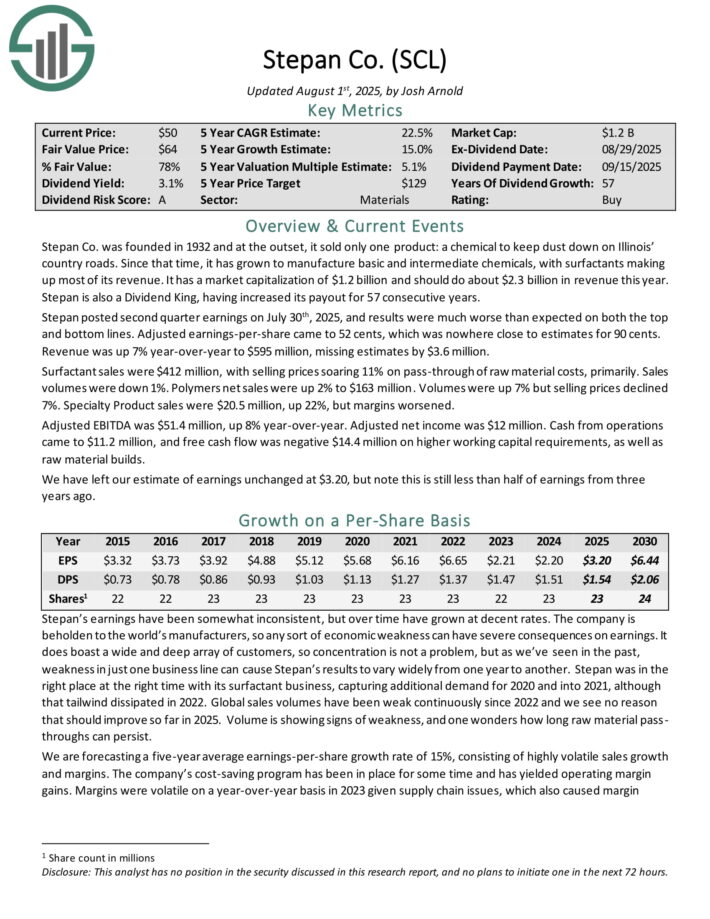

High Retirement Earnings Inventory: Stepan Co. (SCL)

Stepan manufactures primary and intermediate chemical compounds, together with surfactants, specialty merchandise, germicidal and cloth softening quaternaries, phthalic anhydride, polyurethane polyols and particular substances for the meals, complement, and pharmaceutical markets.

It’s organized into three distinct enterprise strains: surfactants, polymers, and specialty merchandise. These companies serve all kinds of finish markets.

The surfactants enterprise is Stepan’s largest by income. A surfactant is an natural compound that comprises each water-soluble and water-insoluble elements.

Stepan posted second quarter earnings on July thirtieth, 2025, and outcomes have been a lot worse than anticipated on each the highest and backside strains. Adjusted earnings-per-share got here to 52 cents, which was nowhere near estimates for 90 cents. Income was up 7% year-over-year to $595 million, lacking estimates by $3.6 million.

Surfactant gross sales have been $412 million, with promoting costs hovering 11% on pass-through of uncooked materials prices, primarily. Gross sales volumes have been down 1%. Polymers web gross sales have been up 2% to $163 million. Volumes have been up 7% however promoting costs declined 7%. Specialty Product gross sales have been $20.5 million, up 22%, however margins worsened.

Adjusted EBITDA was $51.4 million, up 8% year-over-year. Adjusted web earnings was $12 million. Money from operations got here to $11.2 million, and free money stream was destructive $14.4 million on greater working capital necessities, in addition to uncooked materials builds.

Click on right here to obtain our most up-to-date Certain Evaluation report on SCL (preview of web page 1 of three proven beneath):

High Retirement Earnings Inventory: AbbVie Inc. (ABBV)

AbbVie is a biotechnology firm targeted on growing and commercializing medicine for immunology, oncology and virology. AbbVie was spun off by Abbott Laboratories in 2013.

AbbVie has turn out to be one of many largest gamers within the biotechnology trade, particularly following the closing of its acquisition of previously unbiased pharma firm Allergan.

AbbVie reported its second quarter earnings outcomes on July 31. The corporate was capable of generate revenues of $15.4 billion in the course of the quarter, which was 7% greater than AbbVie’s revenues in the course of the earlier 12 months’s quarter.

Revenues have been positively impacted by compelling development from a few of its main medicine, together with Skyrizi and Rinvoq, whereas Humira gross sales declined by 58% on account of rising competitors from biosimilars and market share losses.

AbbVie earned $2.97 per share in the course of the second quarter, up 12% year-over-year. Earnings-per-share beat the consensus analyst estimate by $0.06.

Steering for 2025’s adjusted earnings-per-share was raised in the course of the earnings name; the corporate expects to earn $11.88 – $12.08 on a per-share foundation this 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on ABBV (preview of web page 1 of three proven beneath):

High Retirement Earnings Inventory: H2O America (HTO)

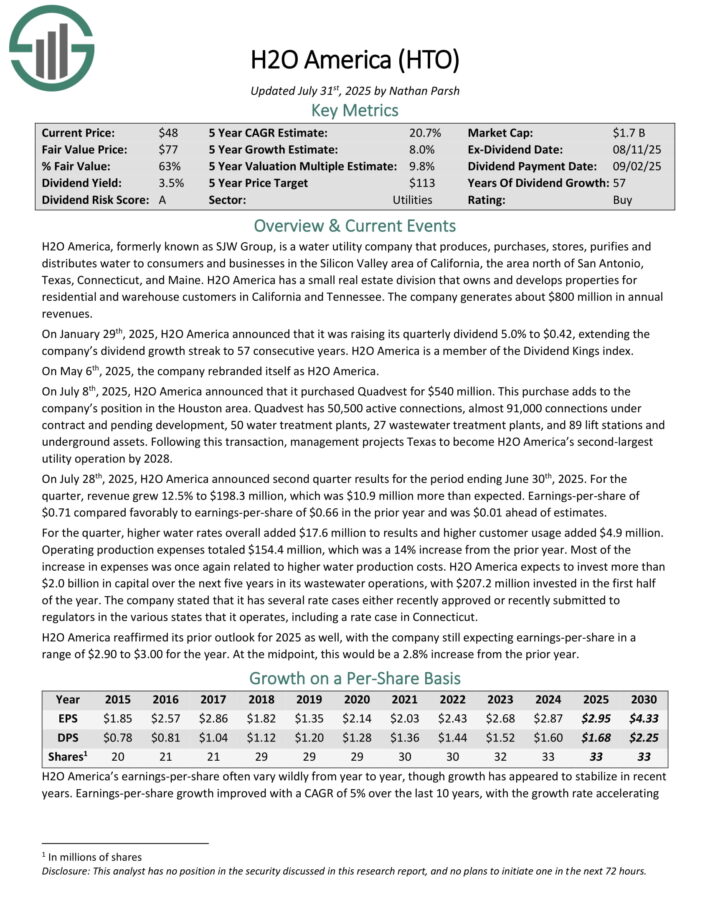

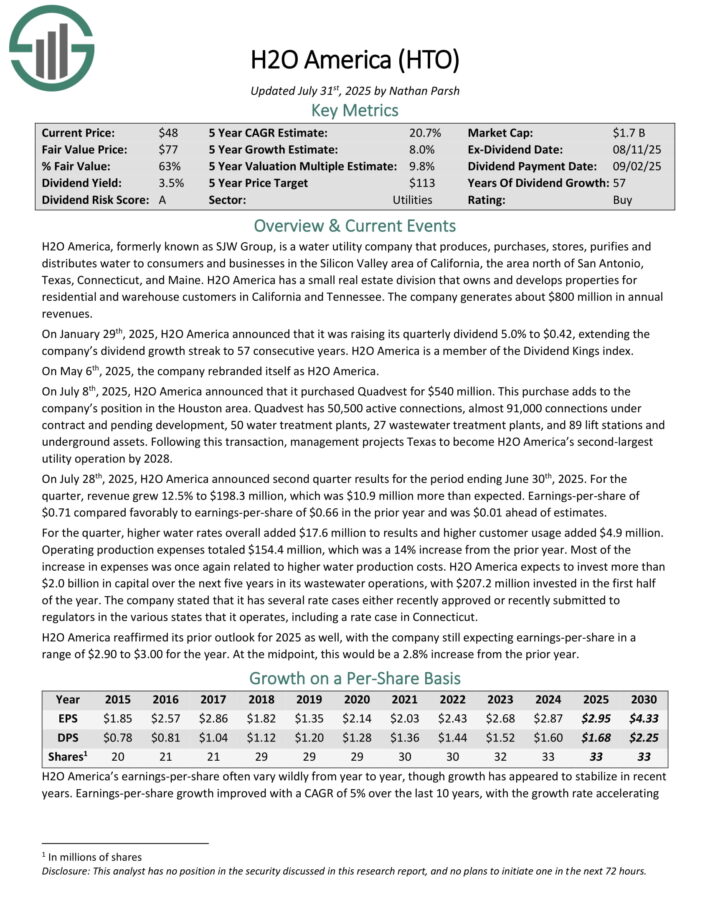

H2O America, previously generally known as SJW Group, is a water utility firm that produces, purchases, shops, purifies and distributes water to shoppers and companies within the Silicon Valley space of California, the realm north of San Antonio, Texas, Connecticut, and Maine.

It additionally has a small actual property division that owns and develops properties for residential and warehouse prospects in California and Tennessee. The corporate generates about $670 million in annual revenues.

On July eighth, 2025, H2O America introduced that it bought Quadvest for $540 million. This buy provides to the corporate’s place within the Houston space.

Quadvest has 50,500 energetic connections, virtually 91,000 connections underneath contract and pending growth, 50 water remedy crops, 27 wastewater remedy crops, and 89 raise stations and underground property.

On July twenty eighth, 2025, H2O America introduced second quarter outcomes for the interval ending June thirtieth, 2025. For the quarter, income grew 12.5% to $198.3 million, which was $10.9 million greater than anticipated.

Earnings-per-share of $0.71 in contrast favorably to earnings-per-share of $0.66 within the prior 12 months and was $0.01 forward of estimates.

For the quarter, greater water charges total added $17.6 million to outcomes and better buyer utilization added $4.9 million. Working manufacturing bills totaled $154.4 million, which was a 14% improve from the prior 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on HTO (preview of web page 1 of three proven beneath):

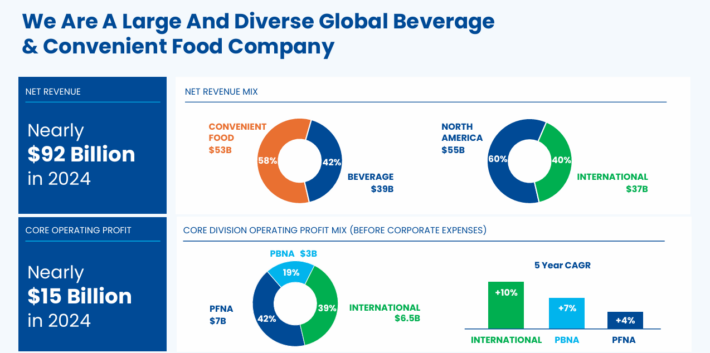

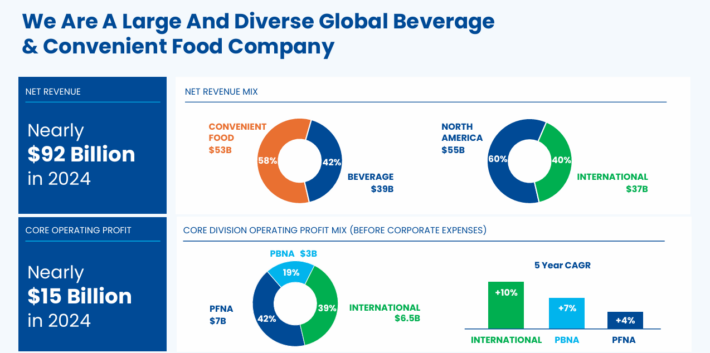

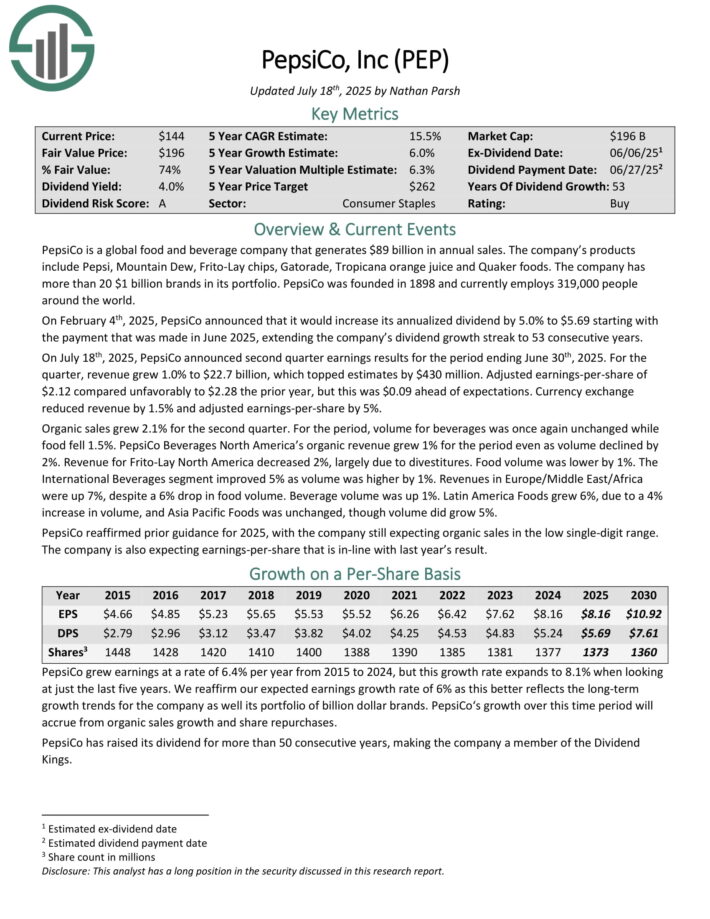

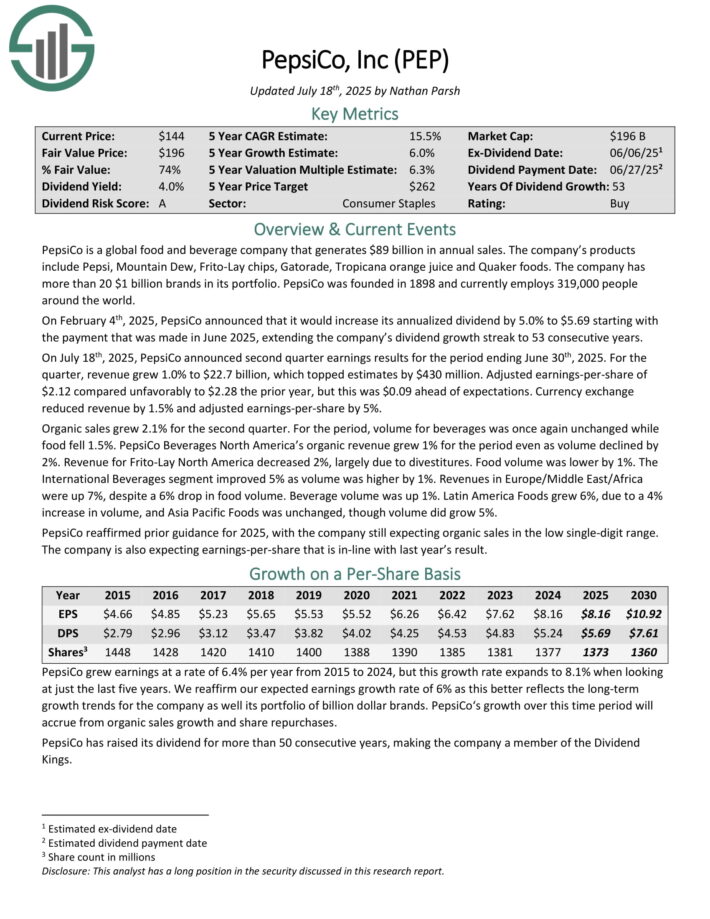

High Retirement Earnings Inventory: PepsiCo Inc. (PEP)

PepsiCo is a worldwide meals and beverage firm. Its merchandise embody Pepsi, Mountain Dew, Frito-Lay chips, Gatorade, Tropicana orange juice and Quaker meals.

Its enterprise is break up roughly 60-40 by way of meals and beverage income. It is usually balanced geographically between the U.S. and the remainder of the world.

Supply: Investor Presentation

On July 18th, 2025, PepsiCo introduced second quarter earnings outcomes for the interval ending June thirtieth, 2025. For the quarter, income grew 1.0% to $22.7 billion, which topped estimates by $430 million.

Adjusted earnings-per-share of $2.12 in contrast unfavorably to $2.28 the prior 12 months, however this was $0.09 forward of expectations. Forex change lowered income by 1.5% and adjusted earnings-per-share by 5%.

Natural gross sales grew 2.1% for the second quarter. For the interval, quantity for drinks was as soon as once more unchanged whereas meals fell 1.5%.

Click on right here to obtain our most up-to-date Certain Evaluation report on PEP (preview of web page 1 of three proven beneath):

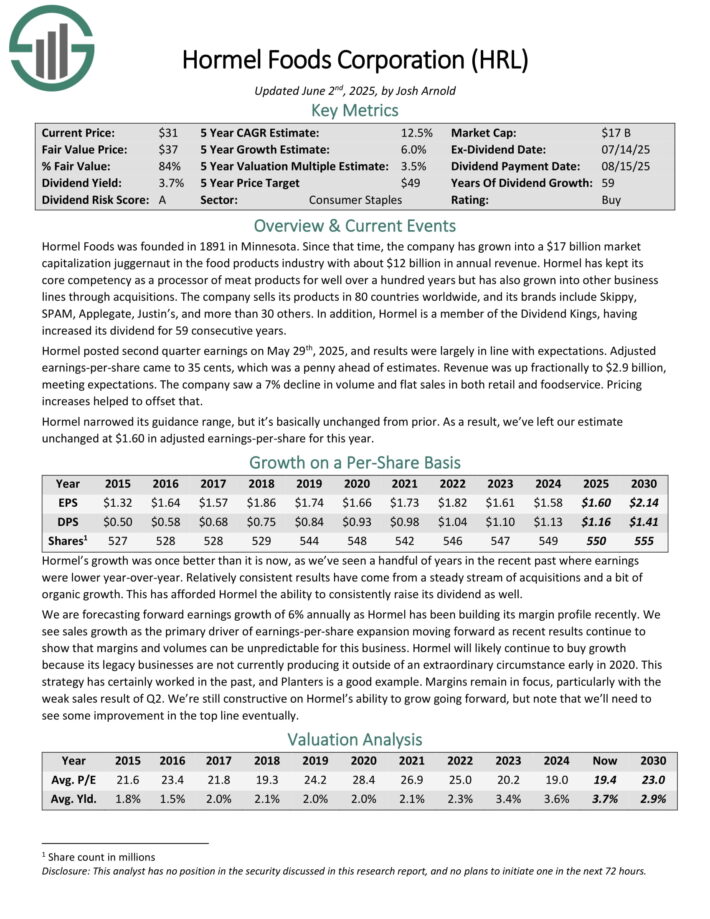

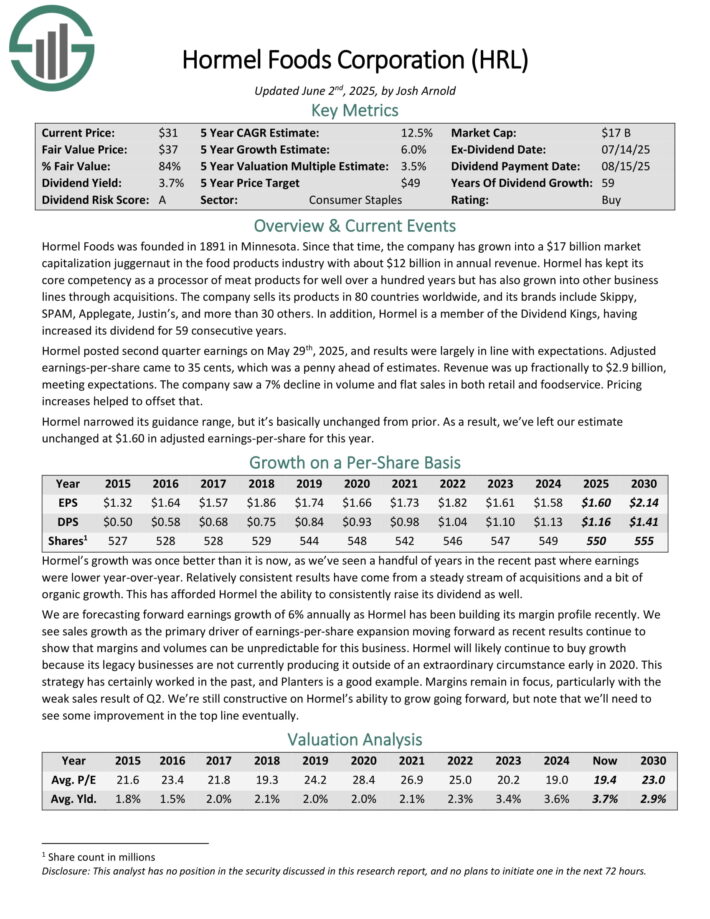

High Retirement Earnings Inventory: Hormel Meals (HRL)

Hormel Meals is a juggernaut within the meals merchandise trade with almost $10 billion in annual income. It has a big portfolio of category-leading manufacturers. Only a few of its high manufacturers embody embody Skippy, SPAM, Applegate, Justin’s, and greater than 30 others.

It has additionally pursued acquisitions to drive development. For instance, in 2021, Hormel acquired the Planters snack nuts enterprise from Kraft-Heinz (KHC) for $3.35 billion, which has boosted Hormel’s development.

Hormel posted second quarter earnings on Might twenty ninth, 2025, and outcomes have been largely in step with expectations. Adjusted earnings-per-share got here to 35 cents, which was a penny forward of estimates.

Income was up fractionally to $2.9 billion, assembly expectations. The corporate noticed a 7% decline in quantity and flat gross sales in each retail and foodservice. Pricing will increase helped to offset that.

Click on right here to obtain our most up-to-date Certain Evaluation report on HRL (preview of web page 1 of three proven beneath):

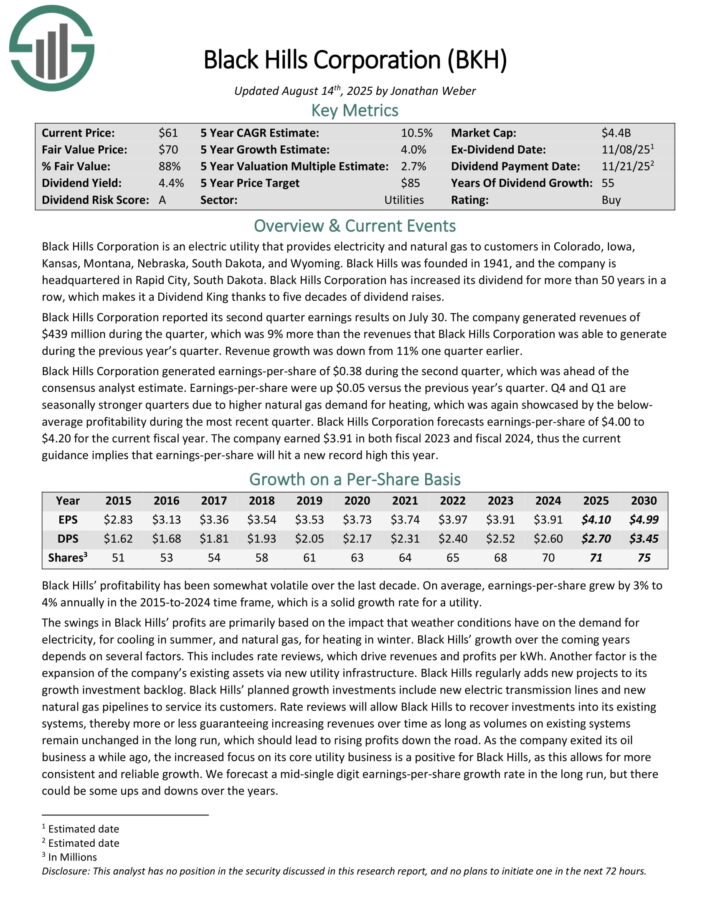

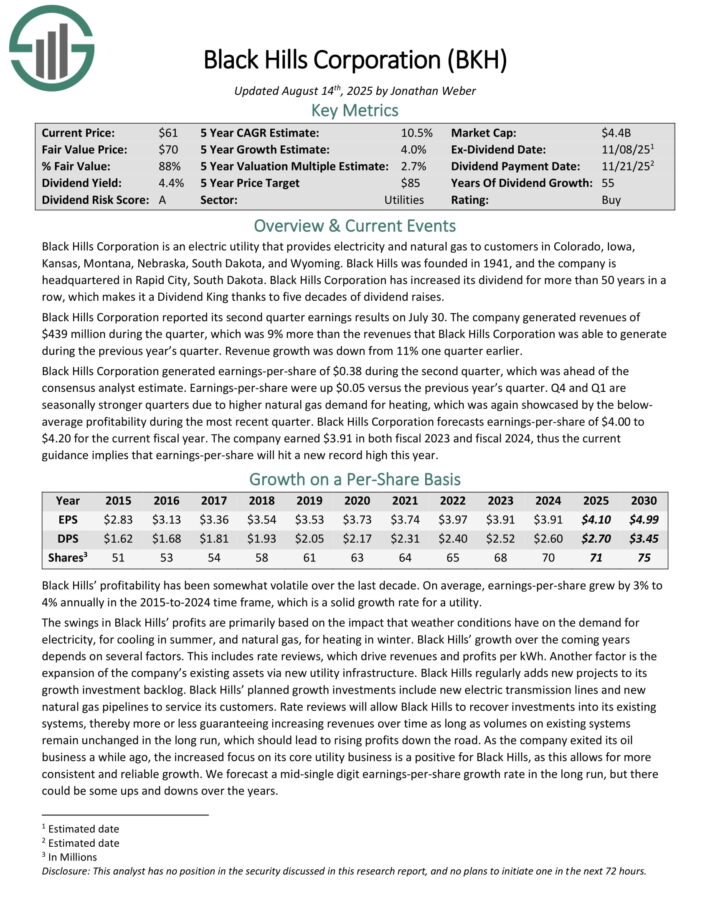

High Retirement Earnings Inventory: Black Hills Corp. (BKH)

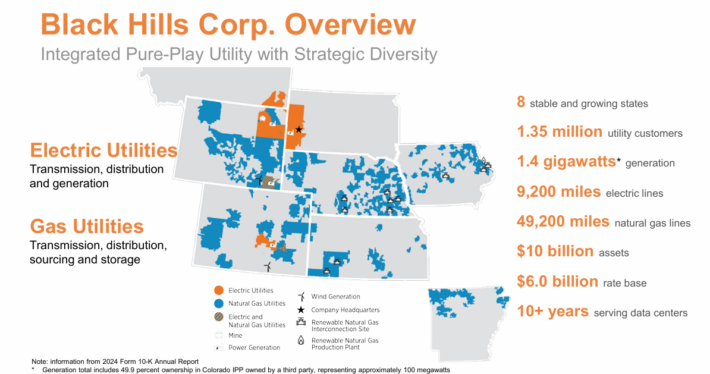

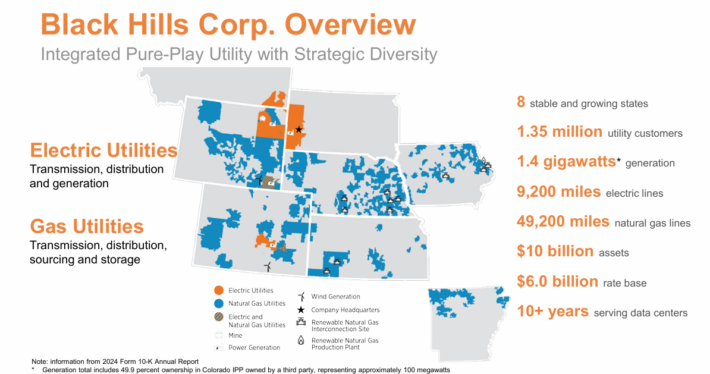

Black Hills Company is an electrical utility that gives electrical energy and pure fuel to prospects in Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, and Wyoming.

The corporate has 1.35 million utility prospects in eight states. Its pure fuel property embody 49,200 miles of pure fuel strains. Individually, it has ~9,200 miles of electrical strains and 1.4 gigawatts of electrical technology capability.

Supply: Investor Presentation

Black Hills Company reported its second quarter earnings outcomes on July 30. The corporate generated revenues of $439 million in the course of the quarter, up 9% year-over-year.

Black Hills Company generated earnings-per-share of $0.38 in the course of the second quarter, which was forward of the consensus analyst estimate.

Earnings-per-share have been up $0.05 versus the earlier 12 months’s quarter. This autumn and Q1 are seasonally stronger quarters on account of greater pure fuel demand for heating.

Black Hills Company forecasts earnings-per-share of $4.00 to $4.20 for the present fiscal 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on BKH (preview of web page 1 of three proven beneath):

High Retirement Earnings Inventory: Goal Company (TGT)

Goal was based in 1902 and now operates about 1,850 large field shops, which supply basic merchandise and meals, in addition to serving as distribution factors for the corporate’s e-commerce enterprise.

Goal posted first quarter earnings on Might twenty first, 2025, and outcomes have been weak. Earnings got here to $1.30 per share, which missed estimates by 35 cents. Income was additionally 3% decrease from the prior 12 months at $23.8 billion, lacking estimates by $550 million. Merchandise gross sales have been off 3.1% year-over-year, partially offset by a 13.5% improve in different income.

Digital comparable gross sales have been up 4.7%, with same-day supply development of 35%. Power in Drive Up continues to drive these outcomes. Complete comparable gross sales fell 3.8%, and administration famous Goal held or gained market share in simply 15 of its 35 classes.

The corporate is investing closely in its enterprise with a purpose to navigate by means of the altering panorama within the retail sector. The payout is now 61% of earnings for this 12 months, which is elevated from historic ranges, however the dividend stays well-covered.

Goal’s aggressive benefit comes from its on a regular basis low costs on engaging merchandise in its guest-friendly shops.

Click on right here to obtain our most up-to-date Certain Evaluation report on TGT (preview of web page 1 of three proven beneath):

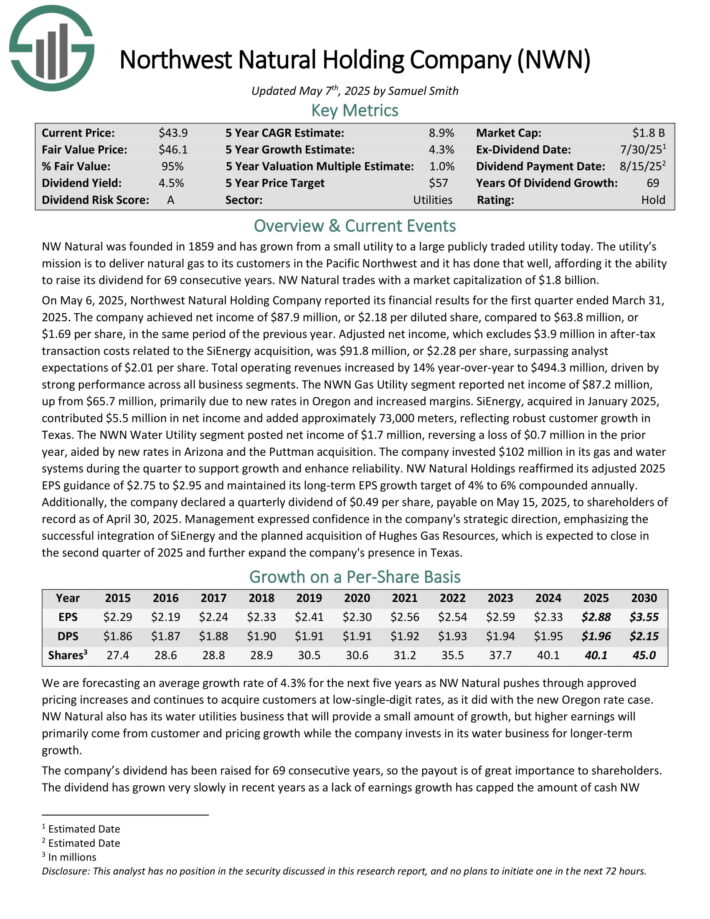

High Retirement Earnings Inventory: Northwest Pure Holding (NWN)

NW Pure was based in 1859 and has grown from only a handful of consumers to serving greater than 760,000 right now. The utility’s mission is to ship pure fuel to its prospects within the Pacific Northwest.

Supply: Investor Presentation

On Might 6, 2025, Northwest Pure Holding Firm reported its monetary outcomes for the primary quarter ended March 31, 2025. The corporate achieved web earnings of $87.9 million, or $2.18 per diluted share, in comparison with $63.8 million, or $1.69 per share, in the identical interval of the earlier 12 months.

Adjusted web earnings, which excludes $3.9 million in after-tax transaction prices associated to the SiEnergy acquisition, was $91.8 million, or $2.28 per share, surpassing analyst expectations of $2.01 per share. Complete working revenues elevated by 14% year-over-year to $494.3 million, pushed by robust efficiency throughout all enterprise segments.

The NWN Gasoline Utility section reported web earnings of $87.2 million, up from $65.7 million, primarily on account of new charges in Oregon and elevated margins. SiEnergy, acquired in January 2025, contributed $5.5 million in web earnings and added roughly 73,000 meters, reflecting strong buyer development in Texas.

The NWN Water Utility section posted web earnings of $1.7 million, reversing a lack of $0.7 million within the prior 12 months, aided by new charges in Arizona and the Puttman acquisition.

NW Pure Holdings reaffirmed its adjusted 2025 EPS steering of $2.75 to $2.95.

Click on right here to obtain our most up-to-date Certain Evaluation report on NWN (preview of web page 1 of three proven beneath):

Last Ideas

Screening to seek out the perfect Dividend Kings shouldn’t be the one option to discover high-quality dividend development inventory concepts.

Certain Dividend maintains comparable databases on the next helpful universes of shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].