The announcement of Unilever’s $1.5B acquisition of Dr. Squatch from Summit Companions has sparked appreciable dialogue amongst business analysts. Whereas this model acquisition could not have dominated headlines, I believe it’s a fascinating acquisition. It’s a case research in strategic development and the evolving advertising and marketing panorama of shopper items.

For CPG leaders evaluating their very own development methods, this Unilever acquisition provides precious insights into when shopping for beats natural development constructing, and what separates profitable acquisitions from pricey missteps.

Why the Dr. Squatch Acquisition Makes Strategic Sense

On the one hand, there are lots of strategic positives for Unilever. Firstly, the lads’s grooming market presents engaging development alternatives that stretch nicely past the US (extra on that later).

Secondly, Dr. Squatch has constructed, grown and expanded its buyer base and product line quickly on the power of intelligent, genuine branding that resonates with its goal demographic and direct-to-consumer (DTC) gross sales. Since launching in 2016 in San Diego by Jack Haldrup, Dr. Squatch has captured over 8% US share in each bar cleaning soap and pores and skin/physique care classes. From 2023 to 2024, Dr. Squatch’s pores and skin/physique care gross sales almost doubled, surpassing Unilever’s Axe model.

Alternatively, this acquisition calls to thoughts Unilever’s buy of Greenback Shave Membership, which was not precisely a homerun…

What’s totally different this time? Ought to we be optimistic or pessimistic?

Studying From Previous Acquisition Modifications

To really perceive the potential of Unilever’s newest deal, we should study Unilever’s previous try to accumulate a model within the males’s grooming area. A lot has modified since 2016 when Unilever purchased Greenback Shave Membership for $1B. It was a time when DTC in shopper packaged items was nascent. The lads’s shaving class was each costly and dominated globally by Gillette.

Greenback Shave Membership spoke on to this frustration with nice success. The model’s launch commercial “Our Blades are F**king Nice!” turned legendary, and founder Michael Dubin positioned the corporate as an everyman’s answer to saving a couple of dollars on shaving. And he did so with sensible humor. It labored.

In 2010, Gillette had 70% world market share whereas Mr. Dubin owned a warehouse of surplus razor blades. By making a model, undercutting current pricing, launching nice promoting and locking in shoppers through a DTC subscription mannequin, Greenback Shave Membership was the catalyst that led to Gillette’s share being lower from 70% in 2010 to underneath 50% in 2016.

Gillette’s market dominance left them susceptible on the low finish of the market. They have been a sufferer of their very own success.

What did Unilever purchase in Greenback Shave Membership? They purchased a DTC firm with a newly-installed buyer base, enticed by nice promoting, primarily cost-focused. What they didn’t purchase is a superior product or a robust platform for class enlargement, prepared for innovation. New opponents like Harry’s and others rushed in to grab the chance, whereas Gillette labored onerous to defend its turf.

Mintel’s information reveals that by 2024, Greenback Shave Membership’s share was all the way down to 1.1% following a 19% gross sales decline from the prior yr. Absolutely, Unilever gained learnings and information of DTC and advertising and marketing to this viewers, nevertheless it was not a convincing success. Whereas Unilever retains a 35% funding within the firm, they bought the bulk stake to Nexus Capital Administration in 2023.

What Makes Dr. Squatch Completely different?

Jack Haldrup launched 2013 in Dr. Squatch in San Diego. The model shares some frequent essential features with Greenback Shave Membership, specifically:

- A DTC-first technique

- Advertising that has resonated deeply with their audience

- Efficient use of humor

- Genuine, irreverent model personalities troublesome to create and preserve in a big firm atmosphere

So why ought to Dr. Squatch be any totally different from Greenback Shave Membership?

There are a number of key components that distinguish the Dr. Squatch acquisition from Greenback Shave Membership, which trace to a stronger potential for long-term success. Let’s discover them beneath:

- Developed Market Situations

For starters, the retail market has basically modified since 2016. Customers at the moment are extra prepared to purchase by subscription and unfold their shopping for throughout channels. Whereas Greenback Shave Membership was a pioneer, DTC and subscription providers have matured to incorporate shopper items. Based on Statista, DTC gross sales are projected to achieve $186B within the US alone, with greater than 20% coming from DTC native manufacturers.

This market evolution creates a extra favorable atmosphere for Unilever to capitalize on Dr. Squatch’s established DTC experience whereas increasing by conventional retail channels.

- Superior Product

In contrast to Greenback Shave Membership’s concentrate on value discount, Dr. Squatch has a unique worth proposition and has constructed its repute on one thing totally different. From the outset, Dr. Squatch produced high-quality soaps that shortly led to adjoining class enlargement. The model’s dedication to premium high quality and substances makes it a extra versatile platform for product growth and innovation, somewhat than addressing a single-category frustration with the price of shaving like Greenback Shave Membership’s technique.

Favorable market shifts and a various, quality-first product portfolio allow extra sturdy development alternatives for Dr. Squatch, the place development can come from new buyer acquisitions and routine enlargement with current customers.

- Explosive Male Grooming Class Progress

The male grooming sector has skilled an enormous enlargement. Mintel’s information reveals that the male grooming class has grown 31% to almost $6B within the US between 2018 and 2023, and is poised for continued development. This trajectory offers a constructive runway for Dr. Squatch’s enlargement underneath Unilever’s new possession.

World Growth Alternatives

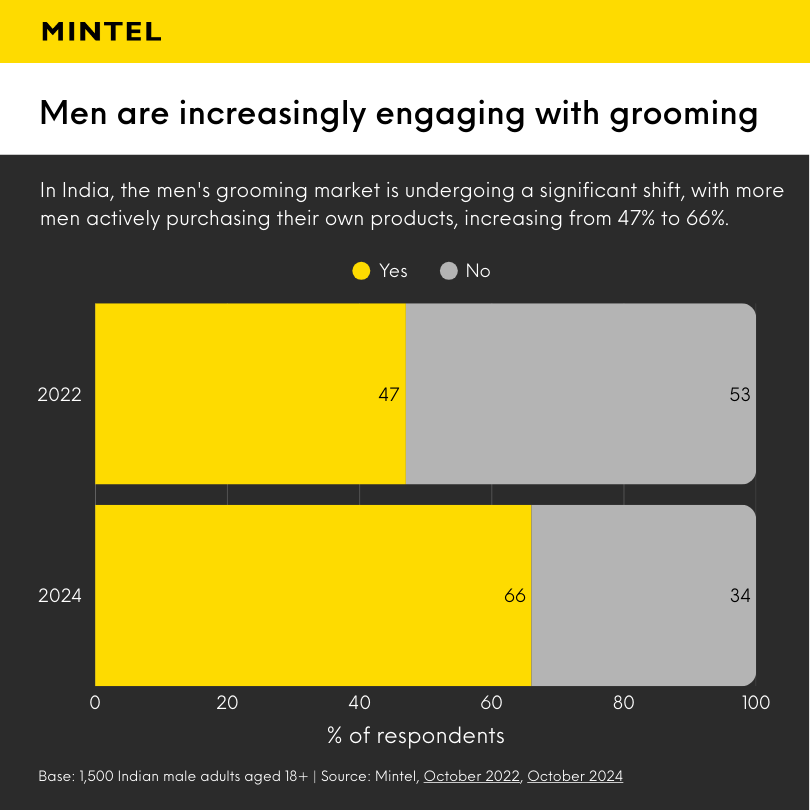

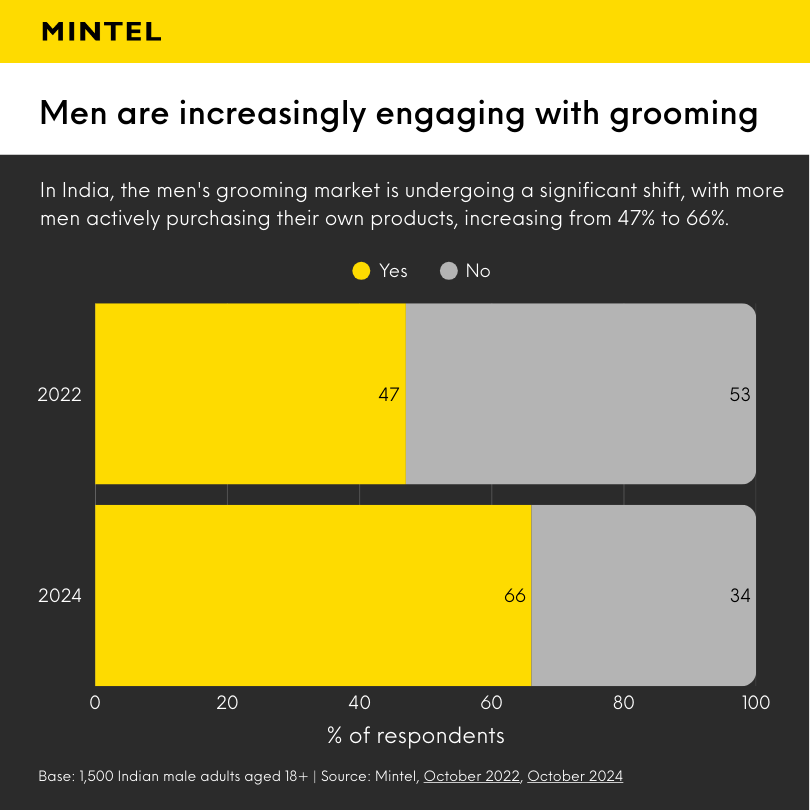

Unilever’s said intention with Dr. Squatch is to develop internationally. The timing could also be proper. For instance, in India, a vital development marketplace for Unilever, 66% of males in 2024 bought throughout the male grooming class prior to now 6 months, in comparison with simply 47% in 2022, signalling world demand.

The problem can be to take care of the credibility and authenticity of the Dr. Squatch model, adapting it successfully to different markets and numerous cultural contexts. That is far simpler stated than accomplished.

Key Success Elements Shifting Ahead

Whereas the market development image seems robust and Dr. Squatch has favorable momentum, some essential questions will decide this acquisition success:

- Model authenticity: Can Unilever successfully handle Dr. Squatch through speedy social adjustments whereas sustaining the model’s “secret sauce?”

- Portfolio integration: Unilever’s Axe is the main world deodorant model. What’s the cannibalization danger to the present portfolio, and the way will Dr. Squatch differentiate to mitigate the danger?

- Market localization: How will the Dr. Squatch model translate to different markets, and the way a lot adaptation can be required to resonate with native market shoppers?

- Funding prioritization: Unilever presently has 13 manufacturers that generate over $1B in annual gross sales. Will Dr. Squatch get the required funding to make sure its continued innovation and development?

Be the First to Know About Model Acquisitions with Mintel

The acquisition appears promising on paper, however… success from right here depends upon the choices Unilever takes to construct upon the model’s successes, make sensible innovation decisions, and resonate in native markets.

The Dr. Squatch acquisition is in line with the development of Huge CPGs rising “non-organically” by buying smaller progressive firms somewhat than innovating in-house. We coated Pepsico’s acquisition of Poppi, learn our evaluation right here! With extraordinarily fast-moving shopper markets and broad entry to start-up capital for entrepreneurs, I anticipate to see extra of those sorts of acquisitions within the near-term future.

Is your organization capitalizing on acquisitions as a part of its market enlargement technique?

Searching for tailor-made insights? At Mintel Consulting, we concentrate on exploring real-time market information to ship customised alternatives and proposals to assist propel market enlargement and gasoline shopper demand. Contact us at this time, so you may lead in aggressive markets!

E book a Marketing consultant Technique Session