This week: month-to-month chart, technical test, and credit score spreads seasonality, terrible Augusts, tech funds milestone, tech weights, electrical energy breakout, defensives.

Learnings and Conclusions from this Week’s Charts:

-

The S&P 500 closed up +2.2% for July (+7.8% YTD).

-

(albeit it subsequently slipped -1.6% the primary day of August).

-

Volatility and Credit score Spreads are seeing a seasonal upturn.

-

Buyers are skewing portfolios heavier and heavier into tech shares.

-

US electrical energy demand has damaged out to a brand new all-time excessive.

General, there does seem like a shift in focus from rebound to threat because the restoration from the April low runs its course and seasonal headwinds start to weigh. Quick-term technicals look a bit tenuous, strain factors proceed to construct, however medium/longer-term pattern indicators stay wholesome. So let’s see what occurs.

1. Completely happy New Month! The closed +2.2% larger in July, inserting it up +7.8% YTD (or 8.6% in whole return phrases); and forward of the (+0.9% in July, 4.7% YTD; 5.8% whole return). July marked the third month again above the 10-month shifting common. All-in-all, it seems to be like a market in an uptrend.

Supply: Topdown Charts

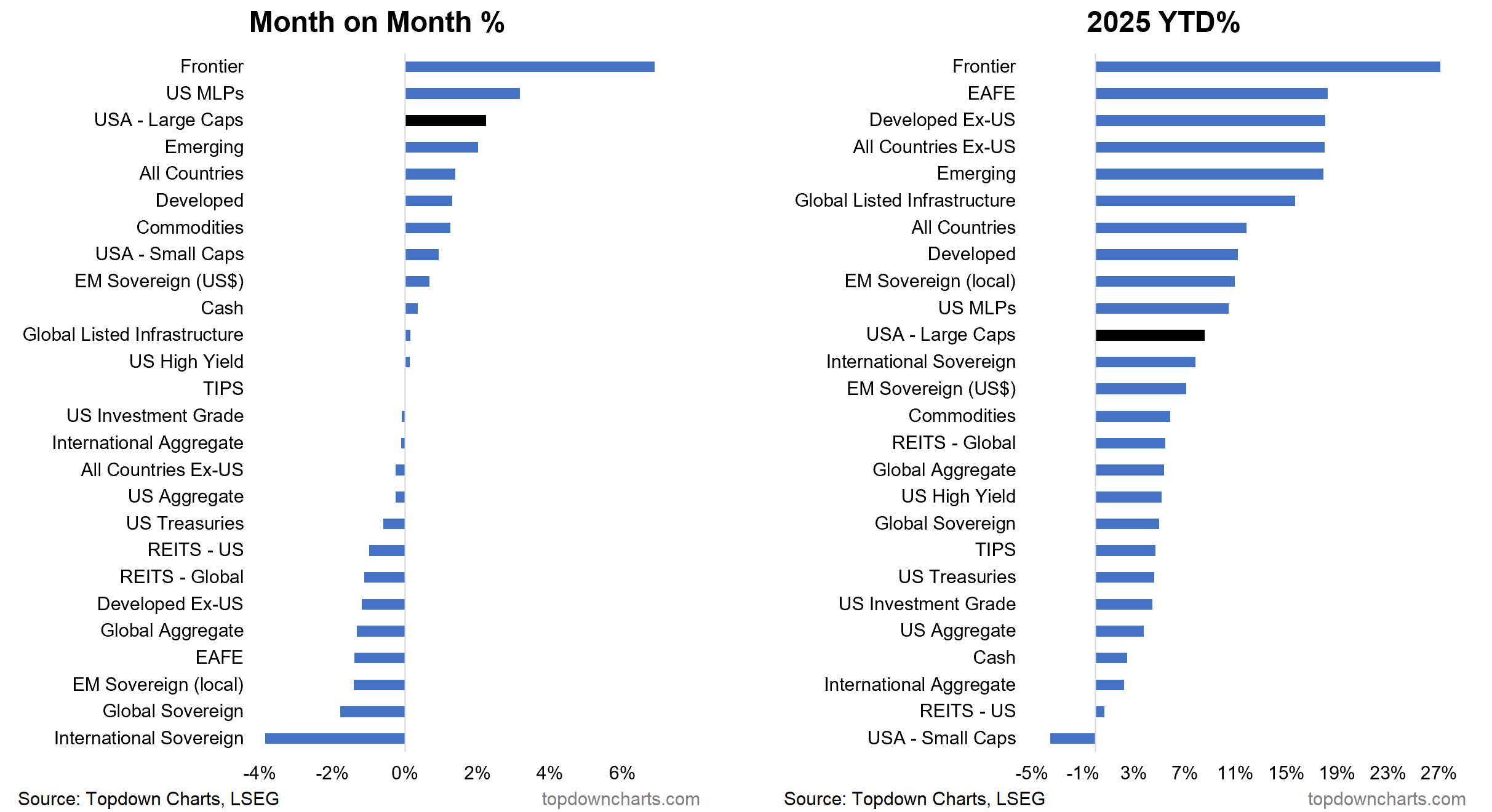

2. Asset Returns Desk: US large-cap shares managed third place within the month-to-month returns desk beneath, with Frontier Markets by far the standout. On the Yr-To-Date stats, US giant caps are about mid-table (world shares nonetheless forward as the good world rotation pushes on). General, it was a risk-on month with shares up and bonds down.

Supply: Asset Class Returns – July 2025

3. Technical Test: After an honest July, August has seen an terrible begin to the brand new month with Friday wiping off an honest chunk of July’s features already. From a technical standpoint, the constructive take is that we’re simply again to short-term assist, however the cautious take is that 50-day breadth is rolling over from overbought ranges (and bearish divergence) —and the selloff would possibly have to run a bit additional to get issues to oversold situations.

Authentic Submit