A number of shares within the US market have not too long ago skilled short-term pullbacks, whilst their general upward tendencies stay intact. These usually are not indicators of a breakdown, however somewhat wholesome corrections inside an extended development trajectory, typically creating engaging entry factors for traders who know the place to look.

Investing.com’s inventory screener is a superb software to assist choose firms for any funding portfolio. It presents many indicators that you would be able to alter freely, giving nearly limitless methods to customise your search. At present’s evaluation will deal with selecting firms which have not too long ago confronted a short lived technical pullback.

The indicator settings are designed to search out firms which are in a short lived pullback inside an general upward pattern however nonetheless have good development potential, primarily based on the InvestingPro Truthful Worth Index. Apart from technical indicators, different teams of indicators give a fuller view of the corporate’s monetary and elementary well being, serving to traders make higher decisions.

One firm to observe, out of the three we discovered, is Okta Inc (NASDAQ:). Despite the fact that the agency’s share worth has been taking place after its quarterly outcomes, it nonetheless has probabilities to maneuver up. Let’s perceive how we discovered this inventory utilizing the screener.

The right way to Set Your Inventory Scanner for Correction Technique

The primary aim of a inventory portfolio utilizing a correction technique is to search out firms which may be in a medium- to long-term upward pattern. The easiest way to do that is to first select firms with optimistic returns over the previous 3 and 6 months.

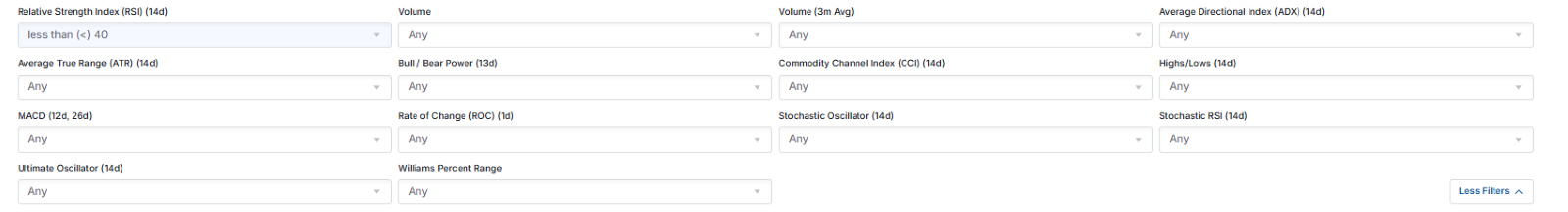

The RSI indicator, set under 40 factors, can be used to determine firms which are at present in a correction section.

We add a common truthful worth indicator to incorporate solely firms with a minimum of 5% upside potential. Utilizing the scanner with these settings, we discovered eight firms from the US market that meet the factors.

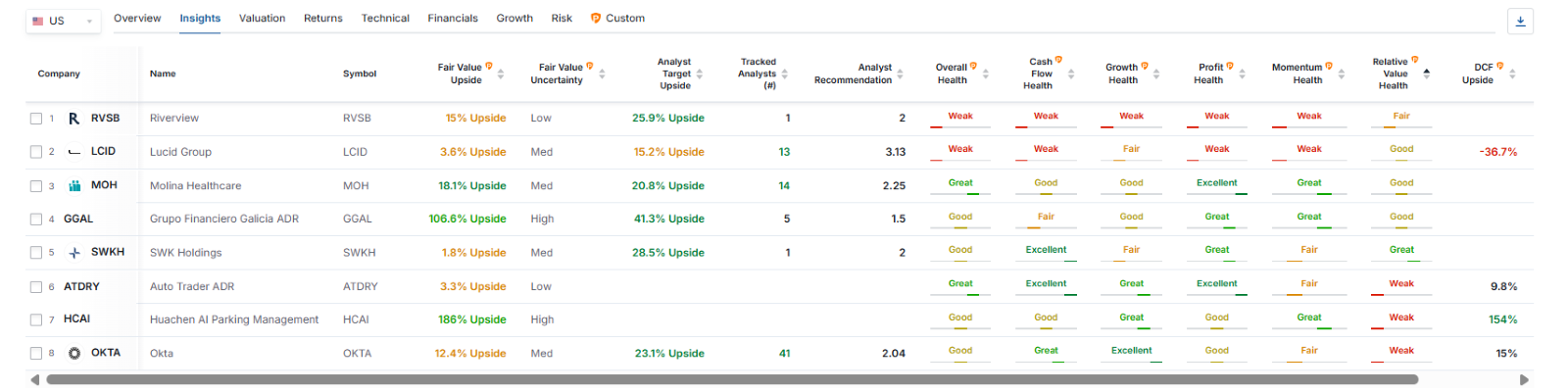

The highest panel exhibits 9 classes, which permit the consumer to view the choice primarily based on totally different elementary indicators.

The ’Perception’ panel gives a view of how every firm ranks by way of development potential and general monetary scores. On this group, Okta, Lucid Group Inc (NASDAQ:), and Molina Healthcare (NYSE:), amongst others, stand out.

Let’s take a more in-depth take a look at Okta, the place each analysts and InvestingPro’s Truthful Worth point out a doable continuation of the long-term uptrend.

Okta’s Inventory Worth Exhibits a Clear Rebound

Okta is a powerful instance of an organization that matches the outlined technique. On the finish of final week, its inventory skilled a major sell-off proper after the quarterly outcomes, though it beat consensus expectations in key areas. The drop was primarily because of cautious forecasts for the approaching quarters, pushed by uncertainty within the macroeconomic atmosphere.

Nevertheless, when trying on the chart, the availability hole didn’t set off any technical sign suggesting a reversal of the uptrend that has been in place since final August.

The primary aim for patrons is to maintain the inventory worth above the accelerated uptrend line, which ought to result in a good worth round $118 per share. The important thing goal stays the latest excessive of $127 per share.

If the value falls under the $88 assist degree, this is able to break the present pattern and will result in a deeper decline, probably all the way down to round $72.

***

InvestingPro presents quite a lot of different funding approaches tailor-made to totally different targets and market circumstances. These methods cowl areas equivalent to development, worth, earnings, and threat administration, serving to traders construct and alter portfolios successfully. By combining technical and elementary evaluation, InvestingPro’s instruments assist knowledgeable decision-making throughout various market environments.

Subscribe now and immediately unlock entry to a number of market-beating options, together with:

- ProPicks AI: AI-selected inventory winners with a confirmed monitor file.

- InvestingPro Truthful Worth: Immediately discover out if a inventory is underpriced or overvalued.

- Superior Inventory Screener: Seek for the very best shares primarily based on lots of of chosen filters and standards.

- High Concepts: See what shares billionaire traders equivalent to Warren Buffett, Michael Burry, and George Soros are shopping for.

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, counseling or suggestion to speculate as such it isn’t supposed to incentivize the acquisition of belongings in any method. I wish to remind you that any kind of asset, is evaluated from a number of factors of view and is extremely dangerous and due to this fact, any funding choice and the related threat stays with the investor.”