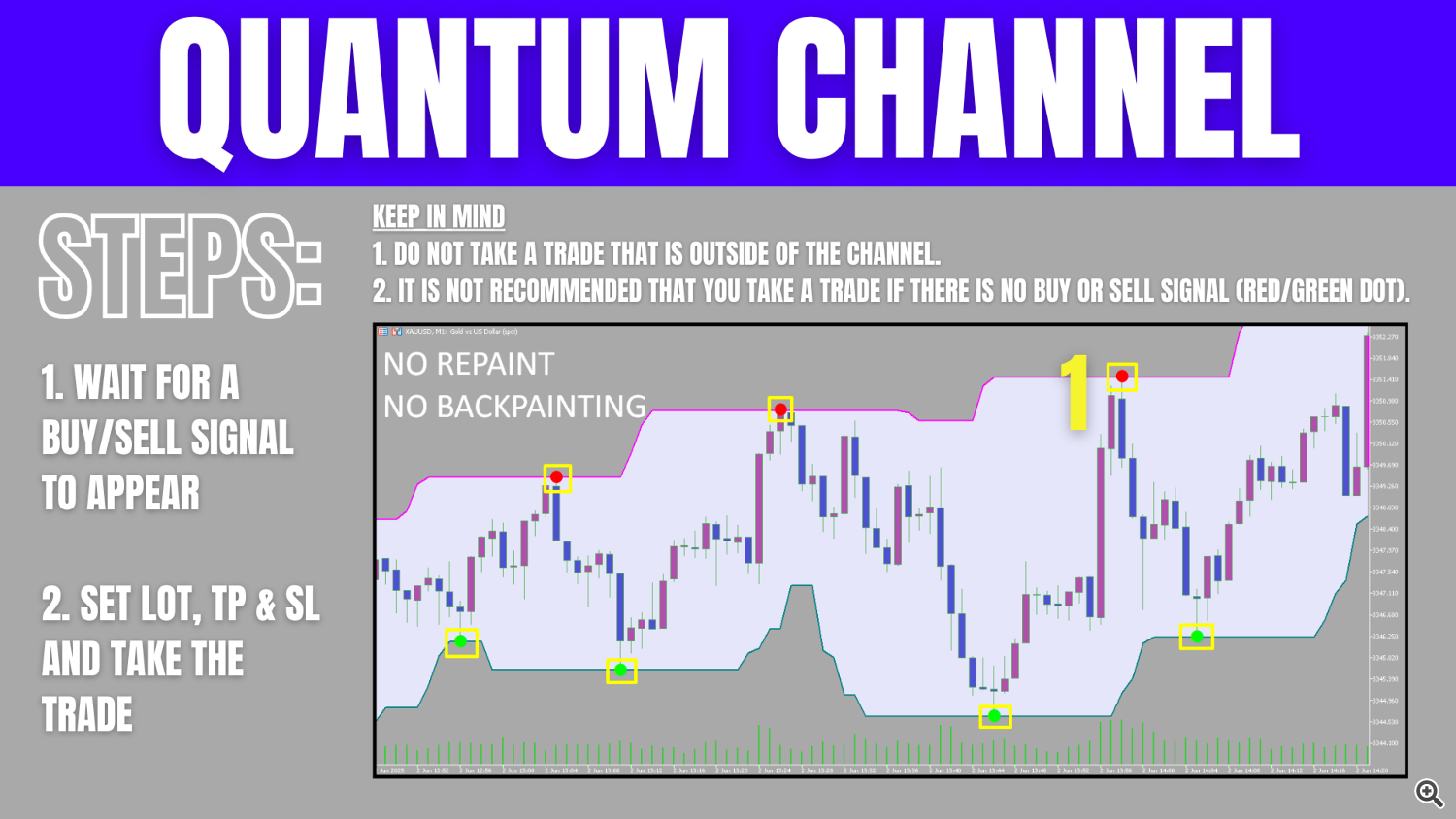

Quantum Channel Indicator

Logic

The Quantum Channel calculates higher and decrease boundaries primarily based on the best excessive and lowest low over a set lookback interval. It fills the realm between these ranges as a shaded channel, updating solely when a bar closes. This strategy ensures that merchants see clear worth extremes with out lagging distortion.

Alerts

Purchase and promote indicators seem as arrows when worth touches the decrease or higher channel boundary, respectively. A inexperienced arrow on the decrease line signifies a possible lengthy entry; a purple arrow on the higher line signifies a possible brief entry. These indicators rely strictly on closed-bar knowledge, avoiding false triggers from incomplete candles.

Does it repaint?

The Quantum Channel doesn’t repaint on closed bars—as soon as a candle closes, its channel values stay fastened. The indicator omits drawing any ranges on the lively bar, so there is no such thing as a backpainting. Alerts solely seem on the following closed bar, making certain that historic knowledge is dependable.

Commerce Setup

Merchants ought to look forward to a confirmed arrow sign inside the channel and confirm that worth stays contained in the shaded space earlier than getting into.

Place stops simply outdoors the channel boundary and take into account targets primarily based on prior channel width or a set risk-reward ratio. This self-discipline helps align entries with outlined assist or resistance zones.

FAQ

Does the Quantum Channel repaint on historic bars?

No. As soon as a bar closes, its channel values are locked in. The indicator doesn’t modify previous ranges or indicators, so historic knowledge stays constant.

How are purchase and promote indicators generated?

A purchase arrow is drawn when the bottom low over the lookback interval happens at a closed bar, touching the decrease boundary. A promote arrow is drawn when the best excessive over the lookback interval happens at a closed bar, touching the higher boundary.

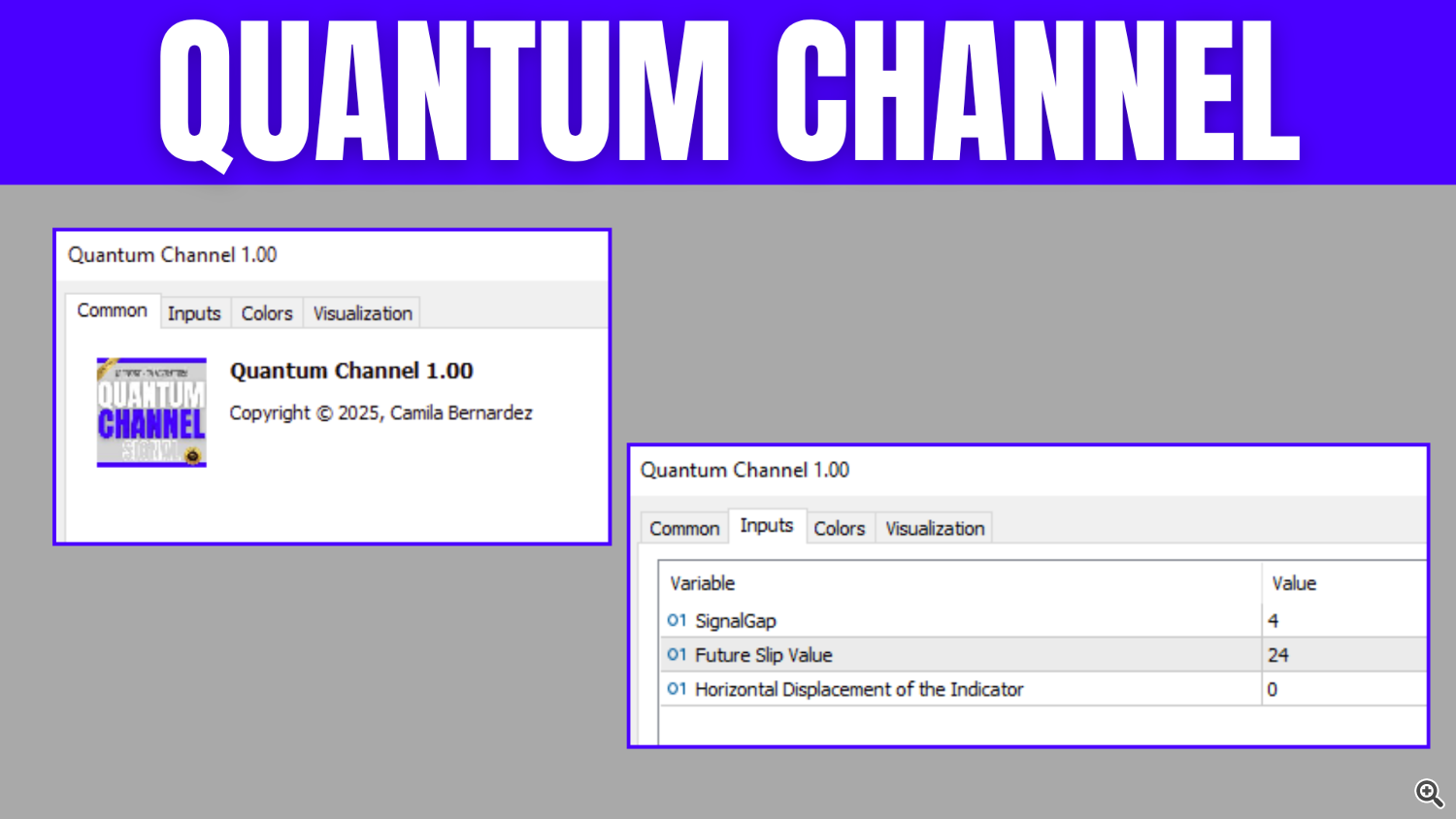

Can I regulate channel sensitivity?

Sure. Change the “Future Slip Worth” enter to widen or slender the channel. A bigger worth creates a broader channel, requiring extra excessive worth strikes to set off indicators; a smaller worth tightens the channel for extra frequent indicators.

What timeframes work finest?

The indicator performs reliably on any timeframe however is handiest on 15–60 minute charts for a stability between sign frequency and noise discount.