EUR/USD TALKING POINTS

- Possible federal gas tax reprieve.

- Focus shifts to Powell’s testimony tomorrow.

- Eurozone current account slumps to lowest level since May 2020.

EURO FUNDAMENTAL BACKDROP

President Joe Biden has announced that he may be considering a federal gas tax holiday to ease inflationary pressures on the U.S. consumer. This looser fiscal policy could aid in the tight monetary policy stance and afford the Federal Reserve greater optionality and flexibility in its battle against inflation. Theoretically, loose fiscal policy attracts more foreign investment and therefore a higher demand for dollars. Coupled with a hawkish central bank, this may give an additional boost to the greenback if the tax cut is approved.

This does not bode well for the euro however, European Central Bank (ECB) President Christine Lagarde managed to ease fears via her statement yesterday around its proactive fight against fragmentation. The eurozone current account release for April came in at its lowest levels since May 2020 at -5.4B (see economic calendar below), but this wasn’t enough to disturb the euro just yet.

Later today, we look to the ECB’s McCaul and the Fed’s Barkin for further guidance ahead of tomorrow’s testimony by Fed Chair Jerome Powell.

EUR/USD ECONOMIC CALENDAR

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

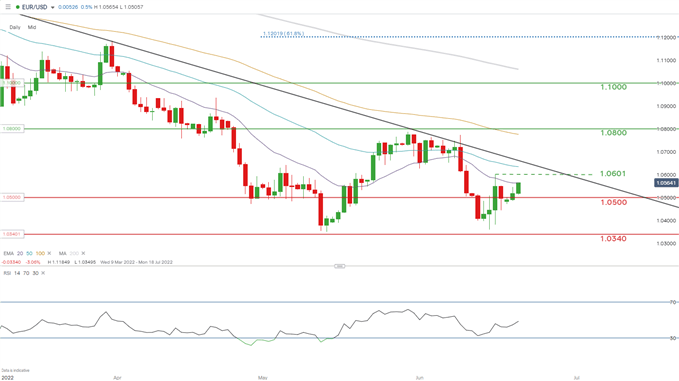

EUR/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Price action on the daily EUR/USD chart above shows a strong start to the European session for bulls who currently test the 20-day EMA (purple) resistance level. While there is still room for further upside, the probability of a push above trendline resistance (black) is unlikely.

Resistance levels:

- Trendline resistance (black)

- 50-day EMA (blue)

- 1.0601

- 20-day EMA (purple)

Support levels:

IG CLIENT SENTIMENT DATA: BULLISH

IGCS shows retail traders are currently LONG on EUR/USD, with 68% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment however due to recent changes in long and short positioning we arrive at a short-term upside bias.

Contact and follow Warren on Twitter: @WVenketas