Up to date on Could 2nd, 2025 by Bob Ciura

Spreadsheet knowledge up to date day by day

Month-to-month dividend shares are securities that pay a dividend each month as a substitute of quarterly or yearly.

This analysis report focuses on all 76 particular person month-to-month paying securities. It consists of the next assets.

Useful resource #1: The Month-to-month Dividend Inventory Spreadsheet Checklist

This checklist incorporates essential metrics, together with: dividend yields, payout ratios, dividend progress charges, 52-week highs and lows, betas, and extra.

Notice: We try to take care of an correct checklist of all month-to-month dividend payers. There’s no common supply we’re conscious of for month-to-month dividend shares; we curate this checklist manually. If you understand of any shares that pay month-to-month dividends that aren’t on our checklist, please e-mail [email protected].

Useful resource #2: The Month-to-month Dividend Shares In Focus Sequence

The Month-to-month Dividend Shares In Focus sequence is the place we analyze all month-to-month paying dividend shares. This useful resource hyperlinks to stand-alone evaluation on every of those securities.

Useful resource #3: The ten Greatest Month-to-month Dividend Shares

This analysis report analyzes the ten finest month-to-month dividend shares as ranked by anticipated whole return.

Useful resource #4: Different Month-to-month Dividend Inventory Analysis

– Month-to-month dividend inventory efficiency

– Why month-to-month dividends matter

– The risks of investing in month-to-month dividend shares

– Remaining ideas and different revenue investing assets

The Month-to-month Dividend Shares In Focus Sequence

You’ll be able to see detailed evaluation on the person month-to-month dividend securities we cowl by clicking the hyperlinks beneath:

- Agree Realty (ADC)

- AGNC Funding (AGNC)

- Atrium Mortgage Funding Company (AMIVF)

- Apple Hospitality REIT, Inc. (APLE)

- ARMOUR Residential REIT (ARR)

- Banco Bradesco S.A. (BBD)

- Diversified Royalty Corp. (BEVFF)

- Boston Pizza Royalties Earnings Fund (BPZZF)

- Bridgemarq Actual Property Companies (BREUF)

- BSR Actual Property Funding Belief (BSRTF)

- Canadian House Properties REIT (CDPYF)

- ChemTrade Logistics Earnings Fund (CGIFF)

- Alternative Properties REIT (PPRQF)

- Cross Timbers Royalty Belief (CRT)

- CT Actual Property Funding Belief (CTRRF)

- SmartCentres Actual Property Funding Belief (CWYUF)

- Dream Workplace REIT (DRETF)

- Dream Industrial REIT (DREUF)

- Dynex Capital (DX)

- Ellington Residential Mortgage REIT (EARN)

- Ellington Monetary (EFC)

- EPR Properties (EPR)

- Change Earnings (EIFZF)

- Extendicare Inc. (EXETF)

- Flagship Communities REIT (MHCUF)

- First Nationwide Monetary Company (FNLIF)

- Freehold Royalties Ltd. (FRHLF)

- Agency Capital Property Belief (FRMUF)

- Fortitude Gold (FTCO)

- Gladstone Capital Company (GLAD)

- Gladstone Business Company (GOOD)

- Gladstone Funding Company (GAIN)

- Gladstone Land Company (LAND)

- World Water Sources (GWRS)

- Granite Actual Property Funding Belief (GRP.U)

- Grupo Aval Acciones y Valores S.A. (AVAL)

- H&R Actual Property Funding Belief (HRUFF)

- Horizon Know-how Finance (HRZN)

- Itaú Unibanco (ITUB)

- The Keg Royalties Earnings Fund (KRIUF)

- LTC Properties (LTC)

- Sienna Senior Residing (LWSCF)

- Predominant Avenue Capital (MAIN)

- Modiv Inc. (MDV)

- Mullen Group Ltd. (MLLGF)

- Northland Energy Inc. (NPIFF)

- NorthWest Healthcare Properties REIT (NWHUF)

- Orchid Island Capital (ORC)

- Oxford Sq. Capital (OXSQ)

- Permian Basin Royalty Belief (PBT)

- Phillips Edison & Firm (PECO)

- Pennant Park Floating Charge (PFLT)

- Peyto Exploration & Growth Corp. (PEYUF)

- Pine Cliff Vitality Ltd. (PIFYF)

- Primaris REIT (PMREF)

- Paramount Sources Ltd. (PRMRF)

- PermRock Royalty Belief (PRT)

- Prospect Capital Company (PSEC)

- Permianville Royalty Belief (PVL)

- Pizza Pizza Royalty Corp. (PZRIF)

- Realty Earnings (O)

- RioCan Actual Property Funding Belief (RIOCF)

- Richards Packaging Earnings Fund (RPKIF)

- Sabine Royalty Belief (SBR)

- Stellus Capital Funding Corp. (SCM)

- Savaria Corp. (SISXF)

- San Juan Basin Royalty Belief (SJT)

- Sir Royalty Earnings Fund (SIRZF)

- SL Inexperienced Realty Corp. (SLG)

- Whitecap Sources Inc. (SPGYF)

- Slate Grocery REIT (SRRTF)

- Stag Industrial (STAG)

- Timbercreek Monetary Corp. (TBCRF)

- Tamarack Valley Vitality (TNEYF)

- U.S. World Traders (GROW)

- Whitestone REIT (WSR)

The ten Greatest Month-to-month Dividend Shares

This analysis report examines the ten month-to-month dividend shares from our Positive Evaluation Analysis Database with the very best 5-year ahead anticipated whole returns.

We at the moment cowl virtually all month-to-month dividend shares each quarter within the Positive Evaluation Analysis Database.

Use the desk beneath to shortly bounce to evaluation on any of the highest 10 finest month-to-month dividend shares as ranked by anticipated whole returns.

Desk of Contents

You’ll be able to immediately bounce to any particular part of the article through the use of the hyperlinks beneath:

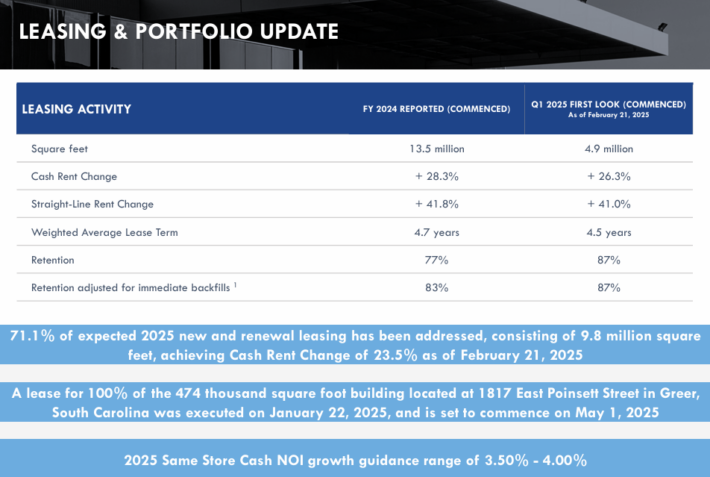

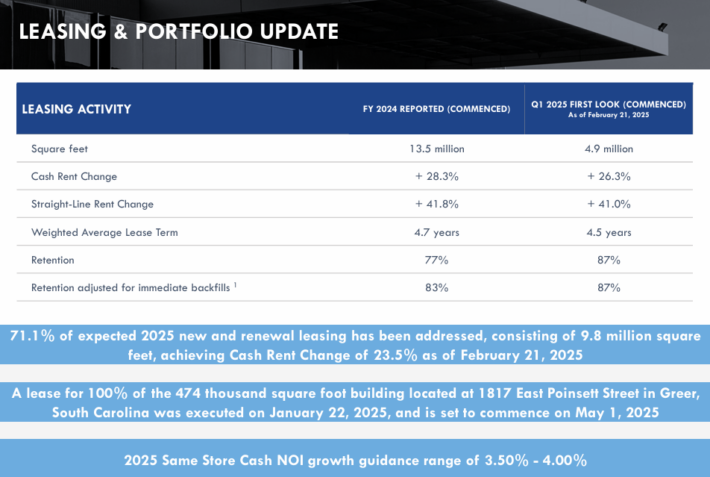

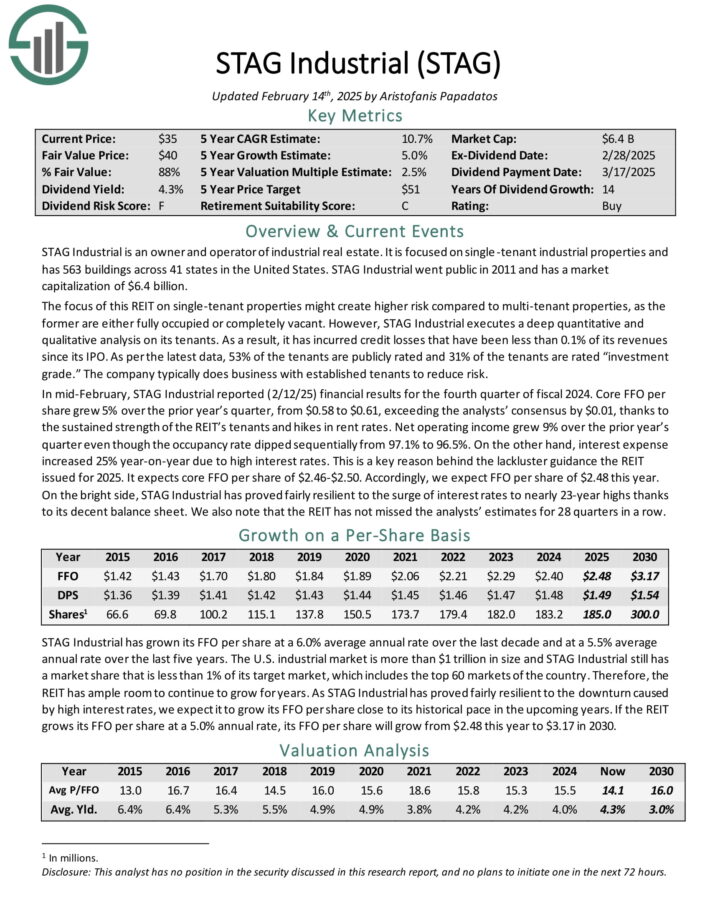

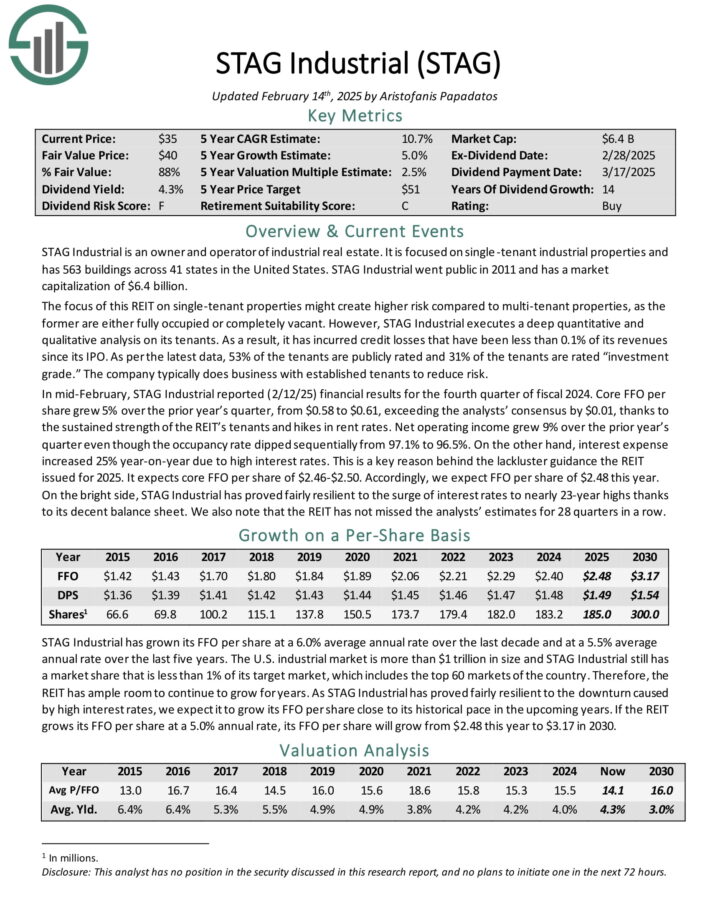

Month-to-month Dividend Inventory #10: STAG Industrial (STAG)

- 5-Yr Anticipated Whole Return: 12.1%

- Dividend Yield: 4.5%

STAG Industrial is an proprietor and operator of business actual property. It’s targeted on single-tenant industrial properties and has ~560 buildings throughout 41 states in the USA.

The main target of this REIT on single-tenant properties may create greater threat in comparison with multi-tenant properties, as the previous are both absolutely occupied or fully vacant.

Supply: Investor Presentation

In mid-February, STAG Industrial reported (2/12/25) monetary outcomes for the fourth quarter of fiscal 2024. Core FFO-per-share grew 5% over the prior yr’s quarter, from $0.58 to $0.61, exceeding the analysts’ consensus by $0.01, due to hikes in hire charges.

Web working revenue grew 9% over the prior yr’s quarter although the occupancy price dipped sequentially from 97.1% to 96.5%. Alternatively, curiosity expense elevated 25% year-on-year as a consequence of excessive rates of interest.

STAG expects core FFO per share of $2.46-$2.50 for 2025.

Click on right here to obtain our most up-to-date Positive Evaluation report on STAG Industrial Inc. (STAG) (preview of web page 1 of three proven beneath):

Month-to-month Dividend Inventory #9: PennantPark Floating Charge Capital (PFLT)

- 5-Yr Anticipated Whole Return: 12.2%

- Dividend Yield: 12.3%

PennantPark Floating Charge Capital Ltd. is a enterprise improvement firm that seeks to make secondary direct, debt, fairness, and mortgage investments.

The fund additionally goals to take a position by means of floating price loans in personal or thinly traded or small market-cap, public center market firms, fairness securities, most well-liked inventory, frequent inventory, warrants or choices acquired in reference to debt investments or by means of direct investments.

PennantPark Floating Charge Capital (PFLT) reported its Q1 2025 outcomes on February 11, 2025, highlighting steady monetary efficiency and continued funding exercise.

For the quarter ended December 31, the corporate posted GAAP internet funding revenue of $0.37 per share and core internet funding revenue of $0.33 per share.

PFLT’s portfolio grew 11% from the earlier quarter to $2.2 billion, pushed by $607 million in investments throughout 11 new and 58 current portfolio firms at a weighted common yield of 10.3%.

Click on right here to obtain our most up-to-date Positive Evaluation report on PFLT (preview of web page 1 of three proven beneath):

Month-to-month Dividend Inventory #8: Dream Workplace REIT (DRETF)

- 5-Yr Anticipated Whole Return: 12.2%

- Dividend Yield: 6.5%

Dream Workplace REIT is a Toronto-focused workplace actual property funding belief that owns and manages a portfolio of 26 high-quality workplace properties totaling 4.8 million sq. toes of gross leasable space.

Most of its properties are concentrated in downtown Toronto, one of the crucial institutional and supply-constrained workplace markets within the nation.

On February twentieth, 2025, Dream Workplace REIT posted its full yr 2024 outcomes for the yr ended December thirty first, 2024. Web rental revenue totaled about $74 million, up barely from 2023, pushed by greater internet rents in downtown Toronto.

Identical property internet working revenue grew by 2.1% to $70 million, as hire progress helped offset the impression of decrease occupancy.

Dream Workplace accomplished about 710,000 sq. toes of leasing exercise in the course of the yr. In Toronto downtown, new leases had been signed at common rents over 10% above expiring ranges, reflecting continued demand for high quality house.

Nonetheless, total in-place occupancy declined to 77.5%, with dedicated occupancy ending the yr at 81.1 %, as a consequence of recognized expiries and asset reclassifications.

Click on right here to obtain our most up-to-date Positive Evaluation report on DRETF (preview of web page 1 of three proven beneath):

Month-to-month Dividend Inventory #7: AGNC Funding Corp. (AGNC)

- 5-Yr Anticipated Whole Return: 12.4%

- Dividend Yield: 16.5%

American Capital Company Corp is a mortgage actual property funding belief that invests primarily in company mortgage–backed securities (or MBS) on a leveraged foundation.

The agency’s asset portfolio is comprised of residential mortgage cross–by means of securities, collateralized mortgage obligations (or CMO), and non–company MBS. Many of those are assured by authorities–sponsored enterprises.

Within the fourth quarter of 2024, AGNC Funding Corp. reported a complete loss per frequent share of $0.99, a reversal from the great revenue of $0.93 per share recorded within the earlier quarter.

Regardless of this, the corporate achieved a optimistic financial return of 13.2% for the total yr, pushed by its constant month-to-month dividend totaling $1.44 per frequent share.

The corporate’s internet unfold and greenback roll revenue, excluding catch-up premium amortization, was $0.65 per frequent share for the quarter, down from $0.67 per share within the prior quarter.

AGNC’s tangible internet guide worth per frequent share stood at $9.08 as of December 31, 2024, reflecting a lower from $9.84 on the finish of the third quarter.

Click on right here to obtain our most up-to-date Positive Evaluation report on AGNC Funding Corp (AGNC) (preview of web page 1 of three proven beneath):

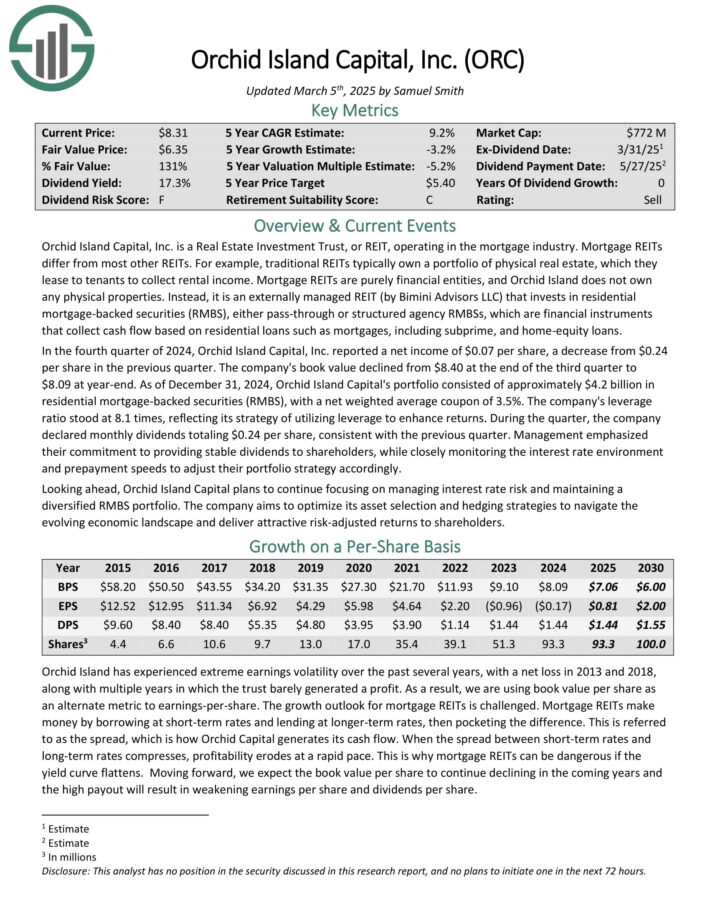

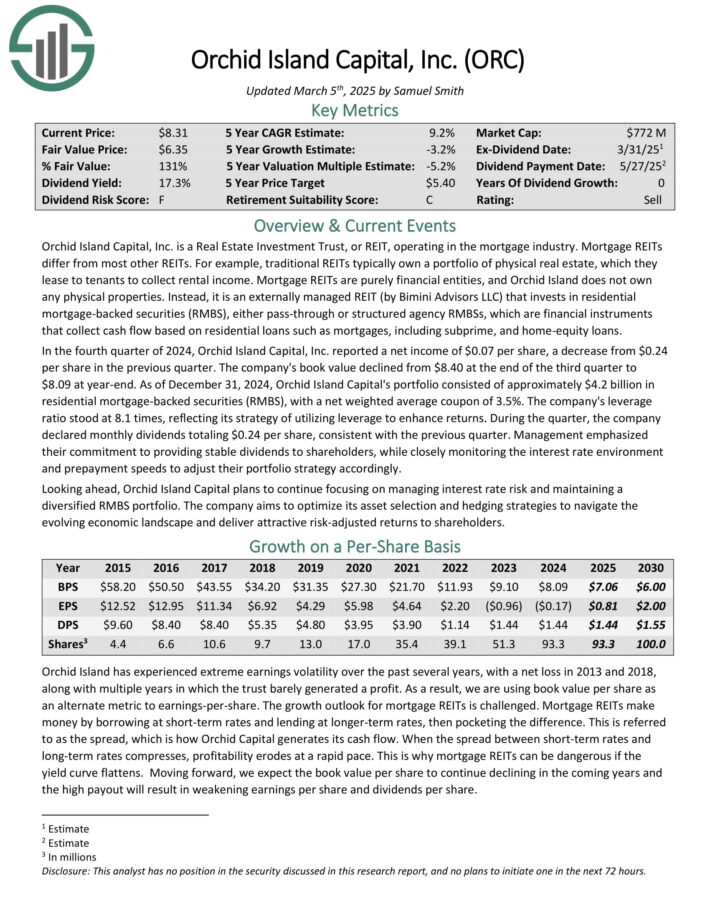

Month-to-month Dividend Inventory #6: Orchid Island Capital (ORC)

- 5-Yr Anticipated Whole Return: 12.9%

- Dividend Yield: 20.7%

Orchid Island Capital is a mortgage REIT that’s externally managed by Bimini Advisors LLC and focuses on investing in residential mortgage-backed securities (RMBS), together with pass-through and structured company RMBSs.

These monetary devices generate money stream primarily based on residential loans resembling mortgages, subprime, and home-equity loans.

Within the fourth quarter of 2024, Orchid Island Capital, Inc. reported a internet revenue of $0.07 per share, a lower from $0.24 per share within the earlier quarter. The corporate’s guide worth declined from $8.40 on the finish of the third quarter to $8.09 at year-end.

As of December 31, 2024, Orchid Island Capital’s portfolio consisted of roughly $4.2 billion in residential mortgage-backed securities (RMBS), with a internet weighted common coupon of three.5%. The corporate’s leverage ratio stood at 8.1 occasions, reflecting its technique of using leverage to reinforce returns.

Click on right here to obtain our most up-to-date Positive Evaluation report on Orchid Island Capital, Inc. (ORC) (preview of web page 1 of three proven beneath):

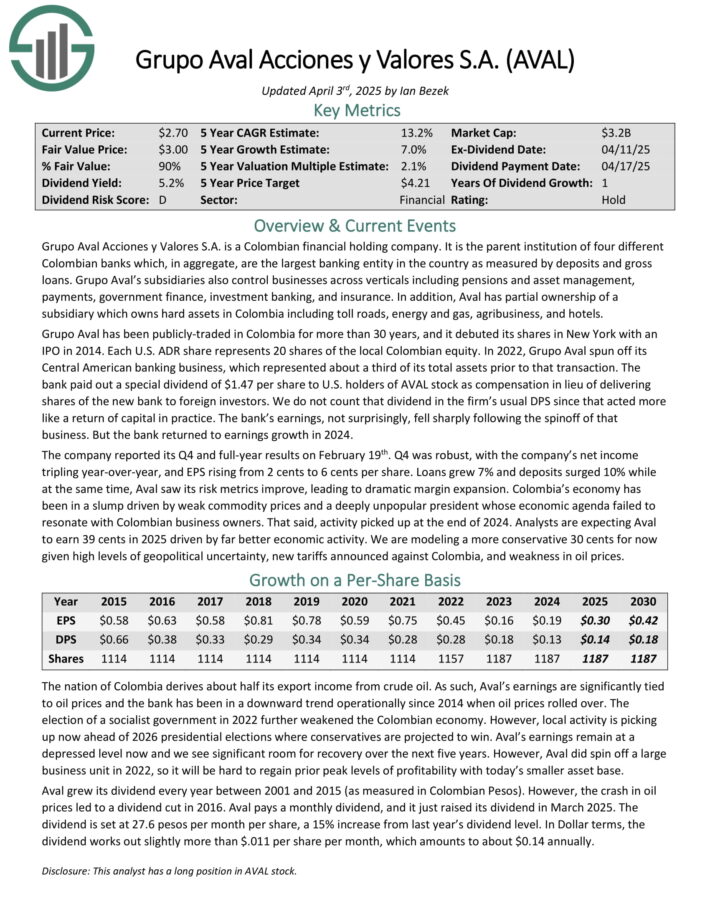

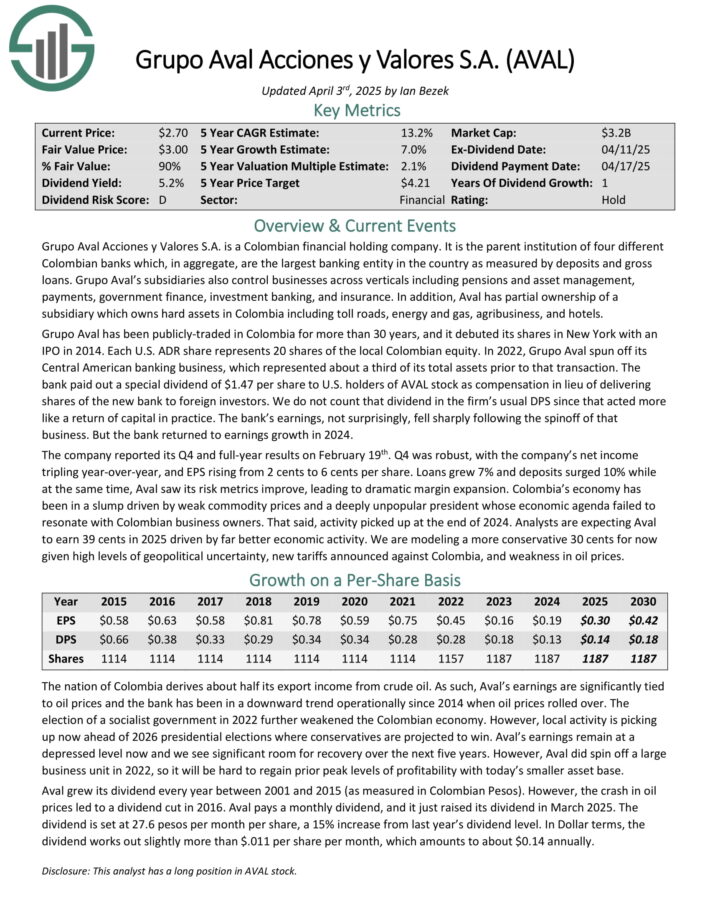

Month-to-month Dividend Inventory #5: Grupo Aval Acciones y Valores S.A. (AVAL)

- 5-Yr Anticipated Whole Return: 13.4%

- Dividend Yield: 5.1%

Grupo Aval Acciones y Valores S.A. is a Colombian monetary holding firm. It’s the mother or father establishment of 4 completely different Colombian banks which, in mixture, are the biggest banking entity within the nation as measured by deposits and gross loans.

Grupo Aval’s subsidiaries additionally management companies throughout verticals together with pensions and asset administration, funds, authorities finance, funding banking, and insurance coverage.

As well as, Aval has partial possession of a subsidiary which owns onerous property in Colombia together with toll roads, vitality and fuel, agribusiness, and resorts.

The corporate reported its This fall and full-year outcomes on February nineteenth. This fall was strong, with the corporate’s internet revenue tripling year-over-year, and EPS rising from 2 cents to six cents per share.

Loans grew 7% and deposits surged 10% whereas on the identical time, Aval noticed its threat metrics enhance, resulting in dramatic margin growth.

Click on right here to obtain our most up-to-date Positive Evaluation report on AVAL (preview of web page 1 of three proven beneath):

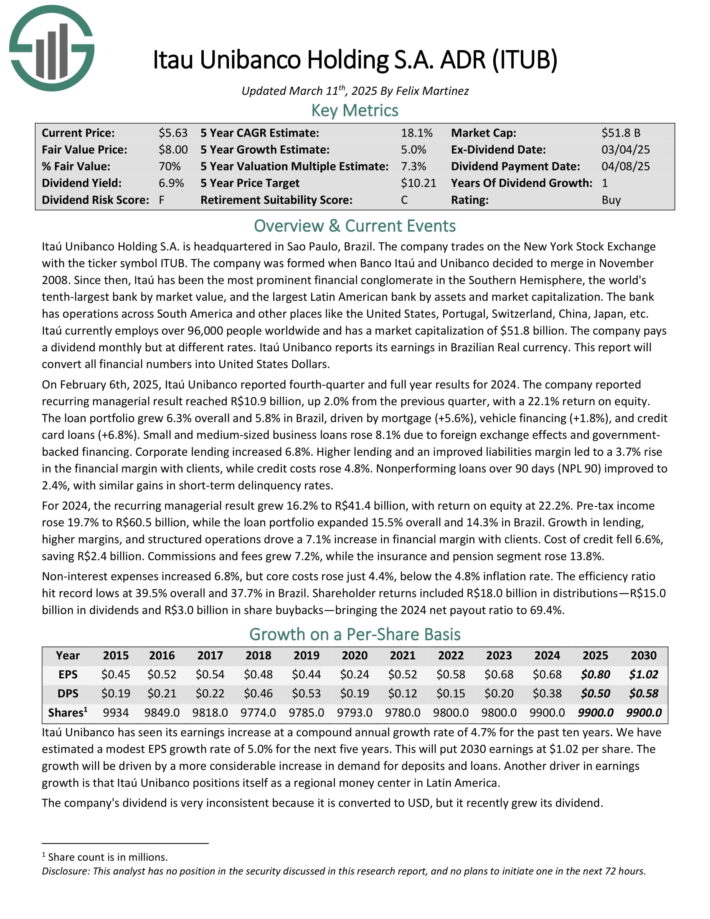

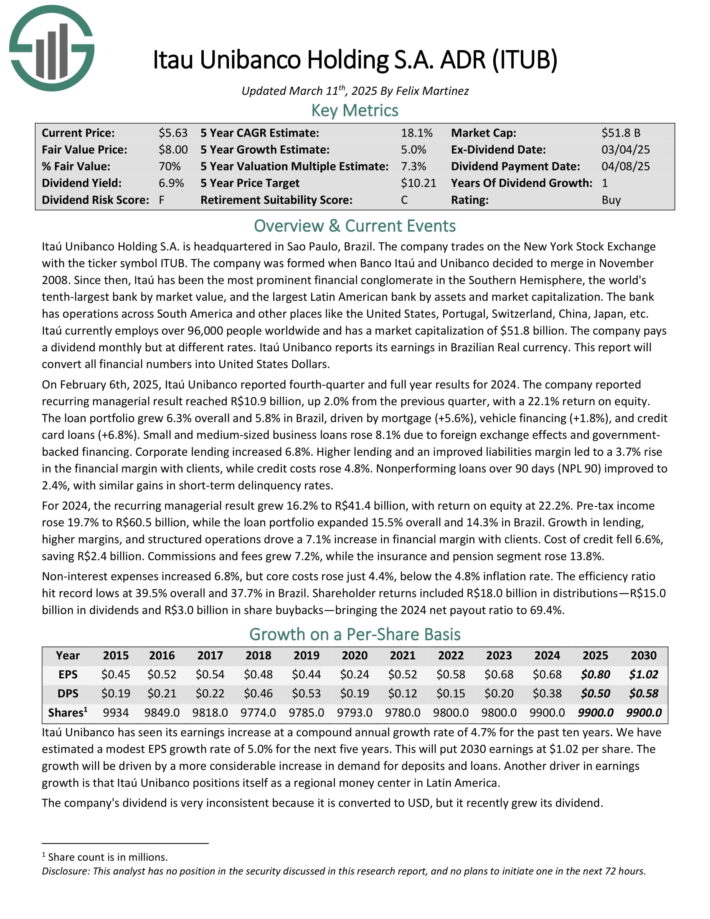

Month-to-month Dividend Inventory #4: Itau Unibanco (ITUB)

- 5-Yr Anticipated Whole Return: 15.5%

- Dividend Yield: 8.1%

Itaú Unibanco Holding S.A. is headquartered in Sao Paulo, Brazil. The financial institution has operations throughout South America and different locations like the USA, Portugal, Switzerland, China, Japan, and so forth.

On February sixth, 2025, Itaú Unibanco reported fourth-quarter and full yr outcomes for 2024. The corporate reported recurring managerial consequence reached R$10.9 billion, up 2.0% from the earlier quarter, with a 22.1% return on fairness.

The mortgage portfolio grew 6.3% total and 5.8% in Brazil, pushed by mortgage (+5.6%), car financing (+1.8%), and bank card loans (+6.8%).

Small and medium-sized enterprise loans rose 8.1% as a consequence of international alternate results and authorities backed financing. Company lending elevated 6.8%.

Increased lending and an improved liabilities margin led to a 3.7% rise within the monetary margin with purchasers, whereas credit score prices rose 4.8%. Nonperforming loans over 90 days (NPL 90) improved to 2.4%, with related good points in short-term delinquency charges.

Click on right here to obtain our most up-to-date Positive Evaluation report on ITUB (preview of web page 1 of three proven beneath):

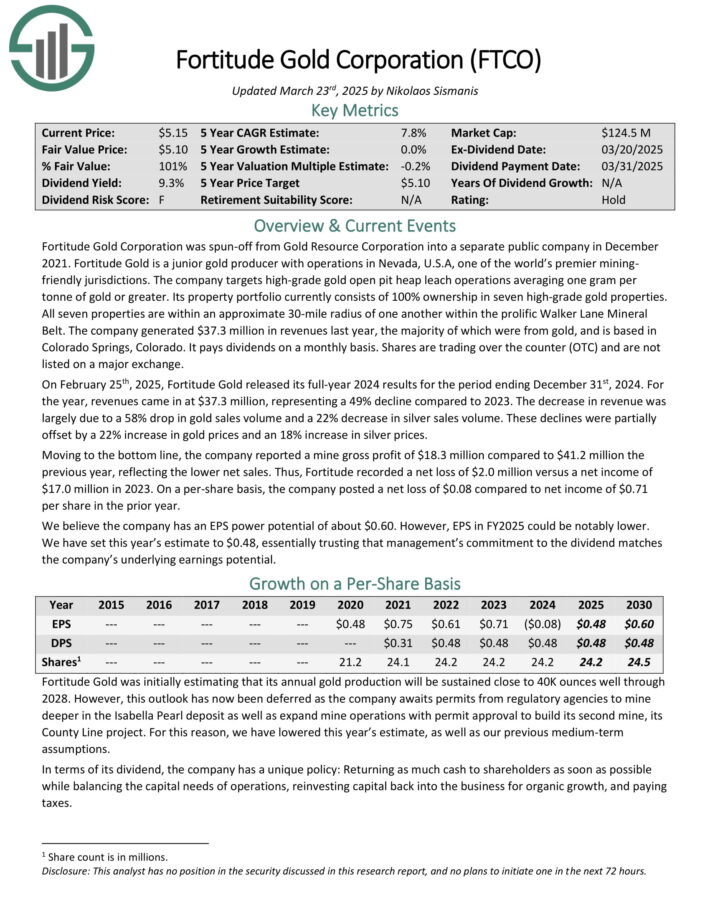

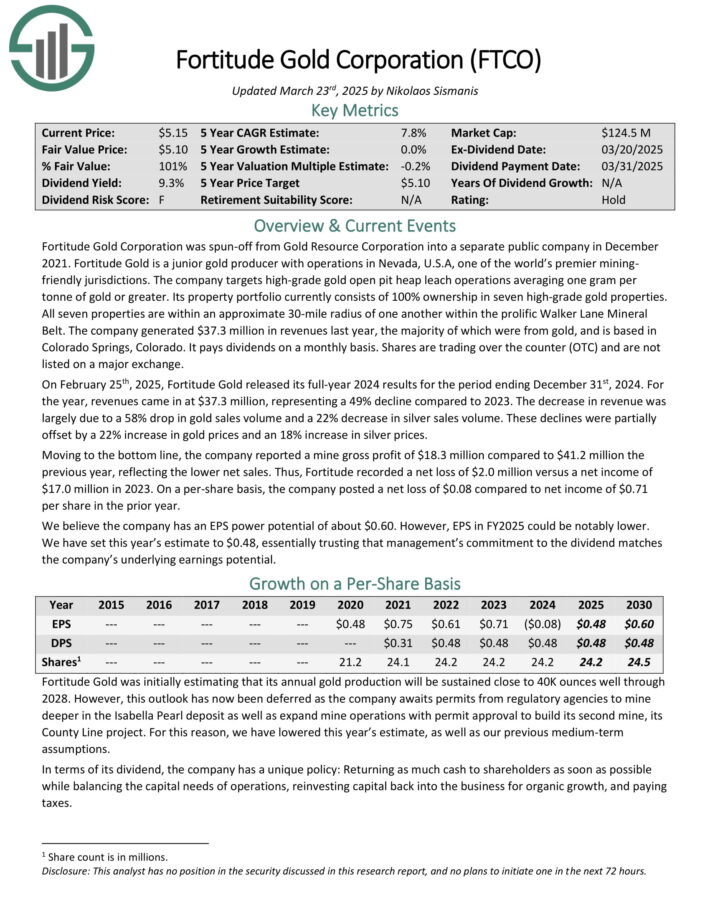

Month-to-month Dividend Inventory #3: Fortitude Gold Corp. (FTCO)

- 5-Yr Anticipated Whole Return: 16.0%

- Dividend Yield: 14.7%

Fortitude Gold is a junior gold producer with operations in Nevada, U.S.A, one of many world’s premier mining pleasant jurisdictions. The corporate targets high-grade gold open pit heap leach operations averaging one gram per tonne of gold or better.

Its property portfolio at the moment consists of 100% possession in six high-grade gold properties. All six properties are inside an approximate 30-mile radius of each other inside the prolific Walker Lane Mineral Belt.

Supply: Investor Presentation

On February twenty fifth, 2025, Fortitude Gold launched its full-year 2024 outcomes for the interval ending December thirty first, 2024. For the yr, revenues got here in at $37.3 million, representing a 49% decline in comparison with 2023.

The lower in income was largely as a consequence of a 58% drop in gold gross sales quantity and a 22% lower in silver gross sales quantity. These declines had been partially offset by a 22% improve in gold costs and an 18% improve in silver costs.

Transferring to the underside line, the corporate reported a mine gross revenue of $18.3 million in comparison with $41.2 million the earlier yr, reflecting the decrease internet gross sales.

Fortitude recorded a internet lack of $2.0 million versus a internet revenue of $17.0 million in 2023. On a per-share foundation, the corporate posted a internet lack of $0.08 in comparison with internet revenue of $0.71 per share within the prior yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on FTCO (preview of web page 1 of three proven beneath):

Month-to-month Dividend Inventory #2: Horizon Know-how Finance (HRZN)

- 5-Yr Anticipated Whole Return: 19.2%

- Dividend Yield: 15.2%

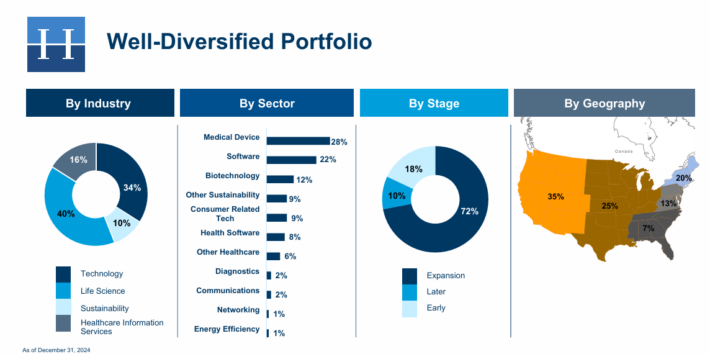

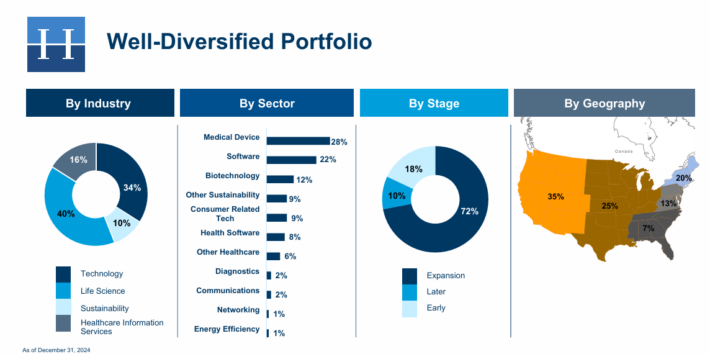

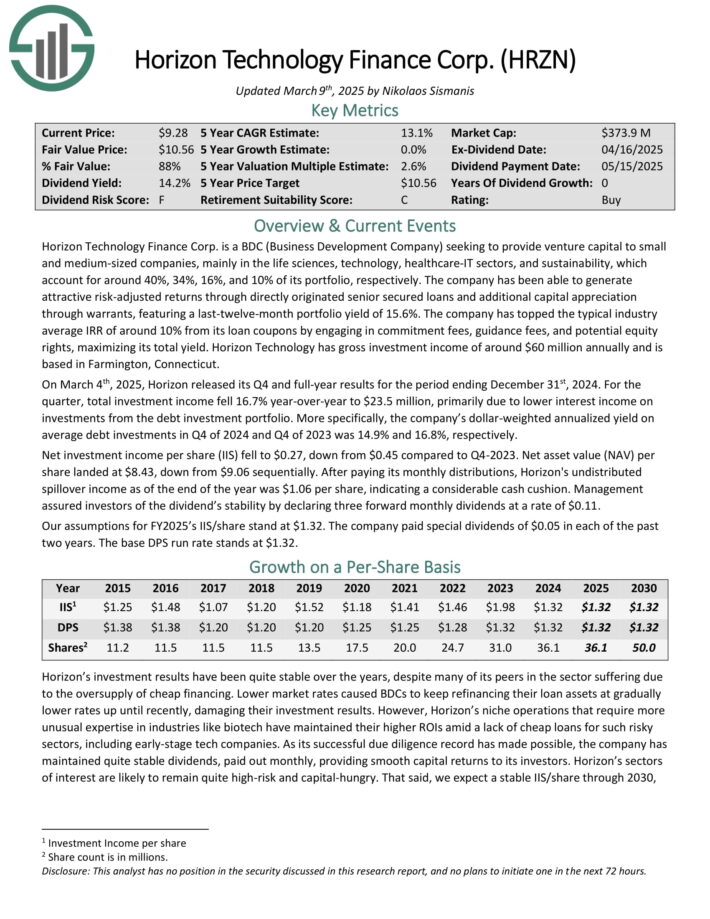

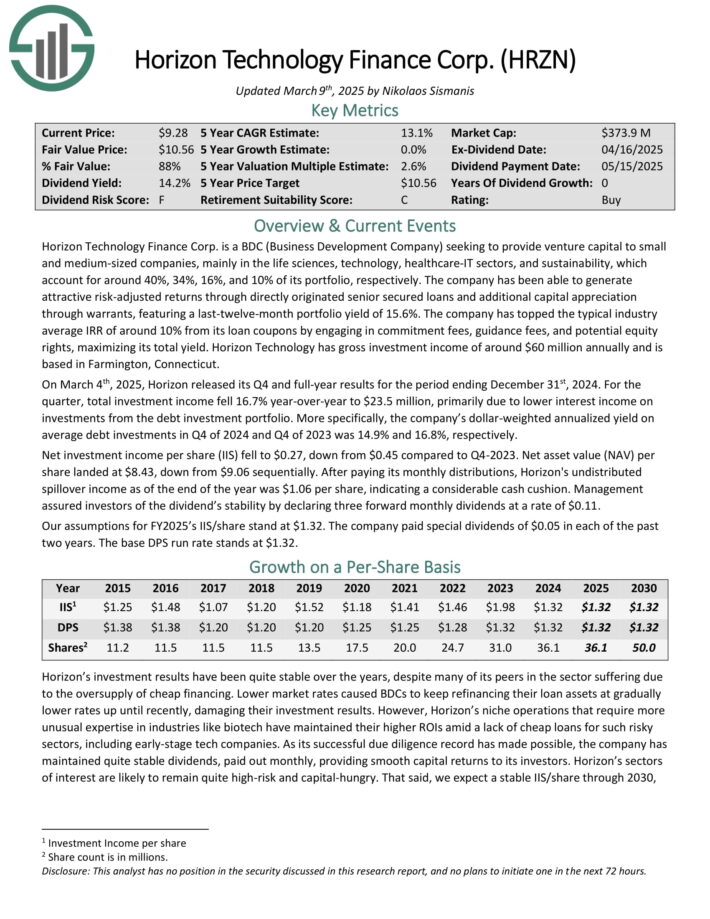

Horizon Know-how Finance Corp. is a BDC that gives enterprise capital to small and medium–sized firms within the know-how, life sciences, and healthcare–IT sectors.

The corporate has generated enticing threat–adjusted returns by means of straight originated senior secured loans and extra capital appreciation by means of warrants.

Supply: Investor Presentation

On March 4th, 2025, Horizon launched its This fall and full-year outcomes for the interval ending December thirty first, 2024. For the quarter, whole funding revenue fell 16.7% year-over-year to $23.5 million, primarily as a consequence of decrease curiosity revenue on investments from the debt funding portfolio.

Extra particularly, the corporate’s dollar-weighted annualized yield on common debt investments in This fall of 2024 and This fall of 2023 was 14.9% and 16.8%, respectively.

Web funding revenue per share (IIS) fell to $0.27, down from $0.45 in comparison with This fall-2023. Web asset worth (NAV) per share landed at $8.43, down from $9.06 sequentially.

Click on right here to obtain our most up-to-date Positive Evaluation report on HRZN (preview of web page 1 of three proven beneath):

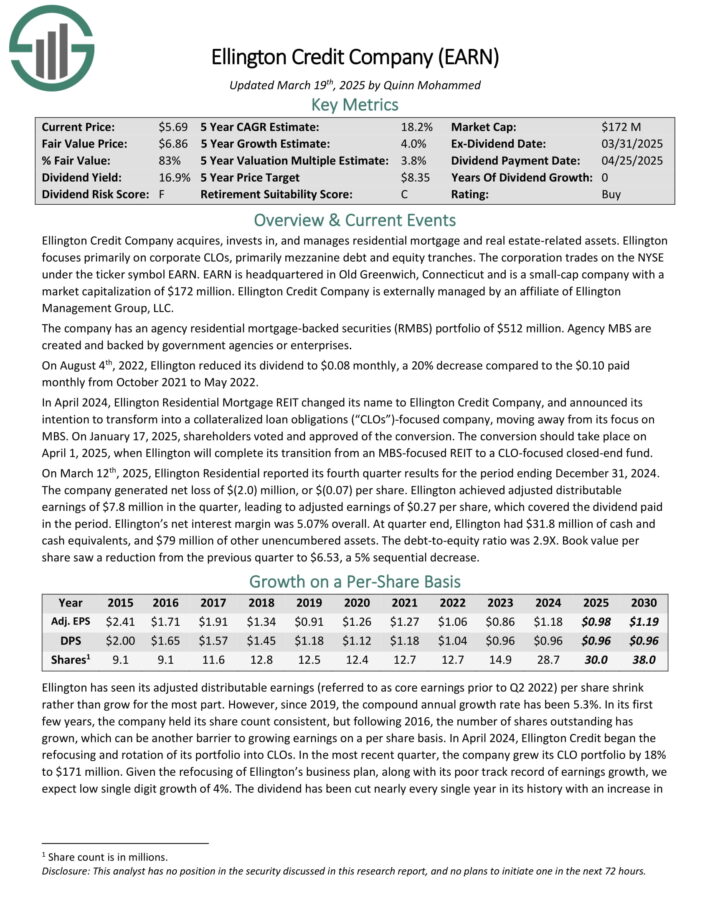

Month-to-month Dividend Inventory #1: Ellington Credit score Co. (EARN)

- 5-Yr Anticipated Whole Return: 19.6%

- Dividend Yield: 17.5%

Ellington Credit score Co. acquires, invests in, and manages residential mortgage and actual property associated property. Ellington focuses totally on residential mortgage-backed securities, particularly these backed by a U.S. Authorities company or U.S. authorities–sponsored enterprise.

Company MBS are created and backed by authorities companies or enterprises, whereas non-agency MBS are not assured by the federal government.

On March twelfth, 2025, Ellington Residential reported its fourth quarter outcomes for the interval ending December 31, 2024. The corporate generated a internet lack of $(2.0) million, or $(0.07) per share.

Ellington achieved adjusted distributable earnings of $7.8 million within the quarter, resulting in adjusted earnings of $0.27 per share, which coated the dividend paid within the interval.

Ellington’s internet curiosity margin was 5.07% total. At quarter finish, Ellington had $31.8 million of money and money equivalents, and $79 million of different unencumbered property.

Click on right here to obtain our most up-to-date Positive Evaluation report on EARN (preview of web page 1 of three proven beneath):

Different Month-to-month Dividend Inventory Sources

Every separate month-to-month dividend inventory has its personal distinctive traits. The assets beneath offers you a greater understanding of month-to-month dividend inventory investing.

The next analysis stories will provide help to generate extra month-to-month dividend inventory funding concepts.

Month-to-month Dividend Inventory Efficiency

In April 2025, a basket of the month-to-month dividend shares above generated unfavourable returns of -1.9%. For comparability, the Russell 2000 ETF (IWM) generated unfavourable returns of -2.3% for the month.

Notes: Information for efficiency is from Ycharts. Canadian firm efficiency could also be within the firm’s residence forex.

Month-to-month dividend shares out-performed the Russell 2000 final month. We’ll replace our efficiency part month-to-month to trace future month-to-month dividend inventory returns.

In April 2025, the three best-performing month-to-month dividend shares (together with dividends) had been:

- Itau Unibanco (ITUB), up 21.9%

- Financial institution Bradesco (BBD) , up 15.9%

- Timbercreek Monetary Corp. (TBCRF), up 14.5%

The three worst-performing month-to-month dividend shares (together with dividends) within the month had been:

- Fortitude Gold Corp. (FTCO), down 28.3%

- Cross Timbers Royalty Belief (CRT), down 20.9%

- Horizon Know-how Finance Corp. (HRZN), down 20.0%

Why Month-to-month Dividends Matter

Month-to-month dividend funds are useful for one group of traders specifically; retirees who depend on dividend shares for revenue.

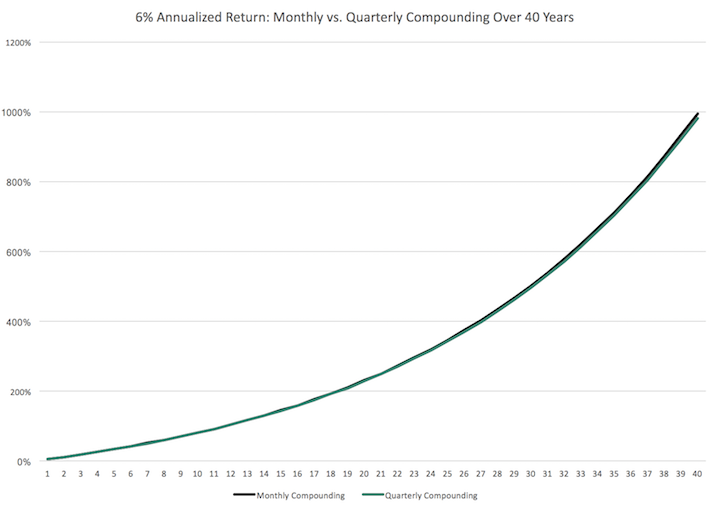

With that mentioned, month-to-month dividend shares are higher underneath all circumstances (all the things else being equal), as a result of they permit for returns to be compounded on a extra frequent foundation. Extra frequent compounding leads to higher whole returns, significantly over lengthy intervals of time.

Take into account the next efficiency comparability:

Over the long term, month-to-month compounding generates barely greater returns over quarterly compounding. Each little bit helps.

With that mentioned, it won’t be sensible to manually re-invest dividend funds on a month-to-month foundation. It’s extra possible to mix month-to-month dividend shares with a dividend reinvestment plan to greenback value common into your favourite dividend shares.

The final advantage of month-to-month dividend shares is that they permit traders to have – on common – additional cash available to make opportunistic purchases. A month-to-month dividend fee is extra more likely to put money in your account while you want it versus a quarterly dividend.

Case-in-point: Traders who purchased a broad basket of shares on the backside of the 2008-2009 monetary disaster are doubtless sitting on triple-digit whole returns from these purchases at present.

The Risks of Investing In Month-to-month Dividend Shares

Month-to-month dividend shares have traits that make them interesting to do-it-yourself traders in search of a gentle stream of revenue. Sometimes, these are retirees and other people planning for retirement.

Traders ought to be aware many month-to-month dividend shares are extremely speculative. On common, month-to-month dividend shares are likely to have elevated payout ratios. An elevated payout ratio means there’s much less margin for error to proceed paying the dividend if enterprise outcomes undergo a brief (or everlasting) decline.

In consequence, we now have actual issues that many month-to-month dividend payers won’t be able to proceed paying rising dividends within the occasion of a recession.

Moreover, a excessive payout ratio implies that an organization is retaining little cash to take a position for future progress. This may lead administration groups to aggressively leverage their stability sheet, fueling progress with debt. Excessive debt and a excessive payout ratio is probably essentially the most harmful mixture round for a possible future dividend discount.

With that mentioned, there are a handful of high-quality month-to-month dividend payers round. Chief amongst them is Realty Earnings (O). Realty Earnings has paid rising dividends (on an annual foundation) yearly since 1994.

The Realty Earnings instance exhibits that there are high-quality month-to-month dividend payers round, however they’re the exception relatively than the norm. We propose traders do ample due diligence earlier than shopping for into any month-to-month dividend payer.

Remaining Ideas & Different Earnings Investing Sources

Monetary freedom is achieved when your passive funding revenue exceeds your bills. However the sequence and timing of your passive revenue funding funds can matter.

Month-to-month funds make matching portfolio revenue with bills simpler. Most private bills recur month-to-month whereas most dividend shares pay quarterly. Investing in month-to-month dividend shares matches the frequency of portfolio revenue funds with the traditional frequency of private bills.

Moreover, many month-to-month dividend payers supply traders excessive yields. The mix of a month-to-month dividend fee and a excessive yield needs to be particularly interesting to revenue traders.

However not all month-to-month dividend payers supply the security that revenue traders want. A month-to-month dividend is best than a quarterly dividend, however not if that month-to-month dividend is decreased quickly after you make investments. The excessive payout ratios and shorter histories of most month-to-month dividend securities imply they have a tendency to have elevated threat ranges.

Due to this, we advise traders to search for high-quality month-to-month dividend payers with cheap payout ratios, buying and selling at honest or higher costs.

Moreover, see the assets beneath for extra compelling funding concepts for dividend progress shares and/or high-yield funding securities.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].