The disclosure of Ripple Labs Inc.’s overture to buy Circle Web Monetary for a reported $4 billion to $5 billion has ignited a uncommon public broadside from throughout the digital-asset business itself, whereas concurrently spotlighting diverging philosophies about how crypto networks must be commercialized.

Simon Dedic, chief govt of the enterprise agency Moonrock Capital, took direct goal at Ripple’s strategy in a submit on X, writing that an tried takeover of Circle could be “the last word instance of ‘pretend it until you make it’ on steroids.” Dedic alleged that “for a decade” Ripple’s enterprise mannequin has been “hyping up [its] group with empty guarantees and flashy information—all simply to pump the XRP token to absurd, centi-billion-dollar valuations.”

He continued: “You then unload your tokens, construct a large battle chest, and attempt to use it to purchase some of the official and worthwhile corporations within the business. If it weren’t so scammy, I’d nearly be impressed by the execution and endurance of Brad Garlinghouse and group.”

Ripple declined to touch upon Dedic’s characterization. The corporate’s acquisition proposal, first reported by Bloomberg on Wednesday, was rebuffed by Circle, which is getting ready an preliminary public providing penciled in for early April and believes the numbers put ahead “undervalue the franchise,” in accordance with folks accustomed to the talks. Circle likewise declined public touch upon the strategy, reiterating that its near-term focus stays on the IPO course of and on the expansion of its USDC stablecoin.

Ripple, whose XRP Ledger was designed for cross-border funds and settlement, is not any stranger to giant cheques. Simply final month the San Francisco-based agency agreed to amass prime-brokerage platform Hidden Highway for $1.25 billion, one of many largest offers in crypto to this point. The tried Circle takeover, nonetheless, would dwarf that transaction and, if consummated, fold the 2 largest non-algorithmic dollar-backed stablecoins moreover Tether beneath a brand new roof.

Ripple = A Excessive Company Creator

The bid has additionally rekindled a long-running debate concerning the position that founding groups and their affiliated foundations ought to play as soon as a community is reside. Hunter Horsley, chief govt officer of Bitwise Asset Administration, argued on X that the market typically overlooks “the position of creators in commercialization.”

Horsley argued that the episode illustrates the “high-agency creator” mannequin more and more widespread amongst Layer-1 protocols. He arrange a spectrum with three archetypes. “No company creator: Bitcoin. Medium company creator: Ethereum, Bittensor, and so on. Excessive company creator: Solana, Avalanche, Aptos, Sui, Ripple, and so on.”

The Bitwise CEO added that initiatives within the third class “have Labs and foundations alongside them with sources, organized expertise, and a want to foster adoption.” In his view, the capability of such entities to “bend destiny to win” signifies that “one of the best product doesn’t at all times win. Typically it’s one of the best go-to-market. Are you factoring this dimension into your expectations?”

In different phrases, Horsley sees Ripple’s acquisitive streak as a textbook instance of high-agency technique in motion, contrasting with protocols comparable to Bitcoin that rely nearly completely on emergent group coordination. Dedic’s critique, in contrast, frames Ripple’s strategy as opportunistic asset-flipping financed by treasury XRP gross sales.

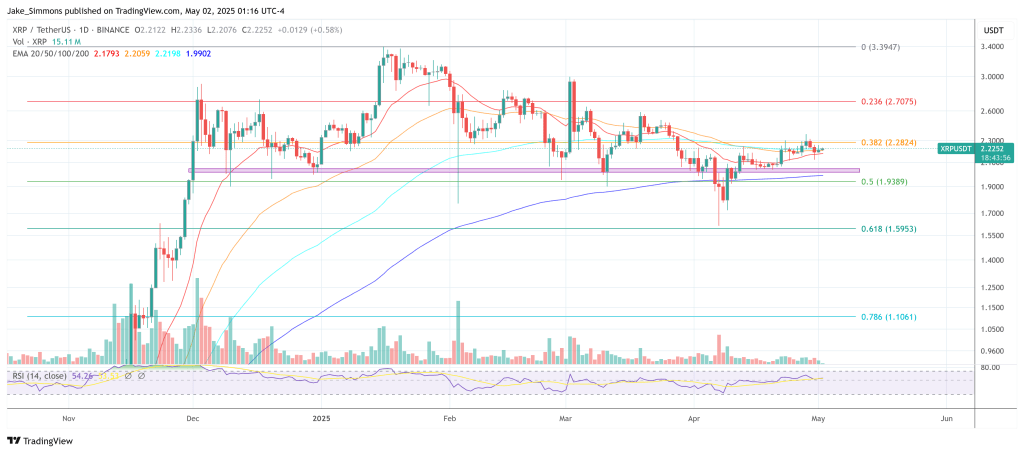

At press time, XRP traded at $2.22.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our group of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.