Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

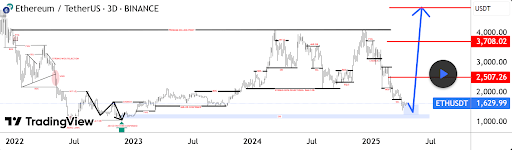

Ethereum’s value motion seems to be setting the stage for a significant transfer that might redefine its market trajectory by the top of 2025. Though latest months have seen the cryptocurrency’s value lose its footing, technical evaluation exhibits that this section may be coming to an finish. Notably, Ethereum is now buying and selling near a assist stage that might trigger an upward bounce in direction of $4,000 by the top of 2025.

Sturdy Demand Zone Exhibits Ethereum Bottoming Out

Ethereum’s value motion all through 2025 has been bearish, marked by a sequence of structural breakdowns which have erased a lot of the bullish momentum carried over from This fall 2024. Since December 2024, the cryptocurrency has slipped by means of a sequence of key technical assist ranges, starting with the breakdown of a good worth hole (FVG) close to $3,700 in early January.

Associated Studying

This was adopted by a crucial CHoCH (Change of Character) round $3,100 in February, signaling a definitive shift from bullish to bearish sentiment. The scenario worsened in March, with Ethereum dropping its $2,000 structural assist stage within the first week of the month, after which plummeting previous a significant liquidity pool at $1,700 by late March that triggered an extra crash till it bottomed at $1,415 on April 9.

Based on a TradingView evaluation, all these actions have pushed the Ethereum value to its lowest assist stage, which may result in a bounce. This assist stage is round $1,629 on the 3-day candlestick timeframe chart.

Trying on the 3-day ETH/USDT chart, Ethereum has retraced into this high-demand zone marked by a number of liquidity sweeps and former order block confirmations again in 2023. This space triggered a big bullish reversal in 2023, which ultimately led to a surge over the following yr.

Three Main Targets On The Path To $4,500

Now that Ethereum has bounced round this order block, the following outlook is a bounce above $2,000 and past, with the TradingView analyst significantly predicting a surge to $4,500. Based on the TradingView evaluation, there are three key value ranges Ethereum is anticipated to hit on its method towards a brand new all-time excessive round $4,500.

Associated Studying

The primary goal sits round $2,507, a stage that corresponds with a bearish order block that led to the break of construction on March 2. The second stage, at $3,708, marks a extra outstanding resistance and is sitting across the truthful worth hole that arose in January. Lastly, the final word goal lies simply past $4,500.

On the time of writing, Ethereum is buying and selling at $1,795, up by 10.7% prior to now 24 hours and piggybacking off Bitcoin’s break above $90,000.

Featured picture from Pixabay, chart from Tradingview.com