Pricey merchants, after having voluntarily eliminated the HFT FAST M1 GOLD SCAPER V6 EA a few months in the past, and receiving tons of of messages—having listened to each “camps”: those that requested me to tame the beast, and those that obtained very upset after I really did restrict it—I spotted that either side had been proper, however it’s not possible to please various kinds of merchants with completely different kinds and ranges of aggressiveness in buying and selling.

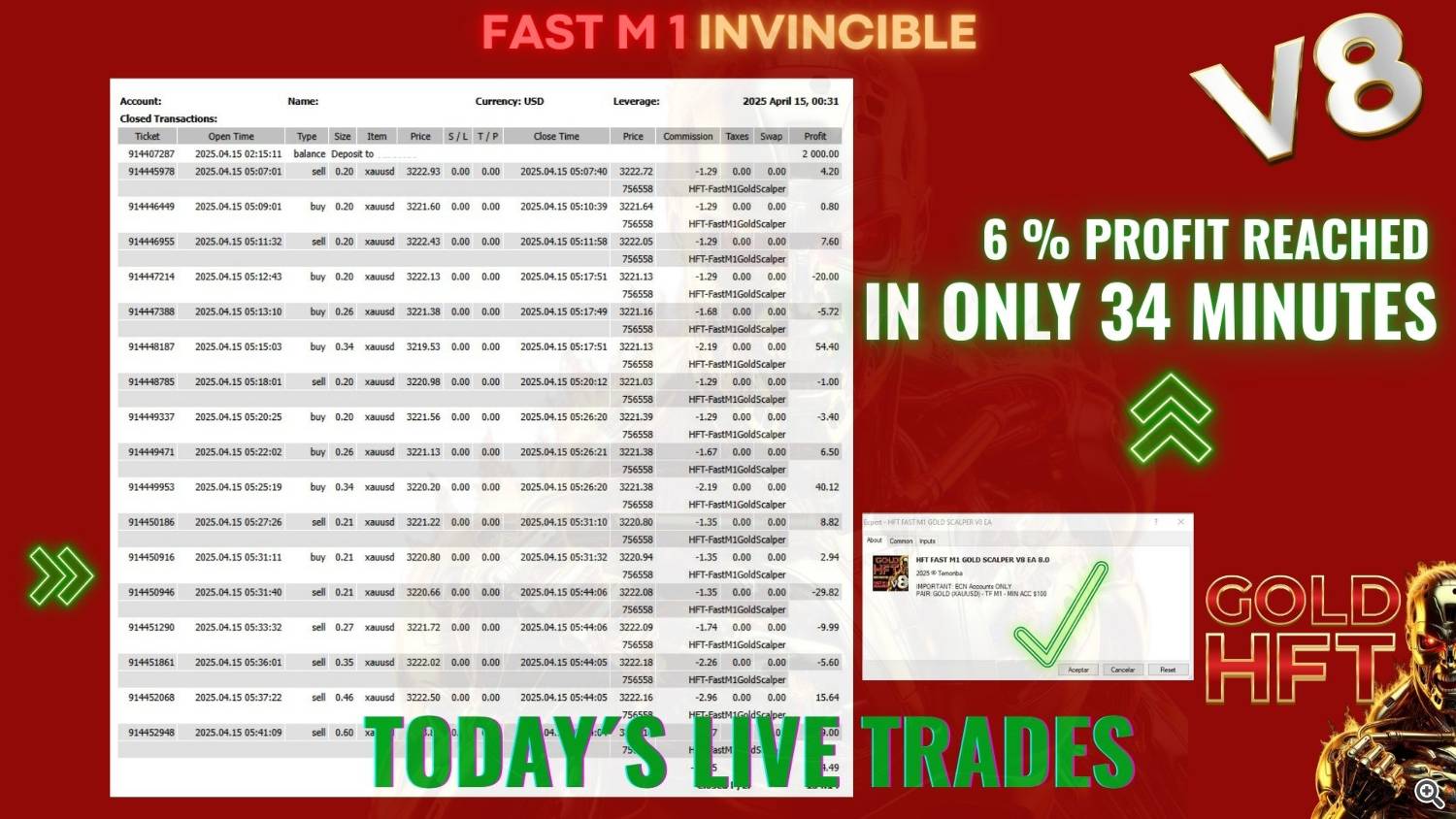

After working tons of assessments with this beastly EA, I concluded that the best strategy is to let it run just for a brief interval every day. How lengthy? Lengthy sufficient to make 6% every day after which fortunately step away.

I wish to make clear that this EA will not be for many who DO NOT READ THE INSTRUCTIONS, nor for many who wish to do one thing completely different like setting a 15% every day revenue or letting it run for 12 hours, nor for many who ignore the principles out of greed or request modifications based mostly on their very own buying and selling model (extra/much less aggressive).

This EA is for you if you’ll be able to observe directions and perceive that the buying and selling model proposed beneath is the one which shall be used—no adjustments shall be made.

Directions for Operation 🚀📊

1- Weekly Capital Administration 💰

- The month is split into 4 or 5 weeks (relying on the calendar).

- Every week, 100 USD is assigned to the EA. (In fact, you need to use no matter capital you would like, however for example, we’ll use the smallest attainable capital).

- On the finish of the week—on Fridays—earnings are withdrawn, so that each new week begins once more with the identical 100 USD in danger.

- The EA will function inside the predefined schedule till it reaches 6% in every day earnings or hits the MaxDailyLossPercentage. Then it stops buying and selling till the subsequent day. That is essential for every day threat administration and have to be revered.

2- Instance of Weekly Outcomes 📝

• Week 1: The EA earns 35 USD revenue on a capital of 100 USD, which is +35% 🔥.

• Week 2: The EA earns 34 USD revenue on a capital of 100 USD, equal to +34% 💸.

• Week 3: The EA incurs an 11 USD loss (out of 100 USD) ⚠️.

• Week 4: The EA as soon as once more incurs an 11 USD loss (out of 100 USD) ⚠️.

On this state of affairs, the standard conduct is that when the EA has a successful week, it often achieves round +30%–35%. In the meantime, on dropping weeks (when it reaches its most drawdown, set at 30%), it tends to finish up with a lack of about 10–15 USD.

The EA has an important restoration functionality. Subsequently, after a day with losses upon hitting its max DD restrict, it retains working the next days to trim that loss and cut back the ultimate quantitative influence 🙌.

3- Concerns About Drawdown (DD) 📉

Often, the every day or weekly drawdown ranges from 2% to 25%. If it reaches a 30% DD (its most restrict), the EA will cease buying and selling for that day. Below regular circumstances—utilizing a superb ECN account with low latency—it hardly ever hits that restrict.

4- Account Necessities and Connection 🌐⚡

It’s important to make use of ECN accounts with quick execution. As a result of that is an HFT system that additionally trades Gold (XAUUSD), slippage can severely have an effect on efficiency. We advocate utilizing a VPS in case your web connection is unstable, or if it’s good to shut down your PC. The EA requires a relentless connection—only one minute offline might be catastrophic.

5- Slippage 🤔

In case your account constantly has, for instance, 20–30 pips of slippage, the EA will yield a lot lower-than-expected efficiency and elevated drawdowns. This EA will not be designed to deal with extraordinarily excessive spreads or slippage on Gold; slippage as much as 10 pips is tolerable, however past that, the outcomes deteriorate drastically. That will help you monitor your present slippage, you will notice a Slippage label on the decrease proper nook of the chart. Below regular circumstances with a superb ECN dealer, the determine ought to stay low more often than not ✅. Verify your working schedule to position the EA within the timeframe greatest suited to your dealer (this may cut back slippage). Ask me in the event you’re uncertain!

6- Working Hours Based mostly on Slippage ⏰

The EA is preconfigured to function throughout a selected time window (between TimeStart and TimeEnd). In case your dealer applies extreme spreads or slippage throughout sure periods (for instance, New York or London), you’ll be able to alter that schedule so it trades throughout much less risky durations. Adjusting the buying and selling hours can enormously enhance efficiency, because it avoids home windows the place Gold experiences unfold spikes and slippage.

Conclusion 🏆

Every week, 100 USD is positioned in danger, and earnings are withdrawn each Friday. The EA can generate about +30% weekly returns when market and execution circumstances (unfold + slippage) are favorable. Conversely, some weeks might even see a lack of round 10–15 USD. The utmost configured drawdown is 30%, and if it’s reached, the EA stops buying and selling for the remainder of the day, permitting it to proceed in subsequent days to reduce the loss. The secret is making certain good market circumstances: an ECN account, low latency, utilizing a VPS (splendid), and avoiding extreme unfold durations.

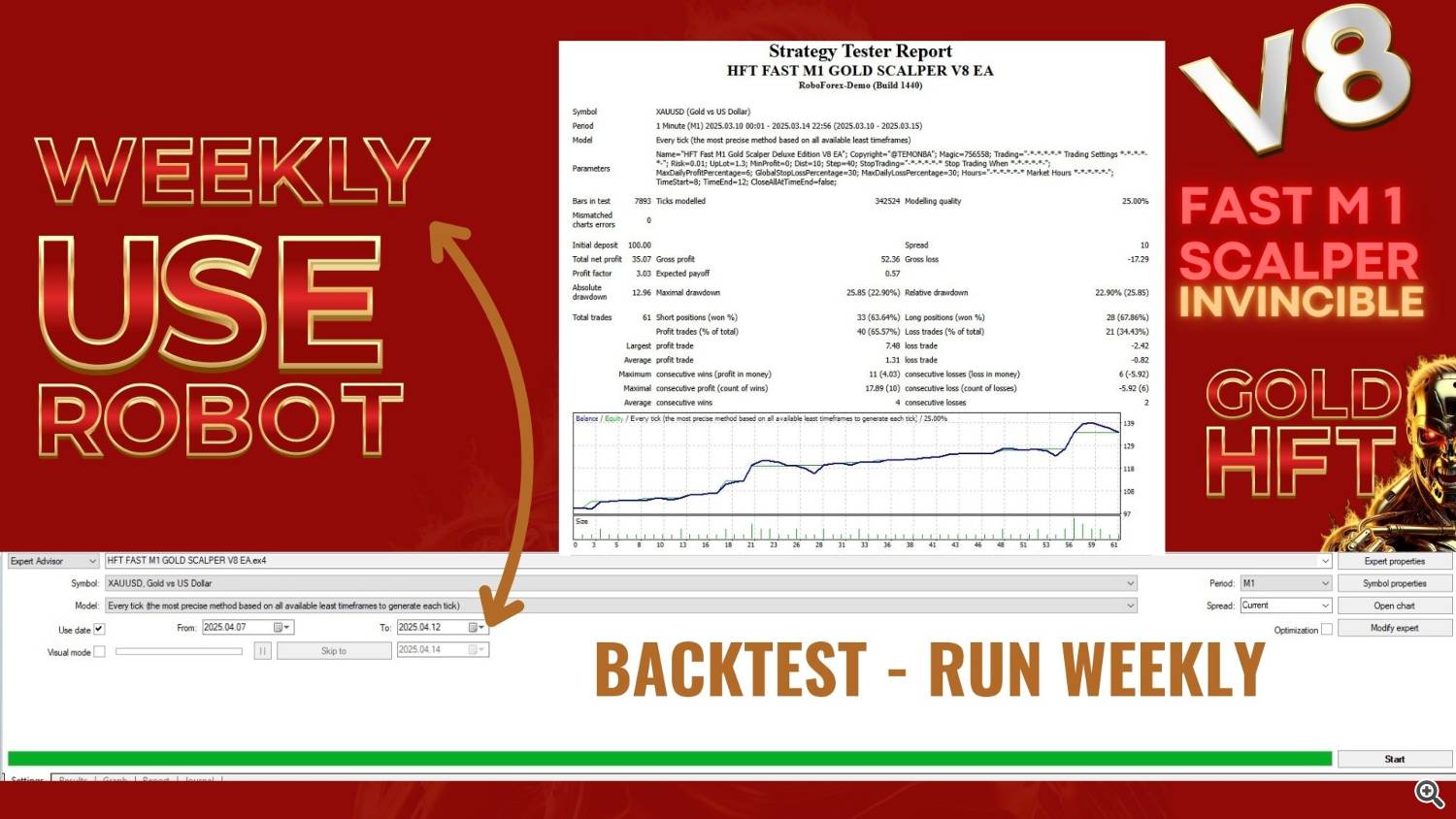

How one can Correctly BACKTEST HFT Quick M1 V8 📊

You may backtest it so long as it’s executed on a WEEKLY foundation. As a result of the proposed technique for this EA is to threat the identical capital repeatedly and withdraw earnings every Friday (to maintain potential losses below management), you should keep away from greed and observe the rules. This EA includes threat, so it’s not advisable to allocate extra capital than you’re keen to lose. In any case, dropping 10–15 USD is one factor (on a 100 USD capital), however dropping what you earned the earlier week doubles the loss—do you see the purpose? In fact, a month-to-month backtest would possibly present increased earnings (as a result of it drags over earlier days/weeks’ positive factors), however DD will skyrocket in addition to the related threat and potential losses. PLEASE FOLLOW THE RECOMMENDATIONS.

Though EAs are sometimes evaluated by their month-to-month efficiency, it’s each legitimate and smart to make use of a weekly capital administration technique. Then, on the finish of the month, you’ll see that through the use of the identical capital repeatedly, you’ll be able to obtain a sure month-to-month share whereas having locked in earnings weekly.

⚠️Disclaimer:

It is a high-risk EA. In case you purchase it, you should perceive your capital is in danger. Previous efficiency doesn’t assure future outcomes. What’s defined right here will not be a promise of earnings, however an evidence of the capital administration logic that should accompany the EA’s use.

Please obtain the demo model and test the EA’s efficiency in your account beforehand.

Don’t purchase it in the event you’re uncertain of what you’re buying. Ask me first.

When you’ve got any questions, don’t hesitate to jot down me—by no means keep unsure!

Regards,

Martin.