- Each US equities and the greenback proceed to get better

- US customers are below stress, because the April 2 deadline is approaching

- Pound suffers from weaker inflation; all eyes on the Finances replace

- Gold, oil and bitcoin transfer in sync

Fairness Markets Are in Higher Temper

Each US fairness indices and the continued their restoration yesterday, with falling beneath 1.08 for the primary time since early March and the testing the 5,800 degree once more. Regardless of these strikes, the general market sentiment stays fragile, because the countdown to the April 2 deadline has formally commenced.

Quite a few experiences for subsequent week’s so-called “Liberation Day” level to a much less aggressive set of bulletins from US President Trump. Polls amongst market contributors forecast a ten% tariff on most international locations, with China dealing with a considerably greater degree, presumably as excessive as 50%. Each Canada and Mexico are higher positioned in comparison with the European Union and will doubtlessly face the bottom attainable tariffs, however Trump stays unpredictable.

Whereas most buyers perceive that Trump’s major goal is China, a 50% tariff on Chinese language imports may considerably disrupt the provision chain, doubtlessly in a manner similar to the COVID interval, which ultimately led to a rare spike in inflation charges. On this context, has already been drawn within the tariff discuss, recording a brand new all-time excessive immediately.

US Shoppers Beneath Stress

The results of these tariff expectations is that the US shopper is seemingly changing into extra skeptical concerning the future. After the current weak College of Michigan report, Tuesday’s confirmed the continued lack of shopper spending urge for food. Because of this Friday’s detailed PCE report, which is the Fed’s most well-liked inflation measure, has gained prominence and has an elevated likelihood of manufacturing a draw back shock.

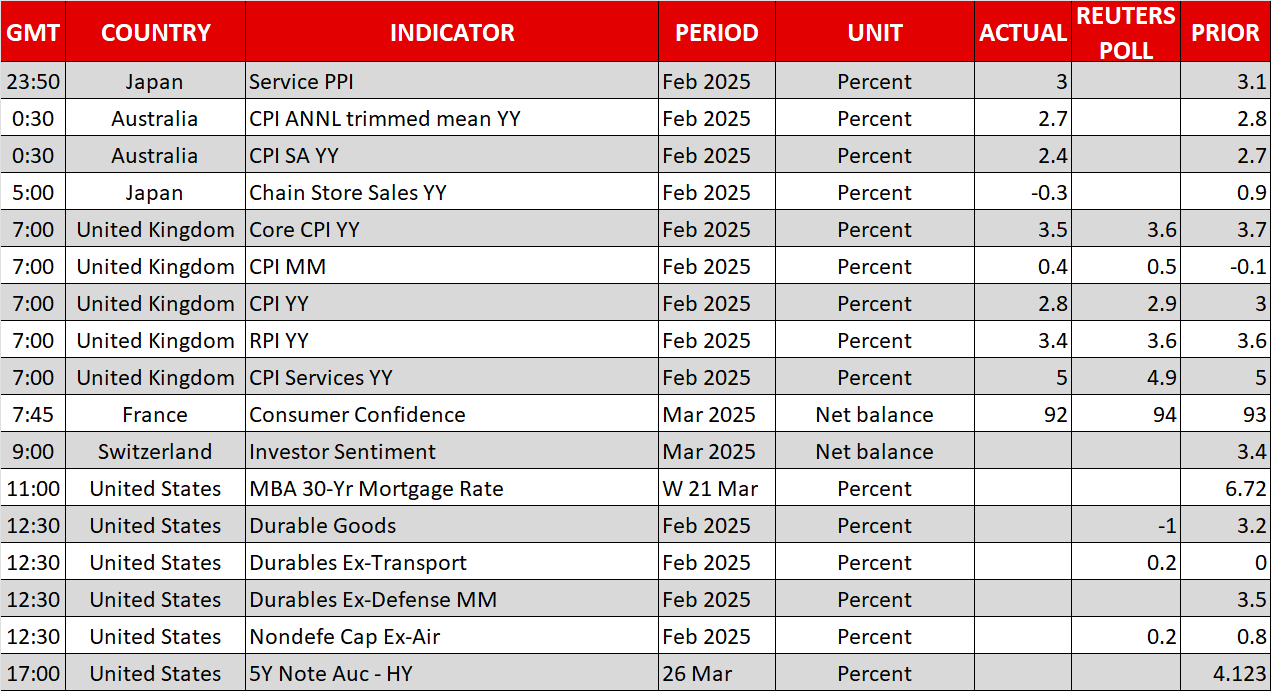

At this time’s calendar is equally busy with quite a few Fed audio system on the wires, most certainly repeating the “endurance” message. Apparently, the February sturdy items orders report may also be revealed. As mentioned by Chair Powell on the current Fed assembly, regardless of the worsening “gentle information”, the Fed stays comparatively assured concerning the outlook because the laborious information are “fairly stable”. Nonetheless, immediately’s information, together with Friday’s PCE report and subsequent week’s key figures and labour market information, may put a sizeable dent on the Fed’s confidence concerning the development outlook.

UK Inflation Eases, Focus Shifts to the Finances Replace

The February inflation report was a welcome reward to doves. Each the headline and core inflation figures decelerated to 2.8% and three.5%, respectively, bringing smiles to the BoE halls and supporting the probabilities of a Could price minimize. The has not taken evenly the decrease inflation prints, although, shedding floor in opposition to each the euro and the greenback.

The main target now shifts to the Finances replace. At 12:30 GMT, and after the discharge of the up to date OBR forecasts, that are prone to present a decrease development profile and better borrowing wants, the Chancellor of the Exchequer will temporary Parliament. Reeves is predicted to keep away from altering her fiscal rule and growing taxes, and as an alternative concentrate on spending cuts.

Experiences level to vital cuts in welfare spending and a leaner public sector, which sounds much like what Musk’s DOGE is implementing within the US. These new measures will most likely be begrudgingly accepted by the vast majority of voters and most Labour MPs, who’re already upset concerning the fiscal coverage combine applied by the Labour authorities.

Gold Maintains Positive factors; Oil and Bitcoin Transfer Larger

Regardless of the small steps recorded in direction of a ceasefire within the Ukraine-Russia battle, stays in demand, buying and selling comfortably above $3,000, because the April 2 deadline is quick approaching. Equally, with Trump focusing on Iran once more, costs are flirting with the $70 degree, and regardless of the OPEC+ alliance most certainly deciding to go forward with the Could deliberate provide enhance.

Lastly, the crypto market is respiration simpler these previous couple of days. Boosted by an enchancment in threat urge for food, as US fairness indices proceed to get better, is buying and selling north of $88,000 and has managed to climb above the $2,000 degree once more. On a month-to-month foundation, the image stays combined, with each and main the rally.