- The US Private Consumption Expenditures (PCE) Value Index, the Fed’s most well-liked inflation gauge, is due.

- Current US financial information has been weaker than anticipated, resulting in elevated market worry.

- Tariff threats by President Trump have added to market issues about inflation and international development.

- Technically, the S&P 500 is in bearish territory, having damaged key help ranges.

The Private Consumption Expenditures () Value Index, the Federal Reserve’s most well-liked gauge of inflation, is about to be launched this Friday.

Market expectations point out that the , which excludes risky meals and vitality costs, may present a 0.3% month-over-month enhance, with annual good points of two.6% for core inflation and a couple of.4% for the headline determine. These projections counsel solely modest cooling from December, signaling that inflationary pressures stay above the Fed’s 2% goal.

Does US Information Present Indicators of a Stalling Economic system?

This week’s US information has underwhelmed and given indicators that the economic system could also be stalling. Now we have seen market sentiment bitter over the previous few weeks with the sharp rise in US CPI including to the market’s skepticism.

The present Concern & Greed Index of twenty-two displays a market primarily pushed by worry, indicating a really cautious method amongst traders. A bounce-back within the US inventory market wouldn’t be stunning given the acute worry ranges.

Supply: Isabelnet

Earlier on Thursday, we had the discharge of US information for This autumn 2024. The US economic system grew by 2.3% within the fourth quarter of 2024, its slowest tempo in three quarters, down from 3.1% within the earlier quarter. This matches earlier estimates. Private spending was the primary driver, rising by 4.2%, the quickest since early 2023, with will increase in spending on each items (6.1%) and companies (3.3%).

fell barely lower than anticipated (-0.5% vs -0.8%), and dropped extra (-1.2% vs -0.8%), which added positively to development. Authorities spending additionally rose greater than beforehand thought (2.9% vs 2.5%). Nevertheless, personal inventories lowered development by much less (-0.81 share factors vs -0.93).

On the draw back, enterprise investments dropped greater than estimated (-1.4% vs -0.6%), primarily due to an even bigger decline in gear investments (-9%) and no development in mental property investments (0% vs 2.6%). On the intense aspect, residential investments improved barely greater than anticipated (5.4% vs 5.3%).

For the entire of 2024, the economic system grew 2.8%.

Regardless of the lackluster information, yesterday’s tariff feedback by President Trump reignited the rally and weighed on US shares. President Trump promised reciprocal tariffs are nonetheless on the right track for April 2 whereas tariffs in Mexico and Canada are set for March 4, subsequent Tuesday.

Tariff Menace to Inflation

Trying on the potential eventualities from tariffs, it continues to weigh on International markets. OPEC + are having disagreements on a possible output hike in April, with tariffs cited as a key concern.

At current, the issues round tariffs relate largely to its impression on inflation and an impression on International development. Inflation fears have been on the rise each within the US and globally, with Central Banks all warning in regards to the upside dangers to inflation.

The US CPI print was scorching this month whereas Michigan shopper sentiment and CB Client confidence each confirmed important will increase within the 12-month inflation expectations. This clearly doesn’t bode properly for customers who have been hoping for extra charge cuts in 2025.

Nevertheless, Fed Chair Jerome Powell was fast to emphasize the significance of the PCE information when the inflation print was launched just a few weeks in the past. This has added to the significance of right this moment’s information launch.

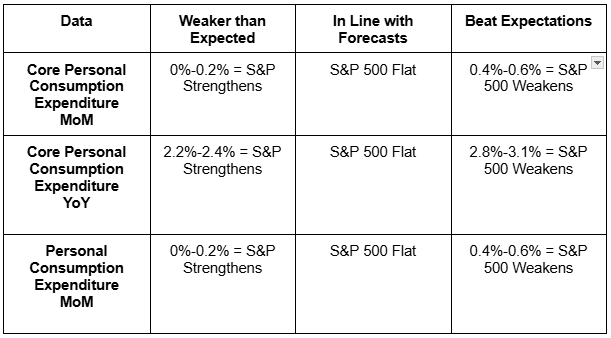

Supply: Desk Created by Zain Vawda

The above desk gives an perception into what I anticipate will occur relying on the PCE prints launched later within the day.

My private expectations are that the information will land fairly near expectations which may result in some short-term volatility and whipsaw value motion earlier than markets quiet down.

Technical Evaluation – S&P 500

From a technical standpoint, the on a each day timeframe is now firmly in bearish territory having damaged beneath the earlier decrease excessive print at 5910.

Value additionally trades beneath the 20 and 100-day MAs with instant help at 5828 and 575 whereas the 200-day MA rests at 5733.

If there may be to be a restoration, the S&P 500 will face a problem at 5910 and 5959 earlier than the 6000 and 6025 handles come into focus.

S&P 500 Each day Chart, February 28, 2025

Supply: TradingView.com

Assist

Resistance

Most Learn:

Unique Submit