peepo

February 19, 2025 Expensive Companions,

In This autumn 2024, the Voss Worth Fund, LP and the Voss Worth Offshore Fund, Ltd., returned +9.6% and +9.5% to traders web of charges and bills, respectively, in comparison with +0.3% whole return for the Russell 2000 (RTY), -1.1% whole return for the Russell 2000 Worth, and +2.4% whole return for the S&P 500 (SPX)(SP500).

As of December thirty first, 2024, the Voss Worth Grasp Fund’s whole gross publicity stood at 184.3% and the web lengthy publicity was 84.9%. The highest 10 longs had a weight of 72.5%, and our prime 10 shorts had a weight of -14.6%.

Voss Worth Grasp Fund belongings below administration stood at roughly $337.2 million and Agency belongings stood at roughly $1.2 billion as of December thirty first, 2024.

Voss Worth Grasp Fund Complicated

NET MONTHLY PERFORMANCE | 2024

|

PERIOD |

Voss Worth Fund |

Voss Worth Offshore Fund |

Russell 2000 TR |

Russell 2000 Worth Index |

S&P 500 TR |

|

JANUARY |

-2.6% |

-2.8% |

-3.9% |

-4.5% |

1.7% |

|

FEBRUARY |

9.3% |

9.4% |

5.7% |

3.3% |

5.3% |

|

MARCH |

2.6% |

2.5% |

3.6% |

4.4% |

3.2% |

|

1st QUARTER |

9.2% |

9.0% |

5.2% |

2.9% |

10.6% |

|

APRIL |

-8.1% |

-8.1% |

-7.0% |

-6.4% |

-4.1% |

|

MAY |

1.4% |

1.3% |

5.0% |

4.7% |

5.0% |

|

JUNE |

0.0% |

-0.1% |

-0.9% |

-1.7% |

3.6% |

|

2nd QUARTER |

-6.8% |

-7.0% |

-3.3% |

-3.6% |

4.3% |

|

JULY |

7.7% |

7.7% |

10.2% |

12.2% |

1.2% |

|

AUGUST |

1.8% |

1.8% |

-1.5% |

-1.9% |

2.4% |

|

SEPTEMBER |

-1.9% |

-2.0% |

0.7% |

0.1% |

2.1% |

|

third QUARTER |

7.6% |

7.4% |

9.3% |

10.2% |

5.9% |

|

OCTOBER |

-0.8% |

-0.9% |

-1.4% |

-1.6% |

-0.9% |

|

NOVEMBER |

12.3% |

12.3% |

11.0% |

9.7% |

5.9% |

|

DECEMBER |

-1.6% |

-1.6% |

-8.3% |

-8.3% |

-2.4% |

|

4th QUARTER |

9.6% |

9.5% |

0.3% |

-1.1% |

2.4% |

|

YEAR TO DATE |

19.9% |

19.2% |

11.5% |

8.1% |

25.0% |

The desk under reveals the Voss Worth feeder fund returns in comparison with a number of the related indices:

|

Web Return Comparability as of December thirty first, 2024 |

||||||||

|

1 Month |

3 Month |

YTD |

1-12 months |

Compound Annual Progress Fee |

||||

|

3-12 months |

5-12 months |

10-12 months |

ITD(1) |

|||||

|

Voss Worth Fund, LP |

-1.6% |

9.6% |

19.9% |

19.9% |

11.9% |

19.3% |

17.2% |

18.0% |

|

Voss Worth Offshore Fund, Ltd. |

-1.6% |

9.4% |

19.2% |

19.2% |

11.9% |

18.9% |

– |

18.9% |

|

S&P 500 |

-2.4% |

2.4% |

25.0% |

25.0% |

8.9% |

14.5% |

13.1% |

15.4% |

|

Russell 2000 |

-8.3% |

0.3% |

11.6% |

11.6% |

1.2% |

7.4% |

7.8% |

11.3% |

|

Russell 2000 Worth |

-8.3% |

-1.1% |

8.0% |

8.0% |

1.9% |

4.7% |

5.8% |

9.6% |

|

Russell 2000 Progress |

-8.2% |

1.7% |

15.1% |

15.1% |

0.7% |

4.0% |

6.7% |

10.6% |

|

HFRX Fairness Hedge Index |

-0.4% |

2.0% |

5.0% |

5.0% |

2.8% |

5.2% |

3.3% |

3.7% |

|

(1) Inception to Date measures the time interval from Voss Worth Fund, LP’s inception date of October 1st, 2011, and from Voss Worth Offshore Fund, Ltd’s inception date of January 1st, 2020. |

||||||||

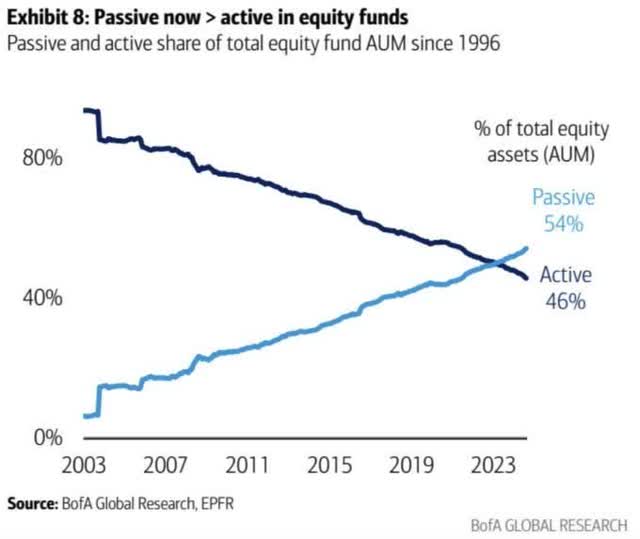

The market is a perpetual paradox machine the place one doesn’t go to meet the necessity for readability and cohesion. As an alternative, one will discover a persevering with oscillation between rationalizations for excessive strikes. The most cost effective quartile of shares is cheaper now than in 2014 and the costliest quartile is rather more costly, partly a perform of capital flooding out of lively and into passive (passive now ~54% of whole US fairness belongings 1). The divergences between the valuation of comparable belongings can typically attain proportions which are laborious to fathom and might’t simply be defined by something empirical, however the very best lengthy/quick fairness alternatives are born from these excessive contradictions that we discover ongoing immediately, thus there’s a excellent inventory selecting backdrop.

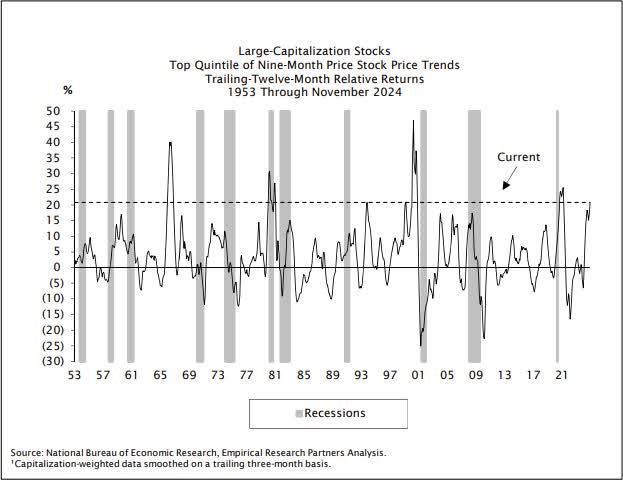

The consistency of value momentum issue efficiency has put it in rarified air, such that many outstanding elements of The Nice Humiliator are breaching the confines of historic likelihood and trampling on the Gaussian curve. Rolling 9-month value momentum of enormous cap shares has solely performed higher on 4 events in market historical past, with the tip of 2020/begin of 2021 being a type of uncommon time intervals. 2

Retail investor inflows and flows throughout almost all asset courses have shattered information thus far in 2025 3, underscoring a persistent imbalance—there may be an excessive amount of capital chasing too few belongings mixed with restricted new asset creation. On this atmosphere, a brand new breed of nihilistic merchants has spawned over 40 million intrinsically nugatory cryptocurrencies, all whereas deriding rigorous basic evaluation and detailed valuation.

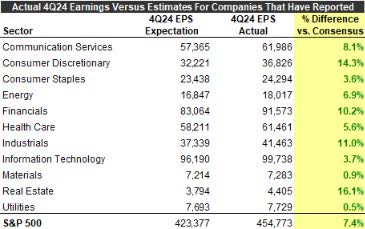

The S&P 500 was up 27% in 2024 with simply 8% EPS development anticipated for the 12 months—the P/E a number of expanded by 15% even with the 10-year yield up >70 bps. This autumn 2024 earnings have been strong thus far and proven an acceleration of development, with each sector beating consensus expectations with whole year-over-year development clocking in at a strong 16.7% (7% above expectations) 4. At a dear 23x 2025 earnings with 14% EPS development already embedded in that ahead P/E ratio (the trailing 20+ 12 months common EPS development has been nearer to 7.2%), we’ll see if traditionally “regular” valuations are given a peaceable reentrance onto Wall Avenue ushered in by continued boomy EPS development the following a number of years or if valuations will violently plop down below the load of unrealistic earnings development expectations. In different phrases, sustained earnings development and a robust ROIC within the tech sector might be essential to conserving total market multiples above 20x, with the market’s notion of burgeoning AI-related capex enjoying a key position.

Small caps maintain making an attempt to carry alpha’s face, however it shortly turns away time and time once more. No matter how issue or type management shakes out this 12 months, our funding workforce’s primary theme and focus coming into 2025 has been on small cap M&A and particular conditions as we felt there was pent up demand for offers after two years of dismal deal circulation. This emphasis on M&A is paying early dividends with three fast wins from acquisitions in our lengthy guide year-to-date: SWI, CTS CN, PLYA.

SolarWinds (SWI) makes for an attention-grabbing case examine of low expectations, as we had hardly ever witnessed such apathy throughout each the buyside and promote facet, together with an odd reluctance to maneuver on from the previous cybersecurity breach in 2020 regardless of clear and ongoing operational execution for a number of years in a row. We wrote in our Q1 2024 letter that “we expect the percentages are elevated that the corporate will obtain a buyout supply from a unique PE fund inside the subsequent 12 months or so.” Given the very fact sample, it was a big place for the fund and Voss was the biggest lively outdoors shareholder when the buyout was introduced. SWI was present process a perpetual license to subscription transition with subscription ARR development of 36% in the newest quarter, with whole ARR development having accelerated as much as 8.4% from low single digits a number of quarters in the past, and whole income development enhancing from 0% to five%. The place the market noticed a sleepy low/no development legacy software program firm, we noticed a transparent deleveraging story with enhancing web income retention, an ongoing acceleration of whole ARR development (pushed by an environment friendly gross sales drive) occurring since 2022, and a 52%+ on the software program “Rule of 40” scale buying and selling for below 9x FCF. The frequent topic of buyout rumors the previous couple of years, SWI lastly discovered a brand new dwelling in Flip/River Capital at 5.2x EV/Income and 13.8x our 2025 FCF estimates, a bit of under our base case valuation, however a win/win for all stakeholders.

Converge Expertise Options Group (CTS CN)(OTCQX:CTSDF), a know-how companies firm and distributor within the vein of CDW, match into the identical depressed sentiment, low valuation penalty field as SWI. Voss first took an interest within the firm as they had been going by a strategic overview a bit of over a 12 months in the past whereas buying and selling at round 5x FCF. Though that overview didn’t lead to a buyout, we started including to our place as we witnessed the newly appointed CFO (with glowing critiques from his earlier stint at Dye & Durham (DYNDF)) unlock an unlimited quantity of free money circulation (~$275 million on a market cap of ~$700 million) and de-lever the corporate to properly under one occasions EBITDA, all whereas sustaining constructive income development and beating EBITDA expectations. Though the corporate ended that streak in Q3 with a miss and guided down, we witnessed equally challenged numbers throughout the buying and selling comp set in names like CDW and ePlus and decided that it was way more of a transient macro problem than a company-specific problem. Maybe there was a bit of world valuation arbitrage at work, however the US names shrugged off the macro headwinds (CDW moved from 13x to 15x NTM EBITDA) whereas Converge sunk again to the sub-5x EBITDA ranges they endured as a much more levered firm. Though our thesis was the corporate would unload their underperforming, subscale Europe enterprise and aggressively purchase again inventory, it’s our understanding that a number of events approached Converge and so they had three gives throughout the takeout value of $5.50 CAD (~56% premium) and settled on H.I.G. Capital.

Playa Inns & Resorts (PLYA) was one in all our “simpler” and extra straight-forward investments that we wrote about publicly. An proprietor and operator of all-inclusive resorts in Mexico, Jamaica, and the Dominican Republic, we lengthy thought that PLYA traded under each non-public market valuations and substitute price. On condition that it was executing properly and nonetheless not getting credit score in public markets, we believed the very best plan of action was to hold up the for-sale signal. When the corporate made out-of-cycle adjustments to their govt change-in-control payouts in September 2024, growing the payouts to prime executives in a sale and doing so three months earlier than their present employment agreements had been set to run out, we considerably upsized the place (shopping for over 6% of the corporate), even calling out Hyatt because the more than likely acquirer. Hyatt introduced they had been buying PLYA for $13.50 per share in early February. Whereas the last word end result and sale value was barely disappointing (8% under the underside of our estimated worth vary), our incremental purchases had an important IRR, because the inventory has risen >75% from the time of the change-in-control amendments simply 5 quick months in the past.

Good issues ought to maintain taking place to worth shares like SWI, CTS CN and PLYA, and we anticipate a number of further portfolio corporations to be acquired because the 12 months progresses.

Portfolio Place Updates

Lengthy Euronet (EEFT)

EEFT’s inventory had been whacked right down to an all-time low valuation coming into its This autumn earnings report, presumably on the fears of the brand new Trump administration’s immigration insurance policies (regardless of far fewer immigrants being deported below Trump than Obama on an annual foundation) affecting Euronet’s cash switch enterprise, Ria, together with normal apathy within the funds house. We predict these fears have been drastically overblown and it’s total financial development (and development employment for the US to Mexico hall) that’s way more vital to its enterprise than reasonable immigrant deportations (not to mention the truth that Ria is a global enterprise and the US to Latin America hall is a small piece of that enterprise). At present valuation ranges of simply ~5.4x 2026 EBITDA and 9x 2026 earnings regardless of remarkably constant execution and a forecasted reacceleration of development, we consider EEFT stays undervalued with vital re-rating potential over the period of 2025.

Part of our Euronet thesis is round ATM take charges. Whereas most “FinTech” corporations are always involved about take fee compression, Euronet appears to have taken fee tailwinds of their most recognized and maligned section, ATMs (which falls inside their Digital Funds Switch, or EFT, section). Somewhat over a 12 months in the past the corporate settled an antitrust lawsuit with Visa and Mastercard, who they believed had colluded with one another to place up roadblocks to elevated charges on ATMs. Administration commented lately that whereas that settlement was a primary step, it was the nations themselves that wanted to formally clear the best way in permitting extra surcharges on ATMs, one thing they said is now taking place. We consider a big bump in fees (which are available at 100% pretax margins) after a decade of compression with rising prices may give the corporate considerably extra confidence in development from their ATMs and will change the narrative across the ATM enterprise as a secular decliner. The final couple quarters have proven the EFT section producing > 50% rolling incremental EBITDA margins, one thing we consider is reflective of early enhancements in EEFT’s ATM take fee.

Past that, the remainder of the enterprise is rising quick sufficient that ATMs are slowly turning into much less related. Lengthy a driver of the questionable funding narrative of EEFT being a dying cash-based enterprise, the ATM section now represents solely 19% of income (and 35% of EBITDA, down from >60% in 2019), with secular development companies like their acquired Service provider Providers enterprise (from Piraeus Financial institution in Greece), REN (real-time funds software program), and Dandelion (B2B cross border funds know-how) growing as contributors, and Ria aggressively transferring from “brick-and-mortar” to “digital” cash remittances. We look ahead to growing disclosures round these companies’ contributions all through 2025. To summarize, the corporate’s most maligned enterprise has substantial, narrative altering tailwinds this 12 months, and their development companies appear to be constructing sufficient momentum to vary the narrative (and valuation multiples) on the corporate from a “secular decliner” to extra of a forefront fintech firm.

We consider administration’s current steering displays this rising optimism, even when they’re unwilling to spell out a number of the potential regulatory advantages. Traditionally conservative in nature, administration guided for accelerating EPS development in 2025, transferring their “10-15% EPS development” framework to “12-16%”, even after noting that 2025 could be an unusually heavy tax 12 months (excessive 20s vs ~24% traditionally). This successfully modified the midpoint of their underlying EPS information from 12.5% development to over 16%, which by our math implies not less than 14-15% EBITDA development and 10% income development. Given this profile, we worth Euronet with a Base Case EV/EBITDA a number of of 9x, and a conservative 13x 2026 EPS for a corporation projected to develop EPS between 13-20%. Euronet’s development re-acceleration throughout income, EBITDA, and working earnings, together with robust steering, alerts a return to robust operational momentum such {that a} “Bull Case” state of affairs can be turning into more and more seemingly. On this case, Euronet will get again nearer to its historic multiples (15-20x NTM earnings) with improved disclosures on higher-growth segments and waning danger round their decrease development segments. This might push the inventory nearer in the direction of the low finish of its historic a number of of 15x P/E ($170 PT), with potential upside to 20x NTM earnings if REN and Dandelion achieve traction (116% upside).

Lengthy Mercedes-Benz Group (OTCPK:MBGYY)

Mercedes-Benz is a luxurious centered world automotive producer with resilient free money circulation technology that’s being undervalued by the market. The corporate has actively positioned itself towards excessive margin luxurious autos on the prime finish of the market, offering a buffer from the value aggressive mass-market section, significantly from aggressive Chinese language authentic gear producers (OEMs). Of be aware, Mercedes is the primary carmaker to have Stage 3 (the producer assumes full authorized danger) autonomous autos on the highway within the US (apart from Waymo) and we expect they may proceed to be know-how leaders within the autonomous car house. Whereas considerations about Mercedes’ slowing development in China and structural inefficiencies in European manufacturing persist, an inflection in MBGYY’s capital return insurance policies is what received us within the inventory lately. In mid-2024, Mercedes dedicated to returning 100% of commercial FCF to shareholders, with a 40% payout ratio for dividends (an anticipated ~8% yield at present ranges), with the remaining 60% going to share repurchases (set to purchase again ~7% of shares out yearly at present ranges).

At ~6x Worth/2025E earnings (and <2x EV/2025E earnings) together with a ~15% whole shareholder return, we discover that MBG is a compelling worth inventory with restricted draw back danger. If the corporate can additional optimize their steadiness sheet, there may be vital re-rating potential. In a base case state of affairs valuing the corporate at 6.8x industrial FCF and giving them credit score for extra money and non-operating investments (equal to ~€42B when together with its money steadiness, F1 stake at a 25% low cost to Forbes’ estimated worth, and €10.8B for his or her Daimler Truck stake), the inventory has ~66% upside.

Lengthy Subaru (OTCPK:FUJHY)

Subaru is a constantly worthwhile Japanese auto OEM with most of its gross sales within the US, to not point out it has probably the most entertaining auto memes on social media. The corporate has been FCF constructive yearly since 2009. With incessant tariff headlines, most auto OEMs aside from Tesla (TSLA) (and maybe Rivian and Ferrari) are extraordinarily out of favor with many valued at ~1x EBITDA (examine this to destructive development, decrease margin TSLA at ~100x). Subaru has been additional punished attributable to being gradual to develop electrical autos. We predict this has confirmed a prudent technique as EV’s at the moment are quickly bleeding market share globally and OEMs are having to closely low cost already unprofitable autos to promote them, in the meantime Subaru is sitting fairly from a listing perspective. Subaru is 21% owned by Toyota (TM)and is engaged in joint improvement packages for plug-in hybrid autos and electrical autos with the biggest automaker on the planet to understand extra effectivity with shared platforms and sources. Ought to Toyota proceed to attempt to clear up its capital construction and steadiness sheet by eliminating crossholdings, Subaru would make for an important bite-sized acquisition (be aware Toyota initially paid ~7x EBITDA for its Subaru stake versus present valuation at ~1x). Like Mercedes-Benz Group, Subaru lately initiated a share buyback and extra aggressive capital return coverage, with out which we admit that the shares might be extra prone to morph into a worth entice with out a catalyst. The corporate has dedicated to returning not less than 40% of earnings annually, and it clearly has the capability to distribute properly above that quantity. With a wholesome >$10B web money place and an enterprise worth approaching zero regardless of constant free money circulation technology, it’s protected to say that market’s ahead expectations for money circulation are fairly low for Subaru, and we’re getting the working enterprise nearly totally free. At simply 6x CY2026E earnings plus the $10b web money on the steadiness sheet, we expect FUJHY has ~60% upside.

Lengthy Amentum (AMTM)

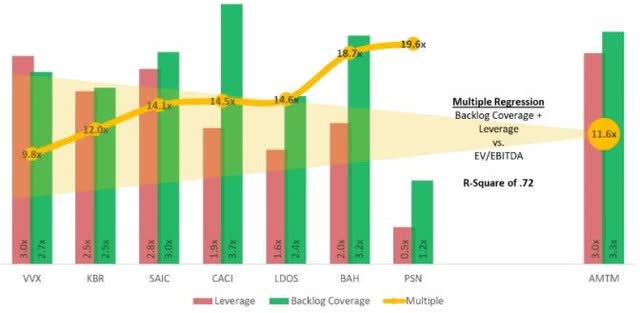

Amentum (AMTM) is a newly shaped, under-covered authorities companies chief buying and selling at an unwarranted 30%+ low cost to buying and selling friends attributable to spin-off dynamics and near-term promoting stress. With a $45 billion backlog (3.2x annual income), robust money technology and a transparent deleveraging path, AMTM gives a compelling re-rate alternative because it executes its post- merger development technique.

AMTM was shaped through a reverse Morris belief (RMT) merger between Amentum and Jacobs’ (ticker J) CMS division in Q3 2024, creating the second-largest public authorities companies supplier by income. The corporate operates throughout 5 key markets: Protection (46%), Civil (17%), Environmental (15%), House (11%), and Intelligence (11%), with rising demand throughout every section pushed by growing geopolitical tensions, cybersecurity wants, house exploration, and authorities modernization initiatives. No single contract accounts for greater than 4% of whole income and AMTM’s scale supplies a aggressive benefit in bidding for bigger contracts. About 65% of whole revenues are earned by cost-plus contracts, which protects them in a excessive inflation atmosphere, which might be our base case as Trump goals to reverse a a long time lengthy pattern of globalization.

The inventory has been whipped round like loopy out of the gate on peer’s outcomes and continuous DOGE headlines however is ignoring its personal robust fundamentals after reporting earnings and is affordable on a relative and absolute foundation at <10x FCF. With over $500M of annual FCF technology anticipated, administration is concentrated on lowering the web leverage ratio from the present 4.0x to <3x by the tip of FY26, which ought to result in a number of enlargement (we consider backlog protection and leverage can clarify a lot of the EBITDA a number of variations amongst friends).

Supply: Raymond James analysis

Jacobs has signaled its intent to promote its remaining 8% stake within the firm by the tip of June 2025, seemingly weighing on shares, however this flips to a transparent catalyst as that date approaches. Ditto as the 2 non-public fairness holders whittle their stakes down. As the corporate integrates operations and executes on synergies from the Jacobs merger, an acceleration of income development would additionally go a good distance in the direction of a a number of re-rating. At a conservative 10.5x 2026E EBITDA, a a number of that can nudge it nearer to friends as soon as they’ve de-levered a bit between now and the tip of 2026, the inventory has 80% upside to $34.

Conclusion

In the long term, TGH will show detached to each market dogma. Within the quick run, nevertheless, the dogma du jour—resembling value momentum—defines him. We reject the rampant fanaticism that always grips the market and fuels investor overconfidence, as an alternative conserving our personal fallibility entrance of thoughts. Market downturns, inevitable as they’re, can both expose hidden speculative vices or function a check of our funding virtues—chief amongst them, valuation self-discipline.

The macroeconomic information circulation in the beginning of 2025 has been viscous in its density, making it straightforward to lose sight of an optimum, bottom-up funding method. A defining characteristic of the inventory market is that it may be made infinitely easy or endlessly advanced, relying on one’s perspective. To chop by the noise, we stay centered on figuring out idiosyncratic, value- oriented particular conditions, constructing a portfolio designed to proceed producing uncorrelated alpha amid uncertainty.

Sincerely,

Voss Capital, LP

|

Appendix: 1 Supply: Financial institution of America World Analysis  2 Supply: Empirical Analysis Companions  3 YTD Flows:

4 This autumn earnings information supply is Morgan Stanley.  Frequent Phrases:

Disclosures and Notices: Starting January 1, 2020, all funding exercise is performed by the Voss Worth Grasp Fund, LP (the “Grasp Fund”), which has two feeder funds, and due to this fact efficiency figures from January 1, 2020 onward are calculated based mostly on the Grasp Fund. All restricted companions spend money on the Fund by a number of of the next feeder funds: Voss Worth Offshore Fund, Ltd. (the “Offshore Fund”) and Voss Worth Fund, LP (the “Predecessor Fund”), every a “Feeder Fund”. Efficiency figures for the Predecessor Fund are contributable to Travis Cocke as sole portfolio supervisor. Mr. Cocke maintains the identical place with the Fund and the Fund will make use of the same technique because the Predecessor Fund. Precise returns are particular to every investor investing by a Feeder Fund. Every Feeder Fund was established at totally different occasions and has various subsets of traders who could have had totally different charge constructions than these at present being provided. On account of differing charge constructions, differing tax affect on onshore and offshore traders, the timing of subscriptions and redemptions, and different components, the precise efficiency skilled by an investor could differ materially from the efficiency reported above. Portfolio statistics proven are inclusive of the Predecessor Fund and the Offshore Fund. Web outcomes are offered after deduction of all operational bills (together with brokerage commissions), 1% every year administration charge, and 20% efficiency allocation. This letter is supplied by Voss Capital, LP (“Voss”, “the Agency”, “the Voss Workforce”, “us”, “we”, and “our workforce”) for informational functions solely and doesn’t represent a proposal or a solicitation to purchase, maintain, or promote an curiosity within the Voss Worth Fund, LP (the “Fund”) or every other safety. An funding within the Fund is speculative and includes substantial dangers. Extra info relating to the Fund, together with charges, bills and dangers of funding, is contained within the providing memorandum and associated paperwork, and needs to be fastidiously reviewed. A suggestion or solicitation of an funding within the Fund will solely be made pursuant to an providing memorandum. This communication is confidential and is probably not reproduced or distributed with out prior written permission from Voss. This confidential report is barely meant for the recipient and is probably not redistributed with out the prior written consent of Voss. The data contained herein displays the opinions and projections of Voss as of the date of publication, that are topic to vary with out discover at any time subsequent to the date of problem. All info supplied is for informational functions solely and shouldn’t be deemed as funding recommendation or a advice to buy or promote any particular safety. Knowledge included on this letter comes from firm filings and displays, analyst experiences and Voss’ estimates. Whereas the knowledge offered herein is believed to be dependable, no illustration or guarantee is made regarding the accuracy of any information offered. Sure info contained on this letter constitutes “forward-looking statements” which might be recognized by way of forward-looking terminology resembling “could,” will,” “ought to,” “anticipate,” “try,” “anticipate,” “undertaking,” “estimate, or “search” or the negatives thereof or different variations thereon or comparable terminology. Attributable to varied dangers and uncertainties, precise occasions or ends in the precise efficiency of the Fund could differ materially from these mirrored or contemplated in such forward-looking statements. There might be no assure that the Fund will obtain its funding aims and Voss doesn’t characterize that any opinion or projection might be realized. The securities contained inside the benchmark indices highlighted herein don’t essentially correspond to investments and exposures that might be held by the Fund and are due to this fact of restricted use in predicting future efficiency of the fund. Indexes are unmanaged and don’t have any charges or bills. An funding can’t be made straight in an index. The Fund consists of securities which differ considerably from these within the benchmark indexes listed under. Accordingly, evaluating outcomes proven to these of such indexes could also be of restricted use. The S&P 500 Whole Return Index is a market cap weighted index of 500 extensively held shares typically used as a proxy for the general U.S. fairness market. The Russell 2000 index is an index measuring the efficiency roughly 2,000 small-cap corporations within the Russell 3000 Index. The Russell 2000 serves as a benchmark for small-cap shares in america. The Russell 2000 Progress Index measures the efficiency of these Russell 2000 corporations with increased value/guide ratios and better predicted and historic development charges. The Russell 2000 Worth Index measures the efficiency of the small-cap worth section of the U.S. fairness universe. It contains these Russell 2000 corporations with decrease price-to-book ratios and decrease anticipated and historic development values. HFRX Fairness Hedge Index encompass Fairness Hedge methods which preserve positions each lengthy and quick in primarily fairness and fairness spinoff securities. All kinds of funding processes might be employed to reach at an funding resolution, together with each quantitative and basic strategies; methods might be broadly diversified or narrowly centered on particular sectors and might vary broadly by way of ranges of web publicity, leverage employed, holding interval, concentrations of market capitalizations and valuation ranges of typical portfolios. The technique utilized by Voss has a excessive tolerance for uncertainty. Several types of investments contain various levels of danger. Due to this fact, it shouldn’t be assumed that future efficiency of any particular funding or funding technique might be worthwhile. Asset allocation could also be utilized in an effort to handle danger and improve returns. It doesn’t, nevertheless, assure a revenue or defend in opposition to loss. Previous efficiency doesn’t assure future outcomes. |

Authentic Put up

Editor’s Word: The abstract bullets for this text had been chosen by Searching for Alpha editors.