The 99 Win Non Repaint Scalping MT5 Indicator claims to resolve this precise concern. Not like conventional indicators that redraw their indicators, this instrument locks its alerts the second they seem. No disappearing arrows, no shifting traces—simply mounted indicators that keep the place they first appeared. However does it really ship on that promise, and extra importantly, is it the precise match on your buying and selling technique?

What This Indicator Truly Does

The 99 Win Non Repaint Scalping indicator is a technical evaluation instrument constructed particularly for MetaTrader 5 that generates purchase and promote indicators for short-term buying and selling. The “non repaint” designation means as soon as the indicator locations an arrow or alert on the chart, it stays there—interval. That sign received’t disappear or relocate when new value information is available in.

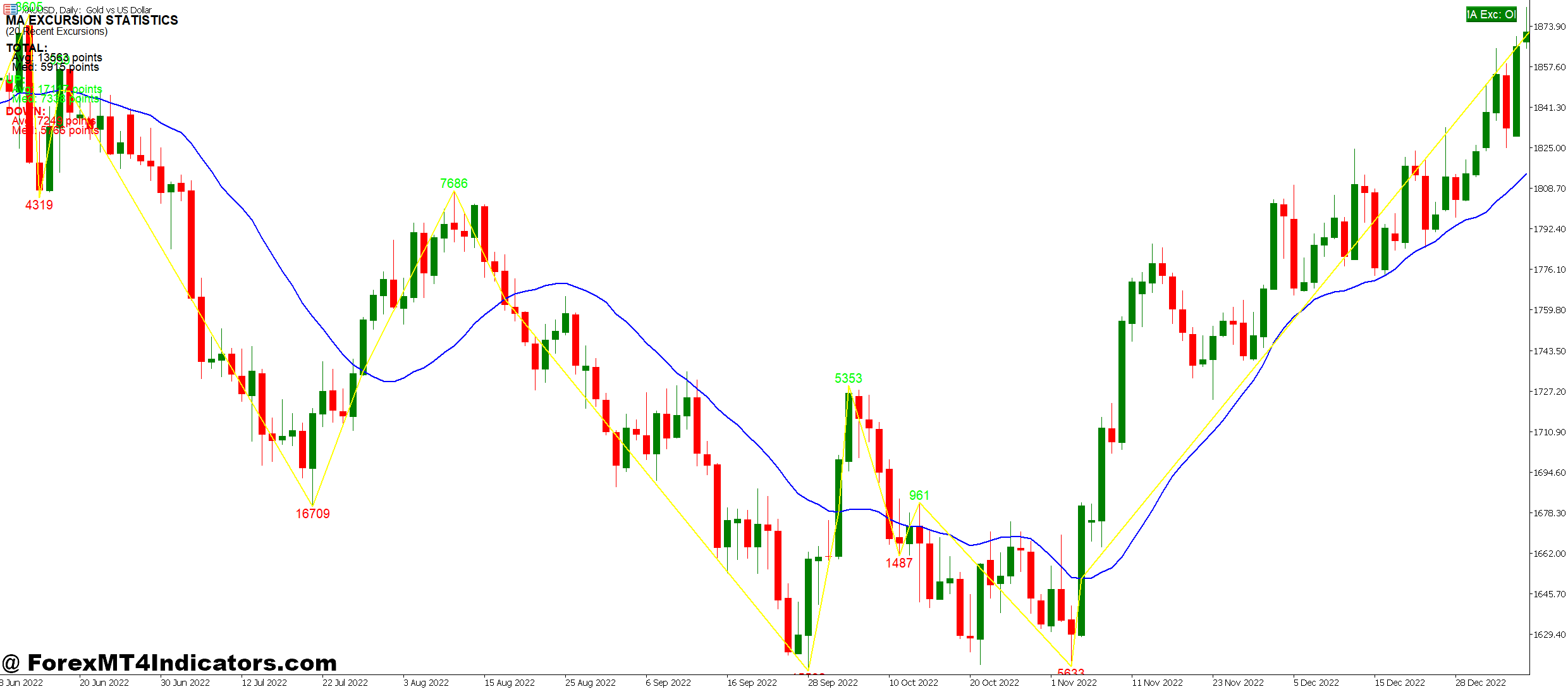

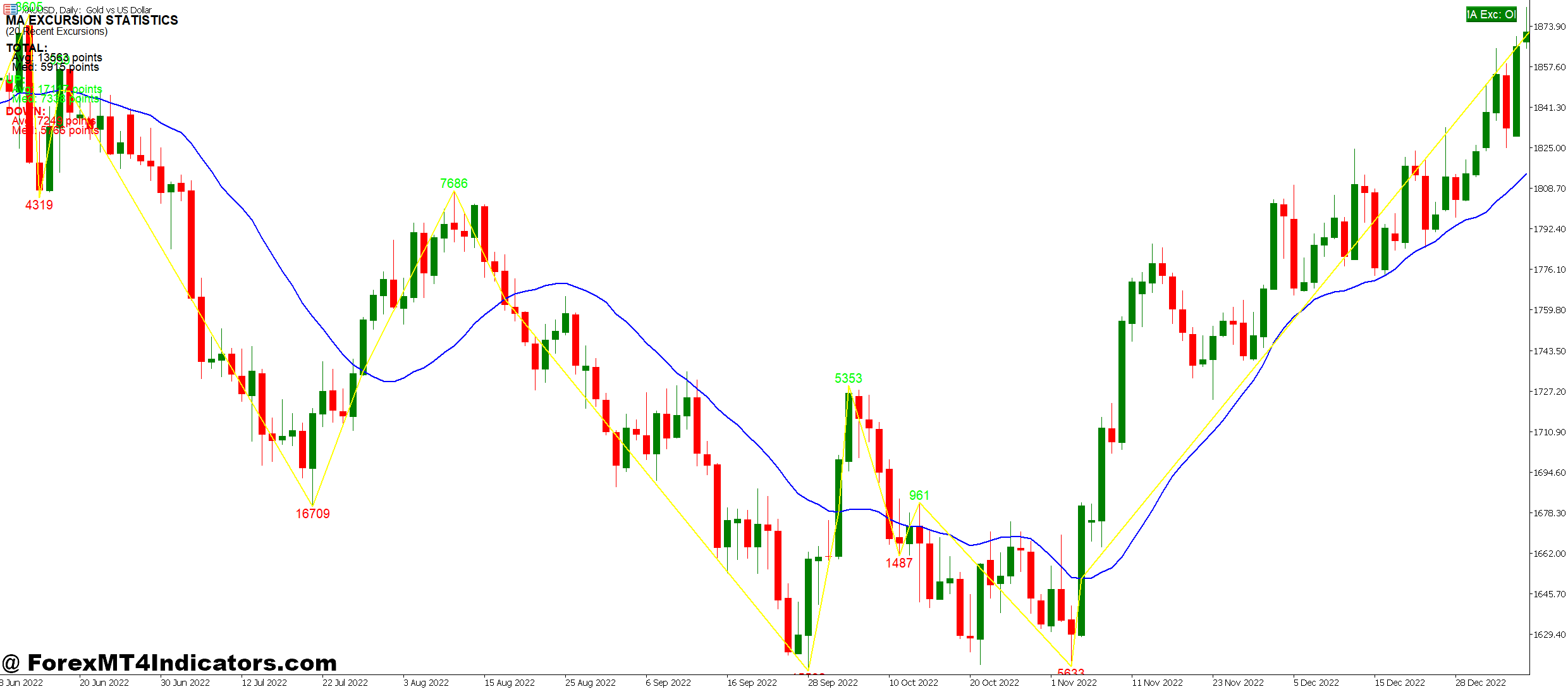

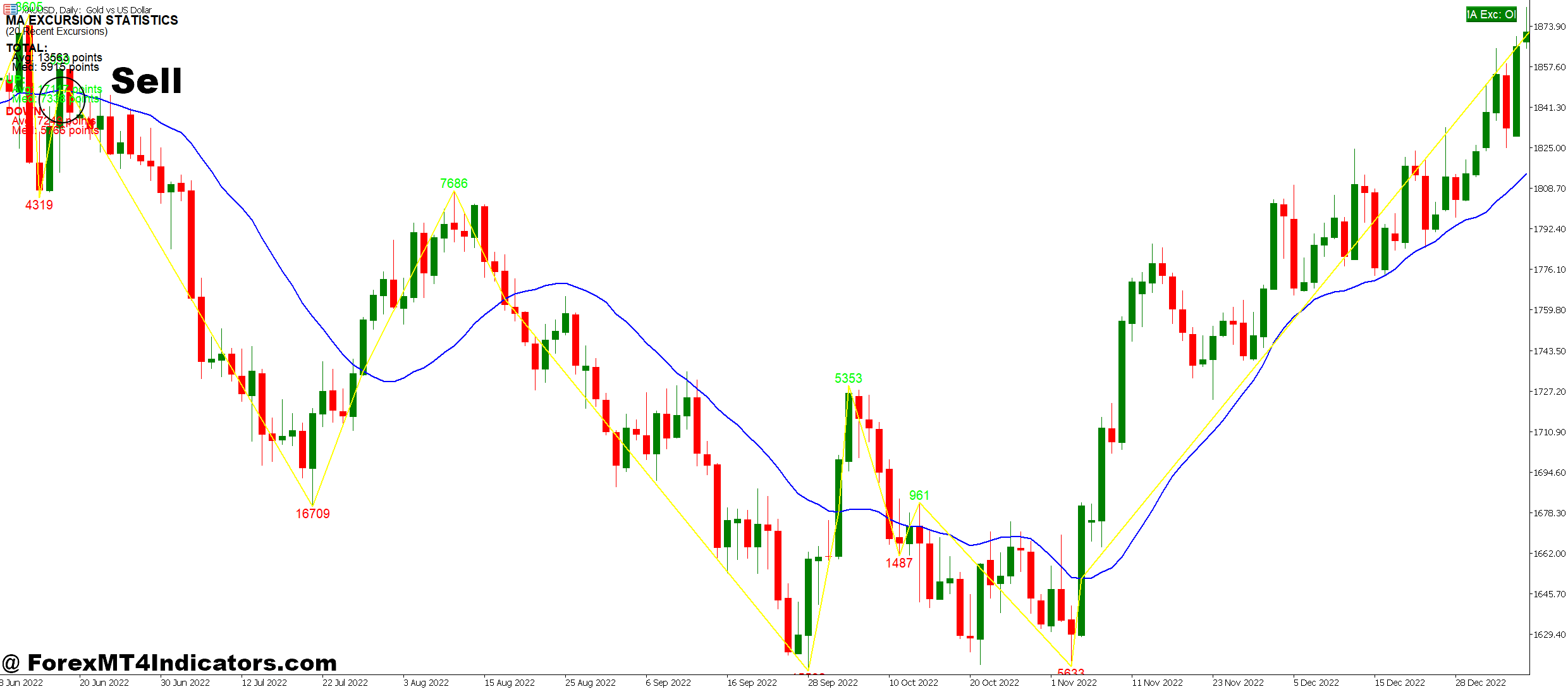

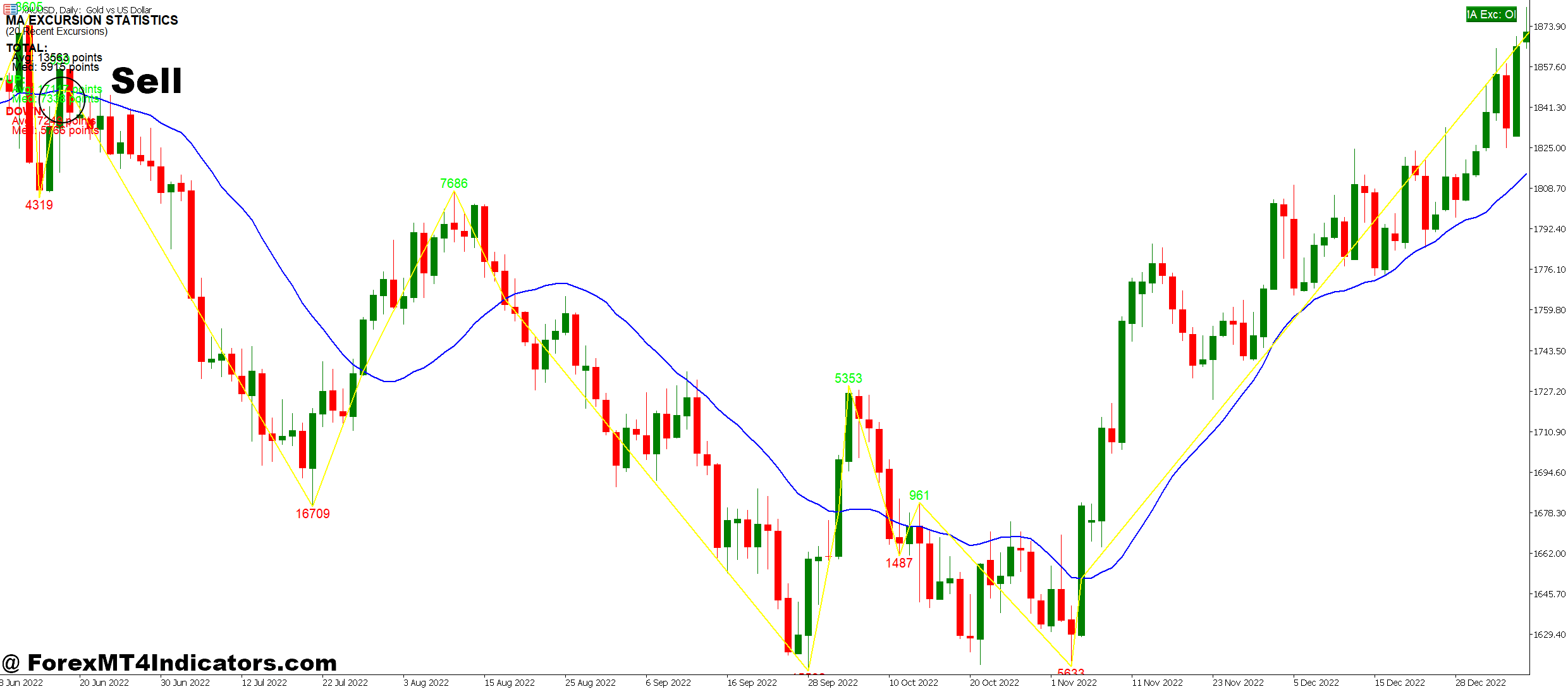

The indicator combines a number of technical parts. Most variations use a mix of shifting common crossovers, momentum filters, and value motion patterns to establish potential entry factors. When these circumstances align throughout particular market buildings, the indicator fires a visible arrow—blue for buys, pink for sells—straight on the worth chart.

What separates this from customary oscillators? Pace and specificity. The algorithm is tuned for the 1-minute to 15-minute timeframes the place scalpers function. It’s designed to catch fast 5-15 pip actions relatively than every day swings, which implies the logic filters out slower traits and focuses on fast momentum shifts.

The Mechanics Behind the Alerts

Whereas precise calculations range by model, most implementations use a three-layer method. First, the indicator measures short-term momentum utilizing one thing much like a 5-period and 10-period exponential shifting common relationship. When the sooner EMA crosses the slower one with adequate distance (not only a tiny overlap), the primary situation triggers.

Second, a volatility filter checks present market circumstances. Throughout useless markets with 2-3 pip ranges, the indicator stays quiet. It desires to see precise motion—sometimes measured via Common True Vary over the past 10-14 bars. If ATR falls beneath a threshold (normally 0.0008 for main pairs), indicators get suppressed.

Third, value motion affirmation comes into play. The indicator received’t fireplace a purchase sign if value simply rejected off a current excessive, even when shifting averages crossed bullish. This layer examines the final 3-5 candles for patterns like engulfing bars or robust directional closes. Solely when all three circumstances align does the arrow seem.

The non-repainting facet works as a result of the indicator solely plots indicators after candle shut, not mid-formation. Some merchants see this as a downside since you’ll be able to’t enter the moment momentum begins. But it surely’s the trade-off for reliability—that arrow represents a accomplished sign that met all standards, not a provisional maybe-signal that might vanish.

Placing It to Work: Actual Buying and selling Eventualities

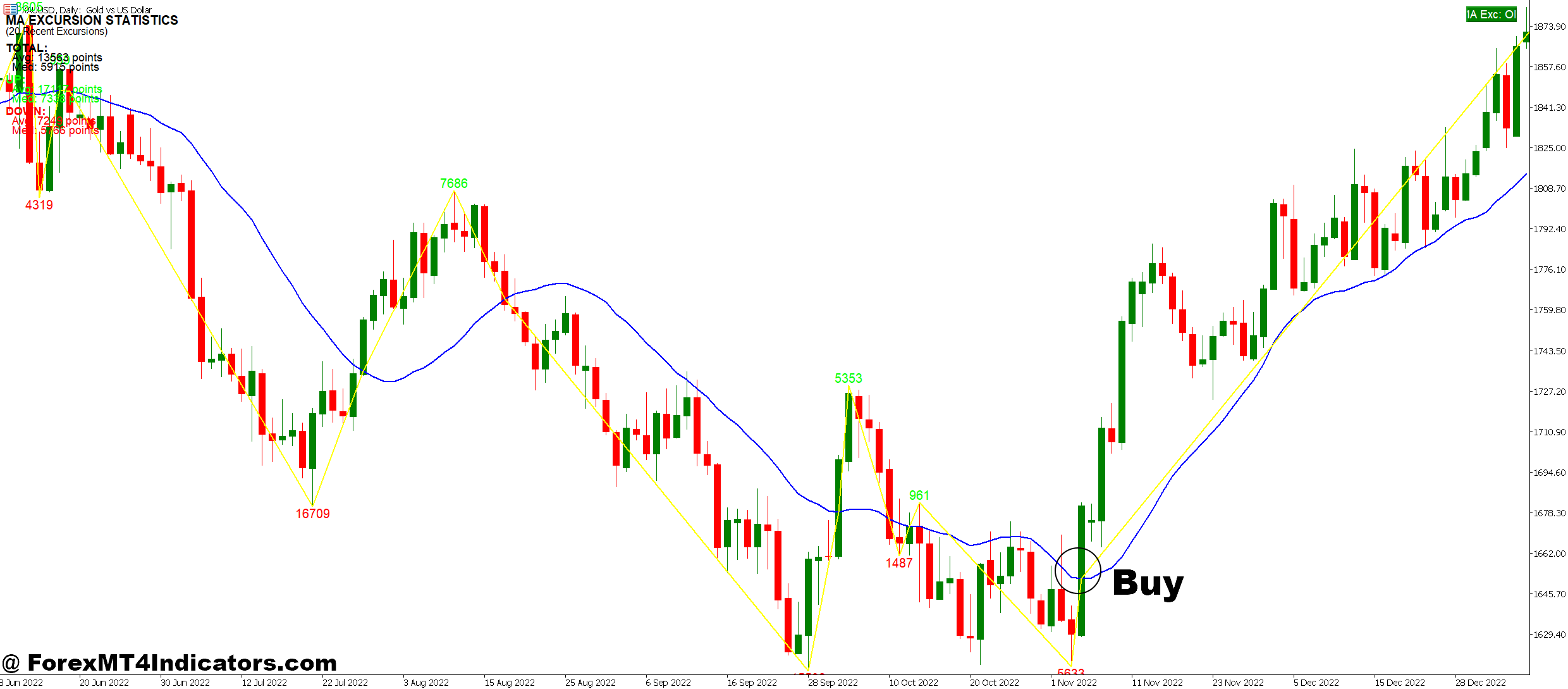

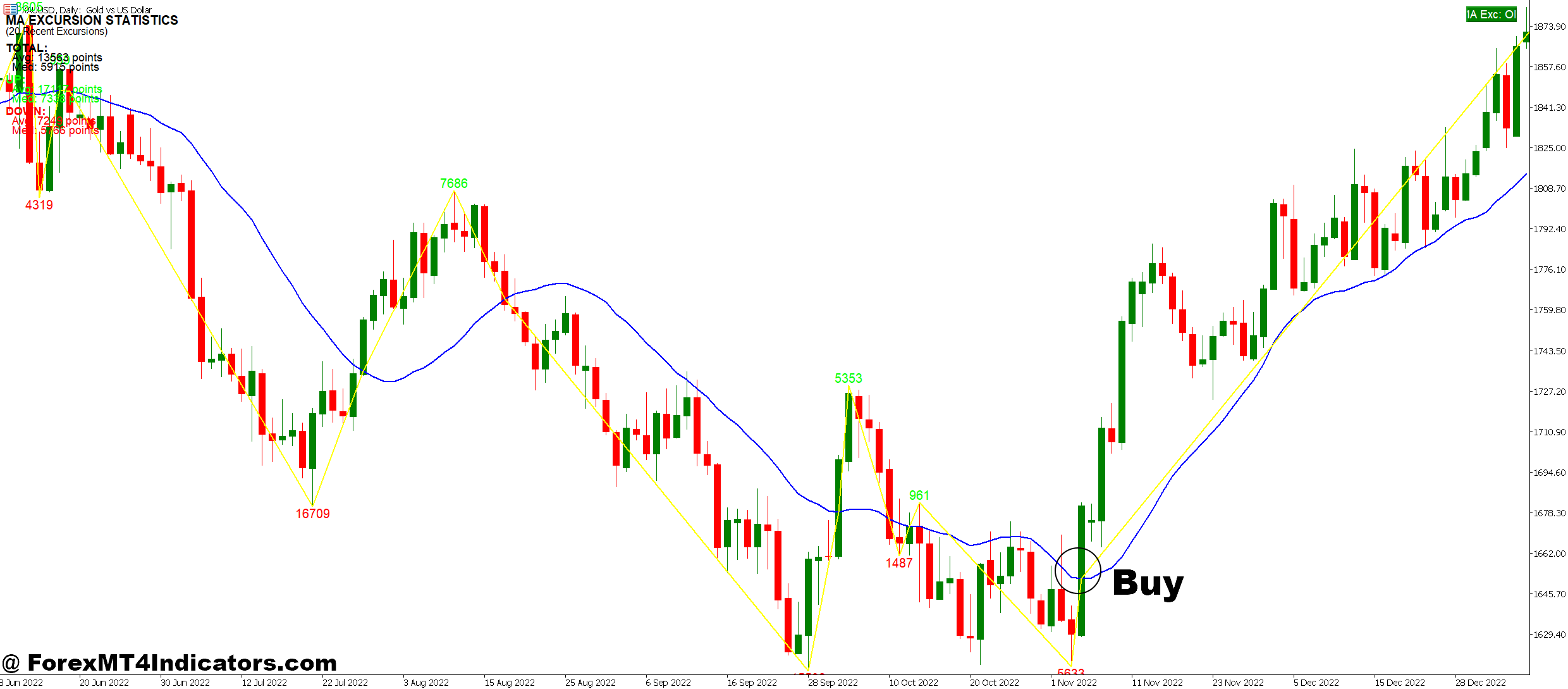

Take a typical London session open on GBP/USD utilizing the 5-minute chart. Worth had been ranging between 1.2650 and 1.2670 for the previous hour—the form of chop that eats cease losses. At 8:15 AM GMT, a information occasion triggers motion. Inside two bars, the indicator fires a blue arrow at 1.2655.

Right here’s what occurred: The 5-EMA crossed above the 10-EMA with a 3-pip separation. ATR jumped from 0.0006 to 0.0012, exhibiting volatility increasing. The earlier candle closed strongly bullish, engulfing the prior bar’s vary. All techniques inexperienced.

A dealer coming into at 1.2655 with a 10-pip cease at 1.2645 and 15-pip goal at 1.2670 would’ve seen value rally to 1.2673 inside eight minutes. That’s a 1.5:1 reward-to-risk winner that truly appeared in real-time—the arrow stayed at 1.2655 whether or not value went up or down afterward.

However right here’s the fact examine: For each clear winner like that, you’ll see 2-3 indicators that hit the cease. Perhaps the EUR/USD sign on the 1-minute chart triggered at 1.0850 throughout Asian session, solely to whipsaw in a 5-pip vary earlier than stopping out. The indicator caught momentum—downside is, momentum died in thirty seconds.

Settings That Truly Matter

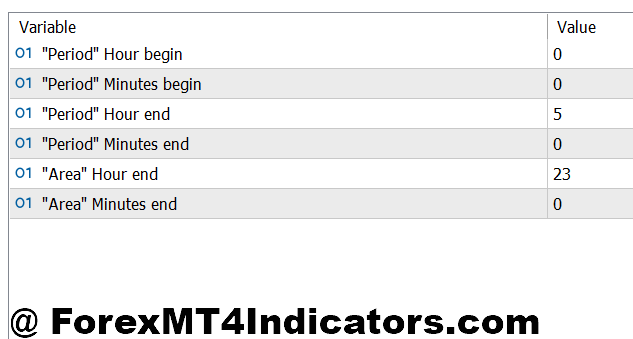

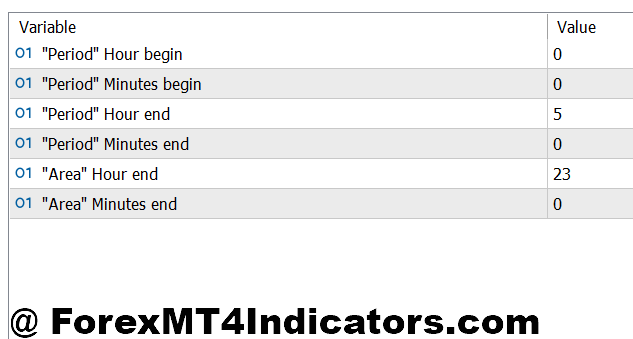

Default parameters hardly ever match everybody’s model. Most variations allow you to alter the EMA durations, ATR lookback, and sign sensitivity. For the 5-minute chart on majors like EUR/USD or USD/JPY, customary settings (5/10 EMA, 14 ATR) work decently throughout energetic classes.

Change to the 1-minute chart, and issues get twitchy. Think about tightening the ATR filter to 0.0010 minimal to scale back indicators throughout low-volatility grinds. For pairs like GBP/JPY that transfer 20-30 pips rapidly, you would possibly loosen it to 0.0015 to keep away from lacking robust strikes.

The 15-minute timeframe wants a special method solely. Right here, lengthen the EMA durations to eight/15 to filter out noise. The longer bars imply you’re catching mini-trends relatively than pure scalps, so the indicator’s logic ought to adapt. Some variations embrace a “sensitivity” slider—dial it down on increased timeframes to stop overtrading.

One parameter merchants typically ignore: sign affirmation bars. In case your model contains this, setting it to 1 means you get indicators instantly after candle shut. Setting it to 2 means the indicator waits for the subsequent bar to begin earlier than plotting the arrow. That further bar affirmation reduces indicators by roughly 40% however will increase win charge by filtering out weak setups.

The Sincere Benefits and Actual Limitations

The most important promoting level? Psychological readability. When that arrow seems, you understand it’s everlasting. Backtesting turns into significant as a result of indicators you see in historical past are the identical ones that appeared in real-time. That eliminates the harmful phantasm of excellent indicators with 85% win charges that crumble throughout reside buying and selling.

For pure scalpers buying and selling 20-30 positions per session, the indicator offers constant entry construction. You’re not guessing whether or not momentum is “sufficient” or if a crossover is “actual.” The algorithm makes that decision, eradicating emotional waffling at vital moments.

That mentioned, no scalping instrument solves the core concern: transaction prices. For those who’re paying 2 pips unfold on EUR/USD, each commerce begins 2 pips underwater. Concentrating on 10-pip scalps means you want 12 pips of favorable motion simply to interrupt even after unfold and revenue goal. The indicator would possibly sign 60% winners in value motion phrases, however after prices, that drops to 45-50% profitability.

One other limitation: range-bound slaughter. When GBP/USD trades in a 20-pip field for 3 hours, the indicator will nonetheless fireplace indicators. You’ll see arrows on the top quality (sells) and backside (buys), which sounds excellent till you notice half of them are fake-outs. The indicator can’t predict whether or not that breakdown is actual or one other failed probe.

And regardless of the “99 Win” advertising title, let’s clear this up—no indicator wins 99% of trades. Not this one, not any. For those who see advertising supplies claiming that win charge, they’re both cherry-picking timeframes, ignoring transaction prices, or testing on curve-fitted information. Actual-world scalping with this indicator runs 50-65% win charge for expert merchants throughout favorable circumstances.

How It Stacks Up Towards Options

Examine this to straightforward Stochastic or RSI scalping techniques. These oscillators work nice for figuring out overbought/oversold circumstances however generate indicators continually—many throughout horrible market buildings. The 99 Win indicator provides these volatility and value motion filters, which cuts sign frequency by 70% in comparison with uncooked oscillator crosses.

Towards Bollinger Band breakout techniques, this indicator presents extra precision. BB techniques set off when value hits outer bands, however you don’t know if that’s the beginning of a transfer or the top. The momentum affirmation layer right here waits for follow-through, decreasing these painful entries proper earlier than reversals.

The trade-off? Fewer whole indicators. Pure Stochastic crosses would possibly offer you 40 indicators in a session. This indicator would possibly fireplace 12-15. For aggressive scalpers who need fixed motion, that feels limiting. For merchants preferring high quality over amount, it’s a characteristic.

Buying and selling foreign exchange carries substantial threat. No indicator ensures income, and scalping amplifies each positive factors and losses via frequency and leverage.

How one can Commerce with 99 Win Non Repaint Scalping MT5 Indicator

Purchase Entry

- Await blue arrow affirmation – Enter solely after the candle closes fully; mid-bar indicators don’t depend and infrequently reverse earlier than the bar finishes.

- Verify ATR above 0.0008 – Affirm volatility is adequate on EUR/USD or GBP/USD pairs; coming into throughout flat ATR beneath this stage produces 70% extra false indicators.

- Set cease loss 10-12 pips beneath entry – Place your cease slightly below the sign candle’s low; tighter stops get triggered by regular unfold fluctuation throughout scalping.

- Goal 1.5:1 minimal reward-risk – Purpose for 15-18 pips revenue when risking 10 pips; something much less isn’t well worth the unfold and fee prices on fast scalps.

- Keep away from indicators throughout the Asian session – Skip trades between 11 PM – 3 AM EST when main pairs vary in 5-8 pip containers; watch for London or New York open volatility.

- Confirm value above 20-EMA – Affirm the broader pattern helps your purchase; indicators in opposition to the 1-hour or 4-hour pattern fail 60% extra typically.

- Threat most 1% per commerce – Calculate place measurement so a 10-pip cease equals 1% of your account; scalping frequency makes bigger threat percentages unsustainable.

- Skip indicators inside 5 pips of resistance – If GBP/USD fires a purchase at 1.2695 however 1.2700 rejected value thrice as we speak, cross on the commerce; trapped patrons create reversals.

Promote Entry

- Enter on the pink arrow after the candle closes – Await the complete bar to finish earlier than executing; untimely entries on creating arrows lose cash persistently.

- Affirm ATR reads 0.0010 or increased – Confirm adequate motion exists in your chart timeframe; low volatility produces 3-4 pip strikes that may’t overcome spreads.

- Place cease 10-12 pips above sign candle – Place your cease simply above the excessive of the arrow candle; account for 2-pip unfold so whole threat stays underneath 15 pips.

- Exit at 15-20 pip revenue goal – Set your take revenue earlier than coming into; scalps focusing on 25+ pips flip into swing trades when momentum stalls.

- Ignore indicators throughout information occasions – Skip trades quarter-hour earlier than and half-hour after high-impact releases; 50-pip spikes blow via stops no matter sign high quality.

- Verify value beneath 20-EMA – Make sure the 15-minute or 1-hour chart reveals downward construction; counter-trend sells on EUR/USD throughout bullish classes fail twice as typically.

- By no means threat greater than 1% per sign – Measurement your heaps so a 12-pip cease equals 1% most; taking 20-30 trades per session with 2% threat ensures account destruction.

- Keep away from promoting inside 8 pips of assist – If USD/JPY indicators a promote at 149.52 however 149.50 has held thrice this week, watch for a transparent break; blind entries at assist can gas stop-hunting.

Conclusion

The 99 Win Non Repaint Scalping MT5 Indicator delivers on its core promise—indicators that don’t disappear after the actual fact. That alone makes it extra reliable than nearly all of repainting instruments cluttering the indicator market. The mix of momentum, volatility, and value motion filters creates a fairly strong system for catching fast strikes throughout energetic buying and selling classes.

But it surely’s not magic. The indicator works finest throughout trending or unstable circumstances (London open, New York open, main information occasions) and struggles throughout Asian session ranges or low-liquidity hours. Win charges hover round 55-60% for skilled customers who perceive market construction, not the 99% recommended by the title. After spreads and commissions, scalping stays a grind that calls for self-discipline, correct place sizing, and reasonable expectations.

For those who’re contemplating this instrument, take a look at it on a demo account for not less than two weeks throughout completely different market circumstances. Monitor not simply wins and losses, however sign frequency, time of day patterns, and which forex pairs reply finest. The indicator offers construction, however your execution and cash administration decide whether or not it turns into worthwhile or simply one other deserted instrument in your buying and selling arsenal.

Beneficial MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Further Unique Bonuses All through The 12 months

- Unique 90% VIP Money Rebates for all Trades!

>> Signal Up for XM Dealer Account right here with Unique 90% VIP Money Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Companion Code: VIP90