Information reveals the cryptocurrency derivatives sector has seen a mass liquidation occasion up to now day as Bitcoin and different property have crashed.

Crypto Market Has Seen A Lengthy Squeeze In The Final 24 Hours

In accordance with knowledge from CoinGlass, a considerable amount of contracts have been liquidated in the course of the previous day. A place is alleged to be “liquidated” when its platform decides to forcibly shut it down. The trade does this when the holder has amassed losses exceeding a sure threshold.

There are two elements that may elevate the possibilities of liquidation. The primary one is volatility. A extremely unstable asset can find yourself fluctuating each methods a lot that it may be onerous to wager on a route.

Volatility isn’t within the person’s hand, however the second issue, leverage, is. “Leverage” refers to a mortgage quantity that any investor can decide to take up in opposition to their preliminary collateral. Leverage can imply that the income earned by the holder grow to be multitudes extra, however the identical additionally applies to the losses, so the danger of liquidation naturally rises.

Within the cryptocurrency market, each of those elements are usually all the time current, as cash typically show wild swings inside quick home windows and there may be an abundance of speculators keen to wager excessive.

The results of these circumstances is that mass liquidation occasions, popularly referred to as squeezes, happen on the common. One such occasion has taken place within the final 24 hours, because the under desk reveals.

Seems to be just like the liquidations have closely tended in the direction of lengthy contracts on this interval | Supply: CoinGlass

As is seen, cryptocurrency-related liquidations have totaled as much as a whopping $904 million in the course of the previous day. Out of those, $811 million of the flush, representing virtually 90% of the entire, concerned the lengthy contract holders alone.

The rationale behind the liquidations leaning so closely in the direction of the merchants betting on a bullish final result naturally lies in the truth that Bitcoin and different property have witnessed a crash on this window.

Here’s a heatmap that reveals how the liquidations have seemed when divided by image:

The distribution of the liquidations by image | Supply: CoinGlass

As displayed above, Bitcoin has contributed to the most important share of the liquidations at $261 million. Ethereum (ETH) has come second at $113 million and Solana (SOL) third at $39 million.

XRP (XRP) is bigger in market cap than SOL, however has nonetheless carried out worse on this metric, probably due to the truth that the latter has seen a bigger worth drawdown.

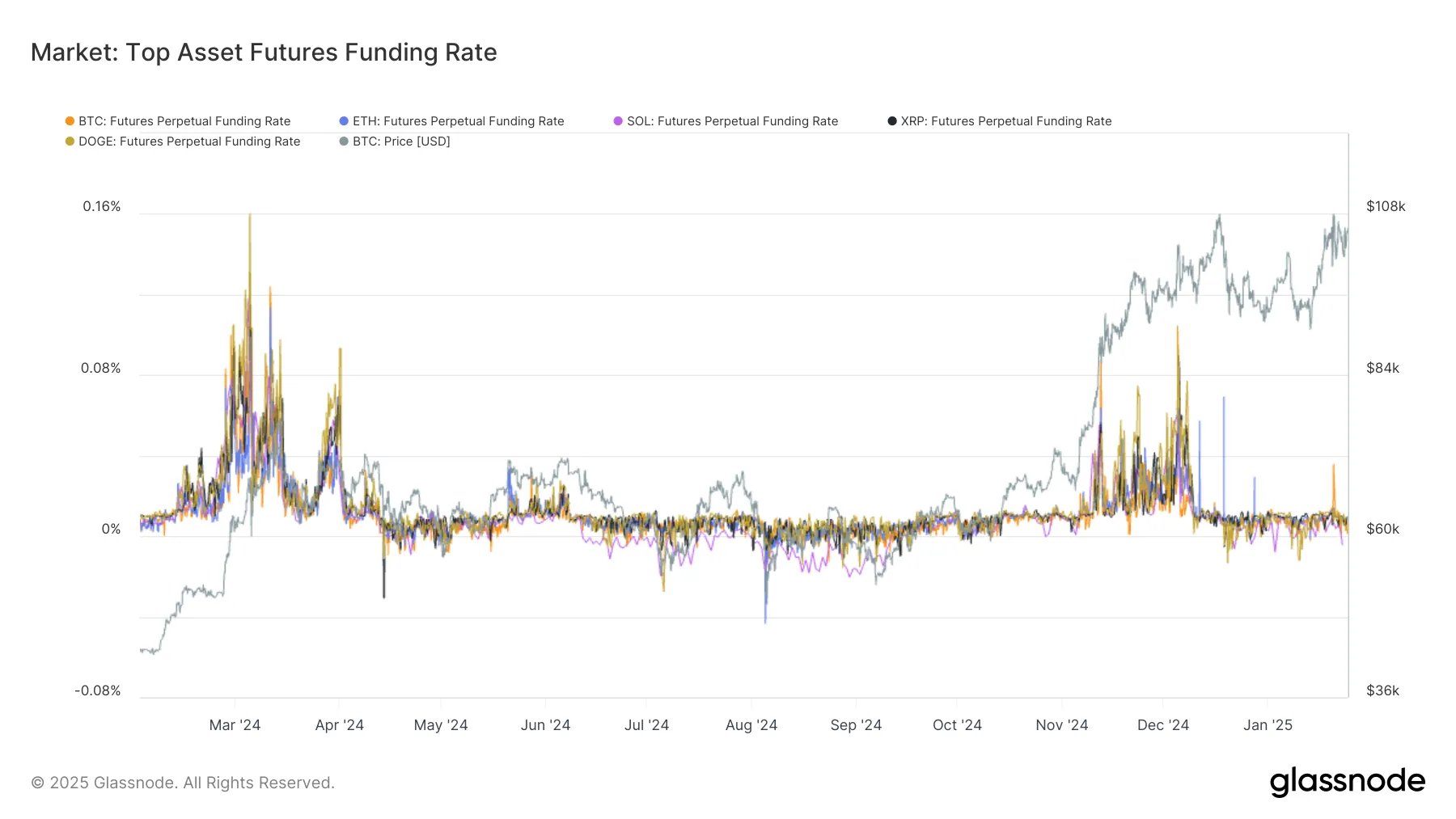

Apparently, whereas an extended squeeze has occurred within the sector, the exchanges have really not been too long-heavy when it comes to positions not too long ago, because the analytics agency Glassnode has identified in an X submit.

The development within the futures funding fee for the highest 5 cryptocurrencies | Supply: Glassnode on X

“The hourly funding charges for the highest 5 property available in the market ( $BTC, $ETH, $SOL, $XRP, $DOGE) present the urge for food for lengthy positions has not returned to the degrees seen within the November to early December rally,” notes Glassnode.

BTC Worth

On the time of writing, Bitcoin is buying and selling at round $100,400, down over 4% within the final seven days.

The worth of the coin appears to have plunged over the previous day | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, CoinGlass.com, Glassnode.com, chart from TradingView.com