- Whereas main US inventory indexes concentrate on large-cap corporations, the Russell 2000 affords perception into the well being of small-cap companies.

- The Russell 2000 is critical because it contains small corporations that present a novel perspective on the nation’s financial well-being.

- On this piece, we are going to study 5 extremely rated shares inside the Russell 2000.

- In 2024, make investments like the large funds from the consolation of your house with our AI-powered ProPicks inventory choice instrument. Be taught extra right here>>

The three essential inventory market indexes within the nation, the , , and Nasdaq, primarily embody large-cap corporations. Nevertheless, there are additionally different indexes composed of small-cap corporations, such because the and the .

The Russell 2000 holds specific significance as a result of small corporations inside it usually present a extra correct reflection of the nation’s financial well being.

These companies concentrate on inside and home operations, primarily inside the US.

To be included within the Russell 2000, corporations should meet three necessities:

- Dimension: The market capitalization of the corporate searching for entry should exceed $30 million.

- Liquidity: The corporate will need to have a day by day common buying and selling quantity of a minimum of $130,000.

- Float: The float, representing the out there excellent shares for buy, should be better than 5% of the whole shares available in the market.

Small market capitalization corporations, generally known as small caps, fall inside the $300 million to $2 billion market cap vary.

These above $2 billion are thought-about medium caps, and the most important are referred to as massive caps or massive caps.

Buyers all for small-cap shares can select from varied specialised automobiles, together with mutual funds and ETFs.

However on this piece, we are going to check out 5 shares inside the Russell 2000 which can be extremely rated by the market, and we are going to make the most of InvestingPro as our major supply of data.

1. Karyopharm Therapeutics

Karyopharm Therapeutics (NASDAQ:) is a pharmaceutical firm that develops and markets medication aimed toward treating most cancers and different illnesses.

The corporate was integrated in 2008 and is headquartered in Newton, Massachusetts.

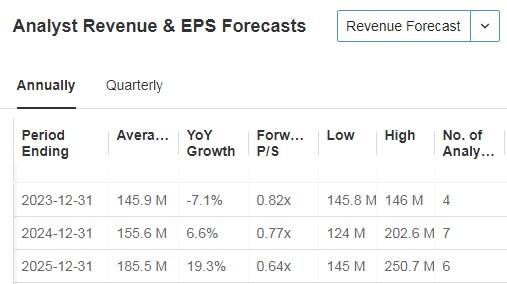

It reviews quarterly outcomes on February 15. Waiting for 2024 the forecast is for earnings per share (EPS) to extend +6.6%, with the rise being +19.3% by 2025.

Karyopharm Therapeutics Analyst Estimates

Supply: InvestingPro

Its shares closed the week at $1.04. The potential the market offers it’s great, at at least round $6.

Karyopharm Therapeutics Targets

Supply: InvestingPro

2. Rallybio

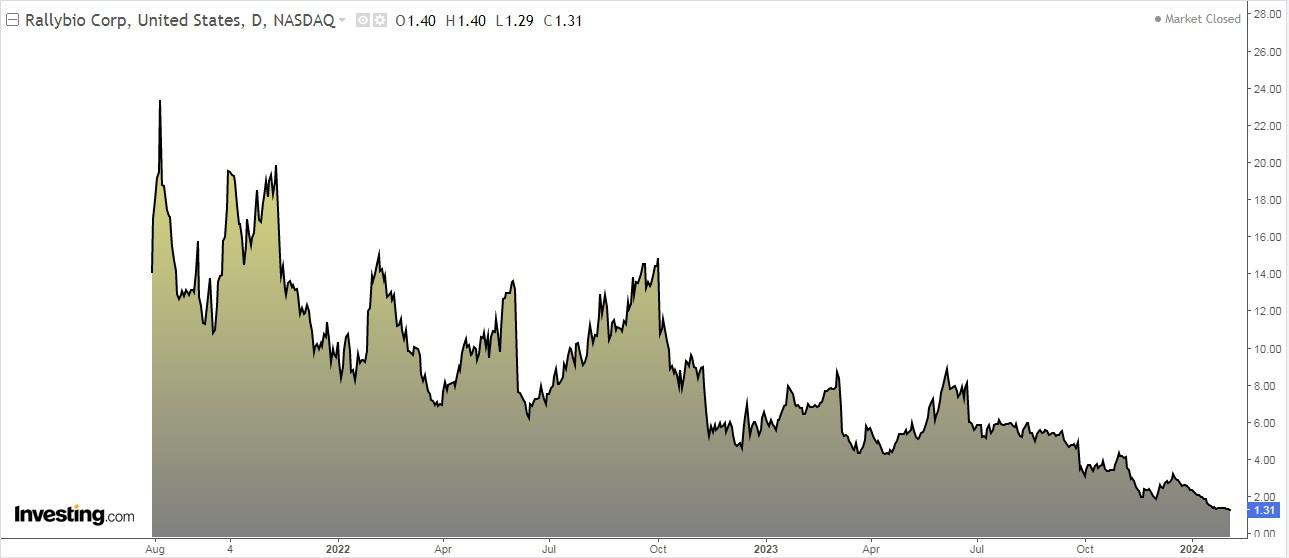

Rallybio (NASDAQ:) is a biotech firm that’s devoted to creating life-transforming therapies for sufferers affected by critical and uncommon illnesses. It was based in 2018 and is predicated in New Haven, Connecticut.

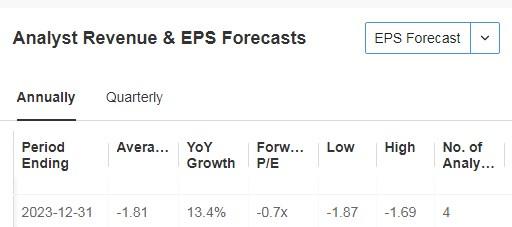

On March 12, we are going to know its accounts for the quarter. The forecast is that within the computation of 2023, it’ll have elevated its earnings per share (EPS) by +13.4%.

Rallybio Forecasts

Supply: InvestingPro

In 2023 a few of their analysis handed part 1 and now in 2024, they count on every little thing to go nicely and obtain essential milestones.

Its shares closed the week at $1.31. The potential the market offers it’s stratospheric at $13.80.

Rallybio Targets

Supply: InvestingPro

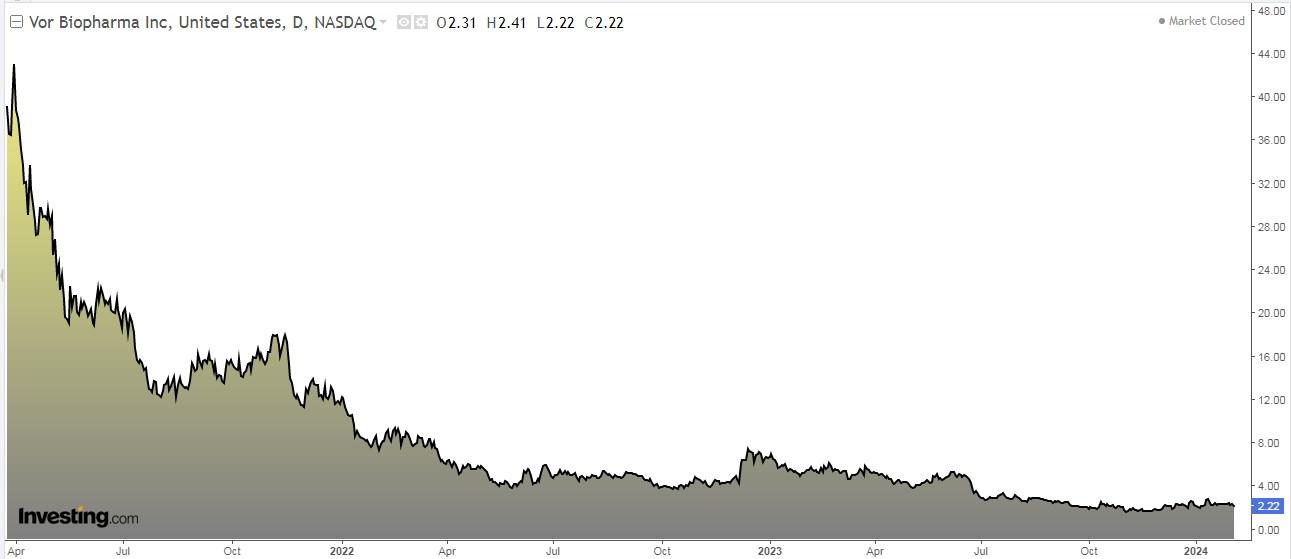

3. Vor Biopharma

Vor Biopharma (NASDAQ:) is engaged within the improvement of engineered stem cell therapies for most cancers sufferers. The corporate was shaped in 2015 and is predicated in Cambridge, Massachusetts.

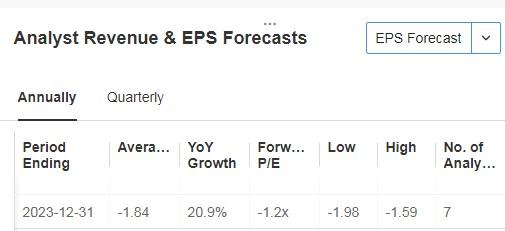

It should launch its numbers for the quarter on March 21 and is anticipated to extend earnings per share (EPS) by +15.74% and finish 2023 on its computation with a rise of +20.9%.

Vor Biopharma Forecasts

Supply: InvestingPro

Its shares closed the week at $2.22. The potential given by the market stands at $15.07.

Vor Biopharma Targets

Supply: InvestingPro

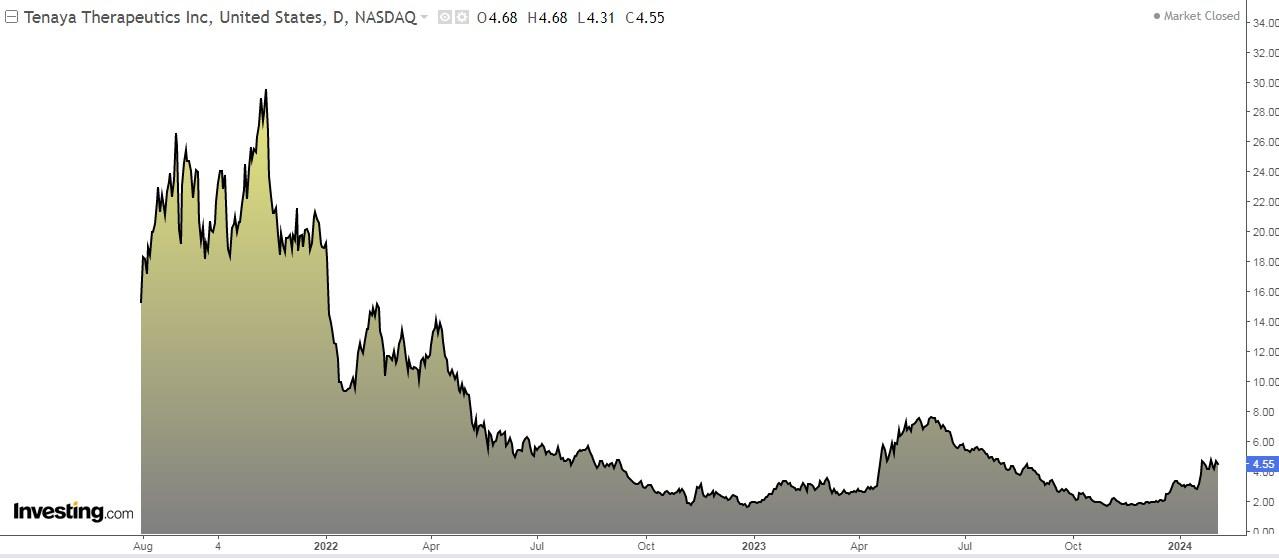

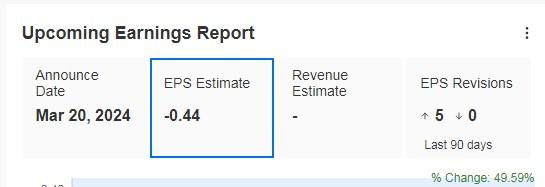

4. Tenaya Therapeutics

Tenaya Therapeutics (NASDAQ:) is a biotechnology firm that develops and affords therapies for coronary heart illness. It was integrated in 2016 and is headquartered in South San Francisco, California.

On March 20 flip for quarter accounts with a forecast of an earnings per share (EPS) enhance of +49.59%.

Tenaya Therapeutics Upcoming Earnings

Supply: InvestingPro

It presents 7 rankings, of which all are purchase.

Its shares closed the week at $4.55. The potential given by the market stands at $19.14.

Tenaya Therapeutics Targets

Supply: InvestingPro

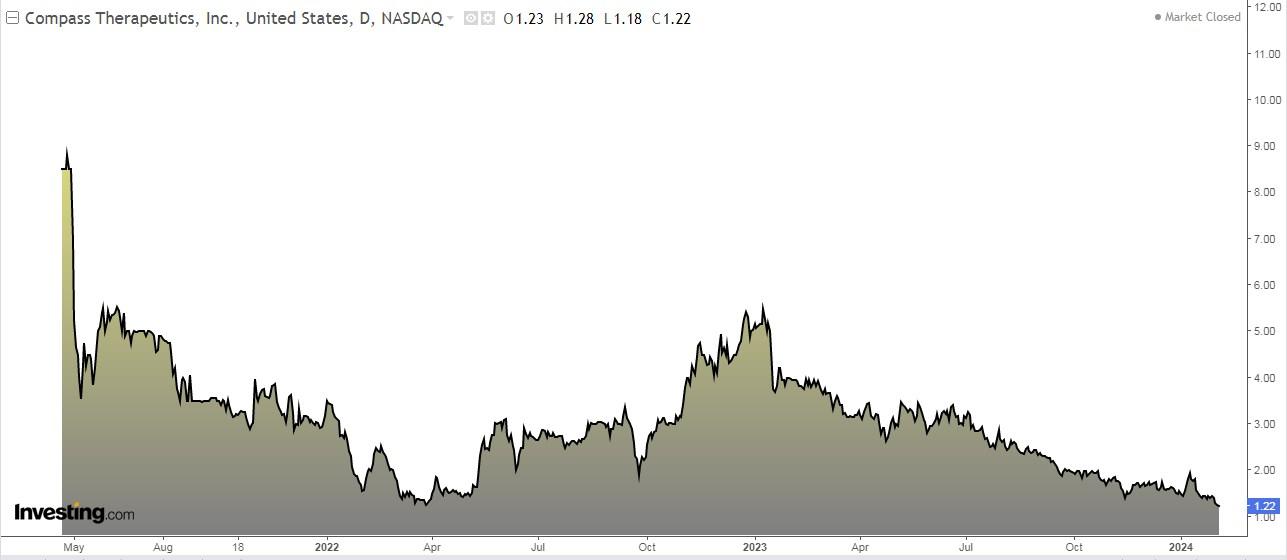

5. Compass Therapeutics

Compass Therapeutics (NASDAQ:) is a biopharmaceutical firm engaged within the improvement of antibody-based therapeutics to deal with varied illnesses. It was based in 2014 and is predicated in Boston, Massachusetts.

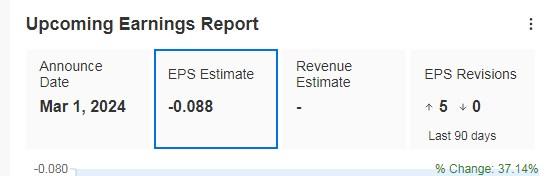

On March 1, we are going to get the quarterly numbers, and so they’re anticipated to indicate a rise in earnings per share (EPS) of +37.14%.

Compass Therapeutics Upcoming Earnings

Supply: InvestingPro

Its shares closed the week at $1.22. The potential given by the market stands at $9.40.

Compass Therapeutics Targets

Supply: InvestingPro

***

Take your investing recreation to the following degree in 2024 with ProPicks

Establishments and billionaire buyers worldwide are already nicely forward of the sport relating to AI-powered investing, extensively utilizing, customizing, and creating it to bulk up their returns and decrease losses.

Now, InvestingPro customers can just do the identical from the consolation of their very own properties with our new flagship AI-powered stock-picking instrument: ProPicks.

With our six methods, together with the flagship “Tech Titans,” which outperformed the market by a lofty 1,183% during the last decade, buyers have the very best number of shares available in the market on the tip of their fingers each month.

Subscribe right here and by no means miss a bull market once more!

Subscribe Now!

Remember your free reward! Use coupon code OAPRO1 at checkout for a ten% low cost on the Professional yearly plan, and OAPRO2 for an additional 10% low cost on the by-yearly plan.

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, or suggestion to speculate as such it isn’t supposed to incentivize the acquisition of belongings in any means. I wish to remind you that any sort of asset, is evaluated from a number of factors of view and is very dangerous and subsequently, any funding determination and the related threat stays with the investor.