Printed on Might twenty seventh, 2025 by Bob Ciura

Spreadsheet knowledge up to date every day

Traders are possible aware of the Dividend Aristocrats, a gaggle of 69 shares within the S&P 500 Index with 25+ consecutive years of dividend will increase.

In the meantime, buyers must also familiarize themselves with the Dividend Champions, which have additionally raised their dividends for at the least 25 years in a row.

You’ll be able to obtain your free copy of the Dividend Champions record, together with related monetary metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the hyperlink beneath:

Nonetheless, even Dividend Champions can fall from grace. For instance, Walgreens Boots Alliance (WBA) was faraway from the Dividend Champions record in 2024.

The corporate slashed its dividend as a result of a pronounced enterprise downturn within the brick-and-mortar pharmacy retail trade, amid elevated aggressive threats from on-line pharmacies.

This was after Walgreens Boots Alliance had maintained a 40+ 12 months streak of consecutive dividend will increase.

Whereas dividend cuts from Dividend Champions are sudden, they’ve occurred–and will occur once more. To be clear, the next 5 Dividend Champions will not be at the moment in jeopardy of reducing their dividends.

Their dividend payouts are supported with adequate underlying earnings (for now). If their earnings stay secure or proceed to develop, they’ve at the least a good change of continuous their dividend progress.

However, the 5 Dividend Champions beneath are dealing with elementary challenges to various levels, which doubtlessly threatens their dividend payouts.

This text will present an in depth evaluation on 5 Dividend Champions most in peril of a future dividend reduce.

These 5 Dividend Champions have the bottom Dividend Danger Scores of ‘C’, ‘D’, or ‘F’ within the Positive Evaluation Analysis Database, indicating weak dividend protection.

Desk of Contents

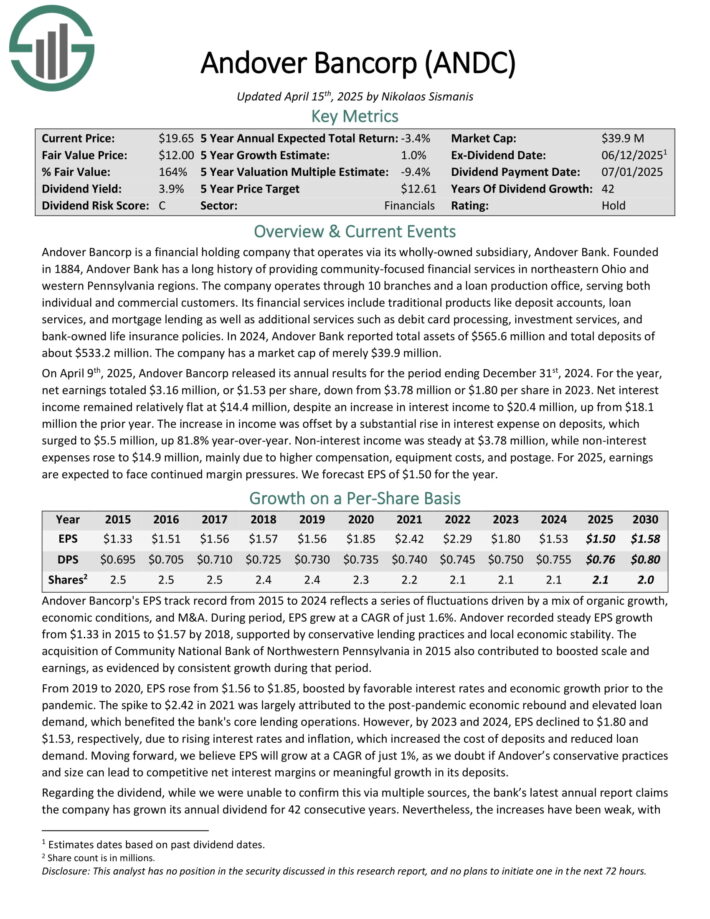

Purple Flag Dividend Champion: Andover Bancorp (ANDC)

Andover Bancorp is a monetary holding firm that operates through its wholly-owned subsidiary, Andover Financial institution. Based in 1884, Andover Financial institution has an extended historical past of offering community-focused monetary companies in northeastern Ohio and western Pennsylvania areas.

The corporate operates via 10 branches and a mortgage manufacturing workplace, serving each particular person and business clients.

Its monetary companies embody conventional merchandise like deposit accounts, mortgage companies, and mortgage lending in addition to extra companies akin to debit card processing, funding companies, and bank-owned life insurance coverage insurance policies.

In 2024, Andover Financial institution reported whole property of $565.6 million and whole deposits of about $533.2 million.

On April ninth, 2025, Andover Bancorp launched its annual outcomes for the interval ending December thirty first, 2024. For the 12 months, web earnings totaled $3.16 million, or $1.53 per share, down from $3.78 million or $1.80 per share in 2023.

Internet curiosity revenue remained comparatively flat at $14.4 million, regardless of a rise in curiosity revenue to $20.4 million, up from $18.1 million the prior 12 months.

The rise in revenue was offset by a considerable rise in curiosity expense on deposits, which surged to $5.5 million, up 81.8% year-over-year.

Click on right here to obtain our most up-to-date Positive Evaluation report on ANDC (preview of web page 1 of three proven beneath):

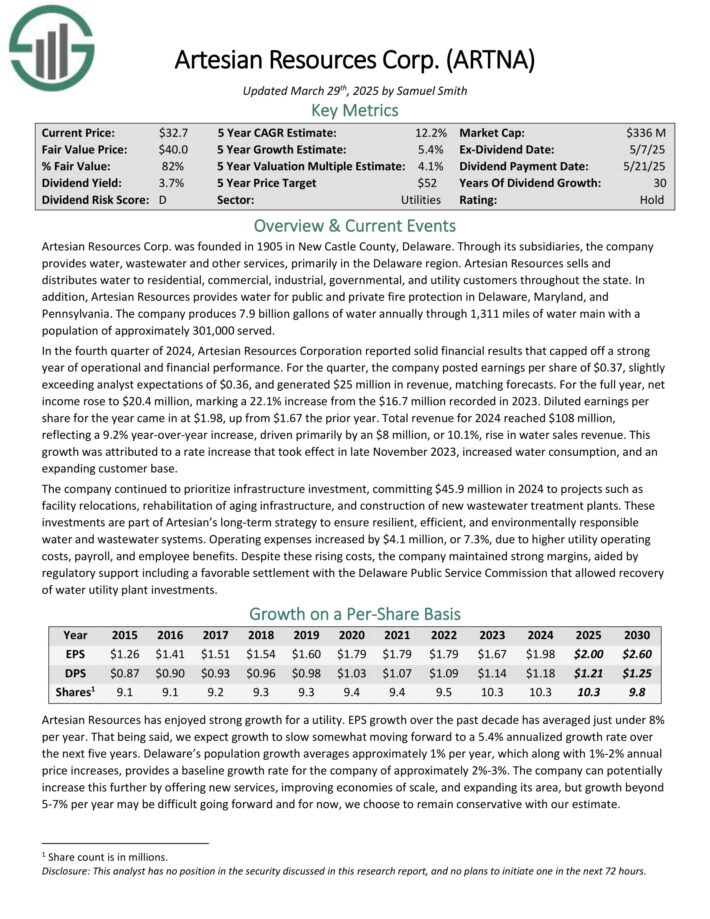

Purple Flag Dividend Champion: Artesian Sources (ARTNA)

Artesian Sources Corp. was based in 1905 in New Fort County, Delaware. Via its subsidiaries, the corporate offers water, wastewater and different companies, primarily within the Delaware area.

Artesian Sources sells and distributes water to residential, business, industrial, governmental, and utility clients all through the state.

As well as, Artesian Sources offers water for private and non-private fireplace safety in Delaware, Maryland, and Pennsylvania. The corporate produces 7.9 billion gallons of water yearly via 1,311 miles of water important with a inhabitants of roughly 301,000 served.

Within the fourth quarter of 2024, Artesian Sources Company reported earnings per share of $0.37, barely exceeding analyst expectations of $0.36, and generated $25 million in income, matching forecasts.

Click on right here to obtain our most up-to-date Positive Evaluation report on ARTNA (preview of web page 1 of three proven beneath):

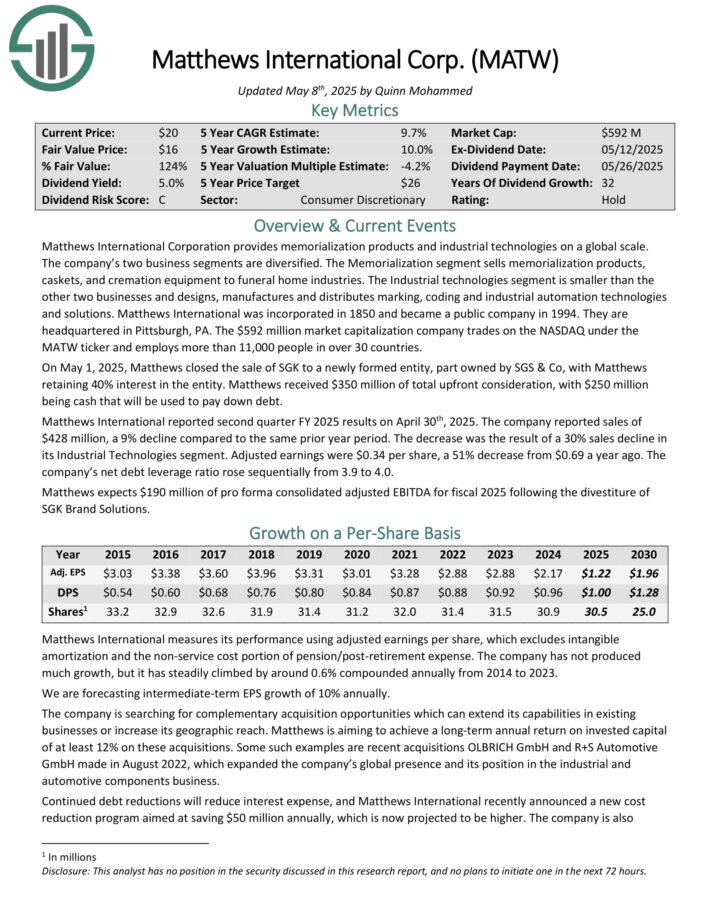

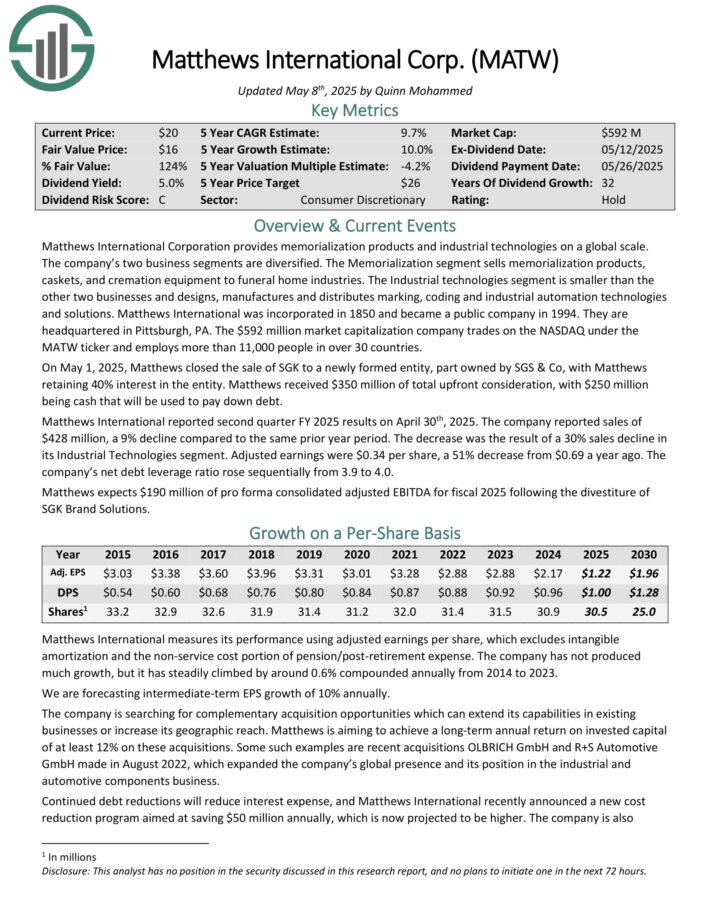

Purple Flag Dividend Champion: Matthews Worldwide (MATW)

Matthews Worldwide Company offers model options, memorialization merchandise and industrial applied sciences on a world scale. The corporate’s three enterprise segments are diversified.

The SGK Model Options offers model improvement companies, printing tools, inventive design companies, and embossing instruments to the consumer-packaged items and packaging industries.

The Memorialization section sells memorialization merchandise, caskets, and cremation tools to funeral dwelling industries.

The Industrial applied sciences section is smaller than the opposite two companies and designs, manufactures and distributes marking, coding and industrial automation applied sciences and options.

Matthews Worldwide reported second quarter FY 2025 outcomes on April thirtieth, 2025. The corporate reported gross sales of $428 million, a 9% decline in comparison with the identical prior 12 months interval. The lower was the results of a 30% gross sales decline in its Industrial Applied sciences section.

Adjusted earnings had been $0.34 per share, a 51% lower from $0.69 a 12 months in the past. The corporate’s web debt leverage ratio rose sequentially from 3.9 to 4.0.

Click on right here to obtain our most up-to-date Positive Evaluation report on MATW (preview of web page 1 of three proven beneath):

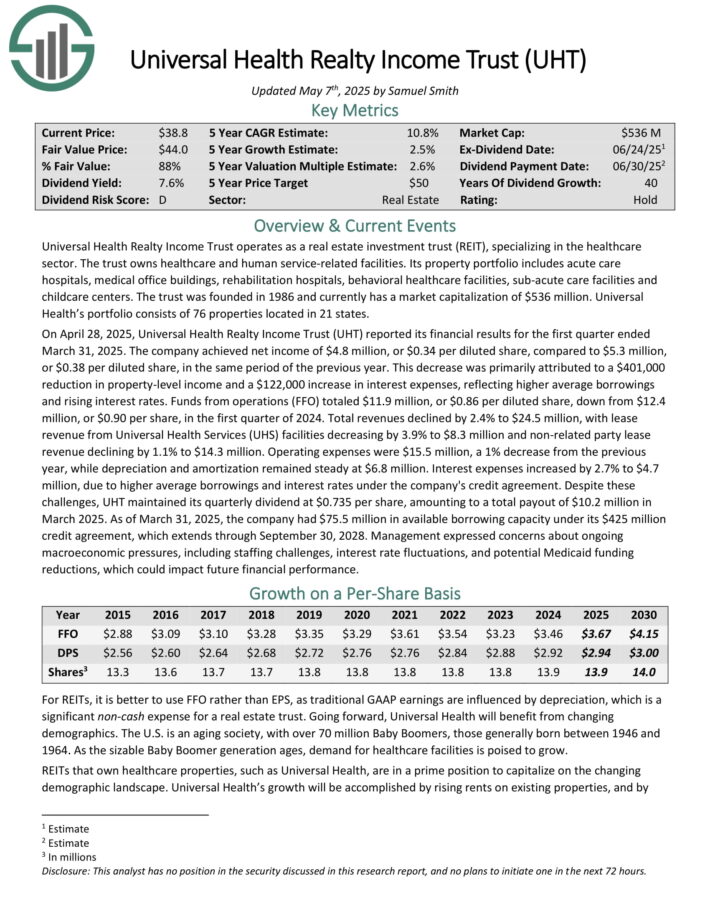

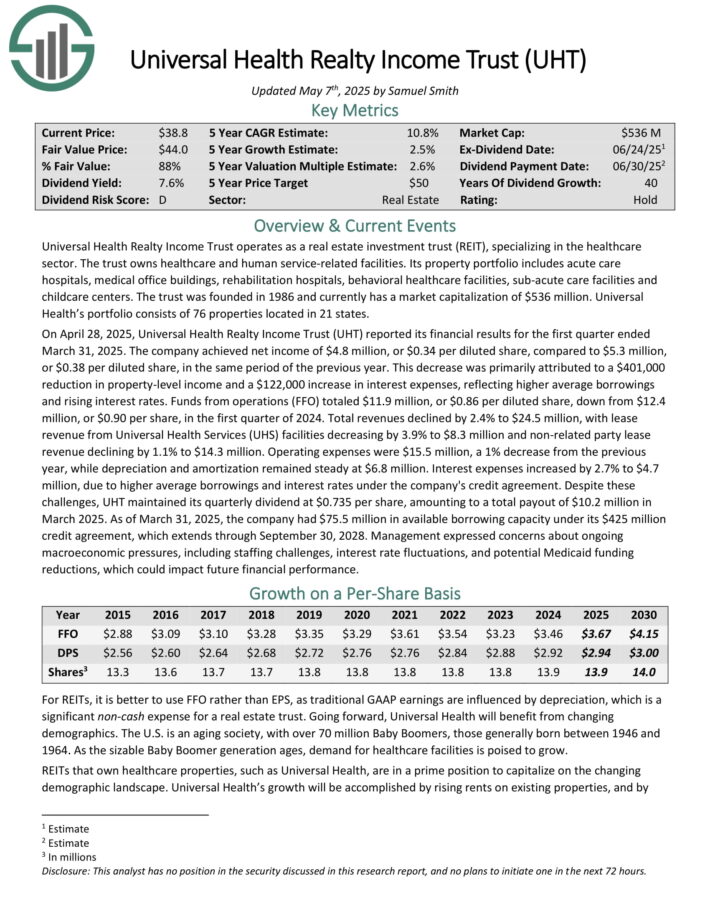

Purple Flag Dividend Champion: Common Well being Realty Earnings Belief (UHT)

Common Well being Realty Earnings Belief operates as an actual property funding belief (REIT), specializing within the healthcare sector. The belief owns healthcare and human service-related amenities.

Its property portfolio contains acute care hospitals, medical workplace buildings, rehabilitation hospitals, behavioral healthcare amenities, sub-acute care amenities and childcare facilities.

Common Well being’s portfolio consists of 76 properties positioned in 21 states.

On April 28, 2025, Common Well being Realty Earnings Belief (UHT) reported its monetary outcomes for the primary quarter ended March 31, 2025. The corporate achieved web revenue of $4.8 million, or $0.34 per diluted share, in comparison with $5.3 million, or $0.38 per diluted share, in the identical interval of the earlier 12 months.

This lower was primarily attributed to a $401,000 discount in property-level revenue and a $122,000 improve in curiosity bills, reflecting increased common borrowings and rising rates of interest.

Funds from operations (FFO) totaled $11.9 million, or $0.86 per diluted share, down from $12.4 million, or $0.90 per share, within the first quarter of 2024. Complete revenues declined by 2.4%.

Click on right here to obtain our most up-to-date Positive Evaluation report on UHT (preview of web page 1 of three proven beneath):

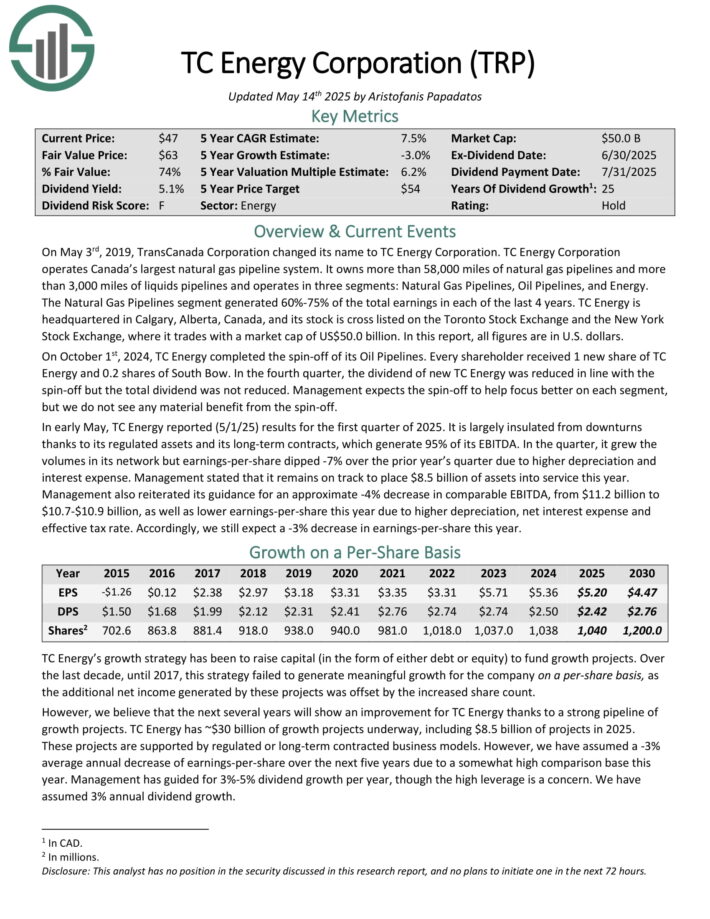

Purple Flag Dividend Champion: TC Vitality Corp. (TRP)

TC Vitality Company operates Canada’s largest pure fuel pipeline system. It owns greater than 58,000 miles of pure fuel pipelines and greater than 3,000 miles of liquids pipelines and operates in three segments: Pure Fuel Pipelines, Oil Pipelines, and Vitality.

The Pure Fuel Pipelines section generated 60%-75% of the full earnings in every of the final 4 years. TC Vitality is headquartered in Calgary, Alberta, Canada. On this report, all figures are in U.S. {dollars}.

In early Might, TC Vitality reported (5/1/25) outcomes for the primary quarter of 2025. It’s largely insulated from downturns because of its regulated property and its long-term contracts, which generate 95% of its EBITDA.

Within the quarter, it grew the volumes in its community however earnings-per-share dipped -7% over the prior 12 months’s quarter as a result of increased depreciation and curiosity expense.

Click on right here to obtain our most up-to-date Positive Evaluation report on TRP (preview of web page 1 of three proven beneath):

Remaining Ideas

The Dividend Champions have elevated their dividends for at the least 25 consecutive years.

And whereas most Dividend Champions will proceed to lift their dividends every year, there may very well be some that find yourself reducing their payouts.

Whereas it’s uncommon, buyers have seen a number of Dividend Champions reduce their dividends over the previous a number of years, together with Walgreens Boots Alliance, 3M Firm (MMM), V.F. Corp. (VFC), and AT&T Inc. (T).

For that reason, revenue buyers ought to view the 5 crimson flag Dividend Champions on this article cautiously going ahead.

Extra Studying

The next Positive Dividend databases comprise probably the most dependable dividend growers in our funding universe:

When you’re searching for shares with distinctive dividend traits, think about the next Positive Dividend databases:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].