- As Donald Trump’s return to the White Home edges nearer, there are a number of mid-cap shares with important honest worth upside potential.

- Utilizing the Investing.com inventory screener, I recognized 5 shares poised to thrive in a Trump 2.0 period.

- Collectively, these 5 corporations supply a novel alternative to learn from anticipated pro-growth insurance policies, regulatory rollbacks, and powerful honest worth upside potential beneath Trump’s affect.

- Searching for extra actionable commerce concepts? Subscribe right here for up 55% off as a part of our Early Hen Black Friday sale!

As Donald Trump’s anticipated return to the White Home approaches, a number of mid-cap shares with notable honest worth upside, in line with InvestingPro’s AI-backed quantitative fashions, seem poised for positive factors.

These corporations are uniquely positioned to thrive beneath the anticipated pro-growth, deregulation-focused insurance policies of a Trump administration, offering buyers with development potential and strong honest worth upside.

Right here’s a have a look at 5 shares positioned to thrive beneath a Trump 2.0 period, together with the components anticipated to drive every.

1. Ovintiv – Power

- Present Value: $44.72

- Honest Worth Estimate: $50.54 (+13% Upside)

- Market Cap: $11.6 Billion

Why It’s Set to Profit: Trump’s “drill, drill, drill” strategy would ease laws on fossil fuels, creating a super atmosphere for U.S.-based oil and fuel producers like Ovintiv (NYSE:) to capitalize on expanded drilling alternatives.

With a serious give attention to shale manufacturing and a sturdy asset base, Ovintiv may increase output in a supportive coverage local weather, doubtless leading to a major income surge.

OVV inventory is presently buying and selling at a cut price valuation, in line with the AI-backed fashions in InvestingPro. Shares may see a rise of 13% from Thursday’s closing worth, bringing it nearer to their ‘Honest Worth’ of $50.54 per share.

Supply: InvestingPro

Wall Road analysts surveyed by Investing.com are much more optimistic and see the inventory at $55.13 per share, implying upside potential of 23.3%.

2. Columbia Banking System – Monetary Providers

- Present Value: $31.12

- Honest Worth Estimate: $36.48 (+17.2% Upside)

- Market Cap: $6.5 Billion

Why It’s Set to Profit: Expectations of deregulation are already giving banking shares a carry. Columbia Financial institution, a regional banking chief, stands to learn from lessened regulatory pressures, enabling larger lending and better margins.

With a powerful buyer base in lending, Columbia’s earnings and funding banking revenues could climb if restrictions are relaxed, creating a good panorama for development.

Based on the InvestingPro mannequin, Columbia Banking System (NASDAQ:) inventory is presently priced properly under its ‘Honest Worth’ estimate. Anticipated development of roughly 17% from its present worth may bridge the hole to $36.48 per share.

Supply: InvestingPro

Moreover, all 12 of the analysts surveyed by Investing.com fee Columbia Financial institution’s inventory both as ‘purchase’ or ‘maintain’, reflecting a bullish advice.

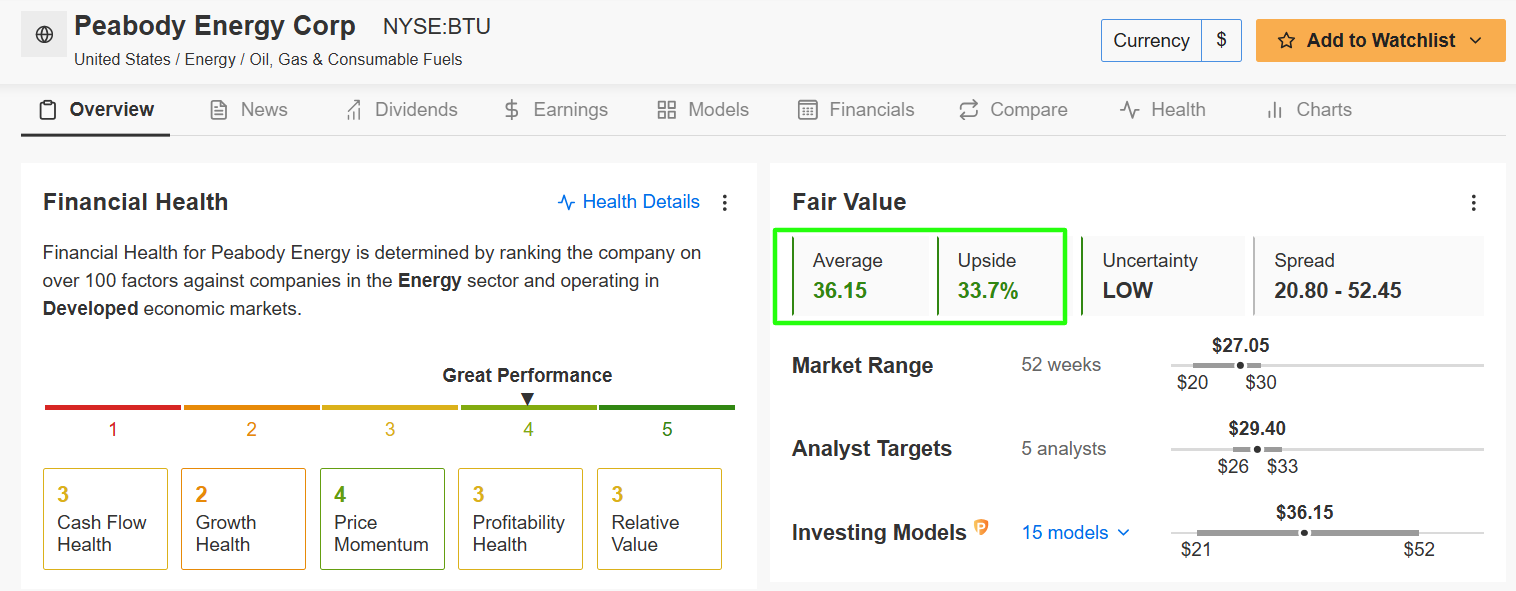

3. Peabody Power – Coal

- Present Value: $27.05

- Honest Worth Estimate: $36.15 (+33.7% Upside)

- Market Cap: $3.3 Billion

Why It’s Set to Profit: Trump’s win may translate to relaxed environmental insurance policies, enabling prolonged lifespans for coal-fired vegetation and boosting Peabody’s manufacturing and exports.

As one of many world’s largest coal producers, Peabody (NYSE:) is positioned to capitalize on new demand, particularly if U.S. coal sees renewed market assist. This favorable backdrop suggests substantial earnings upside if laws stay relaxed.

The current valuation of BTU inventory suggests it’s a cut price, in line with the InvestingPro mannequin. There’s potential for a acquire of just about 34% from its present worth, aligning it with its ‘Honest Worth’ goal estimated at $36.15 per share.

Supply: InvestingPro

Moreover, Wall Road has a long-term bullish view on Peabody Power, with all 5 analysts surveyed by Investing.com ranking the inventory as both a ‘purchase’ or a ‘maintain’.

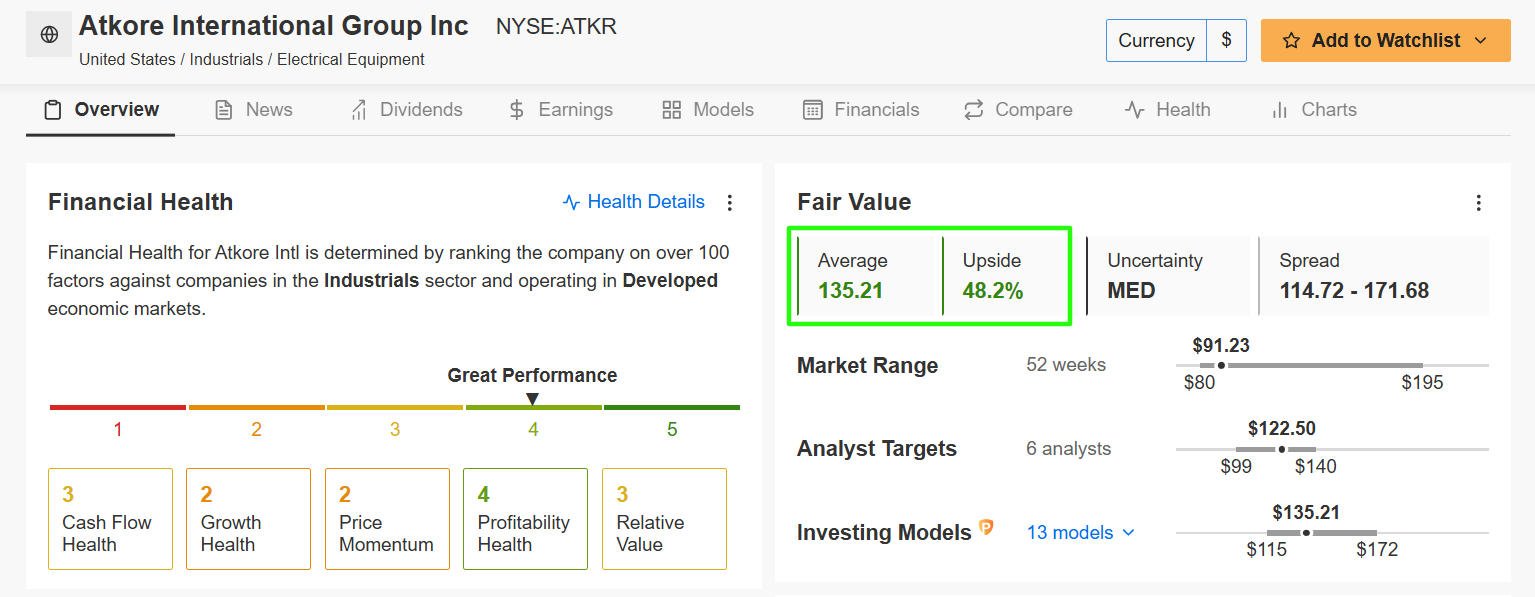

4. Atkore – Industrial Merchandise

- Present Value: $91.23

- Honest Worth Estimate: $135.21 (+48.2% Upside)

- Market Cap: $3.2 Billion

Why It’s Set to Profit: With a give attention to electrical conduits and industrial supplies, Atkore (NYSE:) would profit from Trump’s anticipated infrastructure spending and supportive tariffs on home manufacturing.

Tariffs may bolster home gross sales as Atkore’s merchandise assist main U.S. infrastructure and growth tasks.

ATKR inventory presently trades at a cut price valuation, as indicated by the InvestingPro mannequin, reflecting sturdy investor expectations that building demand could strengthen its core enterprise. There is a risk of a 48.2% improve from its present worth, shifting it nearer to its ‘Honest Worth’ set at $135.21 per share.

Supply: InvestingPro

As well as, Wall Road stays optimistic on Atkore, as per an Investing.com survey, which revealed that analysts have a inventory worth goal of $122.50, implying potential upside of roughly 35%.

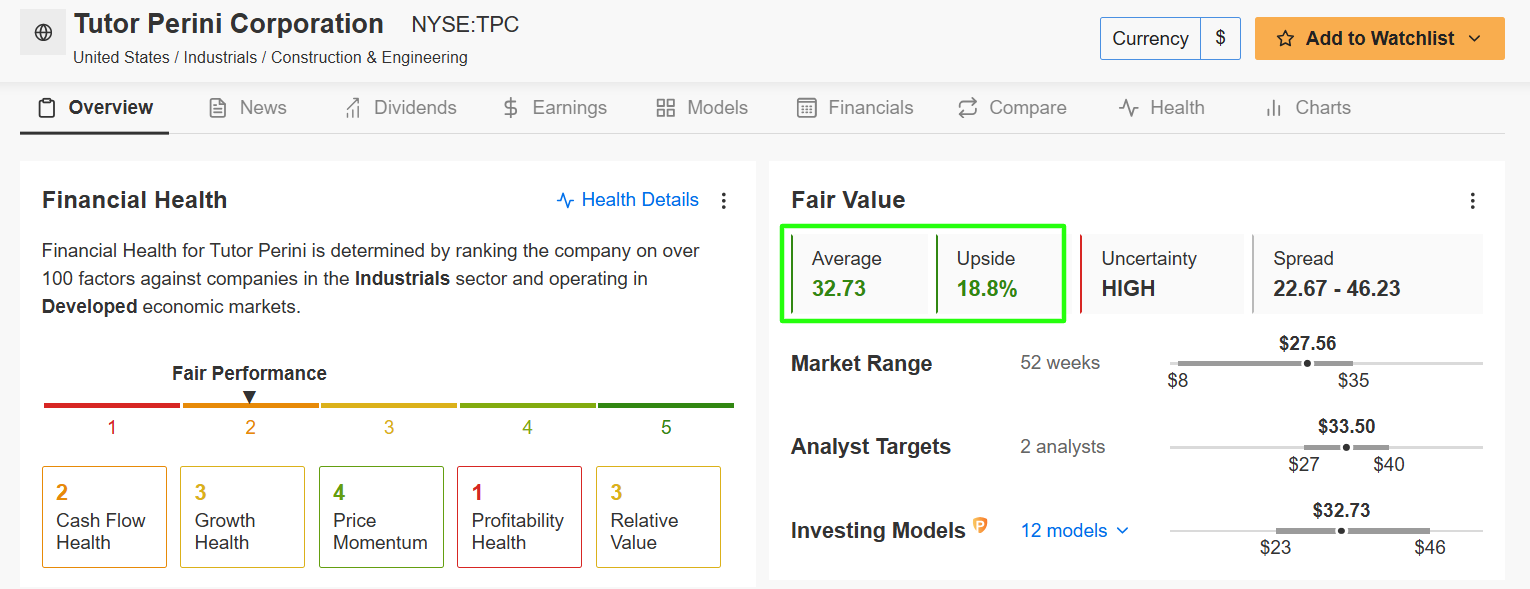

5. Tutor Perini – Building

- Present Value: $27.56

- Honest Worth Estimate: $32.73 (+18.8% Upside)

- Market Cap: $1.5 Billion

Why It’s Set to Profit: Tutor Perini (NYSE:), a outstanding infrastructure builder, may see positive factors from Trump’s pro-construction insurance policies, together with tax incentives and loosened restrictions on constructing.

The administration’s give attention to easing provide shortages in housing and infrastructure may stimulate demand, driving important income development as Tutor Perini’s large-scale mission pipeline meets increasing market wants.

The InvestingPro mannequin signifies TPC inventory is presently extraordinarily undervalued. There is a risk of an 18.8% improve from the present worth, bringing it nearer to its ‘Honest Worth’ estimation of $32.73 per share.

Supply: InvestingPro

Moreover, the sentiment amongst analysts polled by Investing.com is overwhelmingly optimistic, forecasting Tutor Perini’s inventory to climb to $33.50 per share, projecting a major upside of 21.6%.

Whether or not you are a novice investor or a seasoned dealer, leveraging InvestingPro can unlock a world of funding alternatives whereas minimizing dangers amid the difficult market backdrop.

Subscribe now to benefit from the 55% off amid the Black Friday sale and immediately unlock entry to a number of market-beating options, together with:

- ProPicks AI: AI-selected inventory winners with a confirmed observe report.

- Prime Concepts: See what shares billionaire buyers equivalent to Warren Buffett, Michael Burry, Invoice Ackman, and George Soros are shopping for.

- InvestingPro Honest Worth: Immediately discover out if a inventory is underpriced or overvalued.

- Superior Inventory Screener: Seek for the most effective shares based mostly on a whole bunch of chosen filters, and standards.

Disclosure: On the time of writing, I’m lengthy on the S&P 500, and the by way of the SPDR® S&P 500 ETF, and the Invesco QQQ Belief ETF. I’m additionally lengthy on the Know-how Choose Sector SPDR ETF (NYSE:).

I frequently rebalance my portfolio of particular person shares and ETFs based mostly on ongoing threat evaluation of each the macroeconomic atmosphere and firms’ financials.

The views mentioned on this article are solely the opinion of the creator and shouldn’t be taken as funding recommendation.

Comply with Jesse Cohen on X/Twitter @JesseCohenInv for extra inventory market evaluation and perception.