On this week’s e-newsletter, we’re going to offer you an inflation replace primarily based on a few of final week’s vital knowledge releases and in addition share some normal ideas on threat belongings and liquidity.

Let’s dive proper in:

GMI Chart 1 – US PPI YoY% vs. US CPI YoY%

got here in sharply under consensus expectations in February (4.6% vs. 5.4% anticipated) and now targets nearer to 4% within the subsequent one to 2 months.

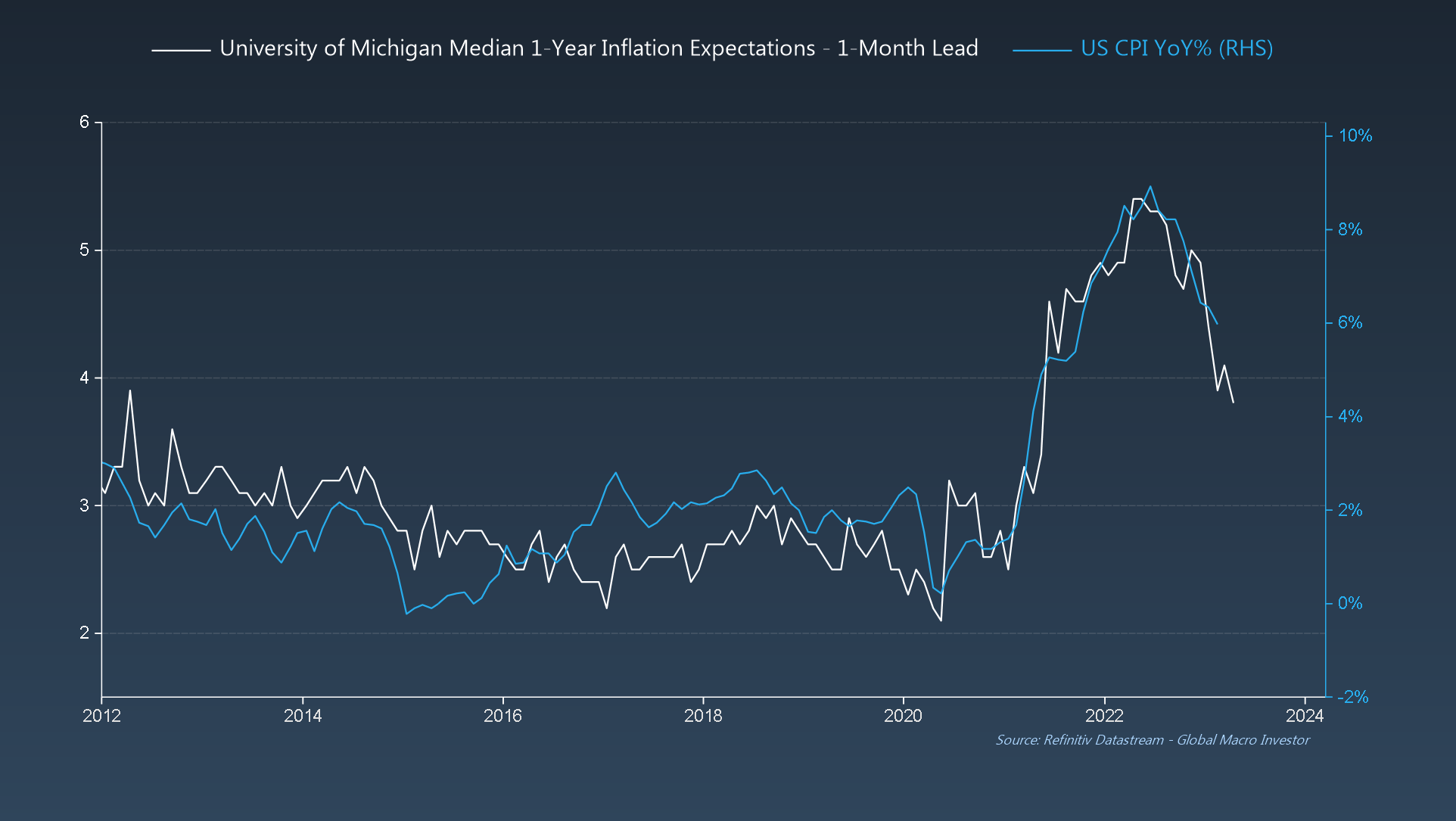

GMI Chart 2 – College of Michigan Median 1-Yr Inflation Expectations vs. US CPI YoY%

College of Michigan point out the identical.

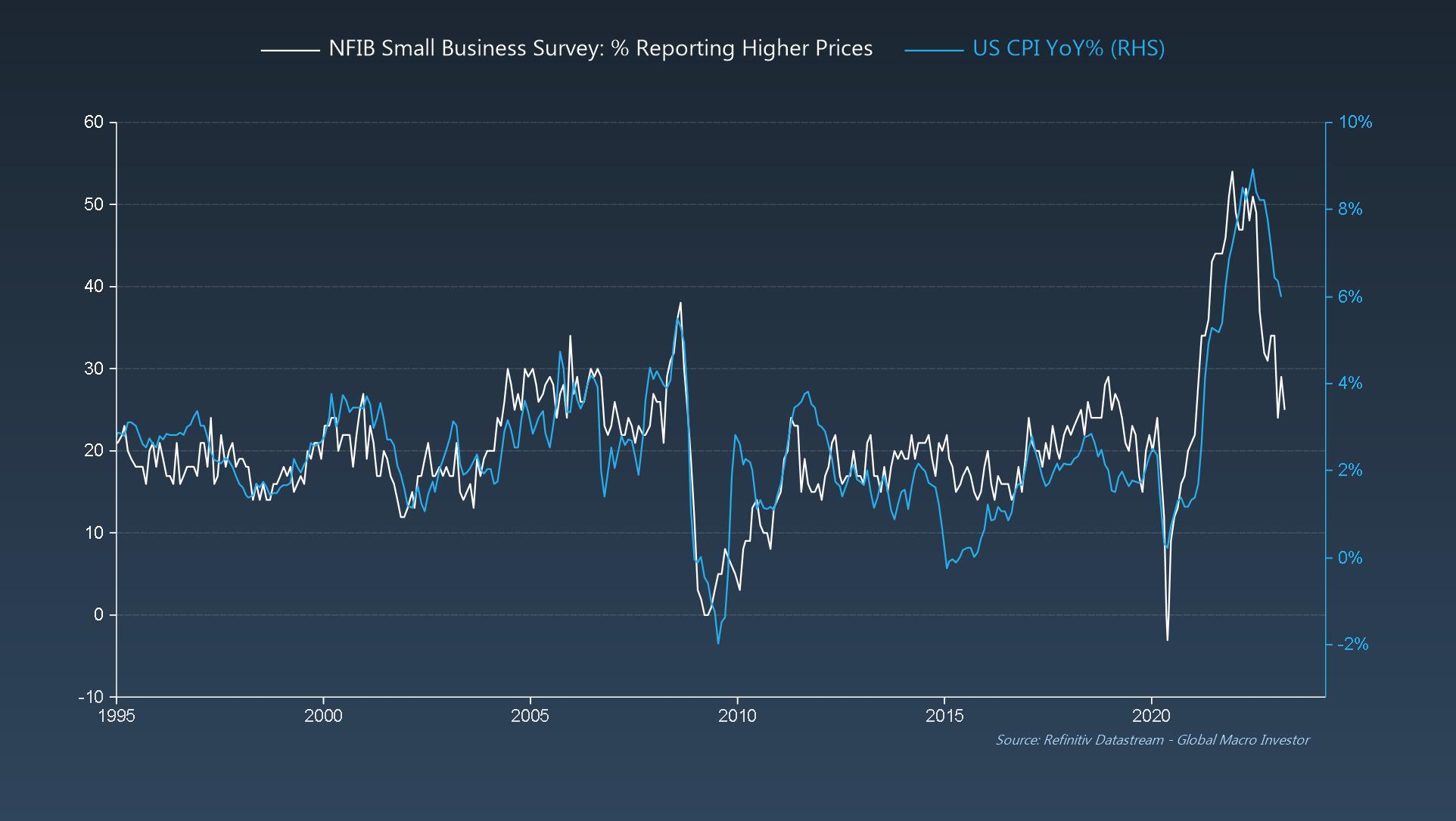

GMI Chart 3 – NFIB Small Enterprise Survey: % Reporting Larger Costs vs. US CPI YoY%

Final week noticed the discharge of the most recent knowledge for February, the place small companies proceed to report a speedy lower in worth pressures.

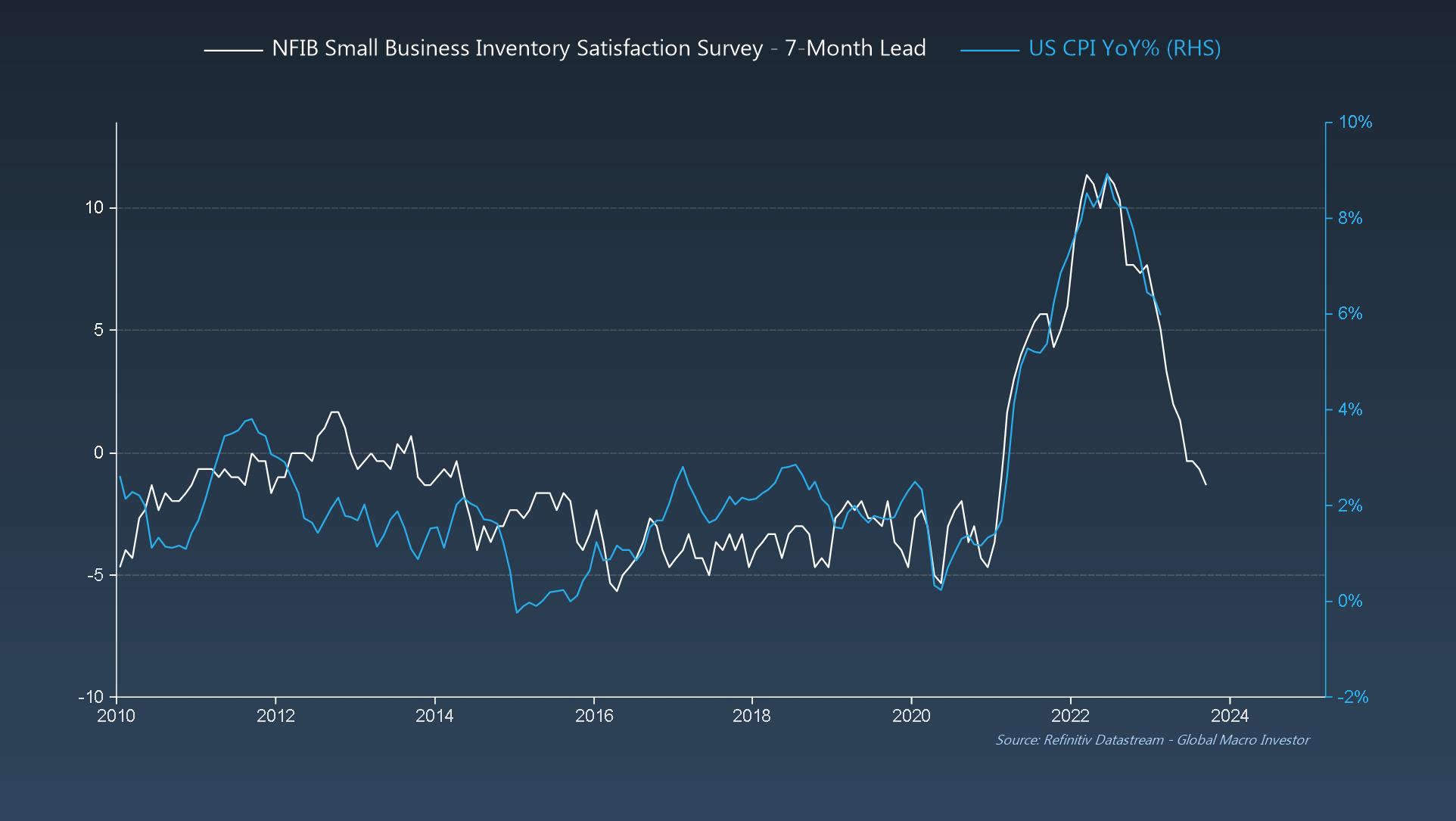

As well as, inventories are nonetheless method too excessive, therefore stock satisfaction ranges proceed to break down.

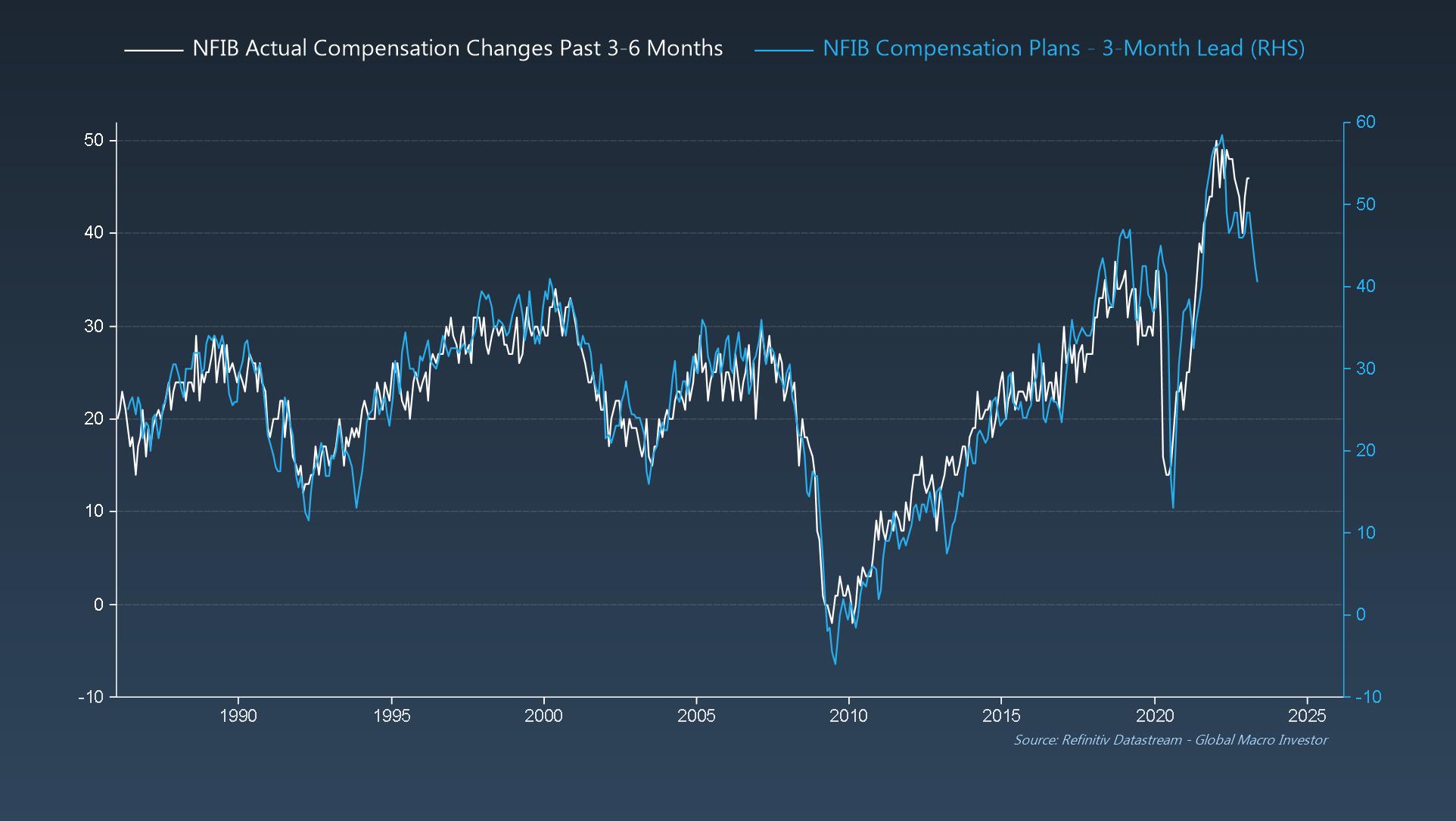

GMI Chart 4 – NFIB Precise Compensation Modifications Previous 3-6 Months vs. NFIB Compensation Plans

Additionally, regardless of ongoing considerations over wages being “sticky,” small enterprise compensation plans proceed to deteriorate, and precise compensation adjustments simply lag by round 1 / 4: wages have peaked.

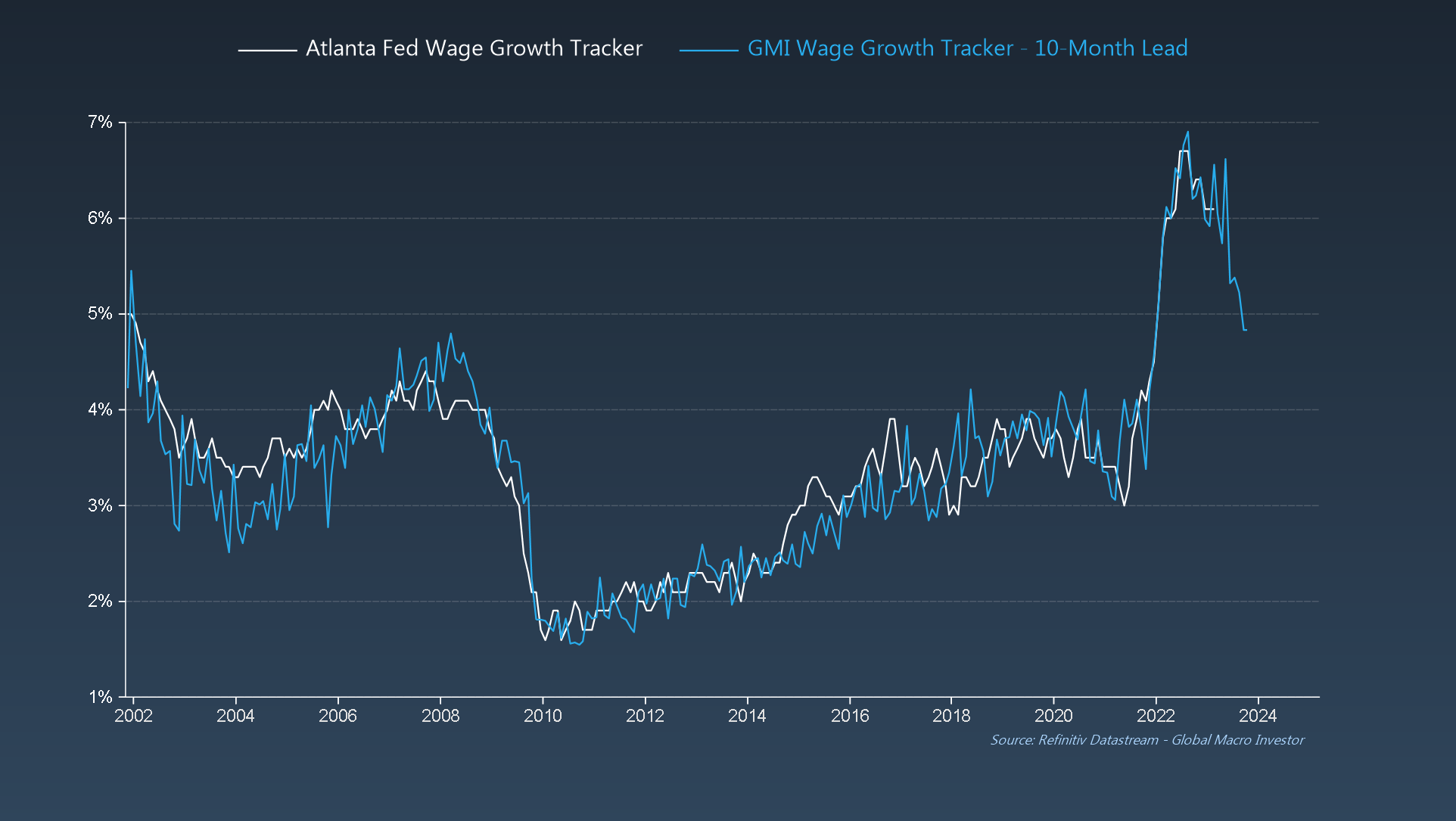

Our personal GMI mannequin signifies the identical: wages aren’t “sticky,” they’re simply extraordinarily lagging.

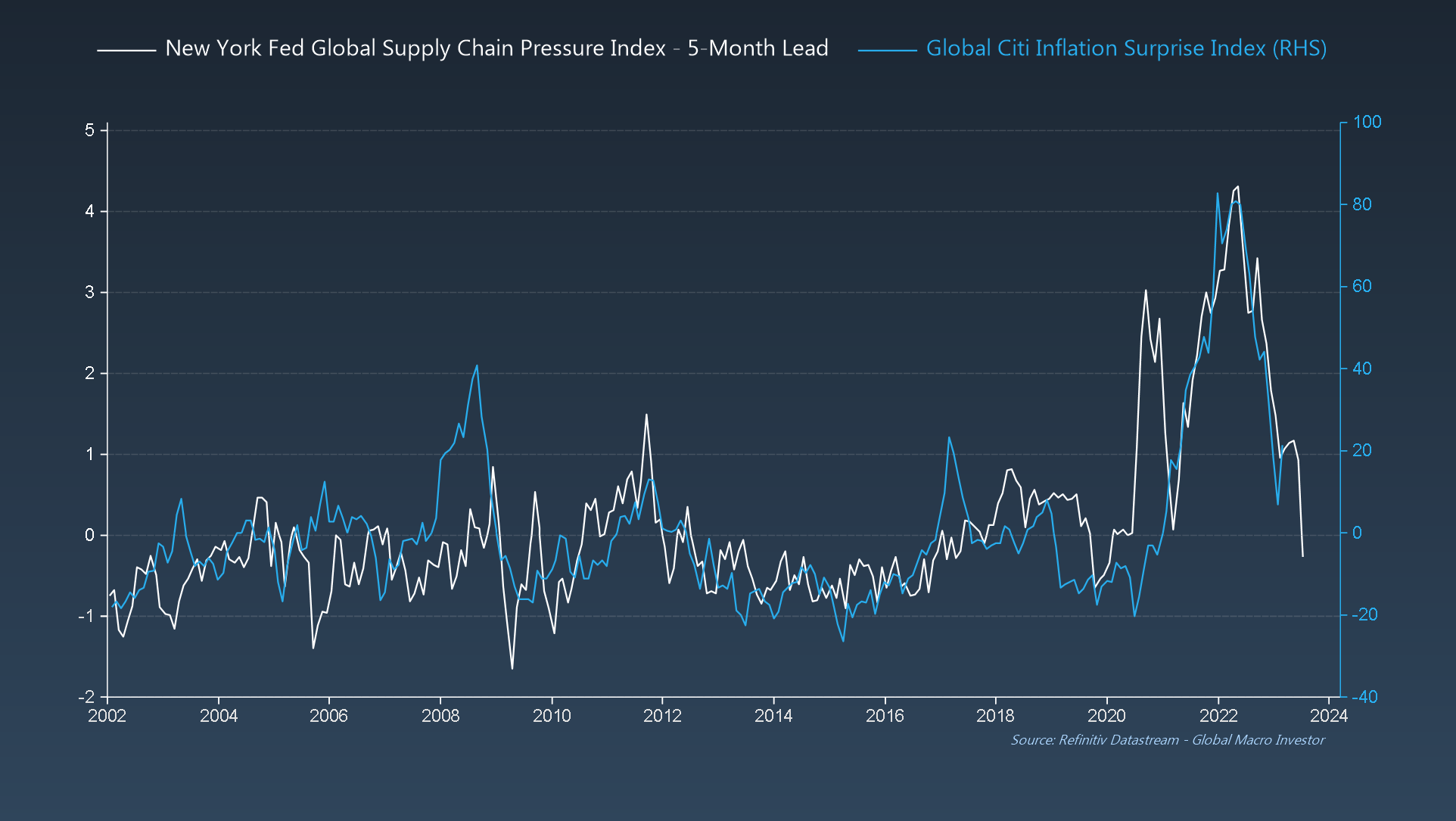

GMI Chart 5 – NY Fed International Provide Chain Strain Index vs. International Citi Inflation Shock Index

Lastly, world inflation surprises are about to show damaging over the following couple of months and we see few folks mentioning this.

The GMI Large Image

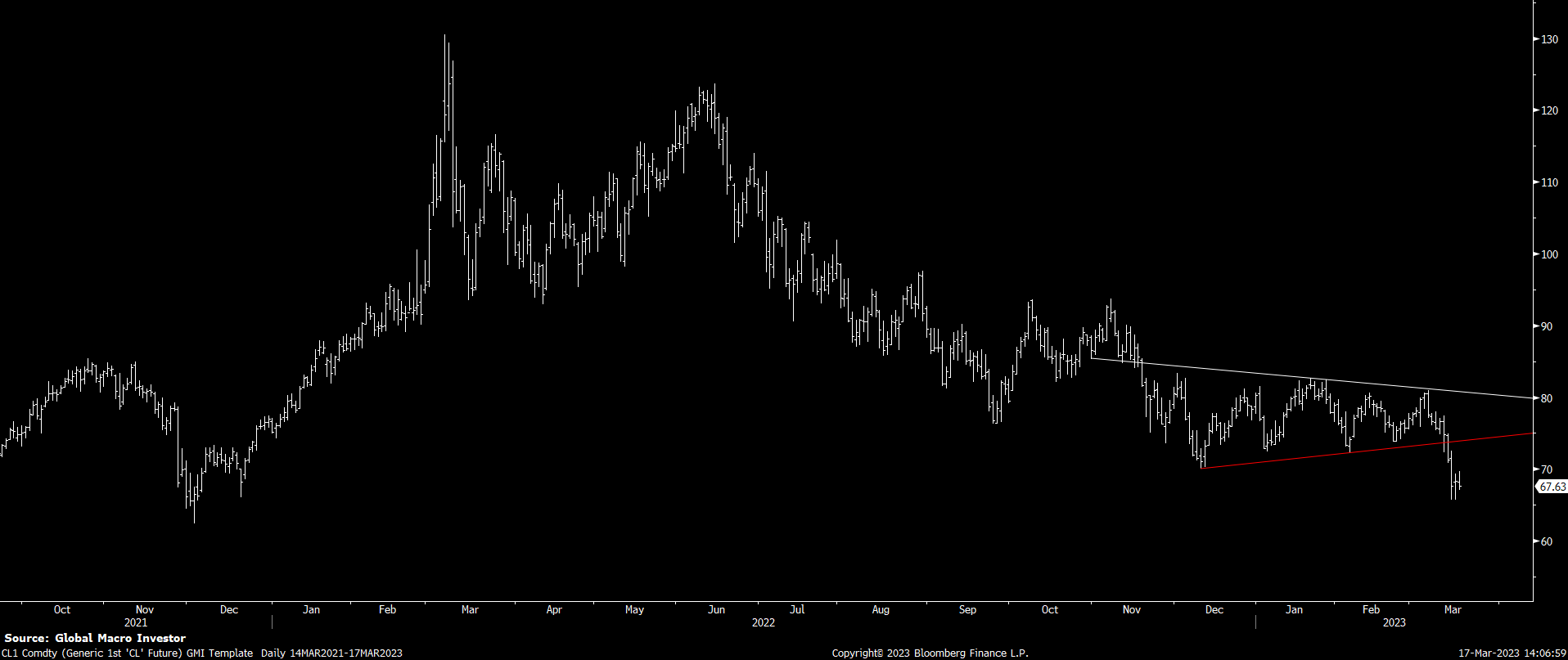

Regardless of all of the inflationistas speaking oil breakouts each time trades larger for 2 or three days, our name at GMI was that we might see $60 earlier than the following flip larger, which has been our core view since Might of final yr at our annual GMI Spherical Desk occasion.

Simply this week, we noticed a break, down from a near-perfect symmetrical triangle continuation sample we had been watching, which targets a transfer precisely all the way down to $60.

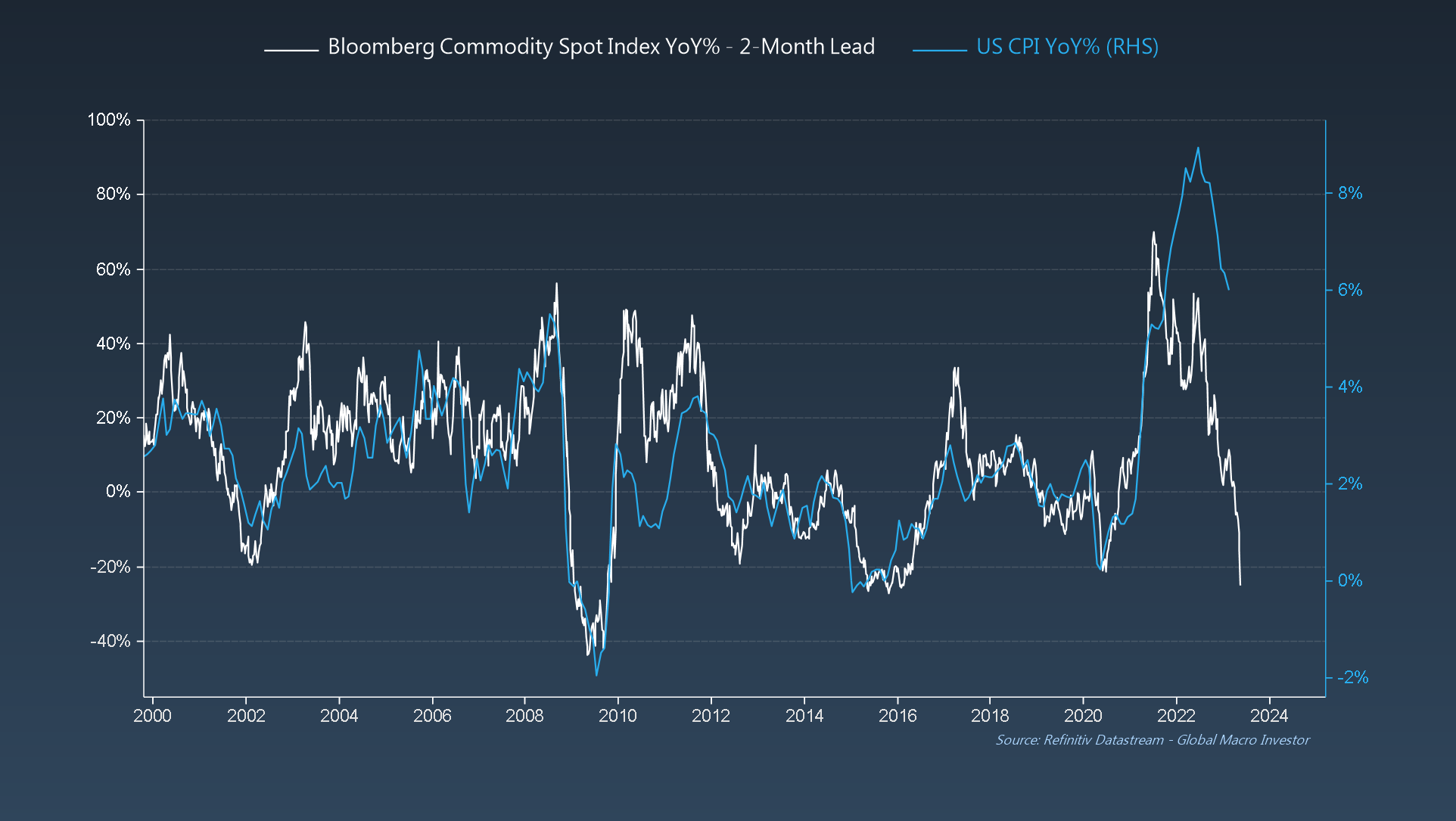

The underside line is that inflation will proceed to gradual and that the decline ought to actually begin to speed up from right here – it’s all all the way down to the bottom impact.

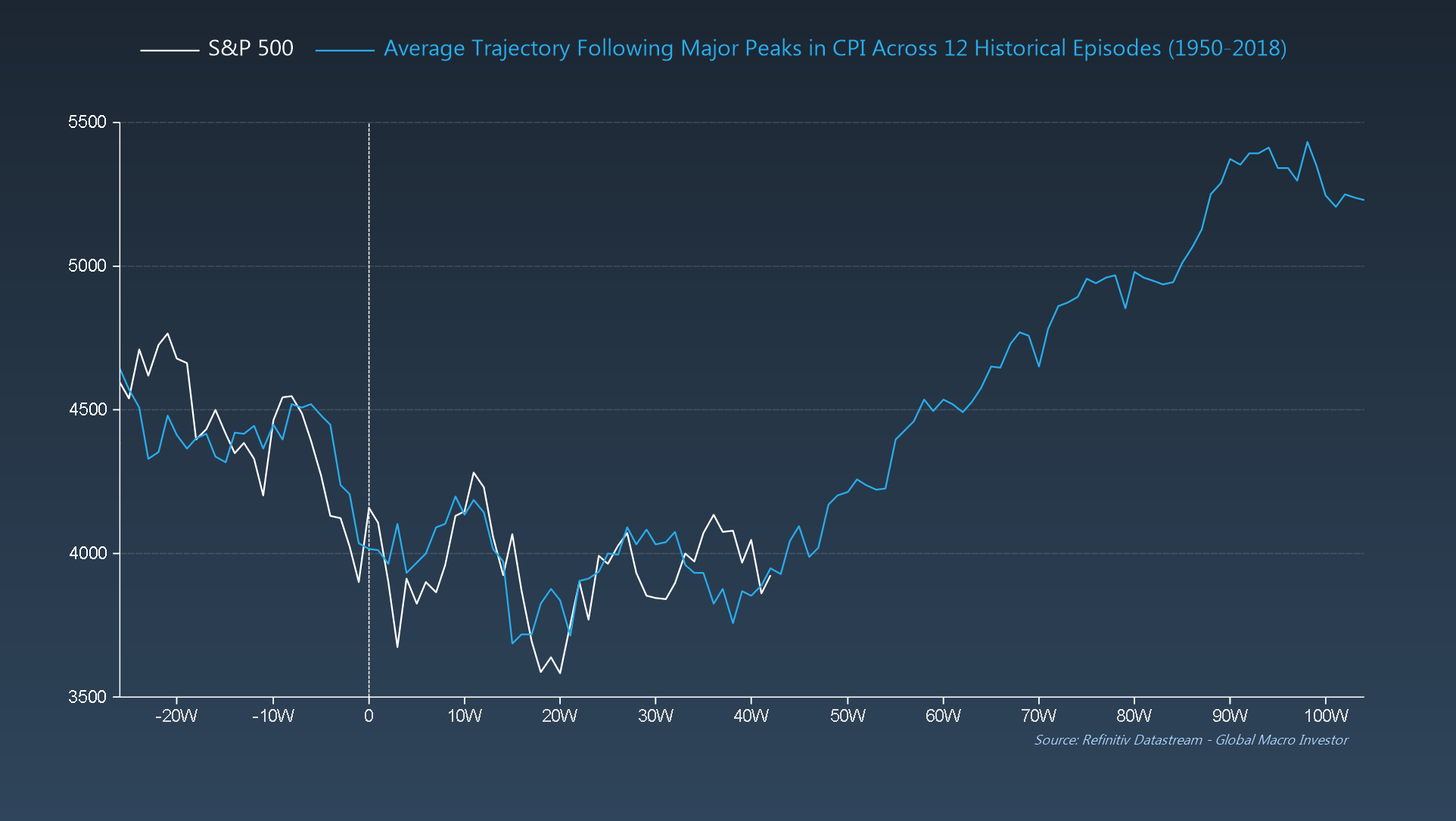

Our view has been – for fairly a while – that this is able to be constructive for threat belongings.

Clearly, the following few weeks would be the actual take a look at. It’s fairly clear after what occurred to Credit score Suisse (NYSE:) this week, with their share worth plunging over 30% intraday on Wednesday and their 5-year CDS exploding to 700+ bps, that potential contagion fears over a funding squeeze on EU banks and different large customers of the markets are rising.

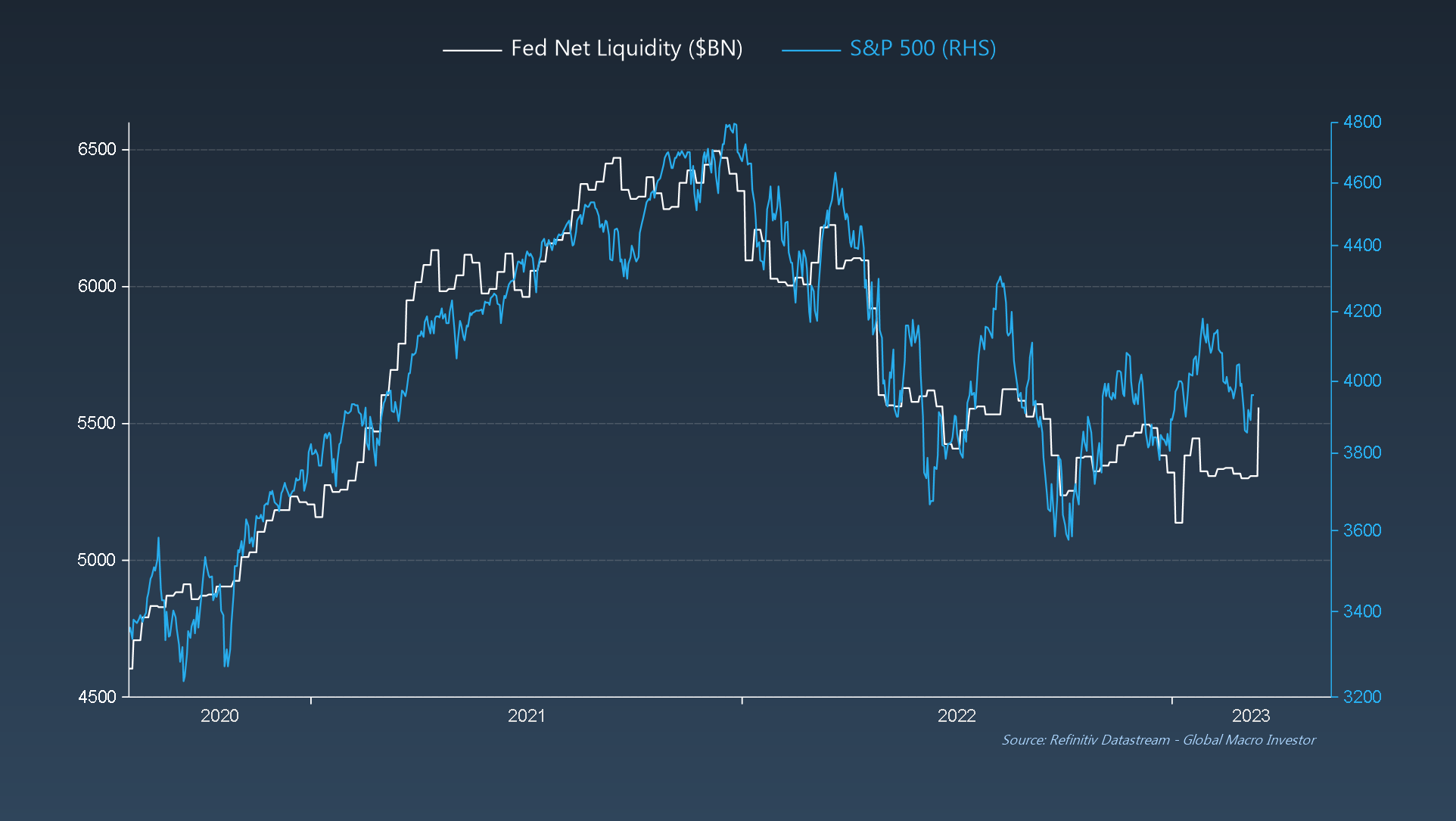

The vital takeaway from all of that is that, whereas contagion dangers are actual and deflation dangers are rising, the more severe issues get now, the extra the Fed will do – dangerous information = excellent news – and extra cowbell is on its method.

That’s it from us this week. See you all subsequent week.

***

As ever, a lot fuller and extra in-depth evaluation will be present in International Macro Investor and Actual Imaginative and prescient Professional Macro. International Macro Investor is our full institutional analysis service and Actual Imaginative and prescient Professional Macro is the subtle retail investor service, which is co-authored with main analysis agency MI2 Companions.

Need to learn these the second they arrive out? Enroll completely free for my e-newsletter, Quick Excerpts From International Macro Investor on Substack. New articles revealed each single Sunday.