Revealed on January twenty ninth, 2026 by Bob Ciura

U.S. pure fuel costs just lately reached $6/MMBtu, for the primary time since 2022.

The important thing issue chargeable for the rise in pure fuel costs previously month is freezing climate that swept throughout a lot of the U.S., boosting heating demand and disrupting provides.

With pure fuel costs hitting ranges not seen since in 4 years, traders may naturally be fascinated by pure fuel shares that might profit.

With this in thoughts, we created a full checklist of practically 80 vitality shares. You may obtain a free copy of the vitality shares checklist by clicking on the hyperlink under:

Extra info may be discovered within the Positive Evaluation Analysis Database, which ranks shares primarily based on their dividend yield, earnings-per-share development potential, and modifications within the valuation a number of.

This text will evaluation 5 high pure fuel shares. These 5 shares have vital companies in upstream pure fuel manufacturing, midstream actions corresponding to pure fuel transportation and storage, or pure fuel utilities.

Learn on to see which U.S. pure fuel shares are ranked highest in our Positive Evaluation Analysis Database.

Desk Of Contents

You should use the next desk of contents to immediately leap to a particular inventory:

The highest 5 U.S. pure fuel shares are ranked primarily based on complete anticipated returns over the subsequent 5 years, from lowest to highest.

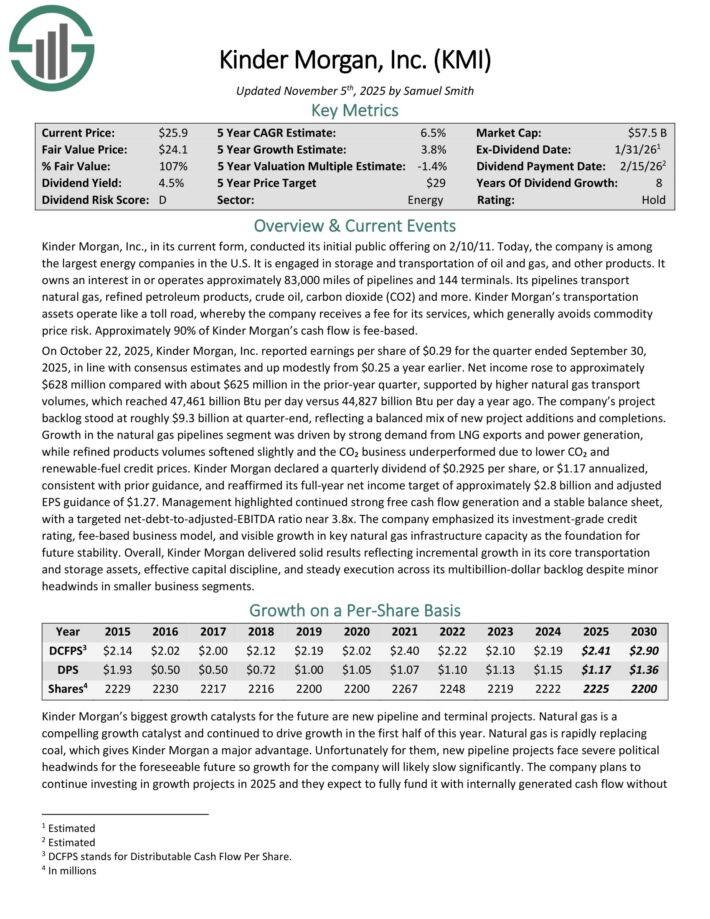

Pure Fuel Inventory #5: Kinder Morgan Inc. (KMI)

- 5-year anticipated annual returns: 3.4%

Kinder Morgan is among the many largest vitality corporations within the U.S. It’s engaged in storage and transportation of oil and fuel, and different merchandise. It owns an curiosity in or operates roughly 83,000 miles of pipelines and 144 terminals.

Its pipelines transport pure fuel, refined petroleum merchandise, crude oil, carbon dioxide (CO2) and extra.

Kinder Morgan’s transportation property function like a toll street, whereby the corporate receives a payment for its companies, which typically avoids commodity value threat. Roughly 90% of Kinder Morgan’s money circulation is fee-based.

On October 22, 2025, Kinder Morgan, Inc. reported earnings per share of $0.29 for the quarter ended September 30, 2025, in keeping with consensus estimates and up modestly from $0.25 a yr earlier.

Web earnings rose to roughly $628 million in contrast with about $625 million within the prior-year quarter, supported by larger pure fuel transport volumes, which reached 47,461 billion Btu per day versus 44,827 billion Btu per day a yr in the past.

The corporate’s undertaking backlog stood at roughly $9.3 billion at quarter-end, reflecting a balanced combine of latest undertaking additions and completions.

Progress within the pure fuel pipelines phase was pushed by sturdy demand from LNG exports and energy technology, whereas refined merchandise volumes softened barely and the CO₂ enterprise under-performed resulting from decrease CO₂ and renewable-fuel credit score costs.

Kinder Morgan declared a quarterly dividend of $0.2925 per share, or $1.17 annualized, in step with prior steering, and reaffirmed its full-year internet earnings goal of roughly $2.8 billion and adjusted EPS steering of $1.27.

Click on right here to obtain our most up-to-date Positive Evaluation report on KMI (preview of web page 1 of three proven under):

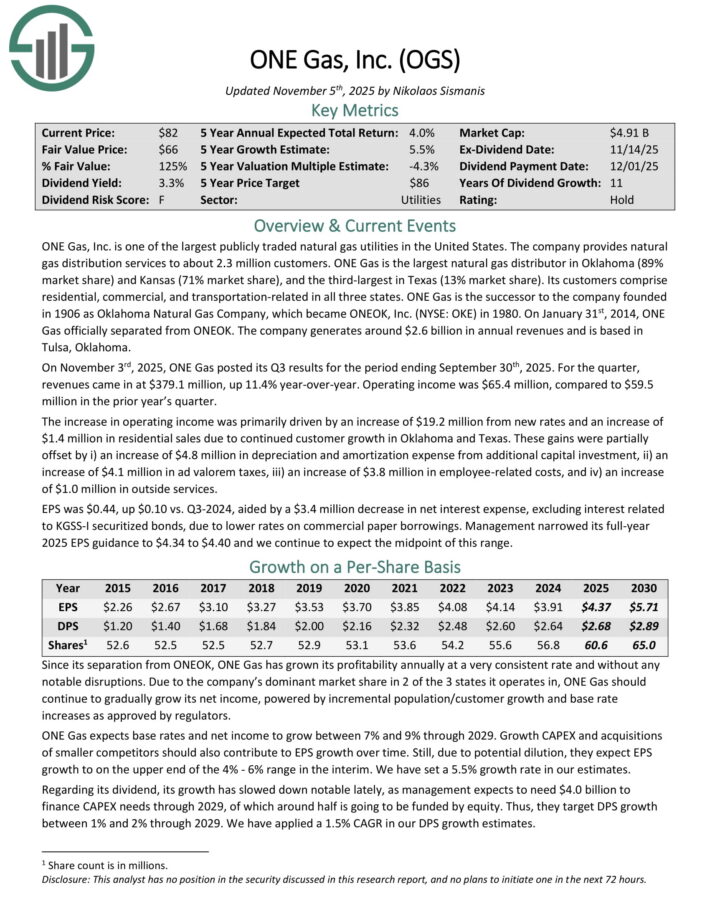

Pure Fuel Inventory #4: ONE Fuel, Inc. (OGS)

- 5-year anticipated annual returns: 5.2%

ONE Fuel, Inc. is among the largest publicly traded pure fuel utilities in america. The corporate supplies pure fuel distribution companies to about 2.3 million prospects.

ONE Fuel is the biggest pure fuel distributor in Oklahoma (89% market share) and Kansas (71% market share), and the third-largest in Texas (13% market share). The corporate generates round $2.6 billion in annual revenues and relies in Tulsa, Oklahoma.

On November third, 2025, ONE Fuel posted its Q3 outcomes for the interval ending September thirtieth, 2025. For the quarter, revenues got here in at $379.1 million, up 11.4% year-over-year. Working earnings was $65.4 million, in comparison with $59.5 million within the prior yr’s quarter.

The rise in working earnings was primarily pushed by a rise of $19.2 million from new charges and a rise of $1.4 million in residential gross sales resulting from continued buyer development in Oklahoma and Texas.

These positive factors have been partially offset by a rise of $4.8 million in depreciation and amortization expense from extra capital funding.

EPS was $0.44, up $0.10 vs. Q3-2024, aided by a $3.4 million lower in internet curiosity expense, excluding curiosity associated to KGSS-I securitized bonds, resulting from decrease charges on industrial paper borrowings.

Administration narrowed its full-year 2025 EPS steering to $4.34 to $4.40 and we proceed to anticipate the midpoint of this vary.

Click on right here to obtain our most up-to-date Positive Evaluation report on OGS (preview of web page 1 of three proven under):

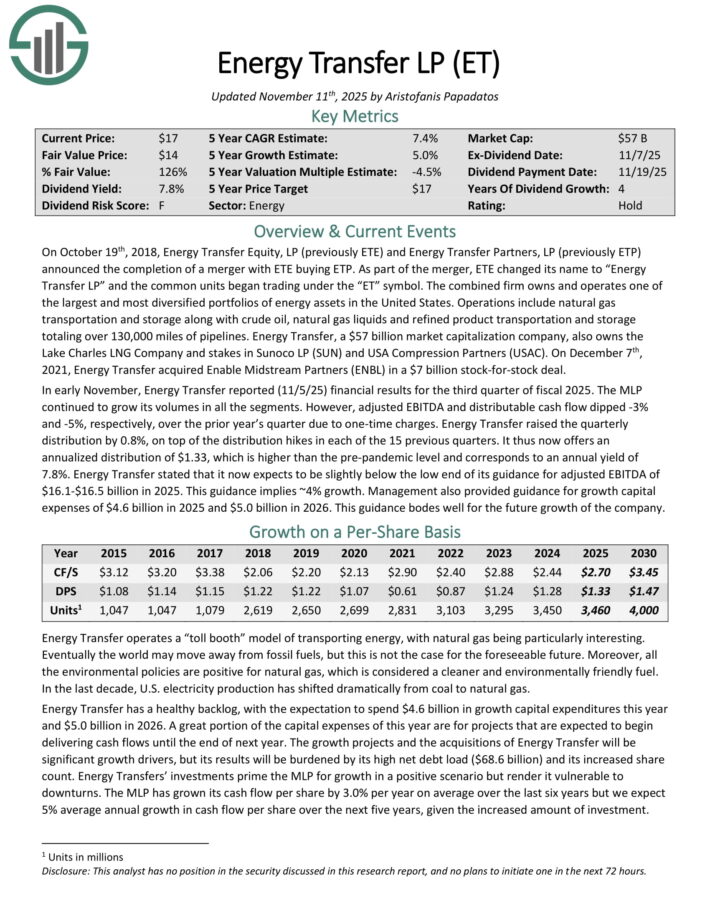

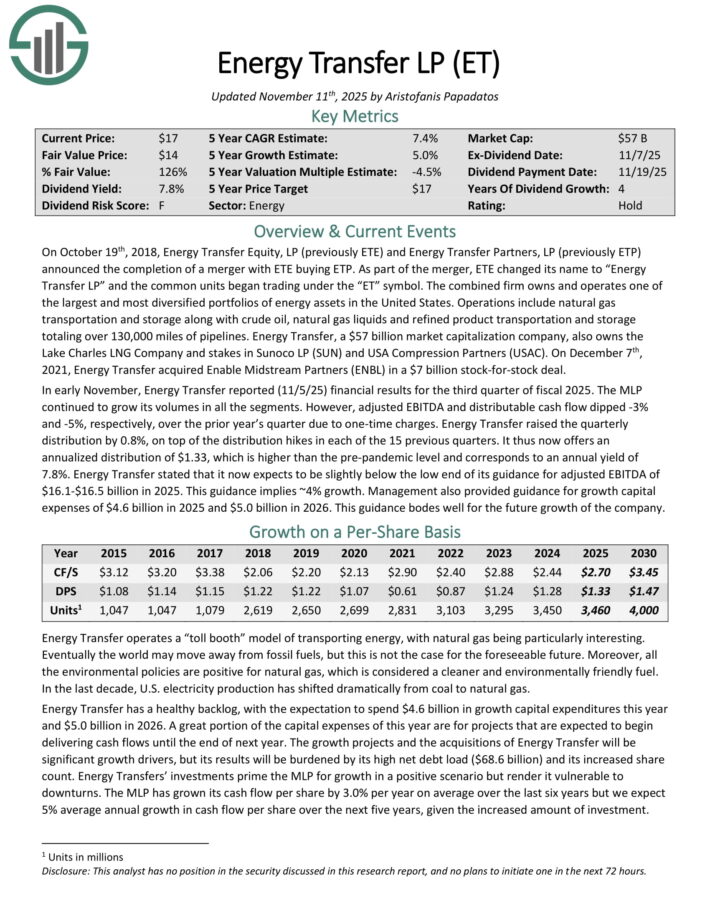

Pure Fuel Inventory #3: Vitality Switch Companions LP (ET)

- 5-year anticipated returns: 6.5%

Vitality Switch LP owns and operates one of many largest and most diversified portfolios of vitality property in america.

Operations embody pure fuel transportation and storage together with crude oil, pure fuel liquids and refined product transportation and storage totaling over 130,000 miles of pipelines.

Vitality Switch additionally owns the Lake Charles LNG Firm and stakes in Sunoco LP (SUN) and USA Compression Companions (USAC).

In early November, Vitality Switch reported (11/5/25) monetary outcomes for the third quarter of fiscal 2025. The MLP continued to develop its volumes in all of the segments.

Nonetheless, adjusted EBITDA and distributable money circulation dipped -3% and -5%, respectively, over the prior yr’s quarter resulting from one-time fees.

Vitality Switch raised the quarterly distribution by 0.8%, on high of the distribution hikes in every of the 15 earlier quarters.

Click on right here to obtain our most up-to-date Positive Evaluation report on ET (preview of web page 1 of three proven under):

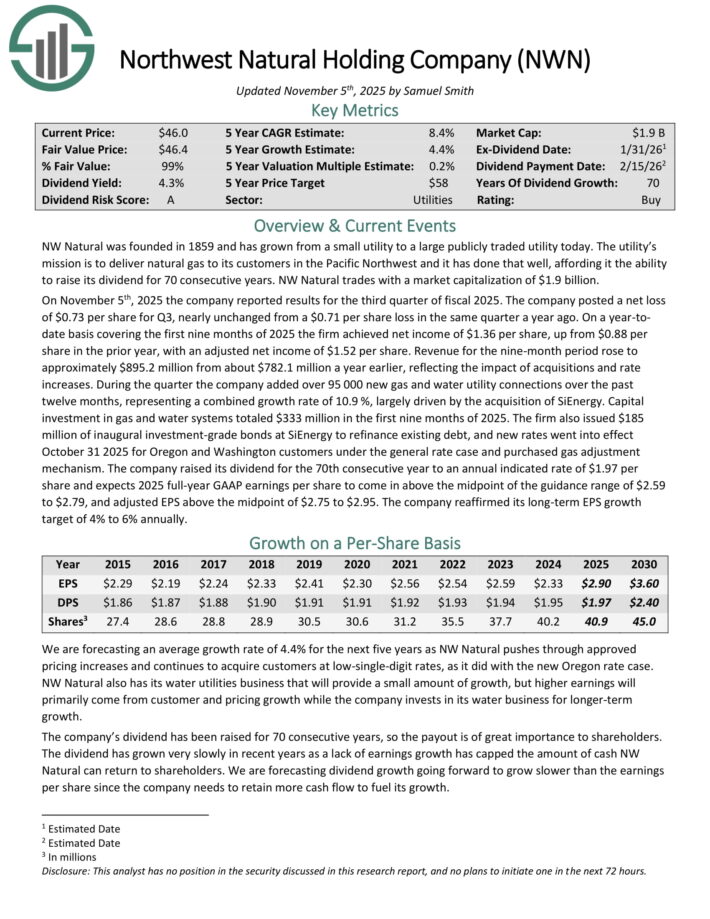

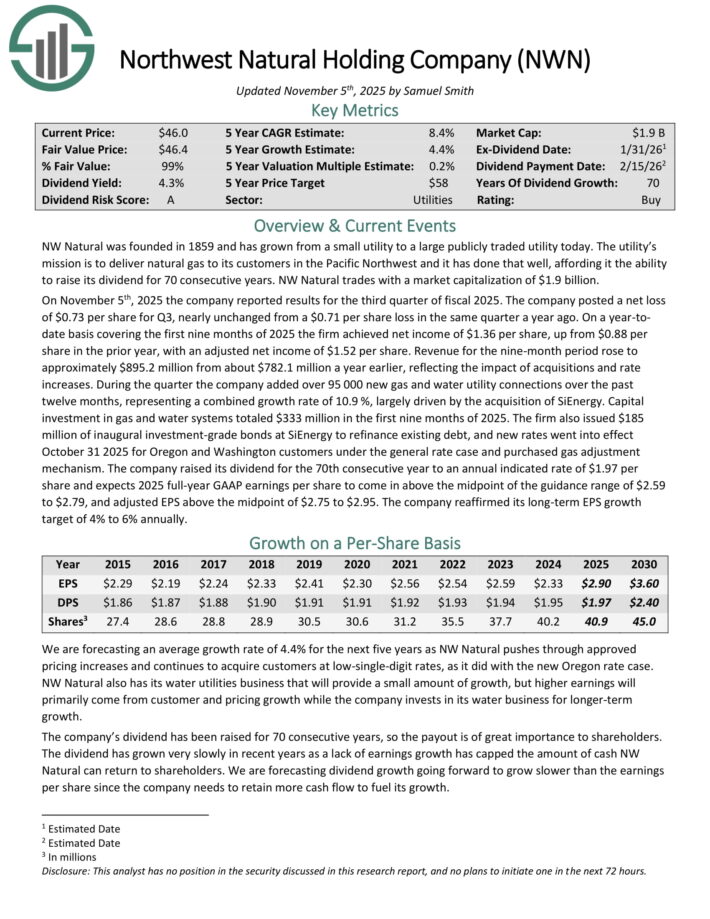

Pure Fuel Inventory #2: Northwest Pure Fuel Holding Co. (NWN)

- 5-year anticipated annual returns: 8.3%

NW Pure was based in 1859 and has grown from only a handful of consumers to serving greater than 760,000 in the present day. The utility’s mission is to ship pure fuel to its prospects within the Pacific Northwest.

The corporate’s places served are proven within the picture under.

On November fifth, 2025 the corporate reported outcomes for the third quarter of fiscal 2025. The corporate posted a internet lack of $0.73 per share for Q3, practically unchanged from a $0.71 per share loss in the identical quarter a yr in the past.

On a year-to-date foundation masking the primary 9 months of 2025 the agency achieved internet earnings of $1.36 per share, up from $0.88 per share within the prior yr, with an adjusted internet earnings of $1.52 per share.

Income for the nine-month interval rose to roughly $895.2 million from about $782.1 million a yr earlier, reflecting the impression of acquisitions and fee will increase.

Click on right here to obtain our most up-to-date Positive Evaluation report on NWN (preview of web page 1 of three proven under):

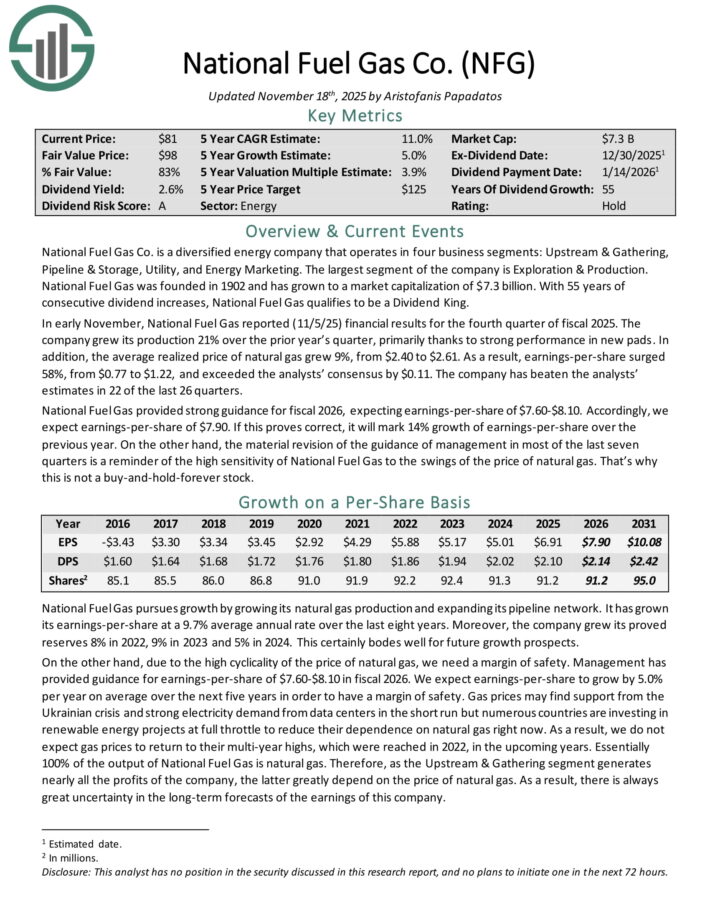

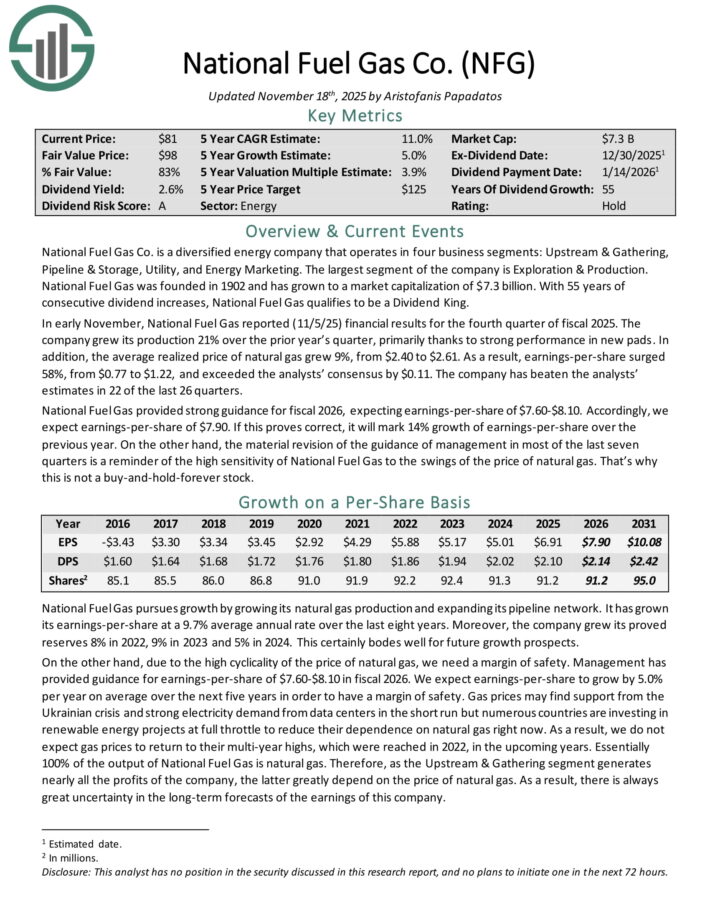

Pure Fuel Inventory #1: Nationwide Gas Fuel (NFG)

- 5-year anticipated annual returns: 10.4%

Nationwide Gas Fuel Co. is a diversified vitality firm that operates in 4 enterprise segments: Upstream & Gathering, Pipeline & Storage, Utility, and Vitality Advertising and marketing.

The biggest phase of the corporate is Exploration & Manufacturing. With 55 years of consecutive dividend will increase, Nationwide Gas Fuel qualifies to be a Dividend King.

In early November, Nationwide Gas Fuel reported (11/5/25) monetary outcomes for the fourth quarter of fiscal 2025. The corporate grew its manufacturing 21% over the prior yr’s quarter, primarily due to sturdy efficiency in new pads.

As well as, the common realized value of pure fuel grew 9%, from $2.40 to $2.61. Consequently, earnings-per-share surged 58%, from $0.77 to $1.22, and exceeded the analysts’ consensus by $0.11.

The corporate has crushed the analysts’ estimates in 22 of the final 26 quarters. Nationwide Gas Fuel supplied sturdy steering for fiscal 2026, anticipating earnings-per-share of $7.60-$8.10.

Accordingly, we anticipate earnings-per-share of $7.90. If this proves appropriate, it is going to mark 14% development of earnings-per-share over the earlier yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on NFG (preview of web page 1 of three proven under):

Extra Sources

The next articles comprise shares with very lengthy dividend or company histories, ripe for choice for dividend development traders:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].