- Upcoming U.S. retail gross sales knowledge is anticipated to affect market perceptions, constructing on a latest enhance.

- Corporations like Goal and Anheuser-Busch InBev are poised for potential development within the retail sector.

- Market analysts are projecting optimistic earnings reviews from main retail and shopper firms this quarter.

- Searching for actionable commerce concepts to navigate the present market volatility? Unlock entry to InvestingPro’s AI-selected inventory winners for underneath $9 a month!

Hedge funds have considerably ramped up their positions in , notably in and {hardware} sectors. This aggressive shopping for spree marks probably the most important surge previously 5 months and comes simply as the company earnings season for the third quarter will get underway.

The sector is being watched, particularly after reviews from Taiwan Semiconductor Manufacturing (NYSE:) and ASML (AS:), which have triggered appreciable market actions. Eagerly anticipated reviews from Superior Micro Units (NASDAQ:) on October 29 and Nvidia (NASDAQ:) on November 14 are subsequent on the listing.

This week, 100 firms, together with Tesla (NASDAQ:) (Day 23), IBM (NYSE:) (Day 23) and Coca-Cola (NYSE:) (Day 22) are set to report their earnings.

In the meantime, the , after a 40% rise within the first half of the 12 months, has dipped and is at the moment up 25% for the 12 months. It’s value noting that semiconductors and associated shares account for 11.5% of the S&P 500.

Within the face of tech inventory shopping for, hedge funds have been promoting shopper shares and have now offered off for 5 consecutive weeks.

Upcoming will probably be intriguing after the earlier knowledge confirmed a rise of 0.4%, accelerating from an unrevised uptick of 0.1% in August, in line with knowledge from the Commerce Division. Economists had seen the studying at 0.3%.

Along with the lower, the potential rise in retail gross sales is anticipated to spice up the accounts of firms within the medium time period, together with retailers and shopper merchandise producers.

Let’s check out a few of these firms:

1. Goal

Goal (NYSE:) is an American division retailer chain and one of many largest retail firms in the US.

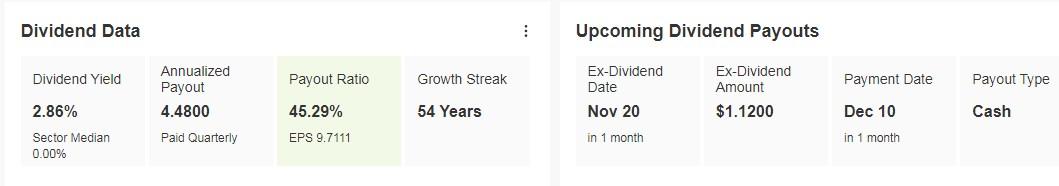

Goal will distribute a dividend of $1.12 per share on December 19, with eligibility requiring shares to be held earlier than November 20. The annual dividend yield stands at 2.86%.

Supply: InvestingPro

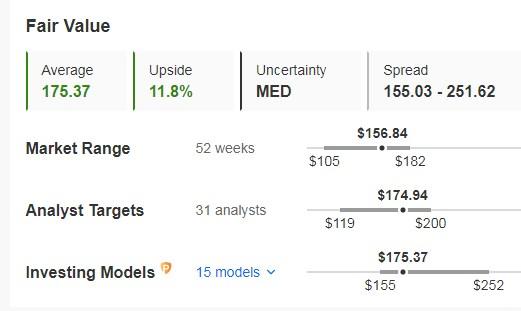

The corporate is about to launch its on Nov. 13, with a projected earnings per share (EPS) development of 13.94%.

Supply: InvestingPro

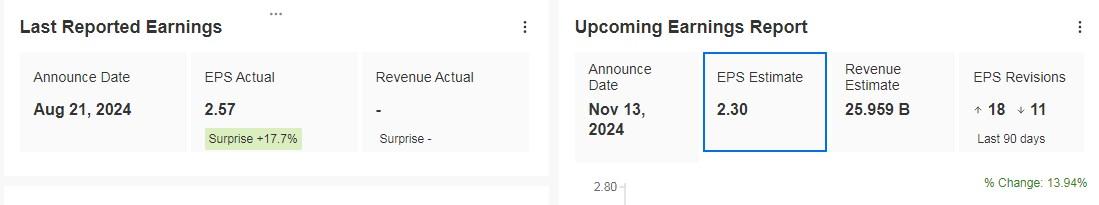

Wall Avenue believes Goal is well-positioned to profit from evolving shopper conduct. It has efficiently positioned itself as a frontrunner in each bodily and on-line retailing, due to its progressive strategy to retailer design, product assortment and supply companies.

On the finish of final week, its shares have been 11.8% beneath its worth on fundamentals at $175.37. The market sees potential for it at $174.94.

Supply: InvestingPro

2. Carnival

Carnival (NYSE:) is the most important cruise operator on this planet, headquartered in Miami, Florida.

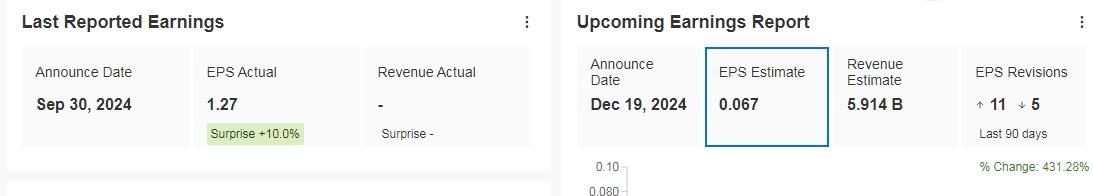

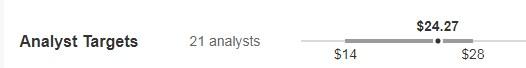

The corporate’s is due on December 19, with EPS anticipated to extend by an astonishing 431.28%.

Supply: InvestingPro

Carnival reported record-breaking third-quarter earnings, with revenues approaching $8 billion and web revenue up greater than 60%. Buyers have been inspired by Carnival’s strategic initiatives and the general resurgence of the trade.

Stable earnings are attributed to excessive cruise demand and elevated shopper journey spending, together with important onboard spending and rising ticket costs.

Carnival’s advance bookings for fiscal 2025 already surpass final 12 months’s file ranges, with increased costs. As well as, the corporate has additionally been increasing its operations and locations.

The market forecasts a possible worth of $24.27, up greater than 13% from the shut of the week.

Supply: InvestingPro

3. MercadoLibre

MercadoLibre (NASDAQ:) is a multinational e-commerce firm in Latin America, headquartered in Montevideo, Uruguay.

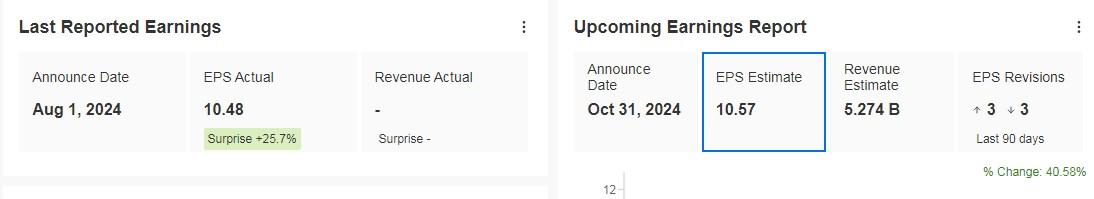

The corporate is about to launch its on October 31, with anticipated EPS development of 40.58% and income development of 25.24%.

Supply: InvestingPro

MercadoLibre has established a robust presence within the Latin American market, the place funds and e-commerce are experiencing substantial development. Key drivers of its success embrace its fee platform, Mercado Pago, and its transport resolution, Mercado Envíos.

The market sees a median potential worth of $2,295.

Supply: InvestingPro

4. Anheuser-Busch InBev

Anheuser-Busch InBev (NYSE:) is the world’s largest beer maker with manufacturers comparable to Budweiser, Corona Further, Stella Artois, and Beck’s.

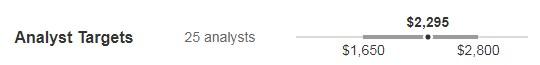

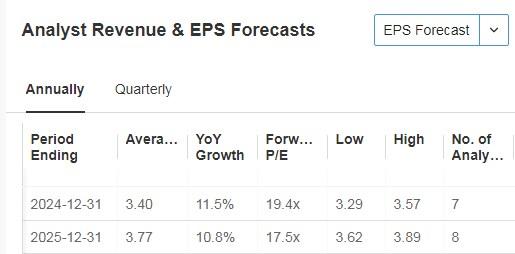

On October 31, it presents its , anticipating a rise in earnings per share of 8.53%. Waiting for 2024 and 2025, the expectation is for development of 11.5% and 10.8% respectively.

Supply: InvestingPro

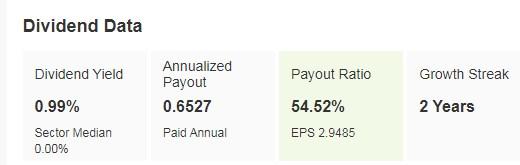

Its dividend yield is nearly 1%.

Supply: InvestingPro

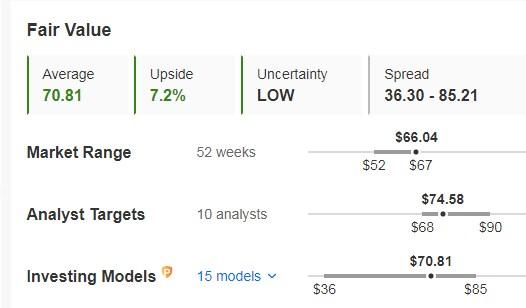

The market assigns it a median worth of $74.58, with Barclays being probably the most cautious at $73.

Supply: InvestingPro

It trades at a 7.2% low cost to its truthful worth or basic worth on the shut of the week.

Supply: InvestingPro

***

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, counsel or suggestion to take a position as such it isn’t meant to incentivize the acquisition of property in any manner. I wish to remind you that any sort of asset, is evaluated from a number of views and is very dangerous and due to this fact, any funding determination and the related danger stays with the investor.