Key themes for the Magnificent 7 Earnings season embrace the AI CapEx growth, digital advert spending, the divergence between enterprise and client spending and the regulatory backdrop.

Nasdaq 100 Key Factors

- Inside the Magnificent Seven, laggards like Apple and Amazon have fallen to date this yr regardless of typically bullish situations and standouts like Nvidia and Alphabet have gained greater than 30% year-to-date

- Key themes embrace the AI CapEx growth, digital advert spending, the divergence between enterprise and client spending and the regulatory backdrop.

- The bias for the Nasdaq 100 stays tilted towards the topside so long as this season’s earnings outcomes at the least meet analyst expectations.

Magnificent Seven Earnings Preview – MSFT, AAPL, GOOG, AMZN, NVDA, META, TSLA

All through a lot of the previous couple of years, the “Magnificent Seven” large expertise shares (Microsoft (NASDAQ:), Apple (NASDAQ:), Nvidia (NASDAQ:), Alphabet (NASDAQ:), Meta Platforms (NASDAQ:), and Tesla (NASDAQ:)) broadly moved as a monolithic unit, rising and falling in unison with the (principally) ups and (fewer) downs of the broader market, albeit to differing extents.

Since flipping the calendar to 2025, the person variations between these large entities have turn into extra stark, with laggards like Apple and Amazon (NASDAQ:) falling regardless of typically bullish situations and standouts like Nvidia (NASDAQ:) and Alphabet gaining greater than 30% year-to-date:

Supply: StoneX, TradingView

Every of the Magnificent Seven shares faces its personal set of alternatives and challenges, however with Q3 earnings season simply across the nook, it’s worthwhile to establish some frequent themes which are related to all of the Magnificent Seven (and plenty of different of the most important expertise shares as nicely).

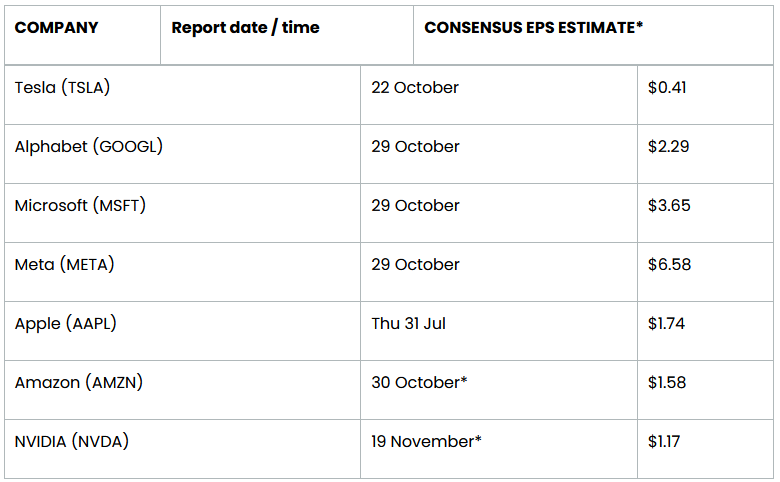

Magnificent 7 Earnings “Cheat Sheet”

*estimated earnings date

Key Magnificent Seven Themes to Watch This Earnings Season:

-

AI CapEx: Spending Huge, Demanding Extra

The hyperscaler capex arms race continues to outline this earnings season, however the tone is shifting from scale to scrutiny. After investing an estimated $345 billion in AI and datacenter infrastructure in 2024, hyperscalers are projected to carry that determine to $414 billion in 2025, and upwards of $430 billion in 2026, based on BofA and McKinsey estimates. AWS, Microsoft Azure, Google Cloud, and Meta lead the cost, with all 4 pushing aggressive build-outs to help inference, coaching, and monetization of their AI fashions and platforms.

However some analysts are questioning whether or not the times of “capex at any value” could also be behind us. Morgan Stanley cautioned in a current observe that AI investments now carry heightened threat: rising energy and actual property prices, rack overbuild threat, and a maturing monetization curve are forcing CFOs to justify infrastructure ROI extra rigorously. In earnings calls, the Road will likely be listening intently for any cracks within the supply-demand steadiness – significantly from Nvidia, which stays offered out of its high-demand Blackwell chips – and whether or not hyperscaler executives are keen to blink on spend ranges heading into 2026.

-

Digital Promoting: Progress Nonetheless Intact, However Watch the Margins

Digital advert income continues to develop, however not with out friction. In line with GroupM and Dentsu, international advert spending is predicted to develop ~5–8% in 2025, with digital commanding almost 75% of the pie—roughly $678 billion in spend. That may mark one other file, but in addition a slowdown in progress from the pandemic-era growth.

Crucially, the businesses inside the Magnificent Seven are depending on digital advert spending to differing extents. Google and Meta are grappling with flattening search and feed advert pricing, whereas Shorts and Reels stock proceed to scale with comparatively decrease CPMs. Amazon, in contrast, remains to be gaining share through its high-margin retail media community and will once more shock to the upside. Ahead steerage will likely be completely important for GOOG, META, and AMZN particularly, the place a pullback in Q4 vacation bookings may overshadow any stable Q3 outcomes.

-

The Two-Velocity Financial system: Enterprise Energy, Shopper Pressure

This quarter could additional entrench the bifurcation between client and enterprise demand. Apple and Tesla, two of the extra consumer-sensitive names within the Magazine 7, proceed to point out indicators of pressure because the chart above exhibits. iPhone volumes in China slipped almost 9% YoY in Q1 2025, whereas Tesla’s auto gross margin declined from 16% in 2024 to 13.6% in Q2, with potential for extra draw back transferring ahead as Mannequin 3 and Y worth cuts chunk.

Enterprise tech, in the meantime, stays wholesome. Microsoft’s cloud enterprise is predicted to publish 13–15% YoY progress, with Azure retaining its AI attach-rate tailwind. Amazon Internet Companies stays on observe for 20%+ YoY features, and Alphabet’s cloud unit is slowly increasing margins whereas gaining share in enterprise AI. This divergence explains a lot of the year-to-date efficiency and can stay a key theme by means of this reporting cycle as buyers reward infrastructure-centric companies with robust cloud positioning, whereas discounting these uncovered to discretionary client tech.

-

Coverage & Geopolitics: The Unrelenting Overhang

Regulatory and commerce overhangs are once more within the highlight. The U.S. Division of Justice has moved into the treatments part of its antitrust victory towards Google, with analysts now debating whether or not the federal government will push for significant enterprise separation or behavioral shifts. Apple, in the meantime, stays entangled in EU Digital Markets Act compliance and is interesting a €500 million superb tied to alleged anti-steering practices.

On the geopolitical entrance, Nvidia’s workaround GPUs together with the much-discussed H20 are serving to it preserve China gross sales regardless of tightening U.S. export controls. However the scenario stays fluid with the US authorities more and more getting concerned each as a policymaker and outright investor in rival companies.

Nasdaq 100 Technical Evaluation – NDX Each day Chart

Supply: TradingView, StoneX

Because the chart above exhibits, the stays inside a 5-month bullish channel for now, exhibiting relative resilience towards its main US index rivals.

Towards that technical backdrop, the bias stays tilted towards the topside so long as this season’s earnings outcomes at the least meet analyst expectations. To the topside, the following stage of resistance to look at is the spherical 25,000 deal with, adopted by the 161.8% Fibonacci extension of the “Liberation Day” swoon close to 25,900 after that.

Nonetheless, if weak earnings studies begin to accumulate and the index breaks down from its channel to fall beneath the 50-day EMA, a deeper retracement towards the 200-day MA close to earlier resistance at 22,150 may very well be within the playing cards.

Unique Publish