- As recession dangers develop, healthcare, utilities, and insurance coverage shares are likely to outperform.

- Defensive shares with low volatility and powerful dividends assist climate downturns.

- On this piece, we spotlight 4 recession-proof shares with stability, revenue, and development.

- In search of extra actionable commerce concepts to navigate the present market volatility? Subscribe right here to unlock entry to ProPicks AI winners.

Recessionary winds have returned to the USA in current weeks. Treasury Secretary Scott Bessent himself has warned that the might not escape it. Warning is suggested in such circumstances, so it’s greatest to take him at his phrase and put together for a possible downturn on this planet’s main financial system.

What Shares Are Price Betting on within the Occasion of a Recession?

When markets start to wobble, some corporations nonetheless handle to take care of soundness and profitability. So, which shares are greatest positioned to deal with a interval of uncertainty? There are specific traits and sectors that are likely to outperform throughout financial downturns.

Among the many primary traits we have to monitor to establish defensive shares are:

- Low beta: These shares are normally much less risky than the market.

- Engaging dividend yield: Shareholders can earn a excessive dividend yield.

- Secure revenues: The corporate maintains regular demand even in occasions of financial downturn.

As for sectors, it’s greatest to deal with:

- Important Consumption: Meals, family items, and low-cost necessities. Demand for these items stays regular, even throughout recessions or financial uncertainty.

- Healthcare: Prescription drugs, well being providers, and firms providing well being merchandise and medical gear. The healthcare sector is mostly much less affected by financial cycles.

- Utilities: Firms offering important providers comparable to electrical energy, fuel, water, and telecommunications. Traditionally, the utility sector is extra resilient throughout recessions, as these providers are basic to day by day life and are consumed recurrently.

Easy methods to Determine Defensive Shares

To establish one of the best shares to purchase forward of a recession, one can depend on skilled instruments, comparable to InvestingPro’s Superior Inventory Screener, which filters shares primarily based on chosen parameters.

Or, since we dwell within the age of Synthetic Intelligence, we will additionally ask AI straight which shares are one of the best to wager on throughout a recession.

That is made potential by InvestingPro’s newest device, WarrenAI, the digital monetary assistant that solutions all market-related questions by synthesizing a flood of knowledge right into a easy reply.

4 Greatest Shares to Defend Towards a Recession In line with WarrenAI

So, let’s say we wish to know what one of the best 4 recession-proof U.S. shares are, with:

- Beta lower than 1 over the previous 5 years;

- Dividend yield higher than 5%;

- Income over $5 billion;

- Income CAGR (5 years) up a minimum of 5%.

Supply: InvestingPro

Simply ask WarrenAI, and the solutions come…

Supply: InvestingPro

A couple of seconds of processing and right here is the consequence:

The highest 4 anti-recession shares in line with AI are:

- Pfizer (NYSE:)

- Edison Worldwide (NYSE:)

- Amcor (NYSE:)

- CNA Monetary Company (NYSE:)

But it surely doesn’t cease there. WarrenAI additionally explains why these shares have been chosen. So, let’s dive into the main points.

1. Pfizer – Well being and Stability in Tough Occasions

- Beta (5 years): 0.54

- Dividend yield: 6.6%

- Income: $63.63 billion

- Income CAGR (5 years): 9.2%

The pharmaceutical sector is likely one of the most sturdy throughout robust financial occasions, and Pfizer is likely one of the greatest choices for these in search of a defensive inventory. With a beta of 0.54, it’s much less risky than the market, and its dividend yield of 6.6% provides a horny return for traders. Moreover, common income development (+9.2% yearly) reveals the corporate’s capability to increase even in difficult environments.

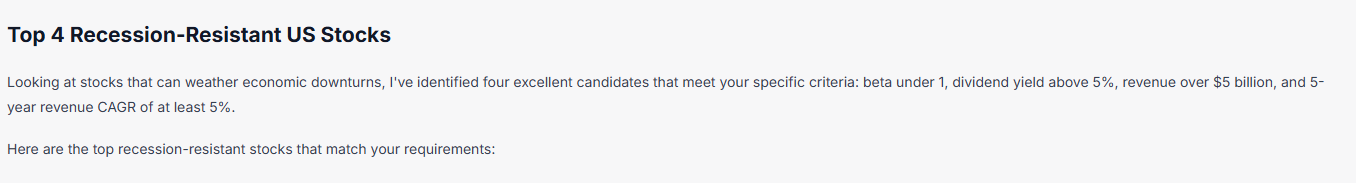

Supply: InvestingPro

Supply: InvestingPro

2. CNA Monetary Company – Insurance coverage and Excessive Yield

- Beta (5 years): 0.68

- Dividend yield: 7.8%

- Income: $14.27 billion

- Income CAGR (5 years): 5.8%

Insurance coverage corporations have one key attribute: prospects proceed to pay insurance coverage premiums even in occasions of disaster. CNA Monetary combines a really excessive dividend yield (7.8%) with sustainable income development (+5.8% yearly). With a beta of 0.68, the inventory is much less prone to market fluctuations, making it a stable defensive alternative.

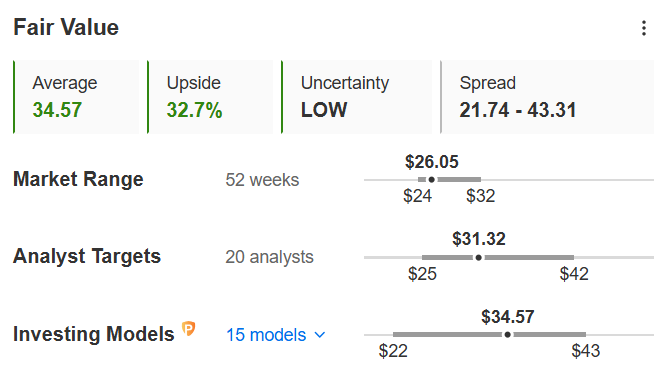

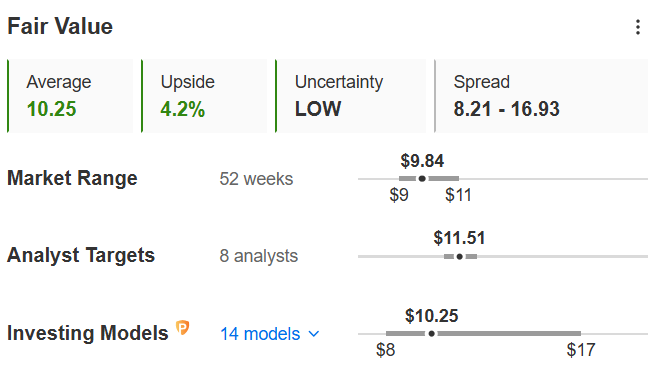

Supply: InvestingPro

3. Edison Worldwide – A Secure Haven within the Utility Sector

- Beta (5 years): 0.88

- Dividend yield: 5.6%

- Income: $17.60 billion

- Income CAGR (5 years): 7.3%

Firms that present important providers comparable to electrical energy and fuel are likely to carry out properly even in extreme recessions. Edison Worldwide, a frontrunner within the utility sector, provides a dividend yield of 5.6% and stable income development (+7.3% yearly). Though it has a barely larger beta than the opposite shares on this listing (0.88), it stays a secure possibility with much less sensitivity to market fluctuations.

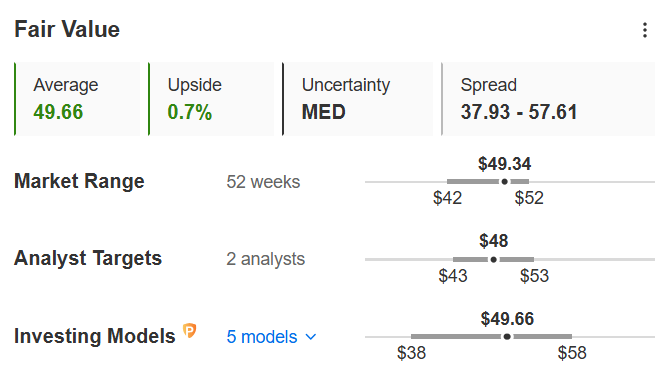

Supply: InvestingPro

4. Amcor – Packaging (NYSE:) That Withstands Crises

- Beta (5 years): 0.81

- Dividend yield: 5.2%

- Income: $13.54 billion

- Income CAGR (5 years): 7.6%

Amcor is likely one of the main international corporations in packaging and packaging supplies manufacturing, a enterprise that continues to be crucial no matter financial circumstances. The corporate combines a dividend yield of 5.2% with regular income development (+7.6% yearly), sustaining secure demand for its merchandise even in weaker financial cycles.

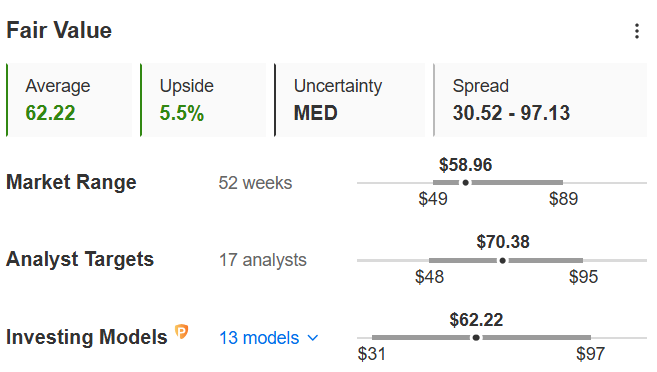

Supply: InvestingPro

Why These Shares in Explicit?

In brief, what do these 4 shares have in frequent in line with WarrenAI?

- They provide important services and products, guaranteeing regular demand even in downturns.

- They exhibit low volatility, with betas under 1, lowering the danger of huge worth swings.

- They assure dividend yields above 5%, offering an revenue stream for traders.

- They present sustainable income development, an indication that their enterprise fashions are sound and increasing.

As well as, WarrenAI helped us diversify away from being too uncovered to at least one sector.

Defensive shares will also be affected by a recession, however traditionally, they have an inclination to carry up higher than the market as a complete. Subsequently, constructing a balanced portfolio, after assessing one’s danger profile and conducting thorough analysis, containing stable corporations and dependable dividends, generally is a good technique for coping with an unsure interval.

Simpler mentioned than performed? Actually, however at present, a minimum of, we have now yet one more ally.

***

Disclaimer: This text is written for informational functions solely. It’s not meant to encourage the acquisition of belongings in any approach, nor does it represent a solicitation, supply, advice or suggestion to take a position. I wish to remind you that every one belongings are evaluated from a number of views and are extremely dangerous, so any funding determination and the related danger belongs to the investor. We additionally don’t present any funding advisory providers.