- 3M’s development trajectory was hindered over the previous decade on account of legal responsibility points

- The current $10.3 billion settlement brings some positivity for 3M buyers.

- Regardless of challenges, 3M nonetheless exhibits potential for upside based mostly on its fundamentals.

- InvestingPro Summer season Sale is on: Try our huge reductions on subscription plans!

Once I first began investing in shares again in 2013, 3M (NYSE:) was my first buy. The Minneapolis, Minnesota-based industrial large had the whole lot I regarded for in a inventory: an internationally recognizable model, robust fundamentals, low volatility, and a hefty dividend yield with stable development for over 50 years.

For 5 years, I simply sat and watched the inventory develop a stable 150% whereas receiving one other 6% protected yearly dividend on high of it. Positive, it wasn’t Apple-like development, however neither was I in search of emotion.

However then one thing snapped, and 3M’s development trajectory modified for good. The corporate received caught in an countless stream of legal responsibility, damaging its popularity and stability sheet, finally erasing a decade of positive factors—which so occurs to be one of many a long time of extra vital development for U.S. shares.

The inventory now trades on the degree I first purchased it in 2013.

All through the course of the 3M’s lengthy bear market, I managed to promote my positions at a median of $170/share, removed from the inventory’s $250 high however nonetheless significantly better than the present ~$100 worth.

Nonetheless, final week, 3M buyers lastly received one optimistic breakthrough: the corporate a $10.3 billion settlement for its ‘endlessly chemical compounds’ go well with.

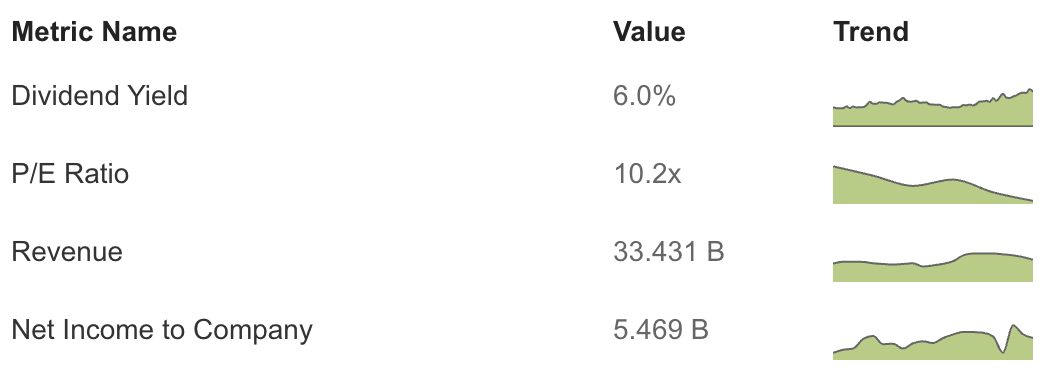

With the inventory operating at a really fascinating 10.2 PE with stable profitability, the query operating by means of buyers’ minds is: is sufficient lastly sufficient for the economic large?

Supply: InvestingPro

To reply that query, let’s dive into 3M’s fundamentals and the corporate’s newest information with InvestingPro.

By the way in which, InvestingPro is presently internet hosting its Summer season Sale, providing huge reductions on subscription plans. That is your likelihood to entry cutting-edge instruments, real-time market evaluation, and knowledgeable opinions at a fraction of the worth.

Get pleasure from unimaginable reductions on our subscription plans:

- Month-to-month: Save 20% and get the pliability of a month-to-month subscription.

- Annual: Save a tremendous 50% and safe your monetary future with a full yr of InvestingPro at an unbeatable worth.

- Bi-Annual (Internet Particular): Save a tremendous 52% and maximize your earnings with our unique net provide.

‘The Resolution to Air pollution Is Dilution’

Again within the 70s, 3M executives would famously quote the above sentence to brush their issues below the rug—or somewhat, to dilute them within the water. However then got here the 2010s, and issues did not grow to be fairly like that, as the corporate received caught in a plethora of authorized actions.

Actually, the data of 3M’s board of administrators of the corporate’s polluting previous has led to an extra shareholder lawsuit towards the board of administrators—which I participated in.

On high of these instances, 3M can be battling the biggest mass tort in U.S. historical past on account of allegedly offering ineffective earplugs to the U.S. navy, damaging the listening to of a whole lot of 1000’s of fight troopers. In accordance with Reuters, the case has 330,000 instances filed and roughly 260,000 pending instances.

In a current unfavorable choice for 3M, U.S. Chapter Decide Jeffrey Graham the corporate’s effort to resolve the lawsuits by submitting for chapter of its subsidiary, Aearo Applied sciences—which 3M claims to be the precise maker of the allegedly faulty earplugs.

Nonetheless, because the ‘endlessly chemical compounds’ lawsuit seems to be nearing an ending, buyers start to marvel if 3M’s legal responsibility is a ‘endlessly downside’ for the 121-year-old firm.

Let’s check out the corporate’s financials for extra clues to that query.

Is 3M Undervalued?

To flatly reply the query above from a strictly basic standpoint, sure—particularly in a market that is starting to indicate indicators of exhaustion after leaping this yr.

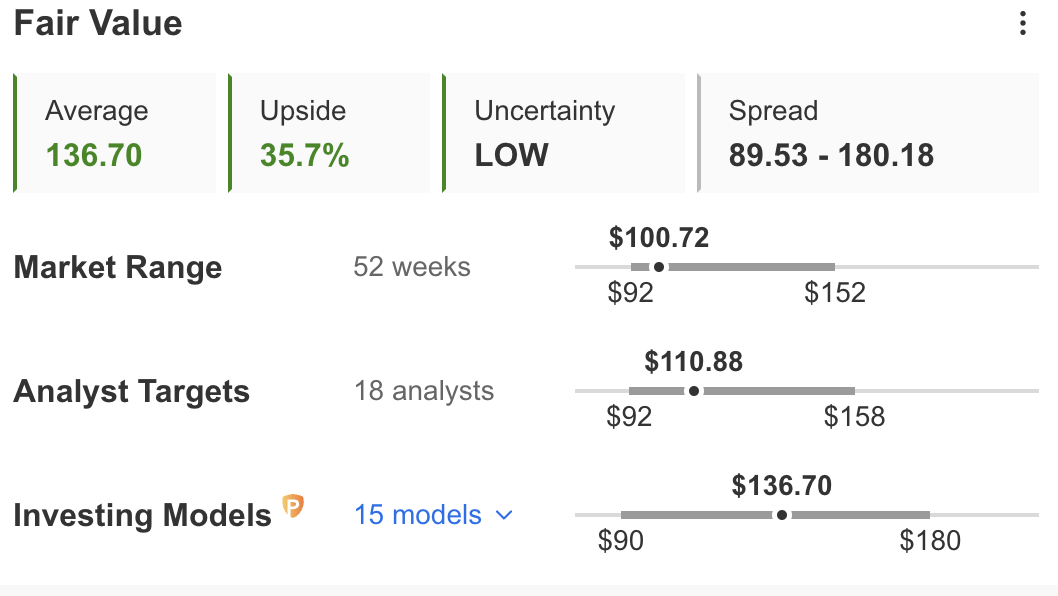

In accordance with InvestingPro’s 15 fashions, the inventory has a possible 35.7% upside potential within the subsequent few months with low uncertainty.

Supply: InvestingPro

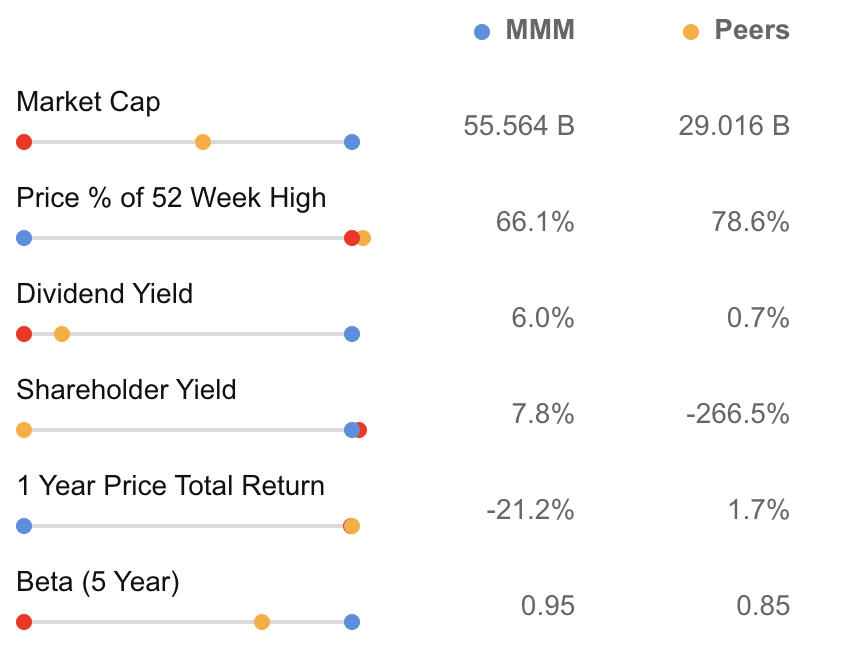

Moreover, the corporate is buying and selling additional away from its 52-week excessive with a higher beta than its sector friends, implying that it might doubtless rise quicker and additional in an uptrend.

Supply: InvestingPro

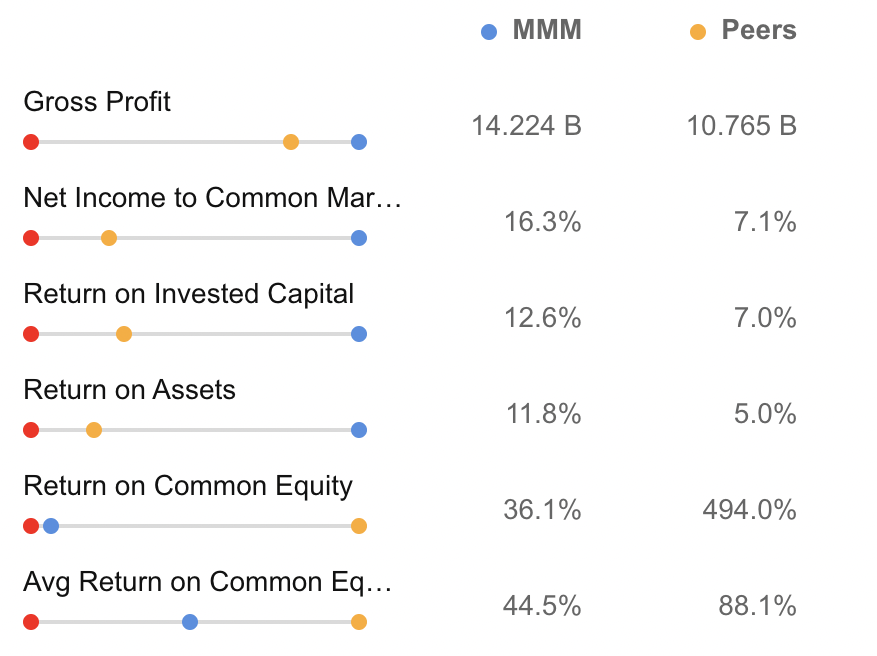

Furthermore, the Minnesota-based firm is means forward of the competitors in gross revenue, web revenue margin, return on invested capital, and return on belongings.

Supply: InvestingPro

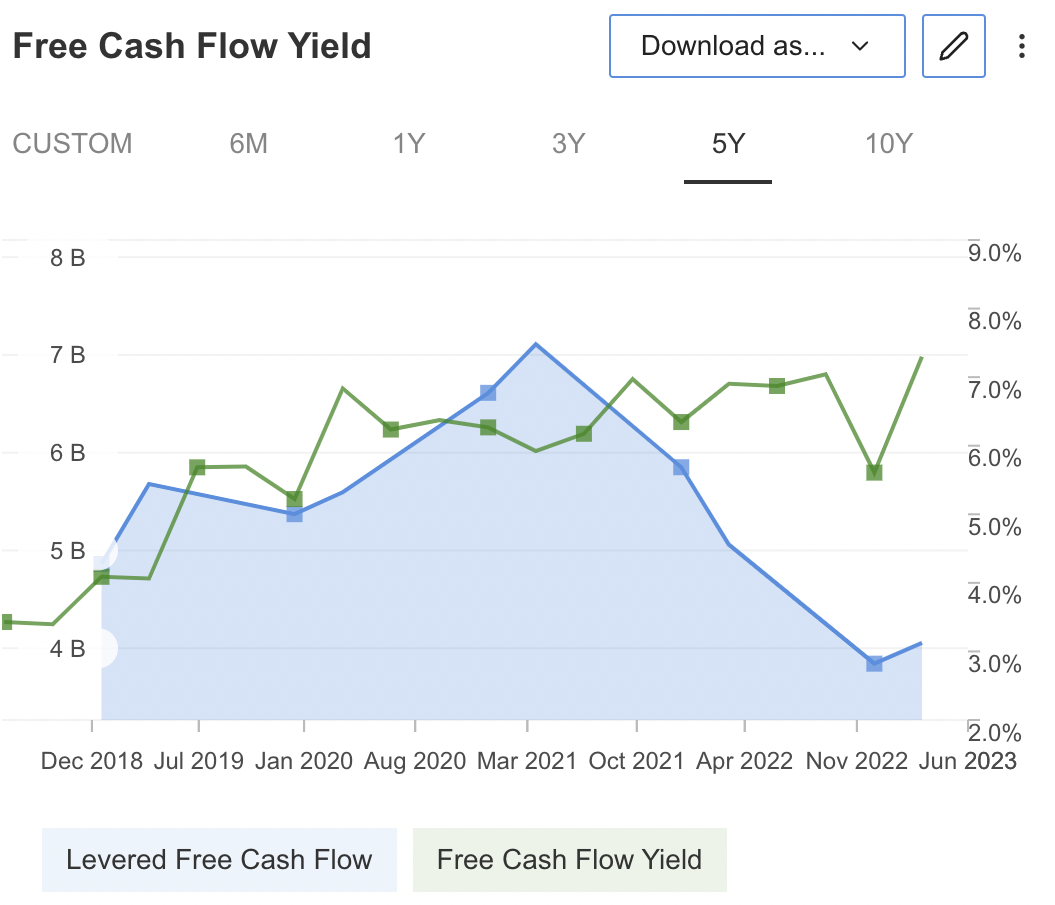

As InvestingPro knowledge exhibits, the corporate has additionally been rising its free money circulation yield whereas holding leveraged money circulation considerably low, implying monetary resilience towards a macroeconomic disaster, equivalent to a possible incoming recession.

Supply: InvestingPro

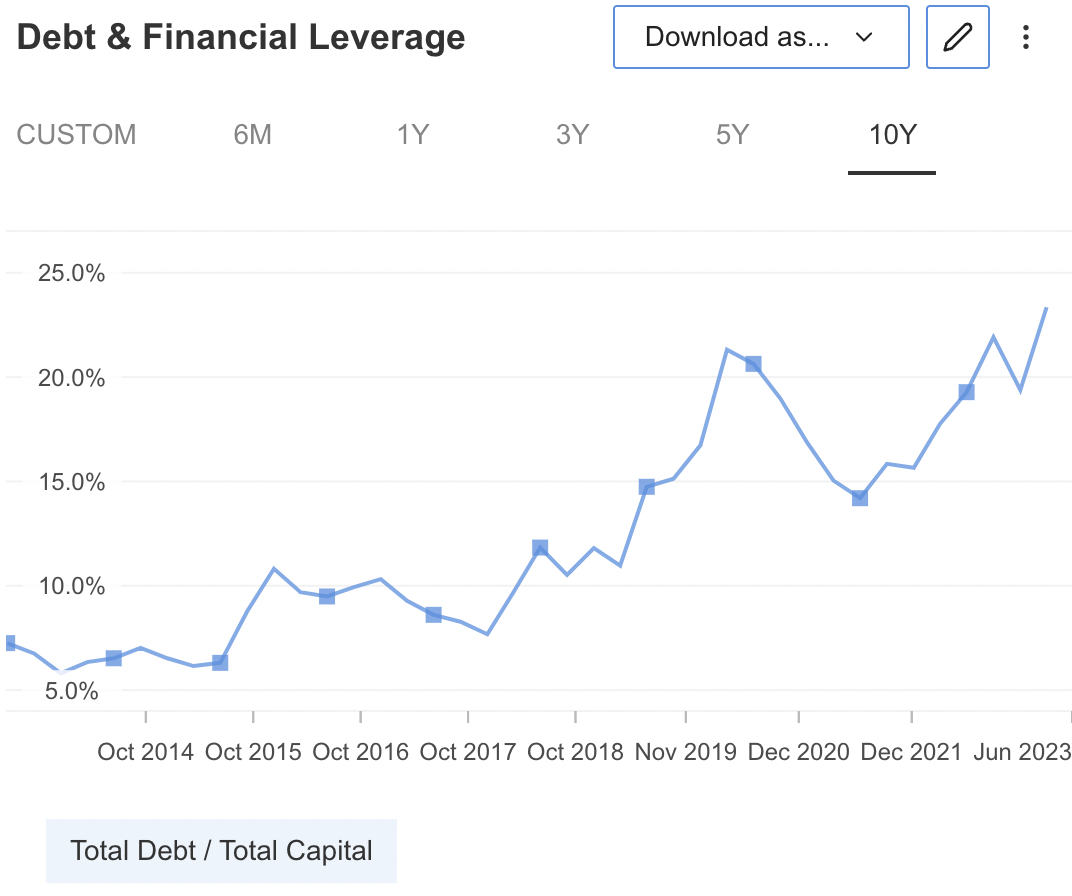

Nonetheless, as a consequence of the authorized battles, 3M’s debt to whole capital has been on a gradual uptrend for the previous decade.

Supply: InvestingPro

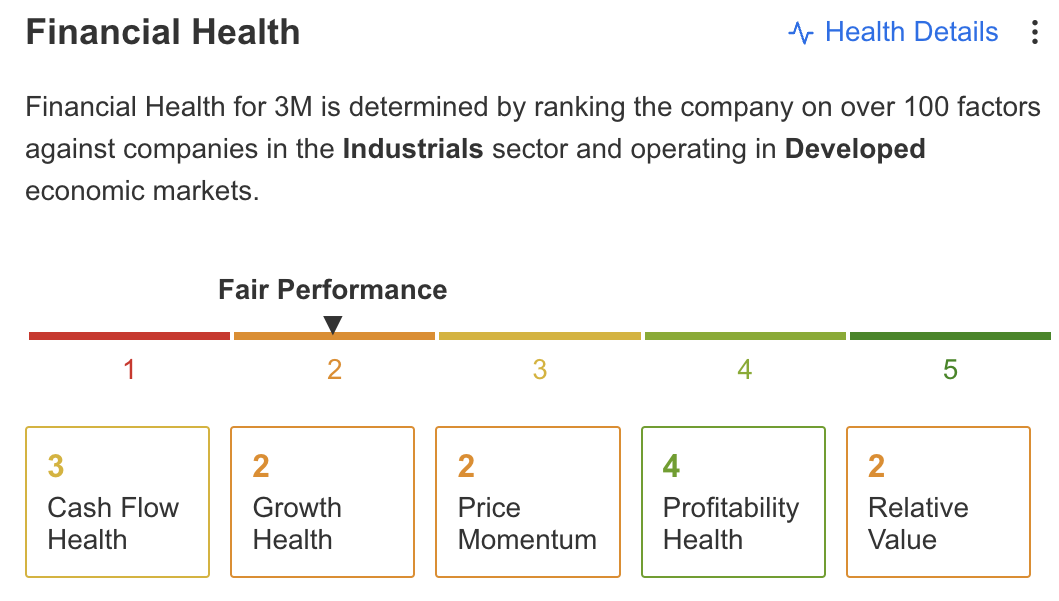

The corporate’s rising debt, mixed with its slowing worth momentum, has led to a low monetary well being rating on InvestingPro.

Supply: InvestingPro

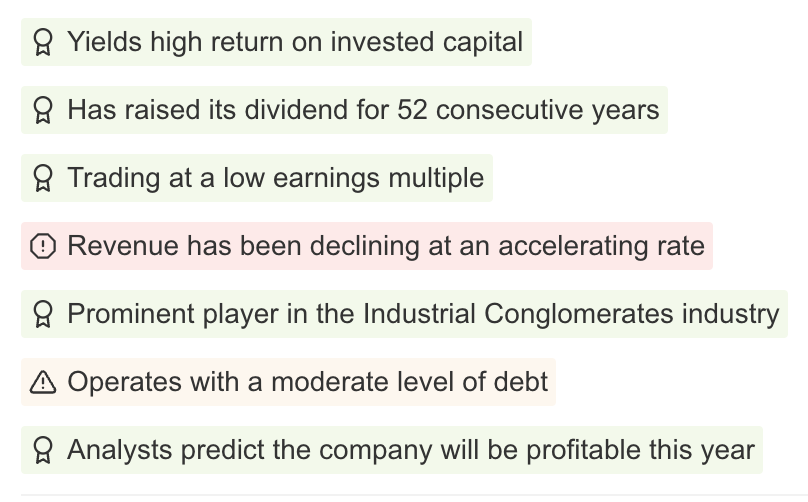

Nonetheless, legal responsibility apart, 3M has extra upside than draw back potential, in line with InvestingPro.

Supply: InvestingPro

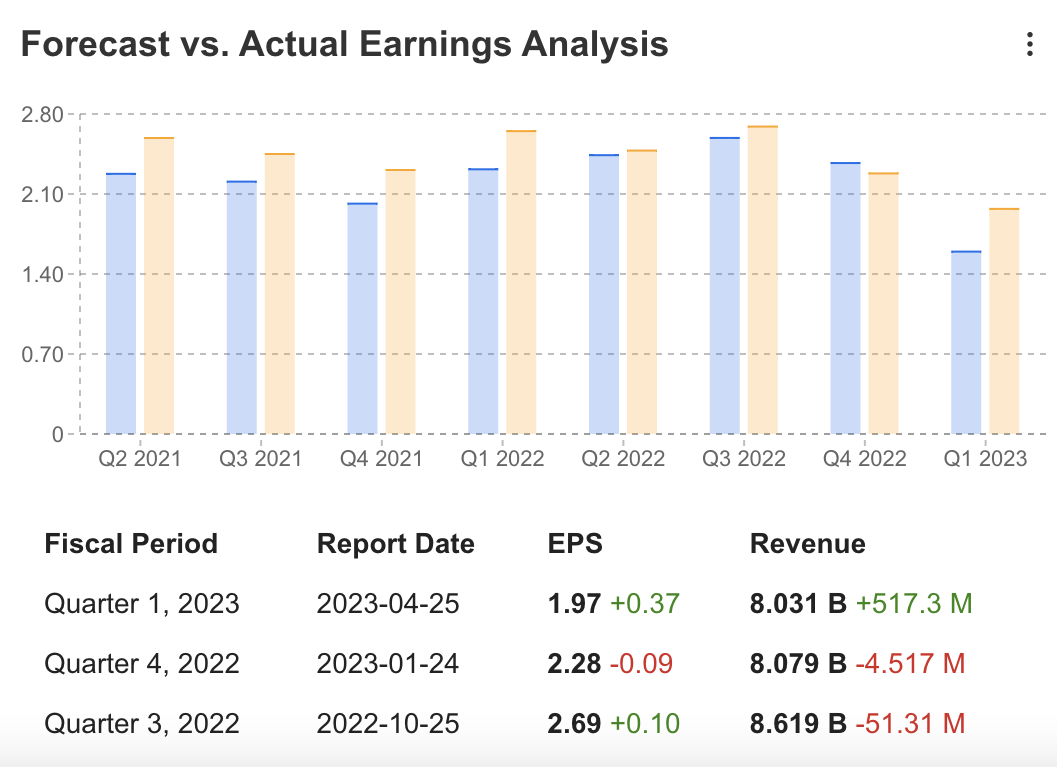

Moreover, regardless of the declining income development—primarily because of the macroeconomic setting—3M posted better-than-expected figures on its newest .

Supply: InvestingPro

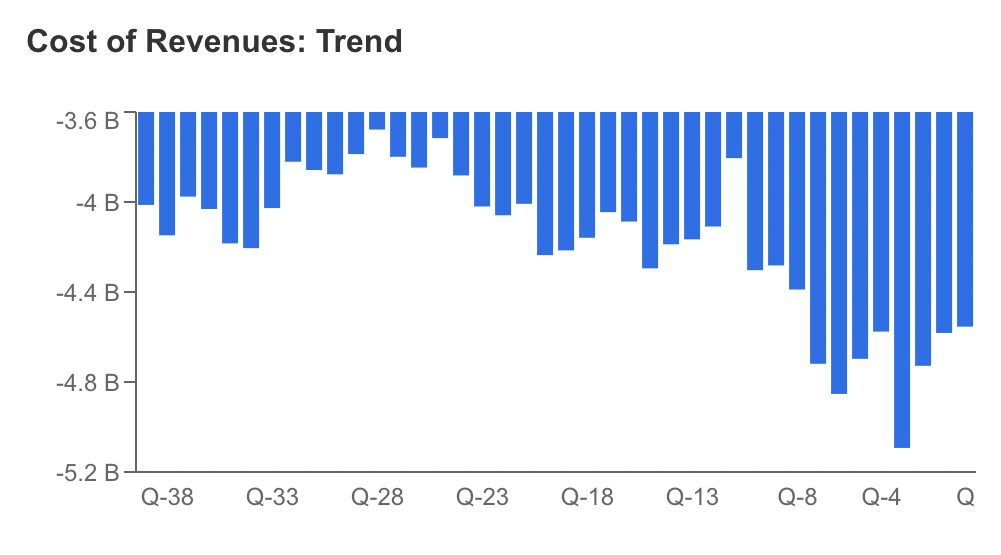

That is primarily as a result of the price of income has been trending a lot decrease—primarily because of the firm’s cost-cutting initiatives, primarily in place since final yr.

Supply: InvestingPro

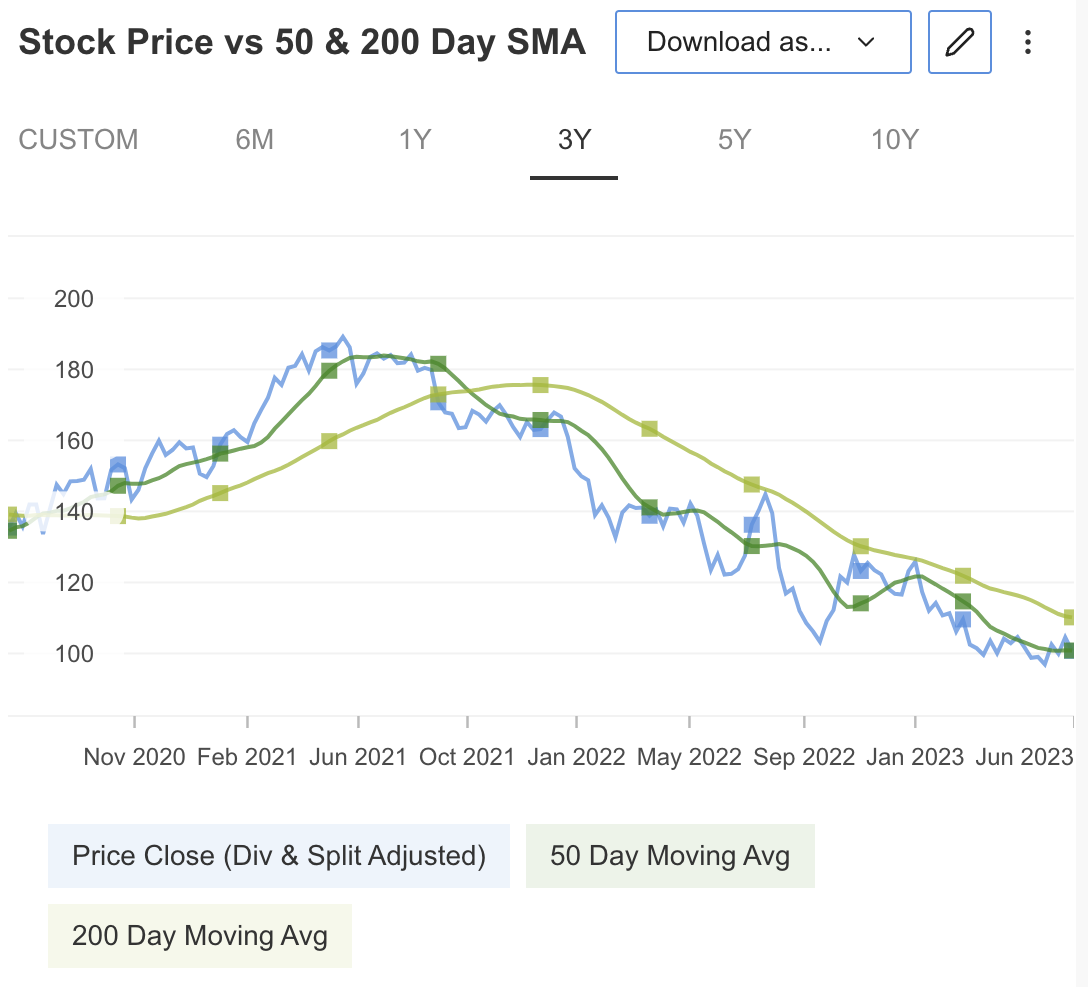

On the technical facet, the inventory is presently sitting at its 50-day transferring common, and a transfer decrease would doubtless create a protected entry level.

Supply: InvestingPro

Backside Line

From a basic perspective, 3M ought to be buying and selling at a lot greater ranges than it presently is—even regardless of the rising harm to its stability sheet incoming from authorized legal responsibility.

Furthermore, it seems protected to guess that the 120-year-old firm will survive this darkish interval in its historical past and see higher days once more sooner or later.

The query lies wherein ranges are value shopping for the inventory within the face of its steady dangers. I’d say something beneath 95$ could possibly be value a attempt, with sub-$85 costs indicating a downright purchase.

Possibly sufficient is not but sufficient for 3M, however fundamentals point out that we’re getting very near that.

***

Do not miss this limited-time alternative to entry cutting-edge instruments, real-time market evaluation, and the most effective knowledgeable opinions.

Be part of InvestingPro right now and unleash your funding potential. Hurry, the Summer season Sale will not final endlessly!

Disclosure: As of this writing, the writer would not personal any positions in 3M. He could think about shopping for the inventory on the ranges talked about on this report.