- Wall Avenue appears set to proceed the rebound from Monday’s sharp selloff.

- Tech shares are again in favor as risk-on commerce returns.

- As such, I used InvestingPro to seek out high-quality, undervalued tech shares with robust upside forward.

- Searching for extra actionable commerce concepts? Attempt InvestingPro for beneath $8/Month.

The latest restoration in danger sentiment has buyers respiration a sigh of reduction, coming simply two days after the suffered its worst day by day decline since late 2022. As risk-on commerce returns, tech shares are as soon as once more drawing investor curiosity.

Supply: Investing.com

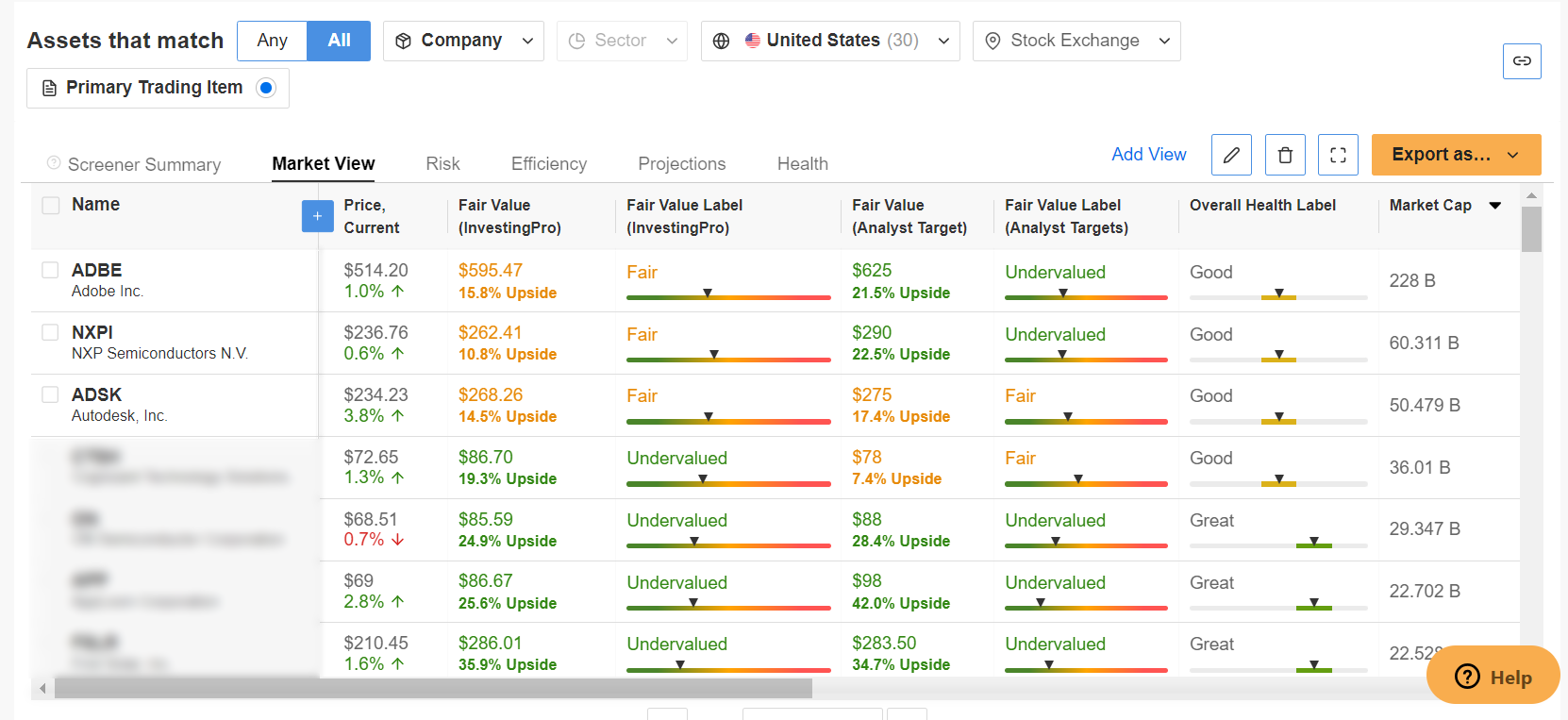

Utilizing InvestingPro, I’ve recognized three high-quality tech shares value contemplating.

Every of those firms has robust fundamentals and vital upside potential in response to AI-powered quantitative fashions in InvestingPro.

With strong monetary well being scores and a good market outlook, these shares are well-positioned to ship sturdy returns amid enhancing danger urge for food.

Supply: InvestingPro

Let’s delve into the highest three tech shares to think about as market sentiment begins to shift.

1. Adobe

- Tuesday’s Closing Worth: $514.20

- Honest Worth Estimate: $595.47 (+15.8% Upside)

- Market Cap: $228 Billion

Adobe (NASDAQ:) is a worldwide chief in digital media and digital advertising and marketing options. Its flagship merchandise, reminiscent of Photoshop, Illustrator, and Acrobat, are broadly utilized by inventive professionals and enterprises.

Adobe’s Inventive Cloud and Expertise Cloud platforms provide a complete suite of instruments and companies for content material creation, advertising and marketing, analytics, and e-commerce.

ADBE inventory ended Tuesday’s session at $514.20, not removed from its 2024 low of $433.97 reached on Might 31. At present ranges, the San Jose, California-based software-as-a-service powerhouse has a market cap of $228 billion.

Supply: Investing.com

Regardless of worries over an more and more aggressive panorama, Adobe continues to learn from the continuing digitization of companies and the rising demand for digital content material creation instruments. Adobe’s subscription-based mannequin gives a gradual income stream, and its progressive product choices preserve it on the forefront of the business.

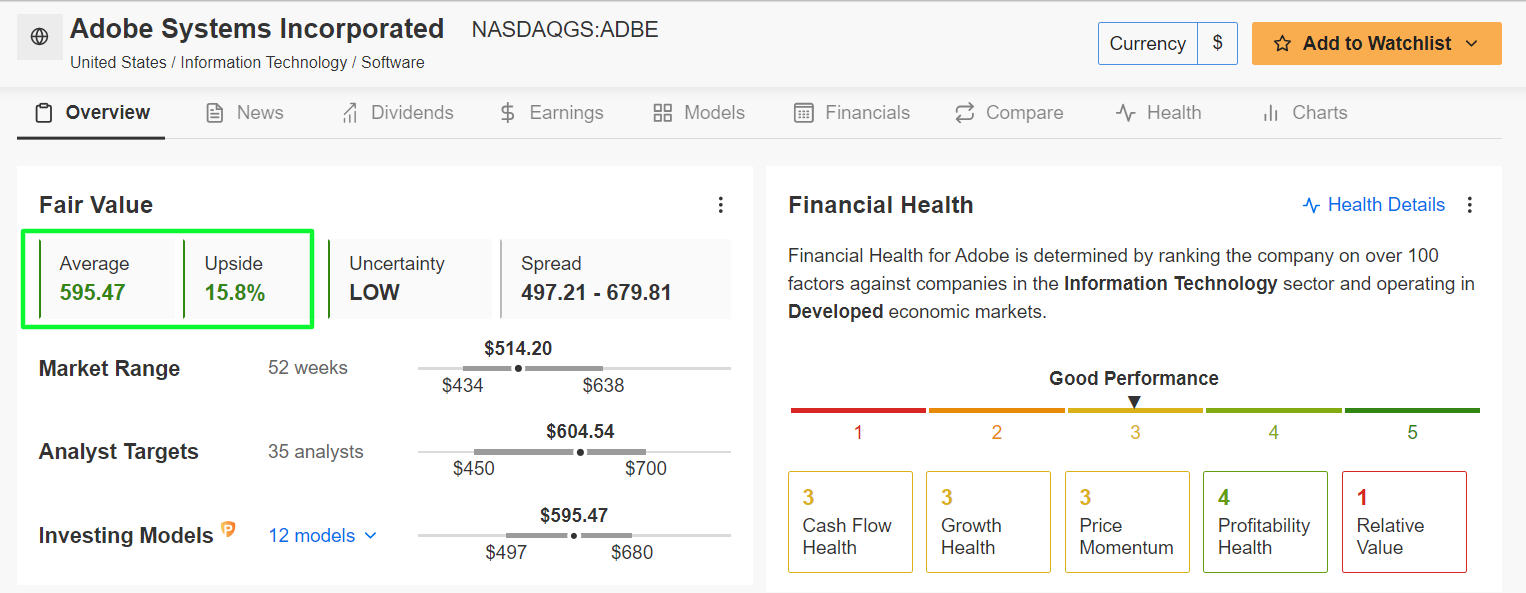

• ‘Honest Worth’ Upside Potential:

In keeping with InvestingPro’s AI-powered ‘Honest Worth’ fashions, Adobe is extraordinarily undervalued with a +15.8% upside potential to its Honest Worth worth estimate of $595.47.

Supply: InvestingPro

This sizable upside, mixed with its main market place and progressive product portfolio, makes Adobe a beautiful funding during times of heightened danger sentiment.

• Firm Well being Rating:

Adobe’s robust ‘Monetary Well being Rating’ is characterised by its sturdy income progress and excessive revenue margins. The corporate persistently generates robust free money circulate, which helps its progress initiatives and shareholder returns.

2. NXP Semiconductors

- Tuesday’s Closing Worth: $236.76

- Honest Worth Estimate: $262.41 (+10.8% Upside)

- Market Cap: $60.3 Billion

NXP Semiconductors NV (NASDAQ:) is a number one international semiconductor producer specializing within the manufacturing of chips for the automotive, industrial, cell, and communications infrastructure markets.

The Netherlands-based firm’s merchandise are integral to functions reminiscent of superior driver help techniques (ADAS), safe related automobiles, cybersecurity, and Web of Issues (IoT).

NXPI inventory ended at $236.76 yesterday, not removed from its 2024 peak of $296.08 reached on July 17. At its present valuation, NXP has a market cap of $60.3 billion, making it the second-largest European semiconductor firm after ARM Holdings (LON:).

Supply: Investing.com

The increasing IoT market and the proliferation of related gadgets create vital alternatives for NXP. The corporate’s experience in safe connectivity and edge processing positions it effectively to capitalize on this rising pattern.

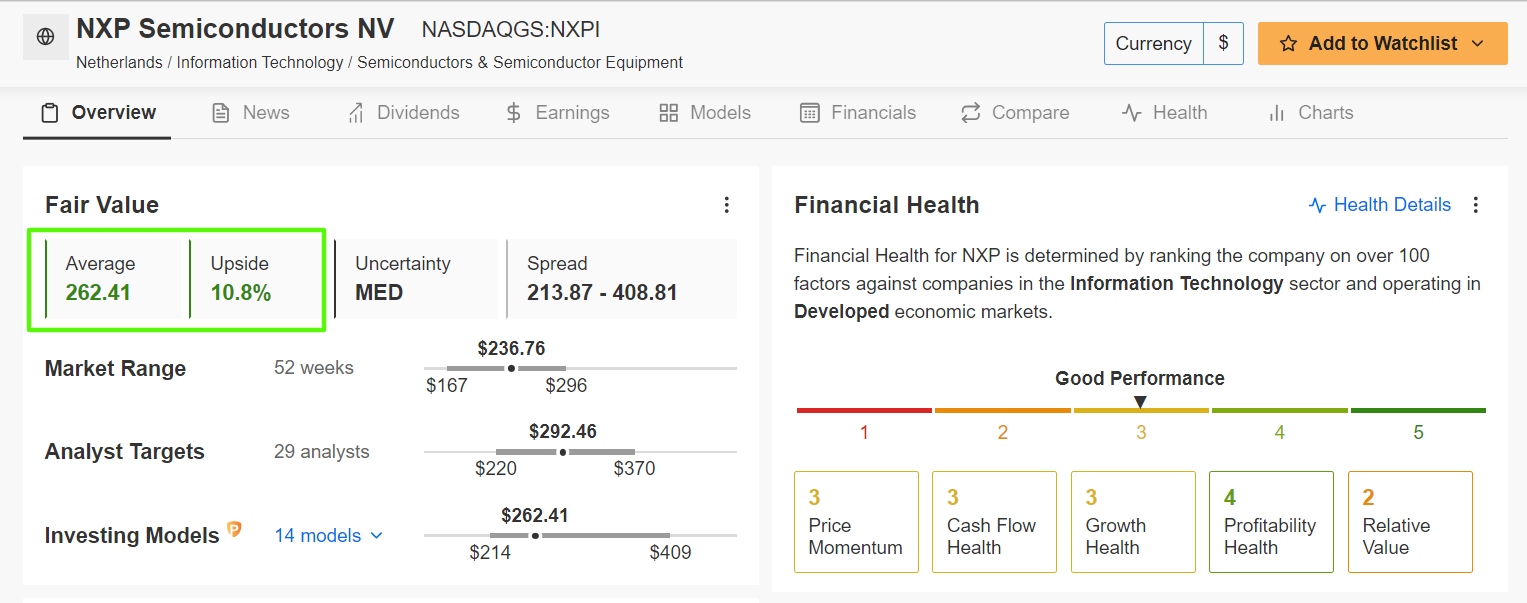

• ‘Honest Worth’ Upside Potential:

Present ‘Honest Worth’ worth goal estimates point out that NXPI inventory is buying and selling at a cut price valuation. InvestingPro’s AI fashions predict a +10.8% potential upside. That might carry shares nearer to their ‘Honest Worth’ worth goal of $262.41.

Supply: InvestingPro

This substantial upside, mixed with its management in automotive semiconductors and robust demand in IoT and connectivity markets, makes NXP a beautiful funding in a risk-on atmosphere.

• Firm Well being Rating:

NXP Semiconductors ‘Monetary Well being Rating’, as assessed by InvestingPro, displays its sturdy monetary place, wholesome steadiness sheet, robust cash-generating capabilities, in addition to its promising earnings and gross sales progress trajectory.

Moreover, InvestingPro additionally mentions that the corporate has raised its annual dividend payout for six consecutive years, a testomony to its steady effort to return capital to shareholders.

3. Autodesk

- Tuesday’s Closing Worth: $234.23

- Honest Worth Estimate: $268.26 (+14.5% Upside)

- Market Cap: $50.5 Billion

Autodesk (NASDAQ:) is a worldwide software program firm that gives design software program and companies for the structure, engineering, development, manufacturing, media, and leisure industries.

Its flagship product, AutoCAD, is broadly used for 2D and 3D design and drafting.

ADSK shares closed at $234.23 final night time, simply above their year-to-date low of $195.32 touched on Might 31. The San Francisco, California-based software program maker has a market cap of $50.5 billion at its present valuation.

Supply: Investing.com

The structure, engineering, and development (AEC) business is experiencing sturdy progress, pushed by growing infrastructure investments and the adoption of digital applied sciences. Autodesk is well-positioned to capitalize on this pattern with its complete AEC product suite.

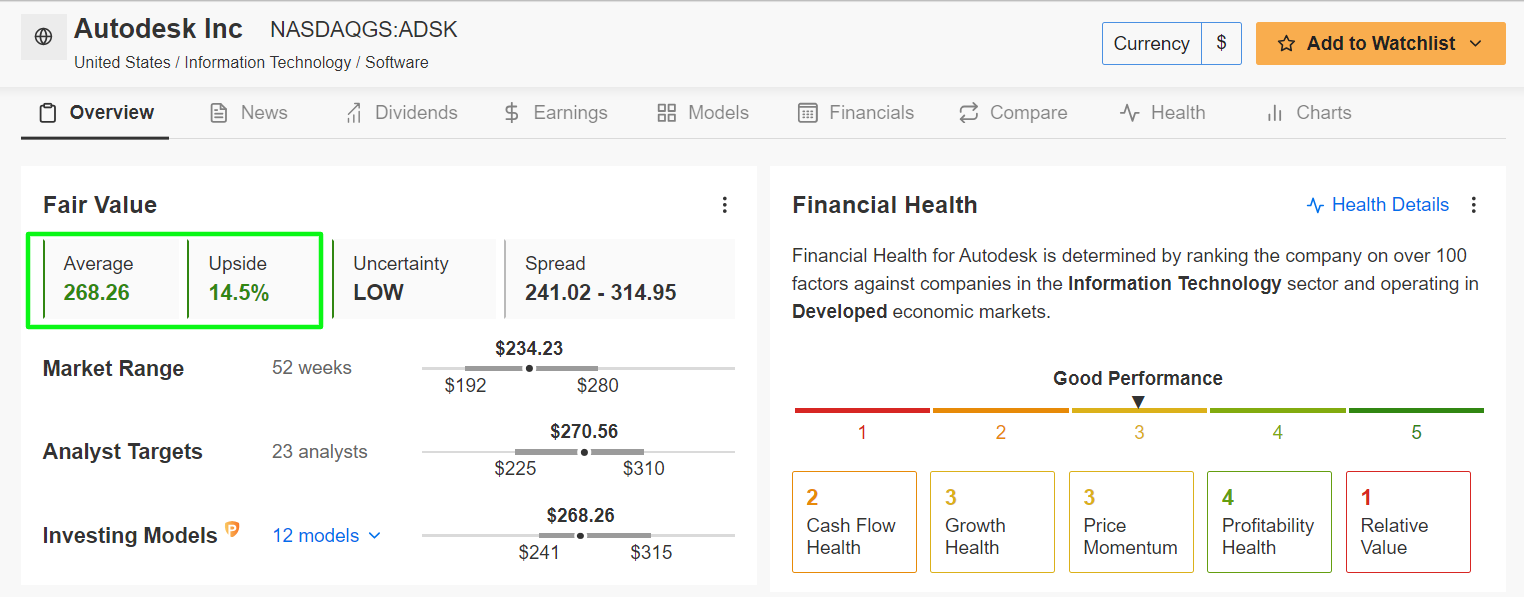

• ‘Honest Worth’ Upside Potential:

The current valuation of Autodesk suggests it’s a cut price, as assessed by the AI-backed quantitative fashions in InvestingPro. There is a chance of a +14.5% enhance from final night time’s closing worth, shifting it nearer to its ‘Honest Worth’ set at $268.26 per share.

Supply: InvestingPro

This vital upside, coupled with its robust market place and transition to a extra steady subscription-based income mannequin, makes Autodesk a compelling funding as danger sentiment improves.

• Firm Well being Rating:

As per InvestingPro analysis, Autodesk’s wholesome profitability outlook, rising web earnings, spectacular gross revenue margins and sturdy steadiness sheet metrics earn it a noteworthy ‘Monetary Well being Rating’ of three out of 5.

Conclusion

As danger sentiment recovers, investing in high-quality tech shares like Adobe, Autodesk, and NXP Semiconductors can present vital upside potential.

Every of those firms is undervalued in response to InvestingPro’s AI-powered fashions and has robust tailwinds supporting their progress.

***

Click on right here to unlock entry to InvestingPro’s highly effective options at a reduction.

Disclosure: On the time of writing, I’m lengthy on the S&P 500, and the by way of the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Belief ETF (QQQ). I’m additionally lengthy on the Expertise Choose Sector SPDR ETF (NYSE:).

I frequently rebalance my portfolio of particular person shares and ETFs based mostly on ongoing danger evaluation of each the macroeconomic atmosphere and firms’ financials.

The views mentioned on this article are solely the opinion of the creator and shouldn’t be taken as funding recommendation.

Observe Jesse Cohen on X/Twitter @JesseCohenInv for extra inventory market evaluation and perception.