As we anticipate what 2023 may need in retailer for buyers, we should first contemplate what the Fed could or could not do. We expect there are three potential paths the Fed would possibly comply with in 2023. The three paths decide the extent of in a single day rates of interest and, extra importantly, liquidity for the monetary markets. Liquidity has a heavy affect on inventory returns.

Let’s study the three paths and contemplate what they could imply for inventory costs.

The Highway Map for 2023

The graph under compares the three most possible paths for Fed Funds in 2023. The inexperienced line tracks the Federal Reserve’s steerage for the Fed Funds price. The black line charts investor projections as implied by Fed Funds futures. Lastly, the “one thing breaks” different in pink relies on prior easing cycles.

Situation 1 The Fed’s Expectations

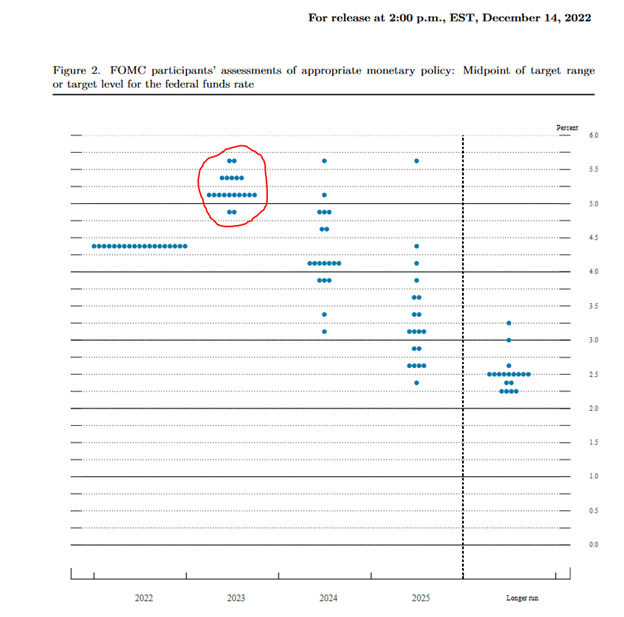

To supply buyers transparency into Fed members’ financial and coverage outlooks, the Fed publishes a abstract of every voting member’s financial and Fed Funds expectations for the following few years. The newest quarterly steerage on the Fed Funds price, as proven under, is from December 14, 2022.

Fed Projections 2023

The dots characterize the place every member expects the Fed Funds price to be sooner or later.

The vary of Fed Funds expectations for 2023 is between 4.875% and 5.625%. Most FOMC members anticipate Fed Funds to finish the yr someplace between 5.125% to five.375%. Primarily based on feedback from Jerome Powell, the Fed appears to suppose Fed Funds will improve in 25bps increments to five.25%.

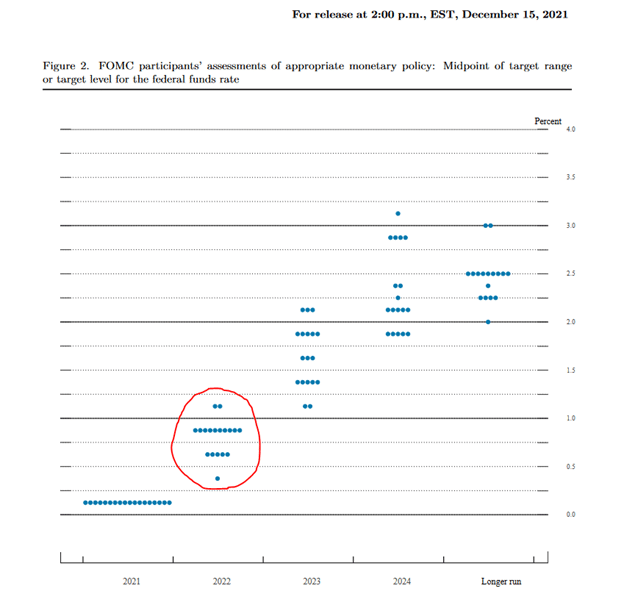

Whereas buyers place numerous weight on the Fed projections, it’s price reminding you they don’t have a crystal ball. For proof, we solely have to look again a yr in the past to its 2022 projections from December 2021.

Fed Projections 2021

Their misguided transitory inflation forecast grossly underestimated inflation’s lasting energy and the way a lot they must elevate charges. The purpose of sharing the graph is to not belittle the Fed however to focus on its poor capability to foretell the longer term.

Situation 2 Implied Market Expectations

Fed Funds futures are month-to-month contracts traded on the CME. Every contract worth denotes what the collective market implies the day by day Fed Funds price will common every month. For instance, when writing the article, the June 2023 contract traded at 95.05. 100 much less 95.05 produces an implied price of 4.95%. We are able to arrive at an implied path for Fed Funds by stringing the month-to-month implied charges collectively.

The market thinks the Fed will elevate charges to only shy of 5% in Could and maintain them there by way of July. After that, the market implies growing odds of a Fed pivot. By December, the market believes the Fed may have reduce rates of interest by about 40bps.

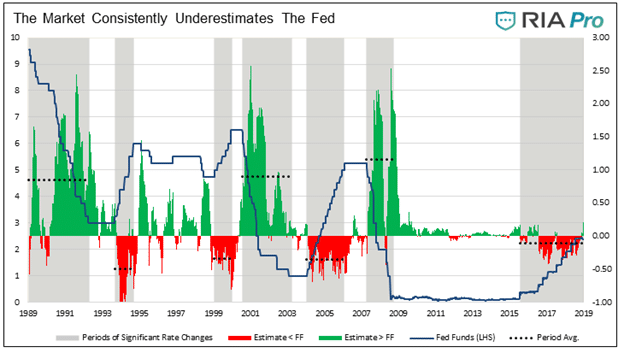

Just like the Fed, the Fed Funds market may also be a poor predictor of Fed Funds.

In late 2019 we wrote an article learning how nicely the Fed Funds futures market predicts Fed price hikes and cuts.

As proven within the graphs, the market underestimated the Fed’s intent to boost and decrease charges each time it modified financial coverage meaningfully. The dotted strains spotlight that the market has underestimated price cuts by 1% on common, however at occasions over the last three rate-cutting cycles, market expectations had been quick by over 2%.

Market Underestimates Fed Funds

Over the last three recessions, excluding the transient downturn in 2020, the Fed Funds market misjudged how far Fed Funds would fall by roughly 2.5%. Implied Fed Funds of 4.6% at this time possibly 2% by December if the market equally underestimates the Fed and the financial and monetary atmosphere.

Situation 3 One thing Breaks

The primary two alternate options assume the Fed will tread calmly, be it elevating charges a little bit extra or a slight pivot in 2023. The third path is the outlier “one thing breaks” forecast.

There’s a important lag between when the Fed raises charges and when the impact is absolutely felt. Economists consider the lag can take between 9 months and, at occasions, over a yr. In March 2022, the Fed raised charges by .25bps from zero %. Since then, they’ve elevated charges by an extra 4%. If the lag is a yr, the primary rate of interest hike won’t be absolutely absorbed into the financial system till March 2023.

The third path, wherein the Fed aggressively lowers charges, can be a response to a considerably weakening financial system, falling far more quickly than anticipated, or monetary instability. It may be a mixture of all or any three components.

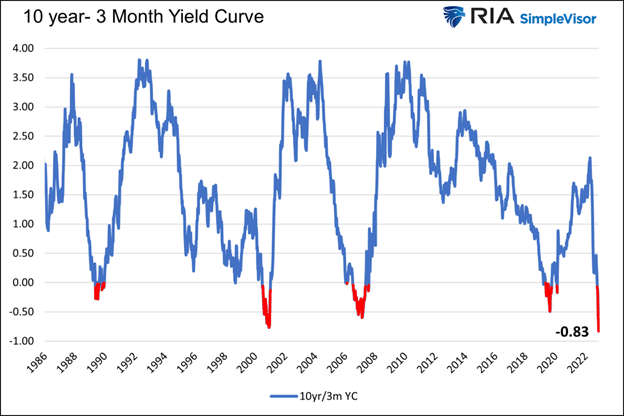

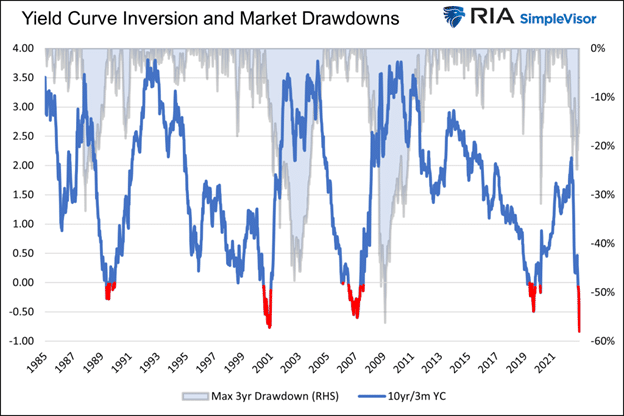

The re-steepening of the is nearly at all times the results of the Fed decreasing rates of interest.

The yield curve is presently inverted to a stage not seen in over 40 years. It can un-invert; the one query is when and the way rapidly. As we wrote:

The monetary foghorn is blowing. Historic odds tremendously favor a recession, inventory market drawdown, and a a lot decrease Fed Funds price.

US Yield Curve

If it un-inverts as violently because it has up to now, the two% Fed Funds for the year-end situation could show too excessive.

Asset Efficiency in The three Paths

Inventory buyers anticipate the second path with a slight pivot throughout the summer time. Presently, company earnings are anticipated to develop by 8% in 2023. Such implies financial progress. Subsequently, it additionally intones the Fed won’t over-tighten and trigger a recession. This goldilocks situation could present buyers with a optimistic return.

The primary different, the FOMC’s anticipated path, could entail extra ache for inventory buyers because it implies charges will rise increased than market expectations with no pivot in sight.

The third “one thing breaks” situation is the potential nightmare situation. Whereas buyers will obtain the pivot they’ve been desperately searching for, they won’t prefer it. Traditionally, quickly declining financial exercise and monetary instability don’t bode nicely for shares, even when the Fed adopts a extra accommodative coverage stance.

The graph under reveals that the yield curve steepens nicely earlier than the market bottoms. Probably, the steepening will end result from the Fed rapidly slashing rates of interest in response to “one thing breaking.”

Yield Curve And Drawdowns

Don’t Neglect About QT

One other Fed coverage aspect to think about is QT. The Fed is eradicating liquidity at a sizeable clip. Like rates of interest, QT has a lag impact. In time, financial and monetary market liquidity diminishes with QT.

Leveraged buyers should usually cut back publicity as liquidity turns into more durable to acquire and dearer. Often, the deleveraging course of begins slowly with fringe belongings and overly leveraged buyers feeling ache. Nonetheless, deleveraging can unfold rapidly to the well-followed broader markets. The U.Ok. pension fund bailouts and failing crypto exchanges like FTX are doubtless indicators of liquidity exiting the system.

Even when the Fed stops elevating charges or marginally lowers them, QT will current headwinds for inventory costs.

Abstract

The unprecedented inflow of liquidity that drove asset costs increased in 2020 and 2021 is rapidly leaving the market. The lag impact of upper rates of interest and fading liquidity will doubtless play a outstanding function in figuring out inventory costs in 2023.

Primarily based on the Fed’s dedication to quash inflation through increased rates of interest and QT, we predict the “one thing breaks” situation is the doubtless path forward.

World renown investor Stanley Druckenmiller appears to agree with us per a latest quote- “I might be shocked if we didn’t have a recession in 2023.”

Given the dynamic nature of the financial and monetary market exercise and the issue of predicting the financial future, the Fed’s projections and the opposite two paths we focus on needs to be monitored carefully all year long.

Anticipate the sudden in 2023 and hold the Fed’s path prime of thoughts.