2025 buying and selling habits prominently featured momentum. Sure classes of shares soared to new heights whereas others had been left within the mud. Towards the tip of the yr, buyers turned locked within the high-fliers for concern of incurring an enormous tax invoice, however with the calendar rolling over they will promote understanding that taxes are 16 months away.

We anticipate important rotation between asset courses. A number of the previously forgotten shares are poised to rebound. Not all that has fallen will get well, however these with the combo of robust fundamentals and engaging valuation are greatest positioned for an early 2026 bounce.

Particularly, we see 3 classes of shares with a potent mixture of dividends, development and worth. Inside every class we are going to function a person inventory that epitomizes the chance.

#1 sector poised for outperformance: manufactured housing led by Flagship Communities

Manufactured housing’s (MH) core benefit comes from the delta in worth level between MH and site-built housing. Each flats and the month-to-month price of residence possession are far too excessive for a big portion of the inhabitants. Manufactured housing is the answer.

The hole in worth level is so huge that there’s room for rents on websites to be raised about 5%-8% a yr for an additional decade whereas nonetheless offering residents with a greater worth than the alternate options. Natural lease development of this nature doesn’t incur additional bills so it filters straight to the underside line such that same-store NOI development for a lot of the trade hovers round 8%-12%.

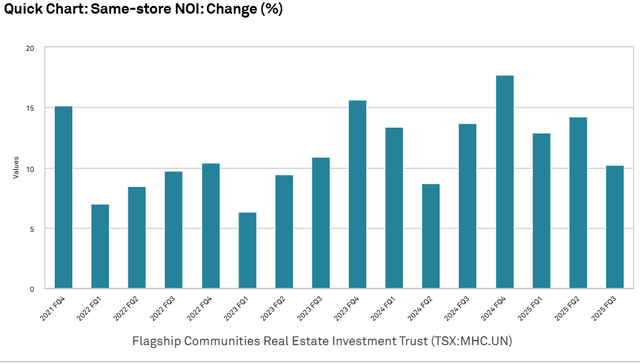

MH has been and continues to be the true property sector with the quickest natural development charge. But, this superior development will not be factored into valuation. Flagship Communities (MHCUF) routinely places up 10% same-store NOI development.

S&P International Market Intelligence

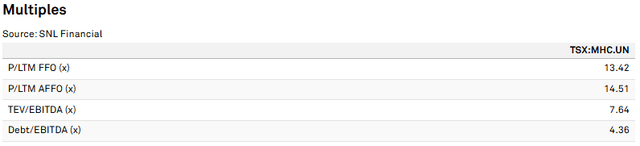

But it trades at simply 14.5X AFFO.

S&P International Market Intelligence

Progress of that magnitude would usually commerce over 20X AFFO.

Flagship is nicely managed and is extending its development runway by buying mismanaged communities to which it may well apply a cleaner working mannequin.

A contributor to why the inventory is reasonable is that it trades on the Toronto Inventory Change whereas proudly owning solely U.S. properties. Thus, for U.S. buyers it may be a little bit of a trouble to commerce, however with persistence and cautious use of restrict orders, the diminished liquidity doesn’t hurt whole return prospects.

Different shares within the sector are UMH Properties (UMH) Fairness LifeStyle (ELS) and Solar Communities (SUN). UMH shares the engaging valuation of Flagship whereas the opposite 2 are a bit extra totally valued.

#2 sector poised for outperformance: Discounted preferreds with low asset degree volatility led by Gladstone Land Preferreds

Preferreds are significantly mispriced proper now. Preferreds are usually small points in market cap which retains most establishments out, but on the similar time the construction is advanced sufficient that it begs an institutional degree of understanding.

One of many greatest errors the market is making in pricing preferreds, is that it’s treating them equally to the frequent shares of the identical issuers. That is simply inherently incorrect as a result of the frequent and most popular have very totally different payout profiles.

- Frequent inventory payout cares about magnitude of upside

- Most well-liked inventory payout cares primarily about stability

Frequent shares of REITs have tended to languish when development potential appears restricted. In most situations of this taking place, the preferreds have fallen together with the frequent. I see these discounted preferreds as extremely opportunistic when the underlying asset class is steady and the capital construction is such that there’s a massive fairness cushion beneath the preferreds.

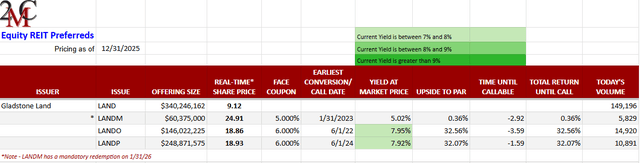

Gladstone Land (LAND) preferreds, (LANDP) and (LANDO), epitomize this kind of mispricing.

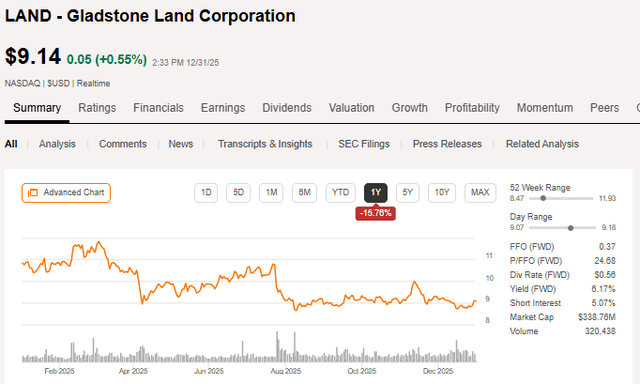

So Gladstone Land owns a big portfolio of farmland, primarily specialty crops grown in California. The market is worried that the worsening water scenario together with commodity volatility could make this enterprise difficult. LAND inventory has fallen.

SA

The drop within the frequent largely is smart. Maybe it fell barely too far making it now low cost, however directionally it was a rational transfer.

As per the sample we recognized above, LAND preferreds fell with the frequent.

SA

This transfer, for my part, is fully irrational.

The popular payout is unaffected by what seems to be low earnings development potential in California farmland. The popular payout is locked on the acknowledged coupon charge and thus solely cares that LAND maintains enough earnings to pay.

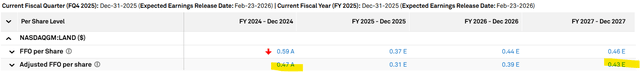

AFFO is calculated AFTER paying most popular dividends, so any AFFO over $0 signifies preferreds are coated.

S&P International Market Intelligence

LAND’s cashflows simply cowl most popular dividend funds.

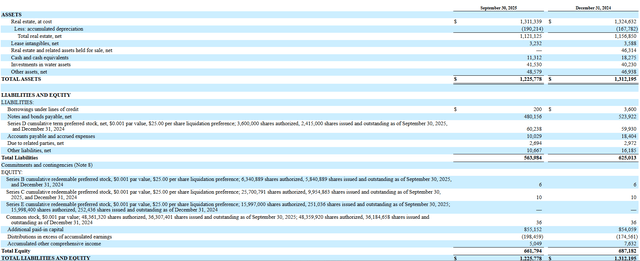

Preferreds additionally care that their liquidation desire is protected by asset worth. LAND has $1.22B of belongings (primarily farmland and farm enhancements like irrigation).

LAND

Liabilities whole $563.9 million which leaves roughly $660 million of belongings for the preferreds.

Portfolio Earnings Options

LANDM has obligatory redemption so its liquidation desire is included in that liabilities determine.

Thus, the preferreds have whole liquidation desire of $392 million.

Asset worth must decline fairly a bit for the preferreds to not be totally coated. We are likely to not like preferreds of firms in sectors with unstable belongings. As an alternative we like preferreds in steady asset sectors like company backed mortgages and farmland.

Farmland values are exceedingly steady with a protracted historical past of dependable appreciation.

USDA

The worst drop in farmland worth within the final 100 years was the dustbowl and even then, the worth declines peak to trough wouldn’t have been sufficient to erode the liquidation desire of LAND preferreds given the protection ratio they’ve right now.

It might take a reasonably catastrophic occasion for farmland belongings to say no in worth that a lot. Maybe some might imagine water shortage could possibly be that occasion. I might agree that it’s a actual threat, however LAND owns 55,532 acre-feet of water in reserve to largely mitigate that threat.

California farmland has some issues, however I simply don’t suppose the market is recognizing the ways in which capital construction and cashflow desire of preferreds over frequent are defending LANDO and LANDP.

The present low cost affords getting in at an 8% dividend yield and 30%+ upside to liquidation desire.

There are a couple of dozen extremely discounted REIT preferreds proper now. Lots of them are connected to firms with equally resilient asset courses.

#3 sector poised for outperformance: triple internet led by Broadstone Web Lease

Triple internet REITs are a sector the place ahead returns are largely tied to valuation on the time of entry.

With treasuries the maths may be very clear. If you should buy a treasury of the identical length at a 5% yield to maturity versus a 4% yield to maturity, it would merely have a better return.

Triple nets should not fairly that locked in, however are comparable in that they derive a lot of the cashflows from long run rental contracts. Lots of the triple internet REITs have weighted common remaining lease phrases within the vary of 8 to 10 years. Thus, there’s a excessive diploma of visibility into future cashflows.

When you purchase a triple internet REIT at a excessive valuation relative to that stream of cashflows, it would most likely end in poor ahead returns. Towards the tip of 2021, triple internet REITs had been the flavour of the month. With treasuries buying and selling at absurdly low yields, the market was yield starved and beginning to pour cash into different autos that resembled treasuries.

Triple internet REITs are equities so they’re definitely not the identical factor, but when one squinted laborious sufficient it may seem like a steady yield substitute for a treasury and even on the excessive valuation at which triple nets traded on the time, the yield was considerably increased than that of the treasuries.

Practically each triple internet REIT has had a poor return for the reason that finish of 2021.

The market is now blaming the asset class and buying and selling the shares at irrationally low valuations.

The poor returns should not the fault of triple internet REITs. Basically they’ve carried out moderately nicely with regular earnings coming from the contracted lease.

Low returns had been simply math in the identical method that if somebody purchased a protracted length treasury at sub 2% yield to maturity it will have additionally had an abysmal return. The treasury didn’t fail. It paid each curiosity fee on time and nonetheless has the identical par worth. The market merely paid too excessive of a worth relative to the worth of the stream of cashflows and so the value needed to come down.

Treasuries have sufficient math centered merchants following them that they nearly instantaneously alter to prevailing rates of interest.

Triple nets market costs are much less environment friendly at adjusting and on this case they overshot.

The ahead returns of a triple internet REIT might be considered approximating dividend yield + AFFO/share development charge. The market began pricing triple nets as if the ahead AFFO/share development charge is near 0%.

That’s as a result of it has been near 0% for the previous few years.

Lacking from the valuation is the inflection level in development.

Why development was close to 0 for the previous couple of years

Triple nets function on the unfold between asset yields and price of capital. Asset yields are largely locked in by the contractual rental streams whereas price of capital depends on the length of their debt. Generally, these REITs ladder their debt maturities with some rolling over every year.

Properly, as rates of interest rose about 200-300 foundation factors, debt needed to be refinanced increased. Value of capital rose whereas the yield on present belongings was locked in (with some escalators). This increased curiosity expense offset development from accretive acquisitions and escalators on present leases. Because of this, the sector noticed minimal AFFO/share development.

Why ahead development appears a lot better

Increased rates of interest don’t harm triple internet development charges. Cap charges transfer, so spreads on acquisitions stay largely the identical. It was the change in rates of interest that harm earnings.

Now that a lot of the triple internet REITs have refinanced their debt on the now increased charge, curiosity expense has stopped rising. With prices roughly flat, triple nets will now see earnings development from escalators and accretive acquisitions.

The expansion charge for the sector is more likely to return to traditionally regular ranges within the low-to-mid single digits.

Valuation of 0 development versus 3-5% development

A static stream of flat cashflows will get valued very in another way than a rising stream of cashflows.

The market appears to be triple internet REITs based mostly on the low to 0 development of the previous few years and valuing them accordingly. Particularly, the common triple internet REIT is buying and selling at an AFFO yield of 8.1%.

That may be a correct valuation for low or no development.

Nevertheless, an 8.1% AFFO yield is considerably undervalued for a rising stream of cashflows. When you take that yield and tack on 3%-5% annual development it would materially outperform the market.

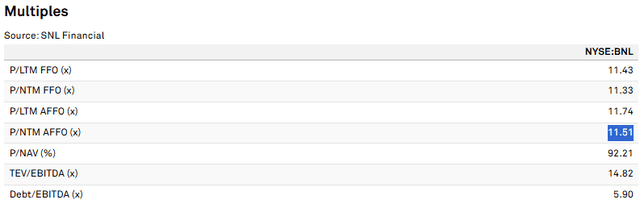

I believe that’s the place the triple nets are positioned right now. Broadstone Web Lease (BNL) is considered one of our excessive conviction shares within the sector as a result of its mixture of worth and sturdy development. It’s buying and selling at 11.51X AFFO which is an 8.7% AFFO yield.

S&P International Market Intelligence

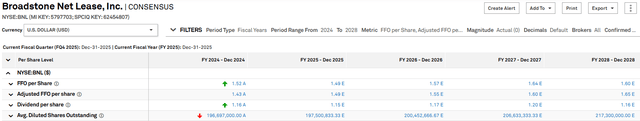

On the similar time it’s arrange for sturdy and extremely seen development within the low-to-mid single digits.

S&P International Market Intelligence

The expansion is coming from escalators on present leases together with already contracted build-to-suit developments as they full and start to cashflow.

Frankly, I believe the market worth of BNL is simply too low for the stream of contracted cashflows.

Different triple nets with comparable profiles embrace W.P. Carey, (WPC) Getty Realty (GTY), VICI Properties, which we wrote extra in-depth about right here, and Easterly Authorities Properties (DEA).

The takeaway

The flip of the calendar removes the tax associated obstacles that had been inhibiting environment friendly pricing of shares. January typically contains a normalization towards truthful worth making it a good time to purchase top quality, undervalued shares akin to Flagship, LAND preferreds and Broadstone Web Lease.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please concentrate on the dangers related to these shares.