Henadzi Pechan/iStock through Getty Photos

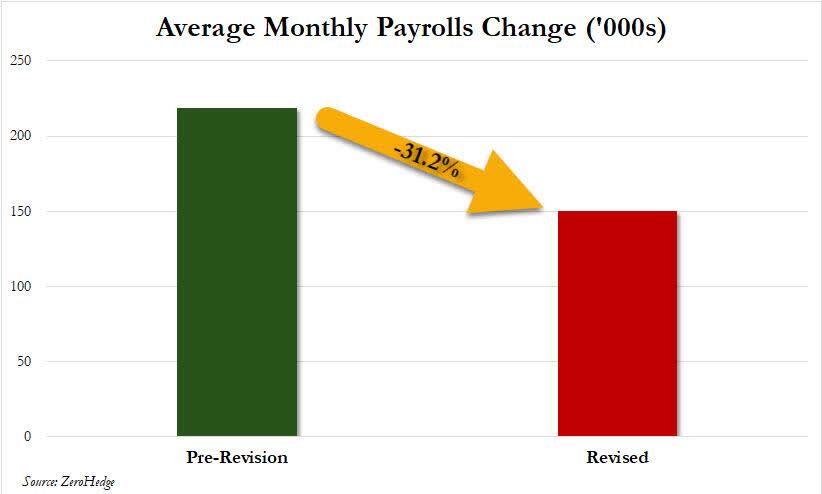

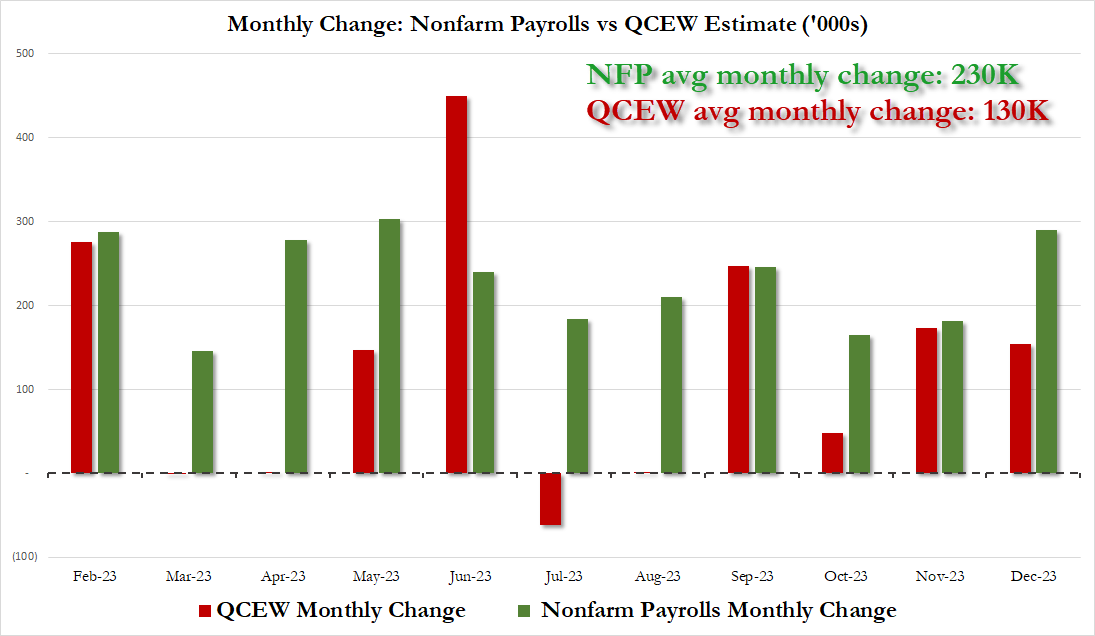

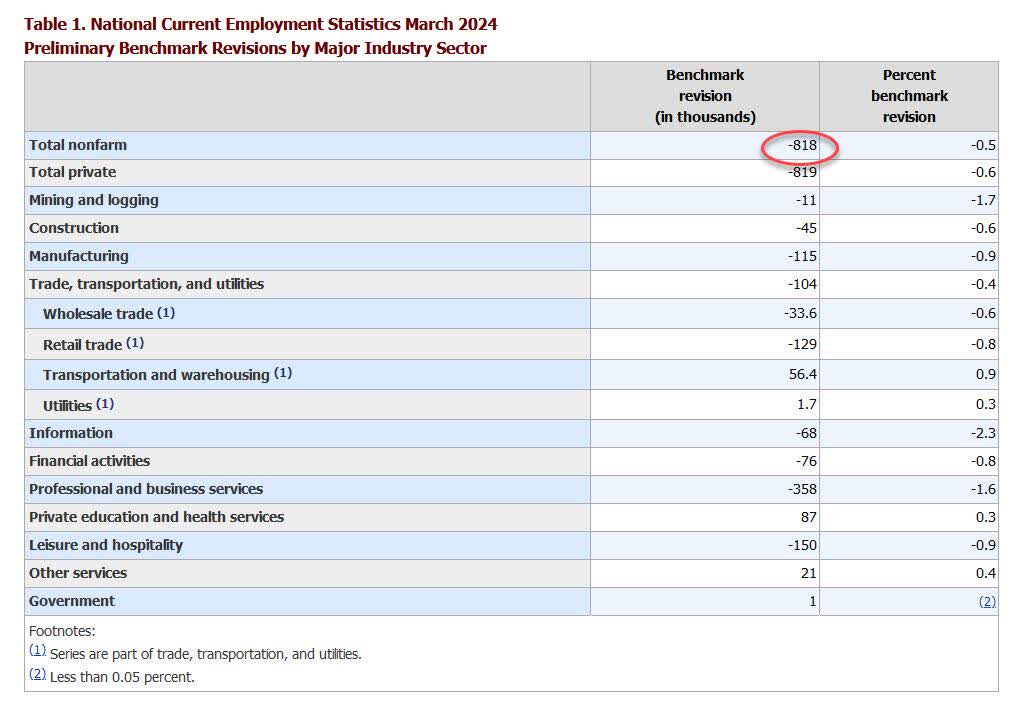

The massive information Wednesday was the up to date jobs numbers for 2023 (April 2023 by way of March 2024 to be extra exact) by the Bureau of Labor Statistics or BLS that have been purported to hit the wires at 10:00am EST. After some delays, the revisions hit a bit later within the morning.

ZeroHedge

It’s tough to sugar coat the revised jobs numbers, they have been abysmal no matter how one slices them. The BLS slashed their estimate of job creation within the U.S. in 2023 by some 818,000 positions. This was barely greater than 30% of the beforehand projected complete. To place in perspective, this was the second-biggest revision within the historical past of the BLS. It trailed solely the revision in 2009 when the nation was within the Nice Monetary Disaster.

ZeroHedge

The brand new numbers present a a lot worse jobs market than beforehand introduced. Some months in 2023 (March, April, and August had no discernible job progress and July had destructive job progress). My common readers right here on Looking for Alpha know I’ve questioned the BLS jobs figures for greater than a yr now. They merely didn’t match up effectively with the roles image introduced by the month-to-month ADP Jobs studies or the Family Surveys. There are a number of issues we will glean from this large discount in jobs created, other than the BLS shouldn’t be superb at doing considered one of their core jobs. Listed here are three implications for the economic system and markets that immediately come to thoughts.

Fed Funds Charges Are Coming:

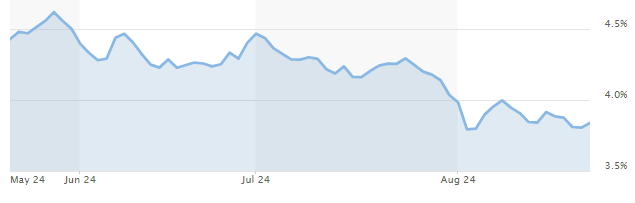

If there was any doubt that the central financial institution would begin to lower charges on the September FOMC, Wednesday’s giant downward revision to 2023’s jobs numbers sealed that consequence. It additionally got here out in minutes yesterday from the final Fed assembly that some members wished to begin to lower charges on the July FOMC get collectively.

10-12 months Treasury Yield (MarketWatch)

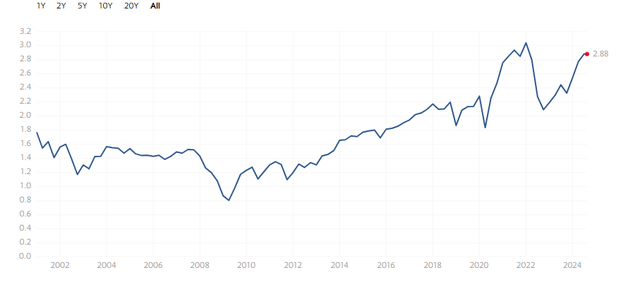

The larger query is whether or not the central financial institution will take down the Fed Funds charge by 25bps or 50bps once they meet 4 weeks from now. The yield on the 10-12 months Treasury yield (US10Y) (above) has already fallen considerably over the previous few months to mirror a weakening economic system and extra certainty about coming rate of interest cuts.

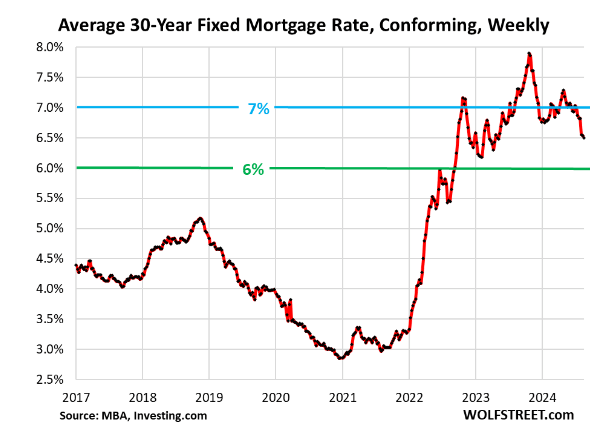

WolfStreet

Traders mustn’t view a lower from the Fed as an “all clear” signal. As I famous in an article earlier this week, the Fed began to chop charges in January 2001 and once more in September 2007. They did little to cease the debacles within the inventory market that adopted. Rate of interest cuts can even take a while to work their approach throughout the economic system. The typical 30-year mortgage charge is down by greater than 100bps from its peak. Nonetheless, that is not serving to the housing sector but, as evidenced by the 16% fall year-over-year drop in housing begins in July. July current dwelling gross sales have been additionally on the weakest stage for a July Redfin has reported since starting to observe that metric in 2012.

Shopper Confidence Takes One other Hit:

Decrease and middle-income customers have been struggling for a while. That is evidenced by tepid steering and cautionary commentary from the likes of Residence Depot (HD), Starbucks (SBUX), McDonald’s Company (MCD), Lowe’s Company (LOW), Macy’s (M) and myriad different client icons within the first and second quarters of 2024.

A deteriorating jobs image is hardly going to spice up client confidence. Job openings have been already at a three-year low. The precise jobs openings image is bleaker than that because of the rise of ‘ghost jobs‘ which CNBC not too long ago reported on. Because the piece famous, “In 2019, there have been eight hires for each 10 job postings. By 2024, that quantity had dropped to 4 hires per 10 job postings.” largely as the results of this new development. Persevering with weekly jobless claims additionally simply hit their highest ranges since 2021.

Zerohedge/BLS

The high-end client is perhaps the final a part of the patron section to begin to pull again as effectively. Excessive-paying Skilled Companies (down 358,000 jobs) was the class that noticed the largest downward job revision in yesterday’s BLS replace. Demand for journey, which has been sturdy for 2 years, additionally appears to be ebbing. As well as, Financial institution of America downgraded American Categorical (AXP) yesterday citing “subdued billings quantity progress” American Categorical caters to the high-end client, it ought to be famous.

The inventory of high-end retailer Williams-Sonoma (WSM) can be heading decrease on Thursday after the corporate delivered combined Q2 outcomes and slashed ahead full-year steering.

The Economic system Is Weaker Than Most Consider:

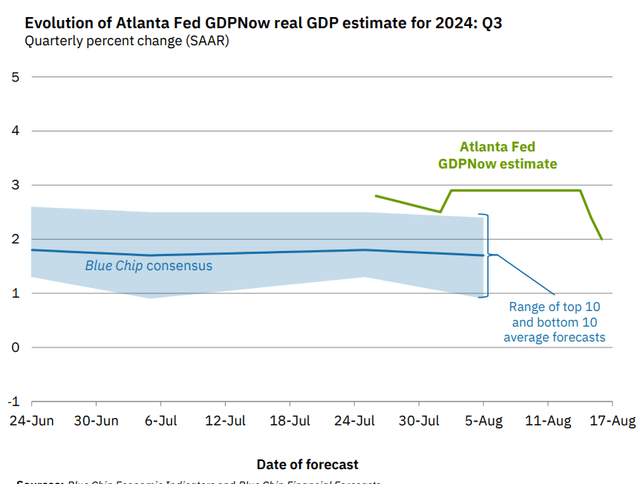

GDP progress within the first half of 2024 was already roughly half that of the again half of 2023 when U.S. GDP expanded simply over 4 %. The Convention Board presently has simply .6% annualized progress penciled in for the third quarter, with one % progress projected for the fourth. The Atlanta Fed’s GDPNow has a better projection for Q3, however that estimate was simply slashed 30% per week in the past. Due to this fact, I might take it with a grain of salt.

GDPNow

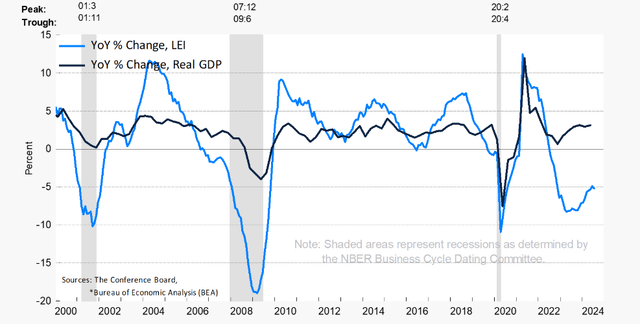

Along with slowing financial and job progress, the Main Financial Indicators have now been down for 28 of the final 29 months, and the Sahm Rule was additionally triggered by the tepid July BLS jobs report. Each indicators have been dependable predictors of upcoming recessions traditionally.

Convention Board

In abstract, the huge downward jobs revision is only one extra destructive for the economic system. A deteriorating jobs market additionally will increase the possibility of a recession within the quarters forward. With equities promoting at roughly 22 occasions ahead S&P 500 (SP500) earnings and extra excessive valuations utilizing different metrics (Ex, value to gross sales), this can be a potential state of affairs that clearly is not priced into the market. Prudent traders ought to place their portfolios accordingly.

Worth to gross sales ratio – S&P 500 (Multpl)