- The toxic mix of stubbornly high inflation and geopolitical uncertainty provides good enough reasons to fortify your retirement portfolio with low-risk stocks

- UnitedHealth is a reliable dividend stock at a time when growth stocks are taking a severe blow

- General Mills is a defensive name that will outperform in a bear market

It is no secret that 2022 has been brutal for stock market investors. Several macroeconomic headwinds have gathered up to push to stubbornly high levels, making stock picking all the more critical for those who wish to succeed in current conditions.

In addition to the Fed’s tightening cycle and 40-year high , developments in the geopolitical conflict in eastern Europe indicate there seems to be no ending in sight.

This toxic mixture provides good enough reasons to fortify your retirement portfolio with low-risk dividend-paying stocks.

Companies that offer regular payouts are considered a good buffer during market volatility. They also are seen as an inflation hedge, considering that dividend growth has outpaced inflation since 2000.

Below, I’ve compiled a list of three dividend stocks that can be trusted to provide steadily growing income. Their dividend yields are, no doubt, low at this point, as their share prices rose during the past year, but each is a low-risk, high-quality name suitable for a conservative retirement portfolio.

1. UnitedHealth Group

The world’s biggest health insurer, UnitedHealth Group Incorporated (NYSE:) offers a solid avenue to generate retirement income.

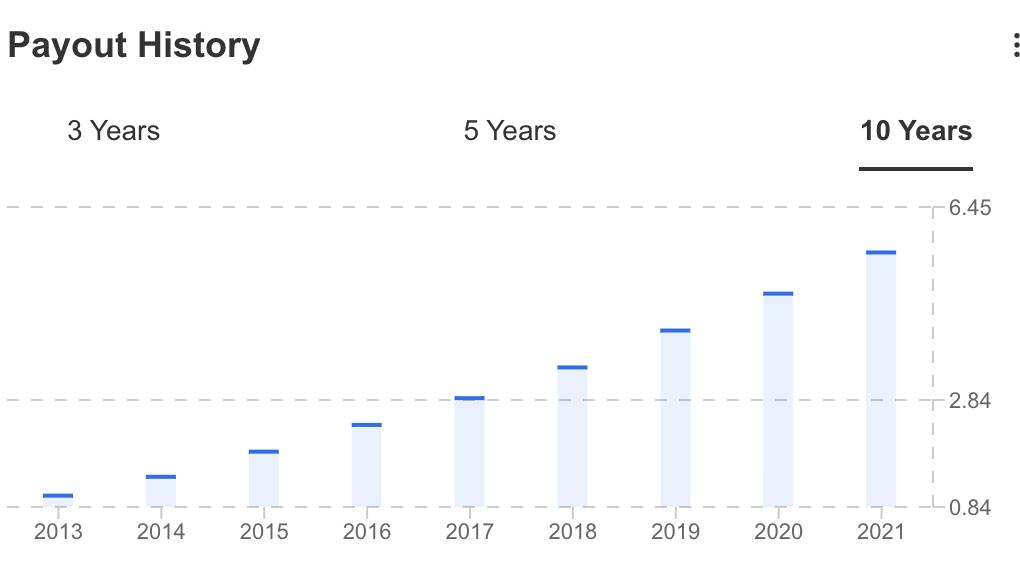

Backed by the company’s strong cash generation, investors have been getting massive dividend hikes during the past five years. The company pays a quarterly dividend of $1.65. Annually, that payout has increased by more than 18% during the past five years.

Source: InvestingPro

UNH stock has also provided impressive capital growth during the past five years. Trading at $519, shares have gained more than 165%.

UnitedHealth, which operates a health insurance business and the Optum medical care services unit, offers income investors an option to hold a reliable healthcare name when growth stocks are taking a severe blow from macroeconomic headwinds.

According to the insurer’s latest guidance, the company expects double-digit revenue growth in the Optum Health business “for many years,” with margins in the 8% to 10% range. Optum Health had operating earnings of $1.4 billion in the quarter, and the company said revenue per consumer served increased 30% from a year ago.

2. General Mills

Consumer staples offer another attractive avenue for buy-and-hold investors. They’re considered safe since these companies are less tied to the economic cycle and tend to sell products that consumers need no matter the economic circumstances. For these reasons, I like General Mills (NYSE:), the maker of Cheerios cereals, Yoplait yogurt, and Nature Valley granola.

With its price reaching $80.64, the stock is up about 20% this year, massively outperforming the benchmark indices. Furthermore, GIS has been rallying today after reporting better-than-expected for its latest quarter.

The company also gave an upbeat forecast for the current fiscal year, indicating that demand for its food items remains strong even in this challenging economic environment.

General Mills has tried to diversify its revenue base to spur growth in recent years. In 2018, the company acquired the maker of Blue Buffalo pet food, its largest deal in 18 years. According to its earnings statement released today:

“Given the strength of our first-quarter results and confidence in our ability to adapt to continued volatility, we are increasing our full-year outlook for net sales, operating profit, and EPS growth.”

The company prioritizes its core markets, global platforms, and local gem brands with the best prospects for profitable growth. It is committed to reshaping its portfolio with strategic acquisitions and divestitures to enhance its growth profile further.

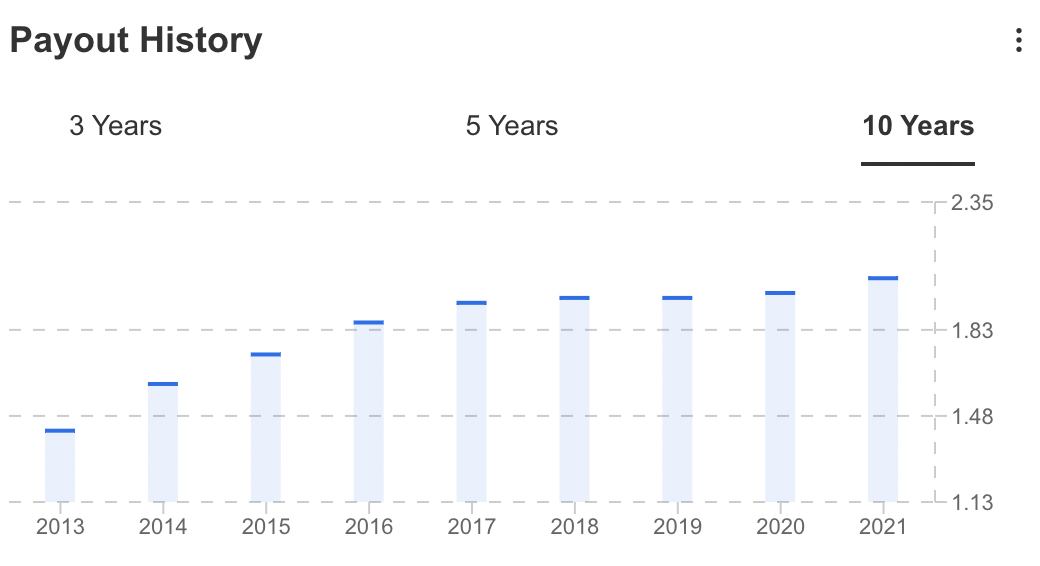

With more than 100 years of track record in paying dividends, GIS is a stock that is likely to underperform in a bull market, but it is also a defensive name that will perform well in a bear market.

Source: InvestingPro

3. Bank Of Montreal

Canadian banks listed on the New York Stock Exchange offer another great income avenue for retirees in North America. U.S.’s northern neighbor’s sound regulatory environment, smaller competition, and revenue diversification make its banks reliable income generators.

Canada’s top lenders have consistently rewarded investors through steadily growing dividends, on which they spend about 40%-50% of their income.

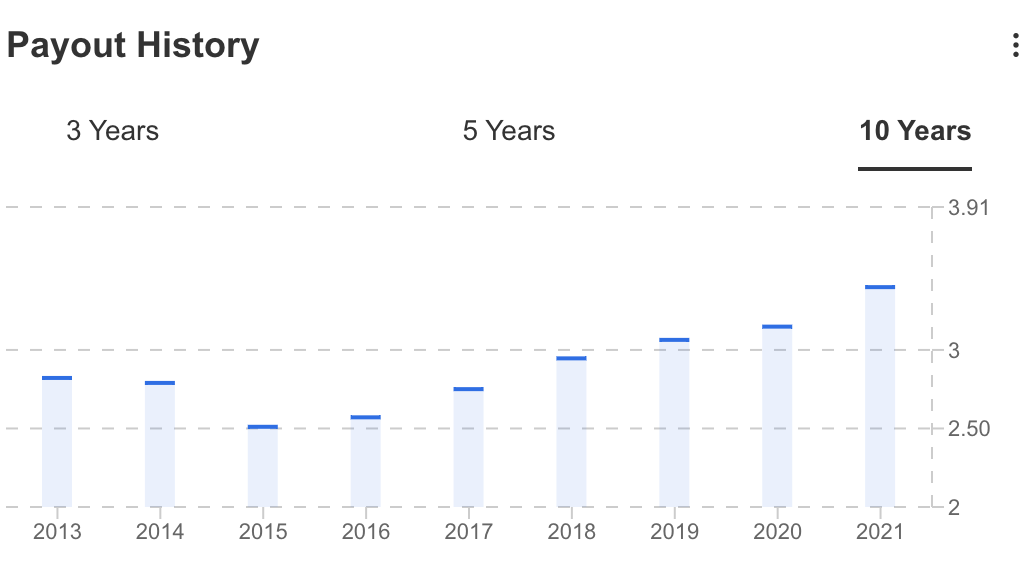

I particularly like Bank of Montreal (NYSE:), Canada’s fourth-largest lender. The company currently offers an annual dividend yield of more than 4.5%, a rate quite attractive when compared with the average yield paid by S&P 500 companies.

Source: InvestingPro

BMO is considered one of the safest dividend stocks in Canada due to its unbeatable track record. The company has sent dividend cheques to investors every year since 1829 — one of North America’s longest streaks of consecutive dividends.

The other benefit of investing in BMO is its diversified franchise with a solid presence in commercial, retail banking, wealth management, and capital markets. The company also maintains a strong foothold in the U.S., mainly in the Midwest. That presence was further strengthened after the lender’s recent purchase of BNP Paribas (OTC:) operations for US$16.3 billion.

Disclosure: The writer doesn’t own shares mentioned in this report.