Richard Drury

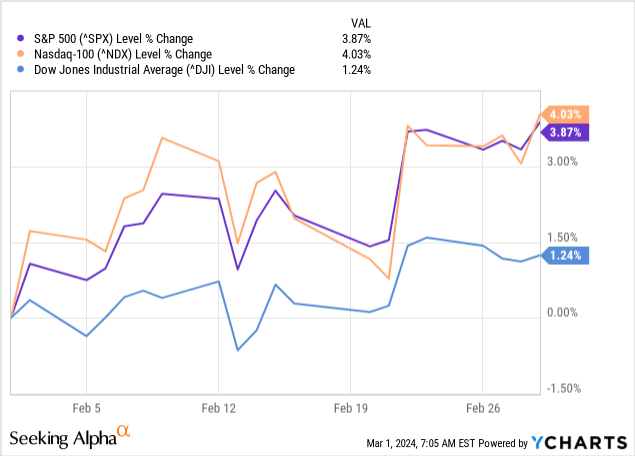

The broader market continues to climb towards file highs relatively usually, and that has stored me from getting too aggressive by way of shopping for. The Dow Jones Industrial Common Index (DJI) represents a extra value-oriented index relative to the S&P 500 Index (SP500), with the NASDAQ 100-Index (NDX) being essentially the most closely tech-oriented main index.

Ycharts

Nonetheless, each month, I am shopping for a minimum of one thing – even when I am letting a bit of money construct up for probably higher alternatives. We all know {that a} market pullback or correction is simply ever a matter of “when” and never “if.”

With that being mentioned, the market can proceed on its pattern larger for a substantial interval earlier than getting such a possibility, too. Provided that there are nonetheless extensive reductions within the closed-end fund (“CEF”) house and out-of-favor sectors, I feel there are nonetheless pockets of alternative.

That is the place I used to be placing some capital to work this month and persevering with to develop my month-to-month money stream.

Eaton Vance Tax-Advantaged Dividend Earnings Fund (EVT)

In February, I began by rising my place in EVT. This was a reputation I’ve held for quite a lot of years. Coincidentally, the final batch of shares I picked up on this identify goes again nearly a 12 months in the past, in January 2023. It is a fund I additionally cowl fairly usually, and that features fairly not too long ago as effectively.

That is an Eaton Vance fund that’s centered a bit much less on the know-how sector and the Magnificent 7 sorts of names and extra on the value-oriented sectors. Their benchmark is the Russell 1000 Worth Index, and the fund can be leveraged. That is why the monetary and healthcare sectors are the most important weighting of the fund. The truth is, these two sectors are adopted by industrials and vitality earlier than we even get to the tech weighting of the fund. The tech weighting involves 7.35%, whereas financials comprise 26%+ of the fund, to provide some shade.

This is among the few Eaton Vance fairness funds that truly have no of the standard mega-cap tech names that comprise the Magazine 7 of their prime ten. It is one of many causes I discover the fund interesting presently.

EVT Prime Ten Holdings (Eaton Vance)

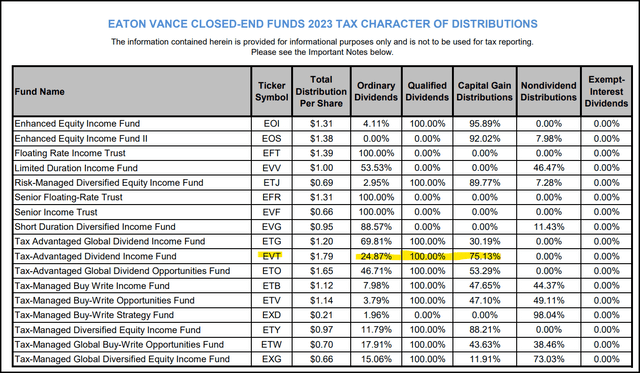

Additional, the fund appears to be like to throw off “tax-advantaged” distributions to traders. That features distributions sourced as primarily certified dividends or long-term capital positive aspects, every of which is extra tax-friendly in a taxable account. Meaning extra cash is left in my pocket relatively than being despatched to Uncle Sam, which is at all times a optimistic.

2023 was in a position to obtain that aim as 100% of the peculiar dividends categorized have been thought of certified. The remainder of the distribution was characterised as long-term capital positive aspects.

Eaton Vance Taxable Fund Distribution Tax Breakdown (Eaton Vance (spotlight from creator))

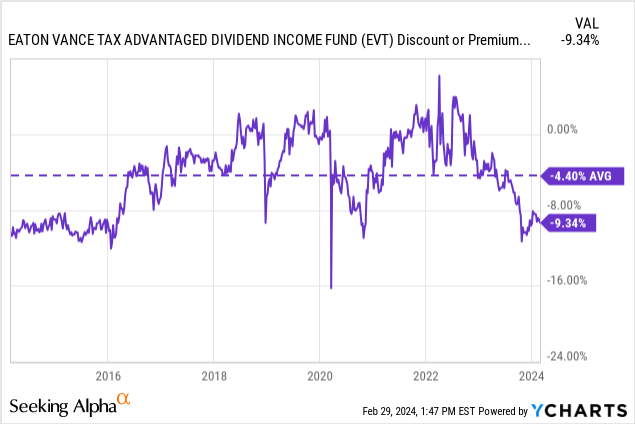

For EVT, the low cost on this fund has actually opened as much as a large low cost on an absolute and relative foundation.

Ycharts

Western Asset Inv Grade Earnings Fund Inc (PAI)

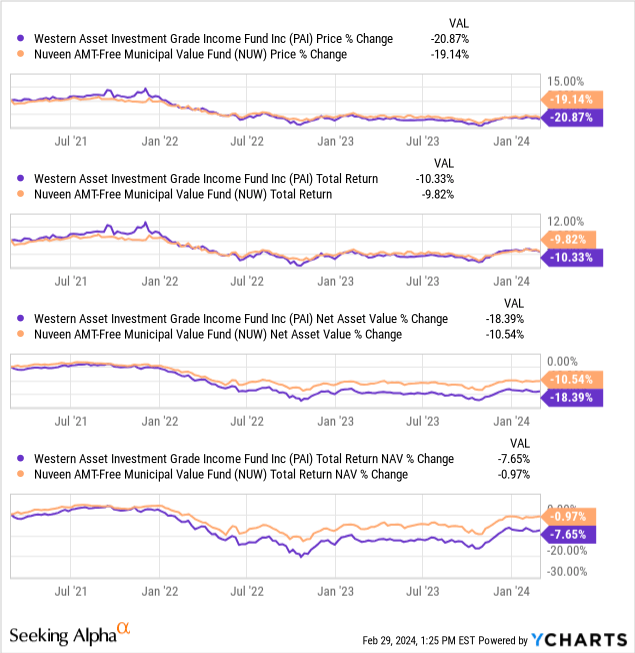

Those that comply with my month-to-month purchase piece usually will know that I have been choosing up shares of PAI (together with Nuveen AMT-Free Municipal Worth Fund (NUW)) during the last 12 months or so. These are each longer-duration bond funds that ought to carry out effectively if yields fall. Each of those funds bought off sharply when charges have been rising, and we noticed some restoration. The charts under look again at returns during the last three years.

Ycharts

I think that extra restoration will come for each of those funds sooner or later. That is a part of what makes them extra interesting as a play for a lower-rate future that’s anticipated.

Right now, neither presents a yield that’s value bragging about, which is among the primary negatives I’ve seen introduced up by readers. That mentioned, if charges keep larger for longer, these distributions may additionally develop. Given the longer maturity of the underlying bonds they maintain, it does take a little bit of time for that to play out. That mentioned, we have already obtained just a few will increase from PAI during the last 12 months as effectively.

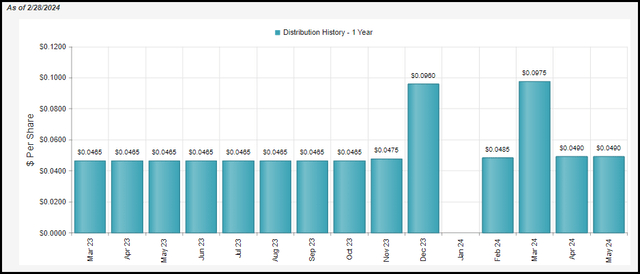

PAI Distribution Historical past (CEFConnect)

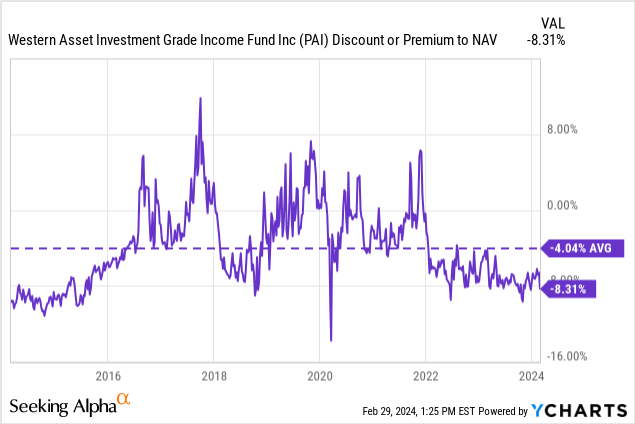

If funds holding longer length bonds reminiscent of PAI begin to come again in favor, I consider the low cost for the fund may slim, too. That would add one other bit of additional complete return to an investor.

Ycharts

For my part, the largest danger for PAI and NUW can be if yields began to rise sharply once more. These are non-leveraged funds, however they might nonetheless expertise additional strain, simply as they noticed when yields have been rising the primary time. We additionally noticed one other instance of what risk-free yields rising can do in October of final 12 months. So, my wager on these funds is that we’re principally at peak charges this cycle and that risk-free yields will not rise materially.

Eaton Vance Tax-Advantaged World Dividend Earnings Fund (ETG)

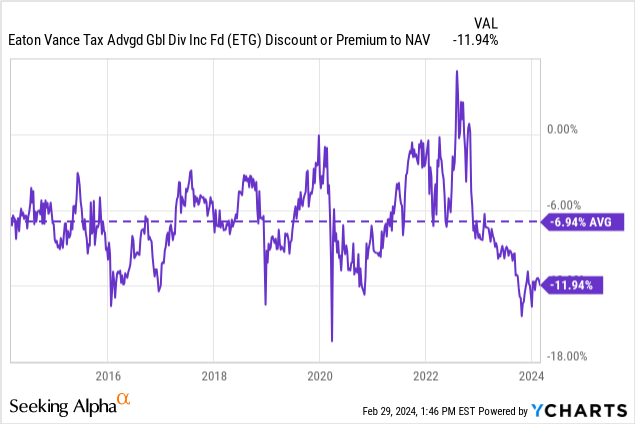

EVT wasn’t the one Eaton Vance fund I have been watching these days. Effectively, I’ve truly been watching most of them as they’ve all develop into fairly closely discounted and due to this fact interesting, in my view. Nonetheless, the opposite one I added to this month was ETG. I additionally lined this identify comparatively not too long ago for these all for an additional deep dive. Satirically, it was final 12 months in February when it was the final time I added to my ETG place.

ETG focuses on offering a tilt in direction of some world positions, and its benchmark is the MSCI World Index. ETG can be a leveraged fund that would profit from a decrease charge setting by seeing their borrowing prices lowered on the leverage they make use of. Eaton Vance didn’t hedge in opposition to a rising charge setting.

ETG is kind of much like EVT in that it’s not as closely invested within the huge tech names. That mentioned, ETG does carry a significant weight to a number of of the Magazine 7 names. 4 of the fund’s prime ten are from this cohort, so there’s positively materials publicity right here.

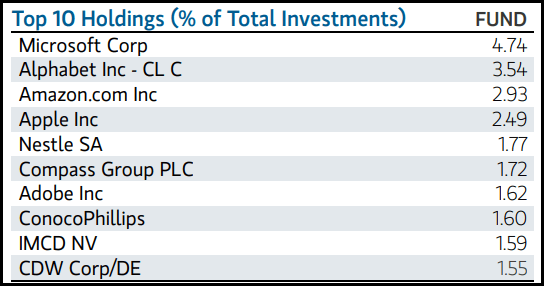

ETG Prime Ten Holdings (Eaton Vance)

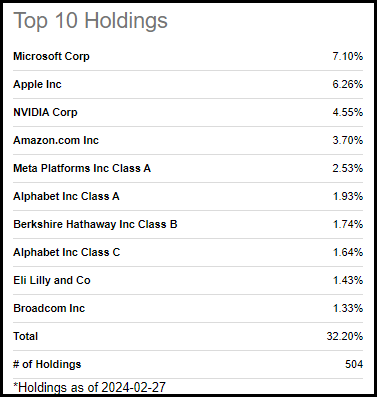

Alternatively, the weightings that this fund carries to those names is considerably much less on a relative foundation to one thing just like the S&P 500 Index. These mega-cap tech names signify 27.71% of the SPDR S&P 500 Index (SPY) in comparison with ETG’s 13.7% allocation.

SPY Prime Ten Holdings (In search of Alpha)

Given the worldwide publicity and the comparatively cheaper valuations of world shares in comparison with U.S. investments, that is one of many areas that, I feel, are enticing presently. That is much like EVT, the place it’s invested in a value-type portfolio, which can be not as costly on a relative foundation.

Similar to EVT, the low cost on ETG is important on an absolute and relative foundation. Nonetheless, ETG’s low cost has traditionally been comparatively wider in comparison with EVT, which might be an argument that it’s much less enticing on that foundation. Additional, with the next charge from the Fed, there’s some low cost widening because it is not as leverage-friendly of an setting.

Ycharts

Hoya Capital Excessive Dividend Yield ETF (RIET)

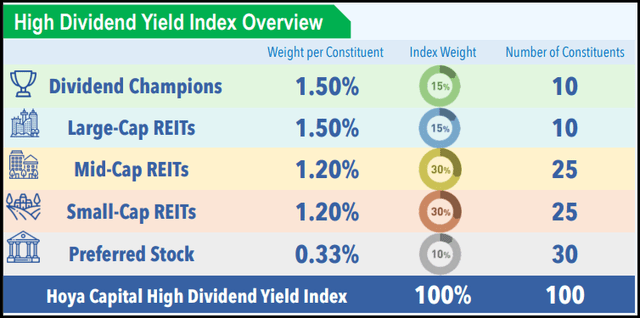

Lastly, to prime the month off, I had additionally added to my RIET place. That is an ETF that invests throughout the spectrum in a diversified portfolio of REITs with a give attention to offering dividend yield. This consists of each fairness REITs and mortgage REITs, in addition to the frequent positions and most well-liked positions inside this group.

RIET Index Overview (Hoya Capital)

As an ETF, there actually is not a reduction/premium that we will look to take advantage of right here. That mentioned, REITs have develop into fairly enticing on a valuation foundation total – as soon as once more, due to the next charge setting.

REITs usually borrow to fund their development, and with the next value of capital, that development turns into restricted. This additionally will influence this sector in relation to having to refinance the debt they’ve already amassed over the earlier zero-rate regime. One other option to develop is to boost capital by issuing new shares. With decrease share costs throughout the board because of anticipated larger prices of capital, that additionally is not essentially essentially the most viable possibility anymore both.

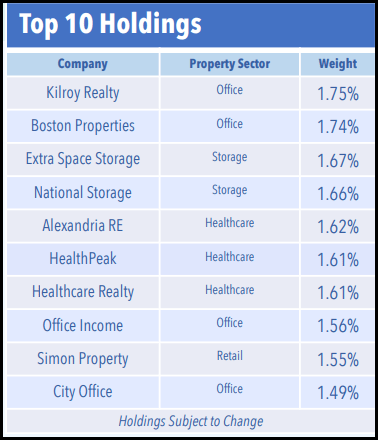

Going again to the yield focus of this fund, the identify can find yourself with some relatively dangerous names. That features a prime ten which might be at present holding a number of workplace REITs.

RIET Prime Ten Holdings (Hoya Capital)

The fund is designed to be diversified by means of the completely different property sectors and capping weights of every constituent. That also needs to assist restrict some dangers. Yields on the extra distressed areas of the market are more likely to rise, given the declines within the share costs.

A optimistic (optimistic?) spin of this may be that you find yourself getting publicity to these areas which might be even additional out-of-favor areas of an already out-of-favor sector. After all, therein lies the chance as effectively – that restoration on this house by no means comes; vacancies stay excessive, after which we may see bankruptcies over the approaching years from the workplace REIT house.