Up to date March tenth, 2022 by Quinn Mohammed

Month-to-month dividend shares enable for dividend traders to compound their wealth month-to-month versus quarterly, which is the most typical dividend schedule on the earth of investing.

This frequent dividend cost permits for traders to reinvest their cash extra shortly if they’re within the asset accumulation part of their life, or to cowl residing bills for retirees.

You’ll be able to obtain our full record of all 50 month-to-month dividend shares (together with vital monetary metrics like dividend yields and payout ratios) by clicking on the hyperlink beneath:

Three years in the past, we regarded into Three Canadian Month-to-month Dividend Shares with Yields As much as 8%. Since then, two of these corporations have been acquired. The third firm is included as soon as once more on this article.

Inter Pipeline Ltd. was totally acquired by Brookfield Infrastructure in late October 2021. Brookfield supplied shareholders $20.00 in money per share, or 1 / 4 of a Brookfield Infrastructure share, or any mixture of those. IPL.TO was then delisted from the TSX on November 1st, 2021.

Dream International REIT was acquired by The Blackstone Group Inc. in an all-cash transaction for $6.2 billion. Every unitholder of DRG.UN obtained $16.79 per unit.

Under are three Canadian corporations buying and selling on the Toronto Inventory Trade which have dividend yields of 5% to six% and have paid dividends each single month for a few years.

Two of the businesses beneath have dividend progress histories spanning over a decade, for revenue traders who depend on dividend progress along with yield.

Desk of Contents

Canadian Excessive-Yield Inventory #1: Pembina Pipeline Corp. (PBA)

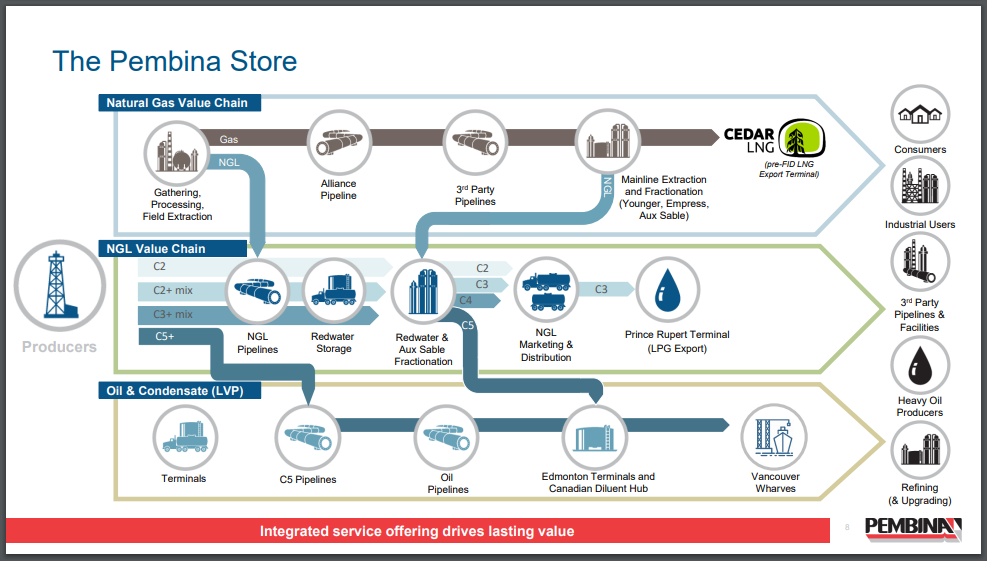

Pembina Pipeline Company is a serious supplier of transportation and midstream companies. Pembina owns pipelines which transport hydrocarbon liquids and pure fuel merchandise. Moreover, they personal fuel gathering and processing services and an oil and pure fuel liquids infrastructure and logistics enterprise. They function in Western Canada and have served their clients for greater than 65 years.

Although Pembina is a Canadian firm buying and selling beneath the ticker PPL on the TSX, it additionally trades on the NYSE beneath the ticker PBA.

The corporate owns and operates three completely different enterprise segments in western Canada. The three enterprise segments of Pembina include: Pipelines, Amenities and Advertising and marketing & New Ventures. For FY 2021, these segments made up 45%, 35%, and 20% of the corporate’s pre-tax revenue, respectively.

Supply: Investor Presentation

The corporate’s long-term technique is to amass and develop high-quality property that generate secure and predictable money movement, whereas delivering robust returns to shareholders.

Pembina already has a big and established backlog of progress initiatives. These initiatives lead administration to consider the company can develop adjusted money movement per share by 8%-10% per 12 months. Given Pembina’s risky earnings historical past, we anticipate they may develop adjusted money movement by about 5% per 12 months over the medium time period. Additionally, they anticipate elevating the dividend charge by 5% per 12 months going ahead.

Present Occasions

To additional gas progress, Pembina entered into an settlement with KKR to mix their western Canadian pure fuel processing property into one single, three way partnership entity. Pembina will personal 60% of the brand new entity, and KKR’s international infrastructure fund will personal the opposite 40%. The brand new firm may also purchase Power Switch LP’s final 51% stake in Power Switch Canada (ETC). All in, the worth of those property add as much as $11.4 billion CAD.

On February twenty fourth 2022, Pembina reported their This fall and FY 2021 outcomes. For This fall, adjusted money movement from working actions per share rose 21% in comparison with 2020, from $1.10 CAD to $1.33. Adjusted EBITDA additionally grew 12% year-over-year to $970 million.

For the full-year 2021, the company grew adjusted money movement from working actions per share by 15%, to $4.80. Adjusted EBITDA was barely larger in comparison with 2020, a 5% enhance to $3.4 billion.

With adjusted money movement per share of $4.80, and the FY 2021 dividend cost of $2.52, Pembina achieved a powerful payout ratio of 53%.

Whereas a protected and secure dividend is of utmost significance to dividend traders, corporations dedicated to rising the dividend each single 12 months present much more profit. Pembina is one such firm because it has paid a better dividend for ten consecutive years, from $1.56 CAD in 2011 to $2.52 in 2021. Thus, Pembina has elevated the annual dividend by 4.9% per 12 months on common over the past decade.

Valuation & Complete Returns

Pembina Pipeline is an organization the place adjusted money movement (“ACF”) from operations are used to calculate the dividend payout ratio, and it’s one whose valuation might be primarily based on price-to-ACF. With adjusted money movement of $4.80 per share and Pembina’s present share value of $46.32 CAD, PPL.TO’s P/ACF is 9.7.

We see truthful worth for Pembina at round 10.0 instances adjusted money movement from operations. This enhance in valuation may end in a 0.7% annual tailwind to whole returns.

With it’s present $2.52 CAD annual dividend, Pembina yields 5.4% (earlier than any dividend withholding taxes for non-Canadians) and pays its dividend month-to-month.

All in, we consider Pembina has the potential to generate annualized whole returns of 10.4% over the subsequent 5 years. These returns stem from a 5% progress charge, a 5.4% beginning dividend yield, and a possible valuation tailwind of 0.7% per 12 months.

Canadian Excessive-Yield Inventory #2: Trade Earnings Company (EIFZF)

Trade Earnings Company is a enterprise which makes investments and acquires corporations within the aerospace and aviation companies and gear sector, in addition to the manufacturing sector.

The businesses acquired are in defensible area of interest markets – medevac transportation, manufacturing of aerospace and protection elements, manufacturing of a complicated unitized “window wall system” used primarily in high-rise multi residential developments; the record goes on to the tune of 15 particular person working subsidiaries.

The acquisition candidates should have a observe document of income and robust, continued money movement era with their administration intact and a dedication to proceed constructing the enterprise.

The technique of the corporate is to develop their portfolio of diversified area of interest operations by way of acquisition and progress alternatives, and the results of that is to supply shareholders with a dependable and rising dividend.

Supply: Investor Relations

The company has elevated their dividend 14 instances within the final 16 years (maintaining it secure by way of 12 months 2009 and 2021), at a 4.8% compound annual progress charge of the dividend. Whereas a close to 5% dividend progress charge just isn’t all that spectacular, 14 years of dividend progress bears extra weight on the TSX than it does on the NYSE. It is because Canada has a a lot smaller record of dividend progress corporations, or “aristocrats”.

We anticipate the corporate can proceed to develop their dividend by about 2.0% over the medium time period. This could be supported by an anticipated adjusted EPS progress charge of about 3.0% per 12 months.

Supply: Investor Relations

Present Occasions

In line with their newest quarterly launch, payout ratio when calculated as a share of free money movement much less upkeep capital expenditures improved to 58% from 71% for the trailing twelve months. Payout ratio when calculated as a share of adjusted web earnings strengthened to 99% from 169% for the trailing twelve months. As well as, the annual dividend cost value the corporate 7% greater than in FY 2020. The adjusted web earnings payout ratio signifies the dividend may very well be in danger and needs to be monitored.

The corporate at present pays an annual dividend of $2.28 CAD, which equates to a 5.9% yield on the present share value of $38.85 CAD. Divided on its month-to-month cost schedule, that’s a 0.49% return on funding per 30 days earlier than taking any capital appreciation into consideration.

For full-year 2021, Trade Earnings generated document excessive income of $1.4 billion, up 23% in comparison with 2020. Adjusted web earnings improved by 82%, to $86 million. Adjusted EPS was $2.31 per share for FY 2021, a 71% enhance over $1.35 in 2020.

Throughout 2021, EIFZF closed on 5 acquisitions, a brand new document for variety of acquisitions in a calendar 12 months.

Valuation & Complete Returns

We estimate the company can generate about $2.56 CAD in adjusted EPS for 2022. Thus, Trade Earnings is buying and selling at 15.2 instances adjusted EPS.

We see truthful worth for Trade Earnings at round 15.0 instances adjusted EPS. This minor valuation drop may end in a (0.2%) annual headwind to whole returns.

With it’s present $2.28 CAD annual dividend, EIF.TO yields 5.9%. Mixed with our estimated 3% annual EPS progress and marginal valuation headwind, Trade Earnings is anticipated to generate annualized whole returns of seven.8% over the subsequent 5 years.

Canadian Excessive-Yield Inventory #3: TransAlta Renewables (TRSWF)

In 2013, TransAlta Renewables was spun off from TransAlta (TAC), which stays a serious shareholder within the various energy era firm. The corporate’s historical past in renewable energy era goes again greater than 100 years.

Its portfolio is made up of over 45 services powered by wind, pure fuel, hydro, or photo voltaic, in 2022. The company generates the vast majority of its money movement from its pure fuel and wind property.

Supply: Investor Presentation

TransAlta’s portfolio is fortified by lengthy contracts, which is evidenced by its weighted common contract lifetime of greater than a decade. The corporate has remodeled $3.5 billion CAD of acquisitions since 2013 however the enhance in share depend (to fund these acquisitions) has prevented its money movement per share from rising a lot, if in any respect, in sure durations.

For instance, TransAlta generated $1.34 CAD in FFO per share in 2013, and in 2021 they posted $1.34 in FCF per share, mainly unchanged. From 2012 to 2021 although, its FCF per share elevated by about 1.2% per 12 months in USD.

Wanting forward, we predict that progress will face a headwind from the Kent Hills 1 and a pair of wind services outage, as the prices of alternative and foregone income will have an effect. Presently, we estimate TransAlta Renewables can develop FCFPS by about 3% by way of 2027.

Present Occasions

In regards to the wind services outage, the corporate just lately suffered a tower collapse on the Kent Hills 2 wind website, and upon additional investigation, decided that every one 50 turbine foundations on the Kent Hills 1 and a pair of wind websites require a full basis alternative. This rehabilitation will take till the top of 2023 to be totally full. And the alternative is predicted to value between $75 million and $100 million.

TransAlta Renewables reported fourth quarter and FY 2021 outcomes on February twenty fourth. The corporate generated barely much less renewable power manufacturing in 2021 at 4,332 GWh in comparison with 4,471 GWh in 2020. Nonetheless, revenues got here in larger by 8% over the prior 12 months, to $470 million CAD.

Yr-over-year, adjusted EBITDA was unchanged and FCF dropped 5% to $357 million CAD in comparison with $377 million. Money out there for distribution (“CAFD”) per share, consequently, additionally decreased 10% to $1.03 CAD.

Valuation & Complete Returns

The corporate at present pays an annual dividend of $0.94 CAD (paid month-to-month at $0.07833), which equates to a 5.1% yield on the present share value of $18.57 CAD. TransAlta Renewables has maintained this dividend charge since 2017, after a sequence of dividend will increase.

We estimate the company can generate about $1.26 CAD in FCF for 2022. Thus, TransAlta Renewables is buying and selling at 14.7 instances FCF.

We see truthful worth for the company at round 13.0 instances FCF. This potential headwind to the valuation may end in a (2.5%) annual loss to whole returns.

This valuation headwind, mixed with the 5.1% beginning dividend yield and three.0% annual progress in FCF may result in annualized whole returns of 5.1% over the subsequent 5 years.

Extra Assets

Along with these 3 high-yield Canadian shares, there are numerous different kinds of high-quality dividend shares to contemplate.

The next Positive Dividend databases include essentially the most dependable dividend growers in our funding universe:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.