Updated on September 1st, 2022 by Bob Ciura

Spreadsheet data updated daily

Monthly dividend stocks are securities that pay a dividend every month instead of quarterly or annually. More frequent dividend payments mean a smoother income stream for investors.

This article includes:

- A free spreadsheet on all 49 monthly dividend stocks

- Links to detailed stand-alone analysis on all 49 monthly dividend stocks

- Several other resources to help you invest in monthly dividend securities for steady income

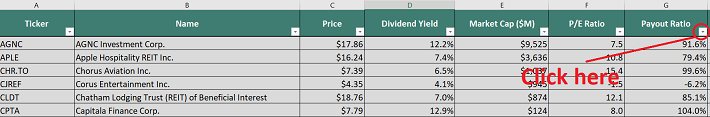

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter like dividend yield and payout ratio) by clicking on the link below:

The downloadable Monthly Dividend Stocks Spreadsheet above contains the following for each stock that pays monthly dividends:

- Dividend yield

- Name and ticker

- Market cap

- Payout ratio

- Beta

Note: We strive to maintain an accurate list of all monthly dividend payers. There’s no universal source we are aware of for monthly dividend stocks; we curate this list manually. If you know of any stocks that pay monthly dividends that are not on our list, please email [email protected].

This article also includes our top 5 ranked monthly dividend stocks today, according to expected five-year annual returns.

We have excluded oil and gas royalty trusts due to their high risks. These high risks make them less attractive for income investors, in our view.

Table of Contents

Having the list of monthly dividend stocks along with metrics that matter is a great way to begin creating a monthly passive income stream.

High-yielding monthly dividend payers have a unique mix of characteristics that make them especially suitable for investors seeking current income.

Keep reading this article to learn more about investing in monthly dividend stocks.

How to Use the Monthly Dividend Stocks Sheet to Find Dividend Investment Ideas

For investors that use their dividend stock portfolios to generate passive monthly income, one of the main concerns is the sustainability of the company’s dividend.

A dividend cut indicates one of two things:

- The business isn’t performing well enough to sustain a dividend

- Management is no longer interested in rewarding shareholders with dividends

Either of these should be considered an automatic sign to sell a dividend stock.

Of the two reasons listed above, #1 is more likely to happen. Thus, it is very important to continually monitor the financial feasibility of a company’s dividend.

This is best evaluated by using the payout ratio. The payout ratio is a mathematical expression that shows what percentage of a company’s earnings is distributed to shareholders as dividend payments. A very high payout ratio could indicate that a company’s dividend is in danger of being reduced or eliminated completely.

For readers unfamiliar with Microsoft Excel, this section will show you how to list the stocks in the spreadsheet in order of decreasing payout ratio.

Step 1: Download the monthly dividend stocks excel sheet at the link above.

Step 2: Highlight columns A through H, and go to “Data”, then “Filter”.

Step 3: Click on the ‘filter’ icon at the top of the payout ratio column.

Step 4: Filter the high dividend stocks spreadsheet in descending order by payout ratio. This will list the stocks with lower (safer) payout ratios at the top.

The 5 Best Monthly Dividend Stocks

The following companies represent our top 5 monthly dividend stocks right now. Stocks were selected based on their projected total annual returns over the next five years.

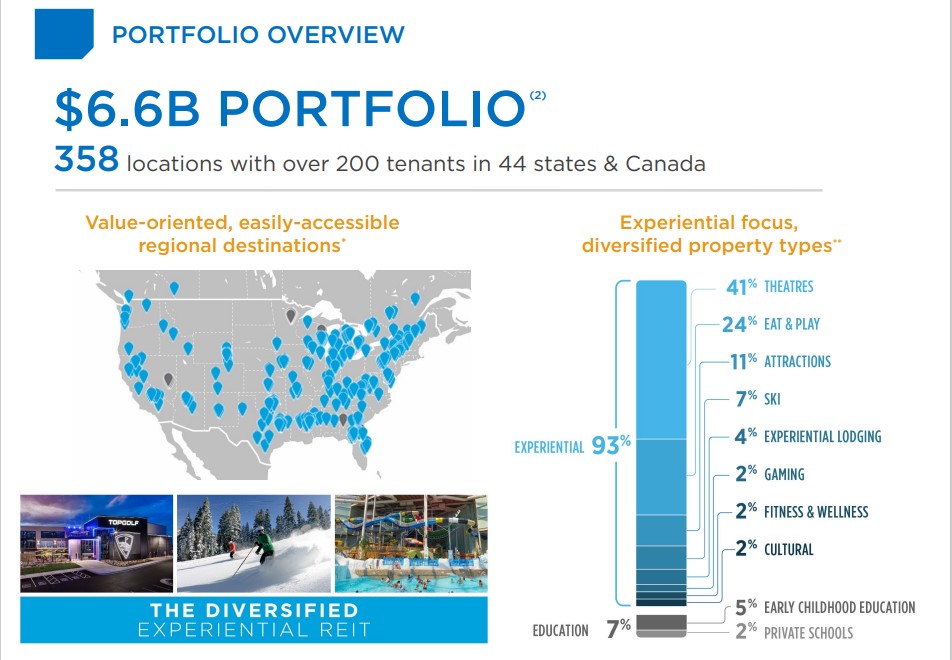

Monthly Dividend Stock #5: EPR Properties (EPR)

- 5-year expected annual returns: 13.5%

EPR Properties is a specialty real estate investment trust, or REIT, that invests in properties in specific market segments that require industry knowledge to operate effectively. It selects properties it believes have strong return potential in Entertainment, Recreation, and Education.

Source: Investor Presentation

The REIT structures its investments as triple net, a structure that places the operating costs of the property on the tenants, not the REIT. The portfolio includes almost $7 billion in investments across 300+ locations in 44 states, including over 250 tenants. Total revenue should be around $600 million this year.

EPR reported second quarter earnings on August 1st, 2022, and results were better than expected on both the top and bottom lines. The trust reported funds-from-operations of $1.23 per share, beating estimates by 13 cents. Revenue soared 28% year-over-year to $160 million, beating expectations by more than $11 million.

EPR boosted guidance for this year as it expects capital deployments to accelerate into the second half of the year. The trust also boosted guidance to $4.50 to $4.60 per share in adjusted FFO, up from the previous range of $4.39 to $4.55.

We expect annual returns of 13.5%, driven by the 7.3% dividend yield, 2% FFO-per-share growth, and a ~4.2% positive impact from an expanding valuation multiple.

Click here to download our most recent Sure Analysis report on EPR (preview of page 1 of 3 shown below):

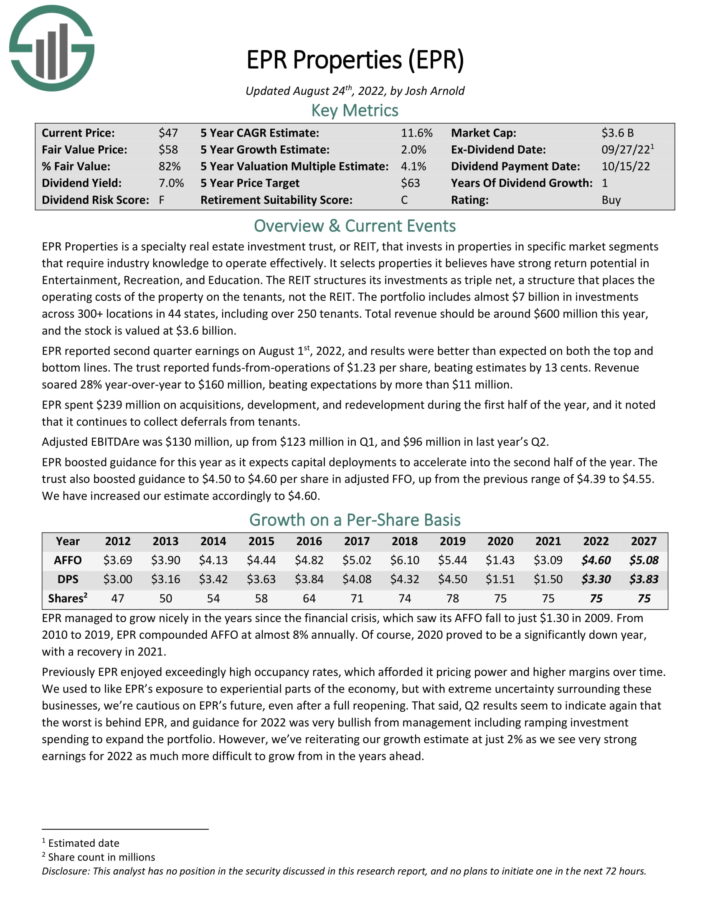

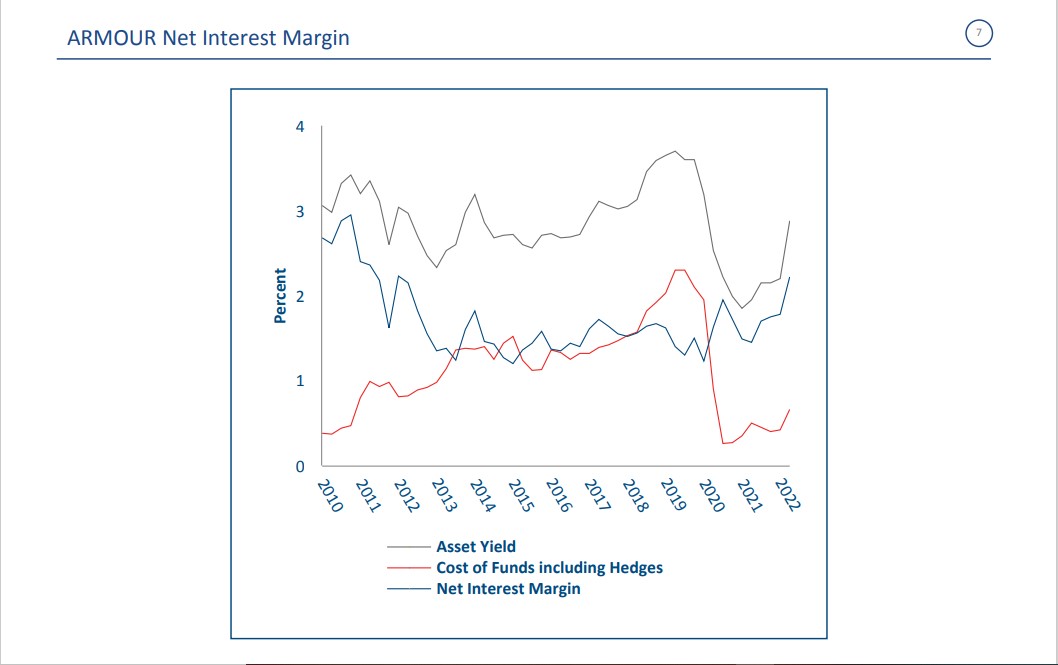

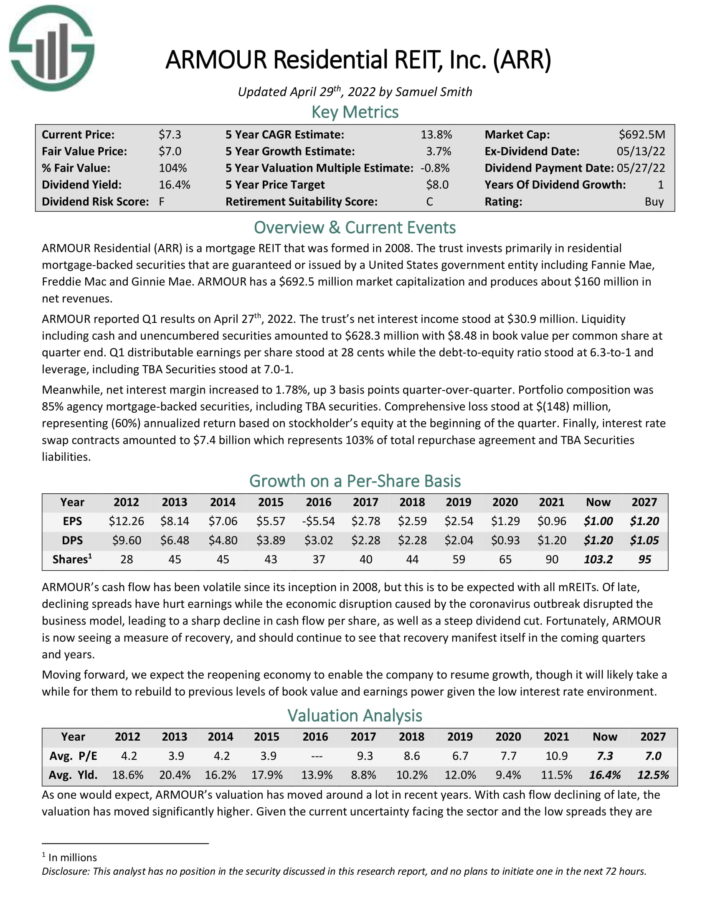

Monthly Dividend Stock #4: ARMOUR Residential REIT (ARR)

- 5-year expected annual returns: 14.4%

ARMOUR is a mortgage REIT that invests primarily in residential mortgage–backed securities that are guaranteed or issued by a United States government entity including Fannie Mae, Freddie Mac and Ginnie Mae.

ARMOUR reported Q1 results on April 27th, 2022. The trust’s net interest income stood at $30.9 million. Liquidity including cash and unencumbered securities amounted to $628.3 million with $8.48 in book value per common share at quarter end. Q1 distributable earnings per share stood at 28 cents while the debt-to-equity ratio stood at 6.3-to-1 and leverage, including TBA Securities stood at 7.0-1.

Source: Investor Presentation

Meanwhile, net interest margin increased to 1.78%, up 3 basis points quarter-over-quarter. Portfolio composition was 85% agency mortgage-backed securities, including TBA securities. Comprehensive loss stood at $(148) million, representing (60%) annualized return based on stockholder’s equity at the beginning of the quarter.

Finally, interest rate swap contracts amounted to $7.4 billion which represents 103% of total repurchase agreement and TBA Securities liabilities.

Click here to download our most recent Sure Analysis report on ARR (preview of page 1 of 3 shown below):

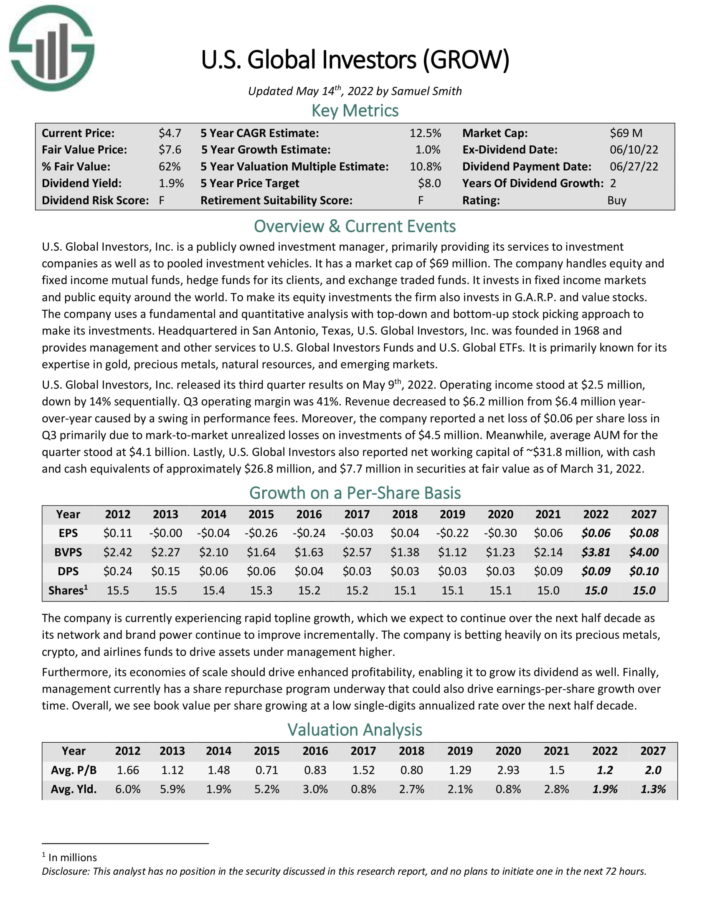

Monthly Dividend Stock #3: U.S. Global Investors (GROW)

- 5-year expected annual returns: 17.5%

U.S. Global Investors, Inc. is a publicly owned investment manager, primarily providing its services to investment companies as well as to pooled investment vehicles. It has a market cap of $69 million. The company handles equity and fixed income mutual funds, hedge funds for its clients, and exchange traded funds. It invests in fixed income markets and public equity around the world.

The company uses a fundamental and quantitative analysis with top-down and bottom-up stock picking approach to make its investments. Headquartered in San Antonio, Texas, U.S. Global Investors, Inc. was founded in 1968 and provides management and other services to U.S. Global Investors Funds and U.S. Global ETFs. It is primarily known for its expertise in gold, precious metals, natural resources, and emerging markets.

The company is currently experiencing rapid top-line growth, which we expect to continue over the next half decade as its network and brand power continue to improve incrementally. The company is betting heavily on its precious metals, crypto, and airlines funds to drive assets under management higher.

Furthermore, its economies of scale should drive enhanced profitability, enabling it to grow its dividend as well. Finally, management currently has a share repurchase program underway that could also drive earnings-per-share growth over time. Overall, we see book value per share growing at a low single-digits annualized rate over the next half decade.

We expect 17.5% annual returns for GROW stock, representing 1% expected EPS growth, the 2.4% dividend yield, and a 14.1% annual boost from an expanding valuation multiple.

Click here to download our most recent Sure Analysis report on GROW (preview of page 1 of 3 shown below):

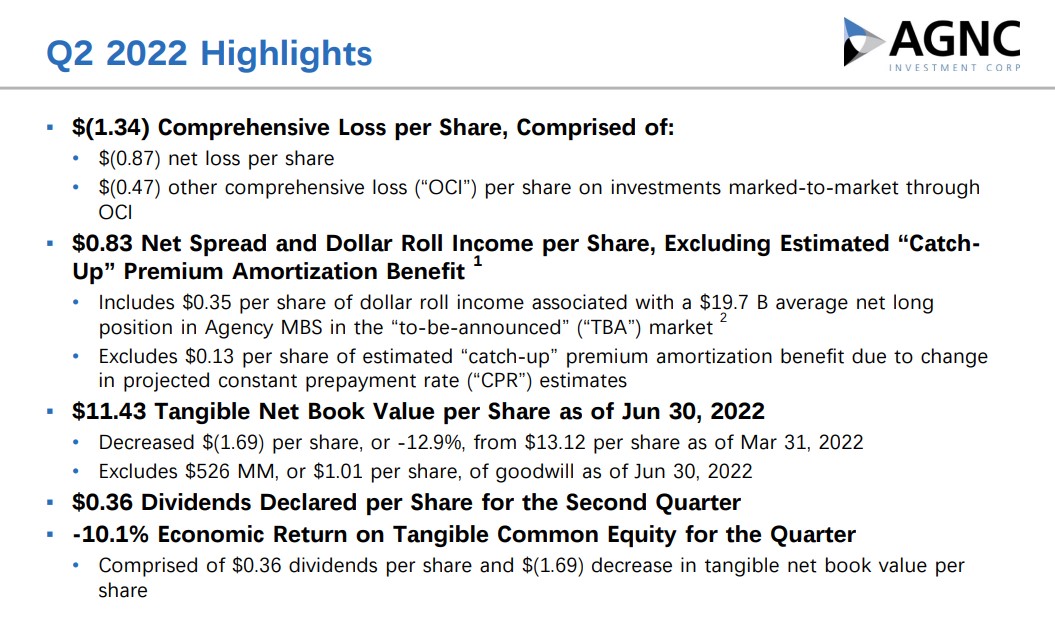

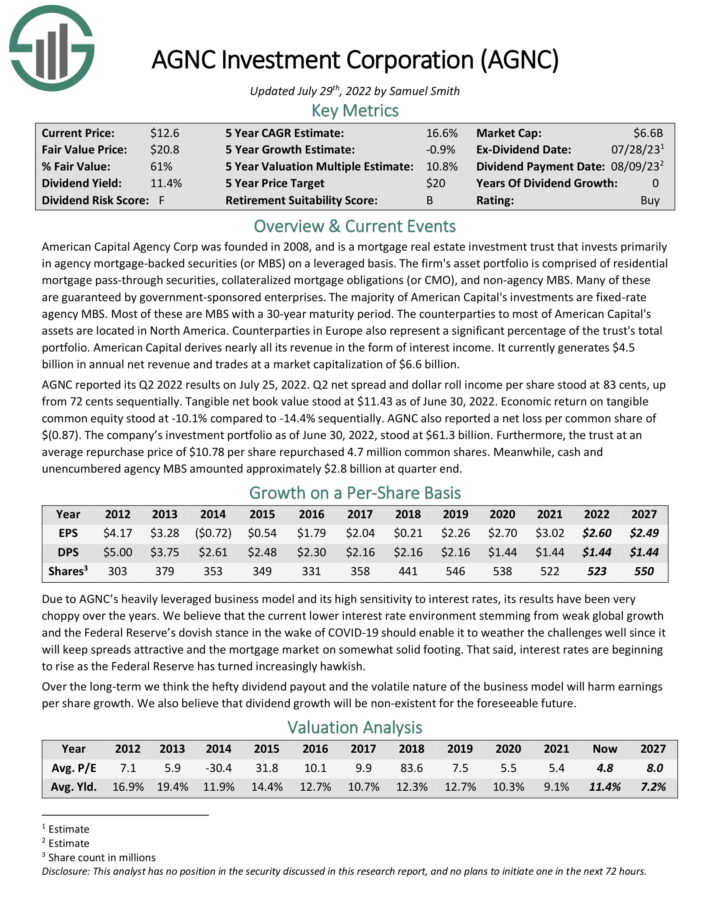

Monthly Dividend Stock #2: AGNC Investment Corporation (AGNC)

- 5-year expected annual returns: 17.8%

American Capital Agency Corp was founded in 2008, and is a mortgage real estate investment trust that invests primarily in agency mortgage-backed securities (or MBS) on a leveraged basis.

The firm’s asset portfolio is comprised of residential mortgage pass-through securities, collateralized mortgage obligations (or CMO), and non-agency MBS. Many of these are guaranteed by government sponsored enterprises.

The majority of American Capital’s investments are fixed rate agency MBS. Most of these are MBS with a 30-year maturity period. AGNC derives nearly all its revenue in the form of interest income. It currently generates $1.2 billion in annual net revenue.

You can see an overview of the company’s second-quarter report in the image below:

Source: Investor Presentation

We expect 17.8% annual returns for AGNC, made up of the 12% dividend yield, negative growth of -0.9%, and a ~6.7% boost from a rising P/FFO multiple.

Click here to download our most recent Sure Analysis report on AGNC (preview of page 1 of 3 shown below):

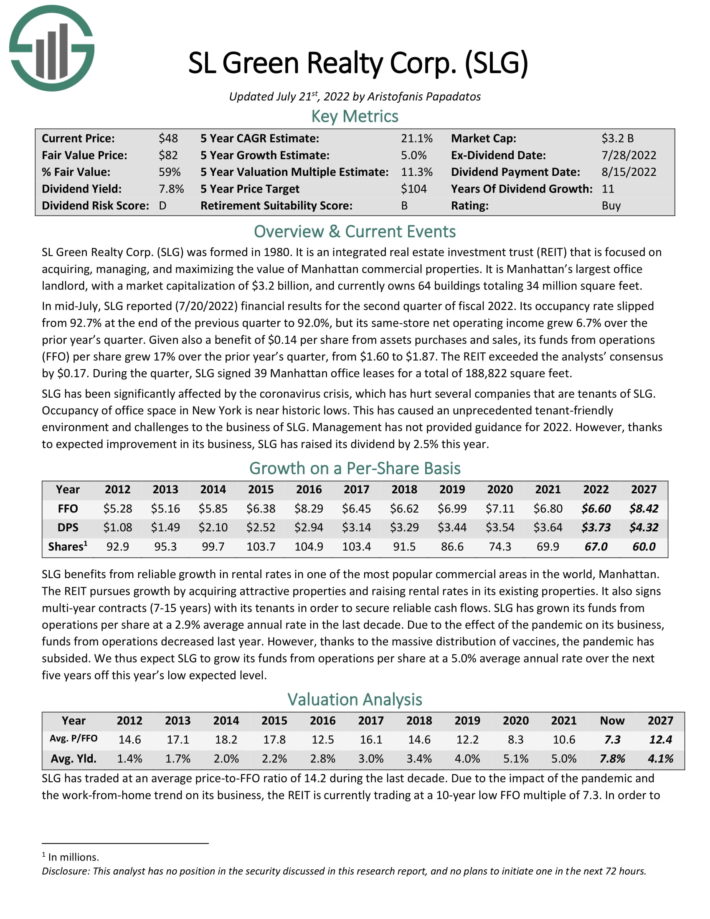

Monthly Dividend Stock #1: SL Green Realty (SLG)

- 5-year expected annual returns: 23.1%

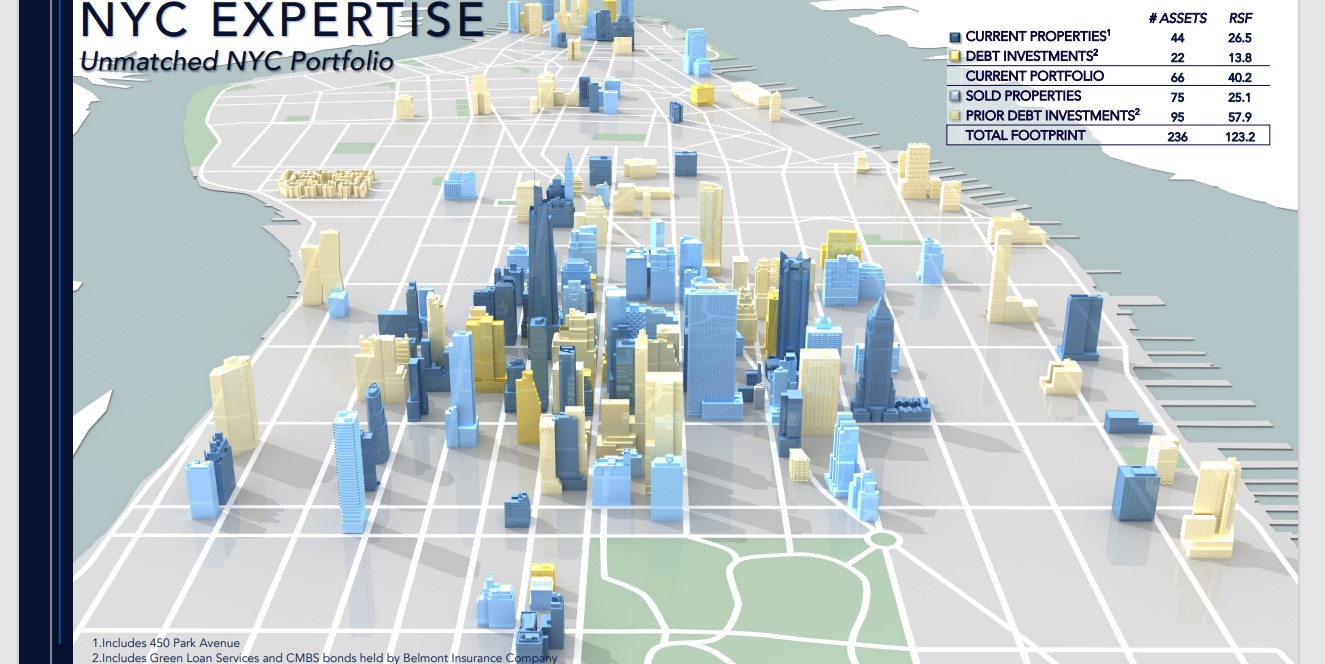

SL Green Realty Corp was formed in 1980. It is an integrated real estate investment trust (REIT) that is focused on acquiring, managing, and maximizing the value of Manhattan commercial properties. It is Manhattan’s largest office landlord, and currently owns 73 buildings totaling 35 million square feet.

Source: Investor Presentation

In mid-July, SLG reported (7/20/2022) financial results for the second quarter of fiscal 2022. Its occupancy rate slipped from 92.7% at the end of the previous quarter to 92.0%, but its same-store net operating income grew 6.7% over the prior year’s quarter.

Given also a benefit of $0.14 per share from assets purchases and sales, its funds from operations (FFO) per share grew 17% over the prior year’s quarter, from $1.60 to $1.87. The REIT exceeded the analysts’ consensus by $0.17. During the quarter, SLG signed 39 Manhattan office leases for a total of 188,822 square feet.

We expect annual returns of 23.1% going forward, comprised of 5% expected earnings growth, the 8.4% dividend yield, and a ~9.7% annual boost from an expanding P/FFO multiple.

Click here to download our most recent Sure Analysis report on SLG (preview of page 1 of 3 shown below):

Detailed Analysis On All of The Monthly Dividend Stocks

You can see detailed analysis on monthly dividend securities we cover by clicking the links below. We’ve included our most recent Sure Analysis Research Database report update in brackets as well, where applicable.

- Agree Realty (ADC) | [See Newest Sure Analysis Report]

- AGNC Investment (AGNC) | [See Newest Sure Analysis Report]

- Apple Hospitality REIT, Inc. (APLE) | See Newest Sure Analysis Report

- ARMOUR Residential REIT (ARR) | [See Newest Sure Analysis Report]

- Banco Bradesco S.A. (BBD) | [See Newest Sure Analysis Report]

- Broadmark Realty Capital (BRMK) | [See Newest Sure Analysis Report]

- Chatham Lodging (CLDT)* | [See Newest Sure Analysis Report]

- Choice Properties REIT (PPRQF) | [See Newest Sure Analysis Report]

- Cross Timbers Royalty Trust (CRT) | [See Newest Sure Analysis Report]

- Dream Industrial REIT (DREUF) | [See Newest Sure Analysis Report]

- Dream Office REIT (DRETF) | [See Newest Sure Analysis Report]

- Dynex Capital (DX) | [See Newest Sure Analysis Report]

- Ellington Residential Mortgage REIT (EARN) | [See Newest Sure Analysis Report]

- Ellington Financial (EFC) | [See Newest Sure Analysis Report]

- EPR Properties (EPR) | [See Newest Sure Analysis Report]

- Exchange Income Corporation (EIFZF) | [See Newest Sure Analysis Report]

- Fortitude Gold (FTCO) | [See Newest Sure Analysis Report]

- Generation Income Properties (GIPR) | [See Newest Sure Analysis Report]

- Gladstone Capital Corporation (GLAD) | [See Newest Sure Analysis Report]

- Gladstone Commercial Corporation (GOOD) | [See Newest Sure Analysis Report]

- Gladstone Investment Corporation (GAIN) | [See Newest Sure Analysis Report]

- Gladstone Land Corporation (LAND) | [See Newest Sure Analysis Report]

- Global Water Resources (GWRS) | [See Newest Sure Analysis Report]

- Granite Real Estate Investment Trust (GRP.U)** | [Historical Reports]

- Horizon Technology Finance (HRZN) | [See Newest Sure Analysis Report]

- Itaú Unibanco (ITUB) | [See Newest Sure Analysis Report]

- LTC Properties (LTC) | [See Newest Sure Analysis Report]

- Main Street Capital (MAIN) | [See Newest Sure Analysis Report]

- Orchid Island Capital (ORC) | [See Newest Sure Analysis Report]

- Oxford Square Capital (OXSQ) | [See Newest Sure Analysis Report]

- Pembina Pipeline (PBA) | [See Newest Sure Analysis Report]

- Permian Basin Royalty Trust (PBT) | [See Newest Sure Analysis Report]

- Phillips Edison & Company (PECO) | [See Newest Sure Analysis Report]

- Pennant Park Floating Rate (PFLT) | [See Newest Sure Analysis Report]

- PermRock Royalty Trust (PRT) | [See Newest Sure Analysis Report]

- Prospect Capital Corporation (PSEC) | [See Newest Sure Analysis Report]

- Permianville Royalty Trust (PVL)

- Realty Income (O) | [See Newest Sure Analysis Report]

- Sabine Royalty Trust (SBR) | [See Newest Sure Analysis Report]

- Stellus Capital Investment Corp. (SCM) | [See Newest Sure Analysis Report]

- San Juan Basin Royalty Trust (SJT)

- Shaw Communications (SJR) | [See Newest Sure Analysis Report]

- SL Green Realty Corp. (SLG) | [See Newest Sure Analysis Report]

- SLR Investment Corp. (SLRC) | [See Newest Sure Analysis Report]

- Stag Industrial (STAG) | [See Newest Sure Analysis Report]

- Superior Plus (SUUIF) | [See Newest Sure Analysis Report]

- TransAlta Renewables (TRSWF) | [See Newest Sure Analysis Report]

- U.S. Global Investors (GROW) | [See Newest Sure Analysis Report]

- Whitestone REIT (WSR) | [See Newest Sure Analysis Report]

Note 1: The asterisk (*) denotes a stock that has suspended its dividend. As a result, we have not included the stock in our annual Monthly Dividend Stock In Focus Series. We will resume coverage when and if the company in question resumes paying dividends.

Note 2: The double asterisk (**) denotes a security that is not included by our data provider and is therefore excluded from our Sure Analysis research database despite being a monthly paying dividend stock.

As we do not have coverage of every monthly dividend stock, they are not all included in the list above. Note that most of these businesses are either small or mid-cap companies.

You will not see any S&P 500 stocks in this list – it is predominantly populated by members of the Russell 2000 Index or various international stock market indices.

Based on the list above, the bulk of monthly dividend paying securities are REITs and BDCs.

Performance Through August 2022

In August 2022, a basket of the 49 monthly dividend stocks above (excluding SJT) generated negative total returns of 3.8%. For comparison, the Russell 2000 ETF (IWM) generated negative total returns of 2.0% for the month.

Notes: Data for performance is from Ycharts. Canadian company performance may be in the company’s home currency. Year-to-date performance does have survivorship bias as some securities have been excluded as they eliminated their dividends. Global Net Lease (GNL) was also eliminated as it changed its dividend to quarterly payments.

Monthly dividend stocks underperformed in August. We will update our performance section monthly to track future monthly dividend stock returns.

In August 2022, the 3 best-performing monthly dividend stocks (including dividends) were:

- Cross Timbers Royalty Trust (CRT), up 22.2%

- Orchid Island Capital (ORC), up 17.4%

- Generation Income Properties (GIPR), up 11.4%

The 3 worst-performing monthly dividend stocks (including dividends) in August were:

- EPR Properties (EPR), down 18.7%

- Broadmark Realty (BRMK), down 14.1%

- Gladstone Land (GLAD), down 13.1%

Why Monthly Dividends Matter

Monthly dividend payments are beneficial for one group of investors in particular – retirees who rely on dividend stocks for income.

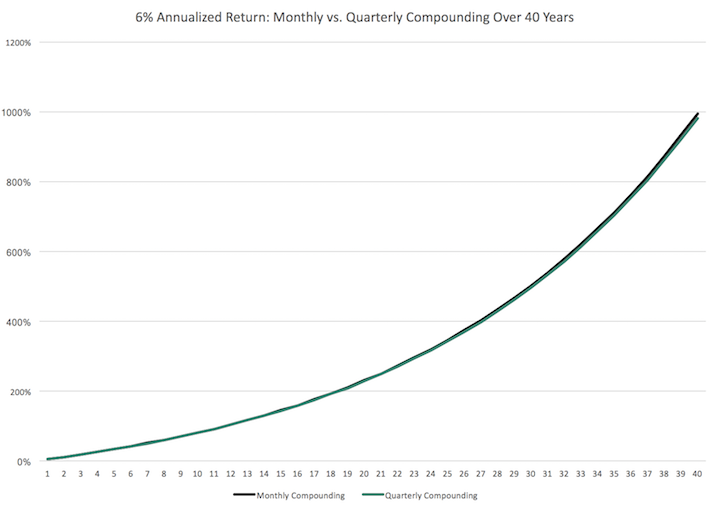

With that said, monthly dividend stocks are better under all circumstances (everything else being equal), because they allow for returns to be compounded on a more frequent basis. More frequent compounding results in better total returns, particularly over long periods of time.

Consider the following performance comparison:

Over the long run, monthly compounding generates slightly higher returns over quarterly compounding. Every little bit helps.

With that said, it might not be practical to manually re-invest dividend payments on a monthly basis. It is more feasible to combine monthly dividend stocks with a dividend reinvestment plan to dollar cost average into your favorite dividend stocks.

The last benefit of monthly dividend stocks is that they allow investors to have – on average – more cash on hand to make opportunistic purchases. A monthly dividend payment is more likely to put cash in your account when you need it versus a quarterly dividend.

Case-in-point: Investors who bought a broad basket of stocks at the bottom of the 2008-2009 financial crisis are likely sitting on triple-digit total returns from those purchases today.

The Dangers of Investing In Monthly Dividend Stocks

Monthly dividend stocks have characteristics that make them appealing to do-it-yourself investors looking for a steady stream of income. Typically, these are retirees and people planning for retirement.

Investors should note many monthly dividend stocks are highly speculative. On average, monthly dividend stocks tend to have elevated payout ratios. An elevated payout ratio means there’s less margin for error to continue paying the dividend if business results suffer a temporary (or permanent) decline.

As a result, we have real concerns that many monthly dividend payers will not be able to continue paying rising dividends in the event of a recession.

Additionally, a high payout ratio means that a company is retaining little money to invest for future growth. This can lead management teams to aggressively leverage their balance sheet, fueling growth with debt. High debt and a high payout ratio is perhaps the most dangerous combination around for a potential future dividend reduction.

With that said, there are a handful of high-quality monthly dividend payers around. Chief among them is Realty Income (O). Realty Income has paid increasing dividends (on an annual basis) every year since 1994.

The Realty Income example shows that there are high-quality monthly dividend payers around, but they are the exception rather than the norm. We suggest investors do ample due diligence before buying into any monthly dividend payer.

Final Thoughts

Financial freedom is achieved when your passive investment income exceeds your expenses. But the sequence and timing of your passive income investment payments can matter.

Monthly payments make matching portfolio income with expenses easier. Most personal expenses recur monthly whereas most dividend stocks pay quarterly. Investing in monthly dividend stocks matches the frequency of portfolio income payments with the normal frequency of personal expenses.

Additionally, many monthly dividend payers offer investors high yields. The combination of a monthly dividend payment and a high yield should be especially appealing to income investors.

But not all monthly dividend payers offer the safety that income investors need. A monthly dividend is better than a quarterly dividend, but not if that monthly dividend is reduced soon after you invest. The high payout ratios and shorter histories of most monthly dividend securities mean they tend to have elevated risk levels.

Because of this, we advise investors to look for high-quality monthly dividend payers with reasonable payout ratios, trading at fair or better prices.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].