Up to date on November twenty fifth, 2022 by Bob Ciura

Lithium, additionally referred to as “white petroleum” is likely one of the flashier metals you’ll encounter.

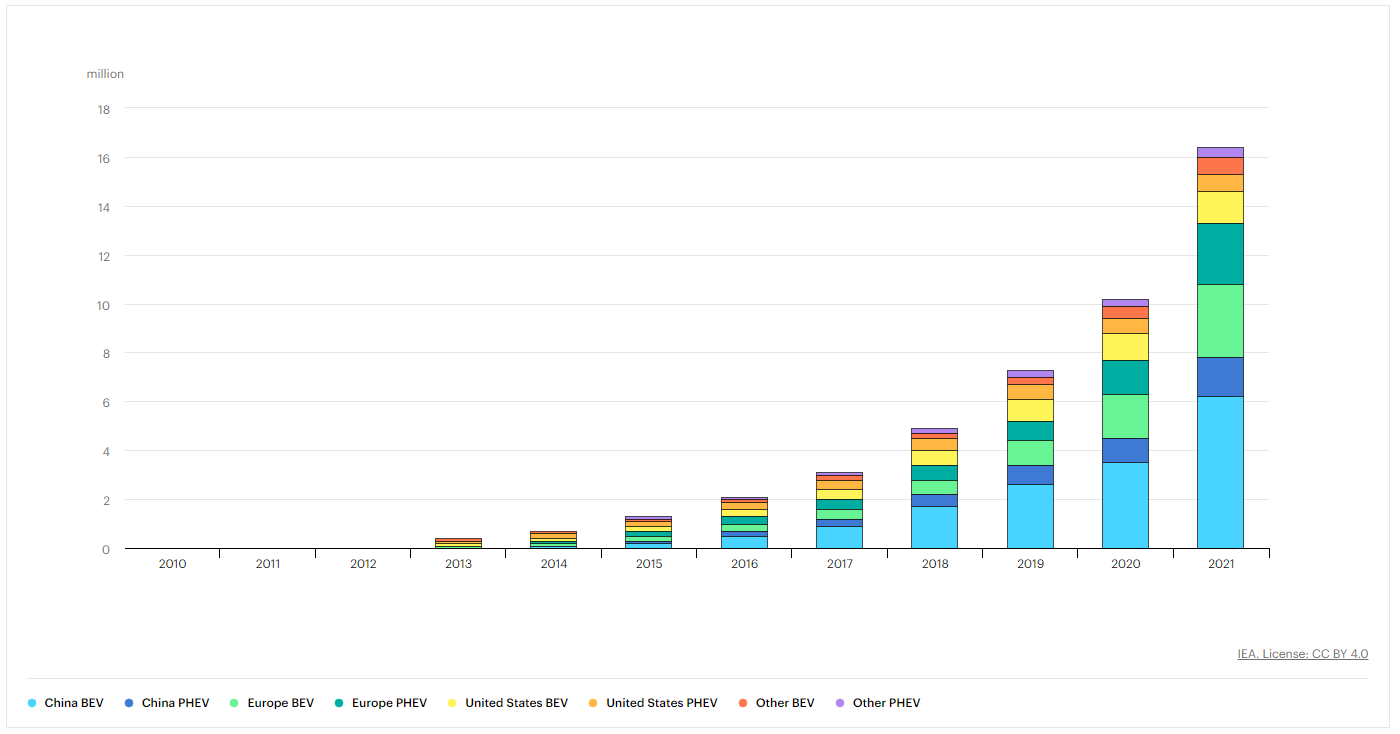

Electrical automobiles have gotten the true drivers of demand, as an electrical automobile requires 5,000 to 10,000 instances as a lot lithium as a cell phone. Additional, demand for electrical automobiles is skyrocketing as increasingly more legacy producers make investments billions of {dollars} within the house.

This has induced curiosity in investing in lithium shares to surge.

Due to this, now we have created a listing of lithium shares (together with necessary monetary metrics akin to price-to-earnings ratios and dividend yields) that may be downloaded utilizing the hyperlink beneath:

This information provides an summary of the lithium trade and an in depth evaluation of lithium shares.

Desk of Contents

Lithium Business Overview

Whereas Lithium is white or grey in typical type, when it’s thrown into a fireplace, it turns shiny crimson. The lithium mineral was documented within the 1790s, nevertheless it wasn’t till 1855 that the factor was separated and recognized.

Lithium (atomic image Li) has many distinctive traits. It’s gentle and mushy – mushy sufficient to be lower with a butter knife and lightweight sufficient to drift on water.

Additional, the steel has a comparatively low melting level however a excessive boiling level. Its makes use of range dramatically, from manufacturing plane and batteries to psychological well being medication.

In 1991 Sony popularized the lithium-ion battery, which has change into an important a part of almost each digital gadget. Naturally, using electronics has taken off, with cell phones main the best way within the final decade.

In 2009, the lithium-ion battery made up roughly 21% of all lithium consumption.

In 2021, about 74% of lithium produced went to battery manufacturing – greater than tripling its share (in a rising market) in simply over a decade. Given the extreme demand for electrical automobiles globally, we anticipate this can proceed to surge.

Extracting Lithium

There are two major methods of extracting lithium: mining and brine water.

Apparently, about two-thirds of lithium is extracted by way of brine water. The very best concentrations of those lakes are present in Chile and Argentina.

Lithium is obtained by way of evaporation within the type of lithium carbonate, the uncooked materials utilized in lithium-ion batteries. This course of additionally leaves behind magnesium, calcium, sodium, and potassium.

Whereas brine mining is a prolonged endeavor – normally taking eight months to three years – it’s nonetheless normally extra accessible and cheaper than arduous rock mining.

The remaining quantity of lithium is present in conventional mining operations.

The lithium focus is extra vital in arduous rock mines, however the associated fee to function these mines and the environmental and geological affect is way higher. Nonetheless, a tough rock mine in operation could be aggressive with an upstart brine mine.

Whereas there are 145 minerals containing lithium, simply 5 are utilized in lithium extraction.

Furthermore, of those 5, spodumene makes up the lion’s share (~90%) of mineral-derived lithium. The mineral is heated, cooled, and blended with sulfuric acid to create lithium carbonate.

Lastly, a minimal quantity of lithium is being recycled from electronics. This methodology doesn’t present pure sufficient lithium to make new batteries, however it’s appropriate for different makes use of, akin to glass and ceramics.

Provide

Whole lithium manufacturing in 2021 amounted to 100,000 MT (metric tons), which we anticipate to proceed rising, given the seemingly insatiable demand.

Listed below are the highest lithium-producing international locations in 2019:

1. Australia = 51,000 MT (60% of worldwide manufacturing)

2. Chile = 16,000 MT (19%)

3. China = 8,000 MT (8%)

4. Argentina = 6,200 MT (7.3%)

5. Zimbabwe = 1,600 MT (1.9%)

As you’ll be able to see, lithium manufacturing is extremely concentrated, with considerably all of it being produced by simply 5 international locations and Australia being a majority by itself.

Certainly, Australia and Chile alone account for nearly 80% of the manufacturing market. The US is a tiny participant on this market, with a fraction of a % of the market share.

Whole worldwide lithium reserves are estimated to be 20 million metric tons.

Lengthy-term mining exercise will doubtless proceed to be pushed by Chile, China, Australia, and Argentina.

Demand

The demand for lithium at present has three major drivers: Continued cellular gadget adoption, vitality storage for electrical grids / renewable vitality, and electrical automobiles.

As famous above, brief and intermediate-term demand for lithium will doubtless rely on the dynamics of the electrical car market.

Cellular gadget adoption will proceed to be a driver, however electrical automobiles require 1000’s of instances as a lot lithium and therefore have a way more vital affect.

Batteries for storage for renewable vitality could possibly be a necessary driver down the road, however that’s considered as extra of a long-term demand driver.

World electrical car gross sales are anticipated to exceed 14 million by 2025 and can doubtless develop over the subsequent a number of a long time as electrical battery prices change into cheaper than inside combustion engines. As well as, legal guidelines in opposition to inside combustion engines have popped up in numerous developed international locations in Europe and the US, which means governments are driving shoppers over the long run towards electrical automobiles.

Supply: IEA, World electrical automobile inventory, 2010-2021, IEA, Paris

Moreover, whereas demand forecasts range extensively, it’s primarily anticipated that electrical car manufacturing will take a look at provide within the years and a long time to come back. We will see that electrical car registrations are mushrooming increased as producers create extra provide annually to satiate shopper demand.

Certainly, some consider that electrical car adoption might be stymied by the provision (or lack thereof) of essential elements like lithium, because the current ramp-up in demand strikes a lot quicker than the flexibility to ascertain new mines, which frequently takes years.

Nonetheless, regardless of super expectations, it needs to be famous that whereas lithium is a necessary a part of electrical automobiles, it’s not essentially a elementary value driver.

Extra necessary value drivers may embody nickel and cobalt, making up ~73% and ~14% of a typical battery, in comparison with ~11% for lithium. Tesla’s Elon Musk calls lithium “the salt on the salad,” noting the comparatively low expense of the fabric in comparison with the car’s total value.

Whereas ample lithium reserves can be found, the demand has picked up tremendously, resulting in supply-side constraints. Consequently, pricing could be unstable. Battery-grade lithium costs, nevertheless, have stabilized considerably prior to now couple of years.

Investing In Lithium

There’s a method to straight and broadly spend money on the lithium trade: The World X Lithium & Battery Tech ETF (LIT).

The ETF “invests within the full lithium cycle, from mining and refining the steel, via battery manufacturing.” The fund goals to “present funding outcomes that correspond to the worth and yield efficiency, earlier than charges and bills, of the Solactive World Lithium Index.”

The “earlier than charges” portion is crucial, as administration charges stand at 0.75% yearly. Furthermore, the present dividend yield is negligible.

The fund was began on July twenty second, 2010. It has generated first rate returns prior to now 5 years, rising about 70% in complete versus the S&P 500’s rise of 55% in the identical interval.

Whereas the ETF’s efficiency has been good over time, the ETF has vastly underperformed extra just lately. The S&P 500 has fallen about 14% prior to now yr, whereas LIT’s decline is double that quantity. As well as, prior to now yr, belongings have fallen from about $6 billion to only underneath $4 billion, a lot of which was because of the poor efficiency of the ETF thus far in 2022.

The fund holds 46 securities, however the prime 10 positions make up 58% of the ETF’s complete belongings:

1. Albemarle (ALB): 15.1% of belongings

2. Sociedad Quimica Y Minera De Chile SA ADR (SQM): 6.2%

3. Samsung SDI Co Ltd: 5.4%

4. Eve Vitality Co: 5.3%

5. TDK Corp.: 5.1%

We don’t discover this ETF enticing – the administration charge and previous report to this point have confirmed to be unimpressive – nevertheless it does supply a chance to debate the most important gamers within the trade.

Lithium Mining Shares

For a very long time, the lithium mining trade was managed by the “large three:” Albemarle (ALB), Sociedad Quimica Y Minera de Chile (SQM), and FMC (FMC).

Rockwood Holdings was additionally a big participant, however Albemarle acquired it a number of years in the past. These three companies accounted for 85% of the world’s lithium market share.

Nonetheless, extra just lately, China has entered the market in an enormous means. For example, Australia’s largest mine, the Greenbushes, is 51% managed by China’s Tianqi Lithium and 49% owned by Albemarle.

Right now, the “large three” market share has dropped to 53%, whereas Chinese language firms management about 40% of the world’s lithium market share.

Listed below are the 5 largest lithium-mining companies:

1. Albemarle

2. SQM

3. Tianqi Lithium

4. Jiangxi Ganfeng Lithium

5. Mineral Assets Ltd.

Whereas the 2 Chinese language shares can’t be invested in simply, the opposite three lithium-mining companies do supply publicly traded shares within the US:

Lithium Mining Inventory: Albemarle (ALB)

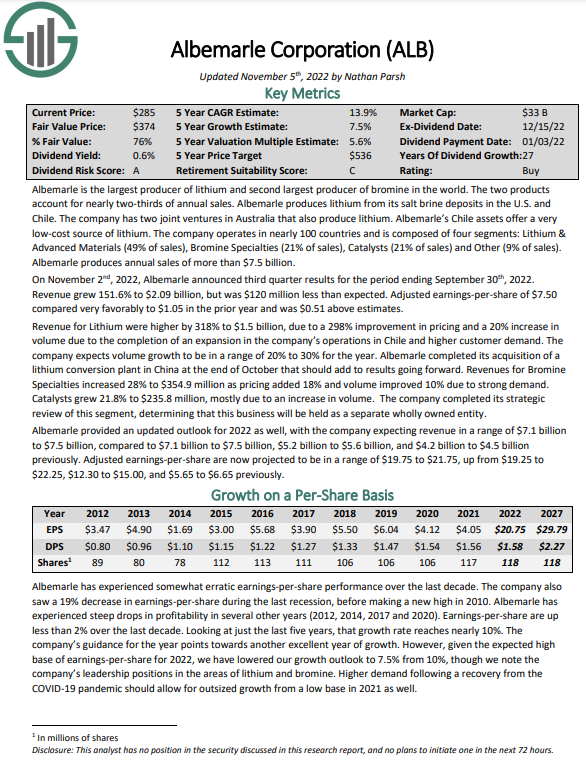

Albemarle is the most important producer of lithium and the second-largest producer of bromine globally. The 2 merchandise account for almost two–thirds of annual gross sales. Albemarle produces lithium from its salt brine deposits within the U.S. and Chile.

The corporate has two joint ventures in Australia that additionally produce lithium. Albemarle’s Chile belongings supply a really low–value supply of lithium.

The corporate operates in almost 100 international locations and consists of 4 segments: Lithium & Superior Supplies (49% of gross sales), Bromine Specialties (21% of gross sales), Catalysts (21% of gross sales), and Different (9% of gross sales).

Albemarle produces annual gross sales of $7.3 billion.

Albemarle has elevated its dividend for over 25 consecutive years. Consequently, it’s on the unique Dividend Aristocrats checklist.

Click on right here to obtain our most up-to-date Positive Evaluation report on Albemarle (preview of web page 1 of three proven beneath):

Lithium Mining Inventory: Sociedad Quimica Y Minera de Chile (SQM)

Sociedad Quimica Y Minera de Chile ADR, extra succinctly often known as SQM, is a Chilean commodities producer specializing in lithium, potassium fertilizers, iodine, and photo voltaic salts. The corporate ought to produce simply over $10 billion in income this yr.

On a per-share foundation, shares commerce fingers round $99. The inventory has a ~6% present dividend yield.

SQM’s most spectacular belongings are the low-cost lithium deposits in Chile’s Salar de Atacama, which has each the very best focus of lithium globally and advantages from the excessive evaporation charges within the Chilean desert.

The corporate additionally has about half the market share in potassium nitrate and is the world’s largest producer of iodine. These three industries ought to profit from the continued traits towards electrical automobiles, elevated crop manufacturing, and healthcare spending.

The corporate has a long-term contract with Chile to extract 414,000 metric tons of lithium via 2030.

Lithium Mining Inventory: Mineral Assets Ltd. (MALRF)

Mineral Assets is a mining firm that’s based mostly in Australia. The corporate primarily operates in its residence nation, China and Singapore. It operates a diversified mining enterprise comprising Mining Companies and Processes, Iron Ore, Lithium, Different Commodities, and Central segments. Via these segments, the corporate presents an enormous array of mining companies, but in addition engineering and building companies, logistics, processing, ship loading, advertising, and extra. The corporate was based in 1993, generates over $4 billion in annual gross sales, and has virtually 4,000 workers worldwide.

To make certain, the corporate isn’t a pure play on lithium mining, nevertheless it has benefited massively from the ramp in lithium demand. Additionally, given it has belongings in essentially the most lithium-rich international locations on the earth – Australia and China – we consider it is going to be an important participant for a few years to come back. Certainly, income needs to be near $5 billion subsequent yr.

The dividend is irregular and is paid solely semi-annually, however as we speak the inventory yields about 1.2%. It’s, due to this fact, not a very sturdy revenue inventory, particularly given the unpredictable nature of funds to shareholders.

Lithium Battery Shares

The producer aspect is comparatively concentrated, though just lately, China has been taking vital market share from the “Massive 3.” On the applying aspect, there are all kinds of battery makers, and the market share continues to be considerably up for grabs.

Right here’s a sampling of the highest 10 lithium-ion battery producers on the earth:

1. Up to date Amperex Expertise

2. BYD

3. CALB-CALB Co., Ltd.

4. LG Chem

5. Panasonic

6. Samsung SDI

7. SK Innovation Co Ltd

8. Shenzhen Grepow Battery Co., Ltd.

9. Toshiba Company

10. A123 Techniques LLC

So far as investable fairness positions for U.S. traders go, the entire above are headquartered outdoors of the U.S. / listed on a overseas change. That is indicative of the place lithium deposits are on the earth and the truth that the US has no considerable market place in consequence.

Nonetheless, two of the above have US-listed ADRs, which implies US traders can simply spend money on these firms’ futures: LG Chemical, Panasonic, and Toshiba.

Lithium Battery Inventory: Panasonic (PCRFY)

Panasonic offers EV batteries for the world’s automakers, with Tesla (TSLA) as its most notable buyer. Nonetheless, this is just one portion of the Japanese enterprise. Panasonic’s working segments embody Automotive & Industrial Techniques, Eco Options, Linked Options, Home equipment, and Others.

As a common theme, earnings have been unstable. Panasonic is a diversified enterprise, going effectively past the lithium battery market, with arms in digital element mounting, home equipment, and residential constructing merchandise.

This advantages security (when one division does poorly, different divisions can usually make up the shortfall), however it could possibly additionally dilute the expansion potential a “pure play” lithium battery maker may need.

Nonetheless, Panasonic is well-positioned within the trade.

Lithium Battery Inventory: Toshiba Company (TOSBF)

Toshiba offers digital gadgets and battery storage options globally. The corporate has many companies outdoors of battery manufacturing, so like Panasonic, Toshiba isn’t a pure play on lithium or batteries. Nonetheless, Toshiba has scale and model recognition within the battery house, promoting numerous digital gadgets with lithium-ion battery energy cells.

Toshiba’s income has waned in recent times, however the firm is underneath a sale course of at present. Earlier this yr, Toshiba submitted a proposal to separate itself into two publicly-traded, separate entities. That proposal was rejected, and a strategic evaluate was then undertaken. Toshiba obtained a number of presents for buyouts, and it seems it is going to be taken personal between $16 and $19 billion, making it one of the vital vital personal fairness offers ever in Japan.

The Finest Lithium Shares

Whenever you look throughout the publicly traded lithium market, it’s arduous to discover a “pure play” lithium inventory. Even among the many lithium producers, every has separate and important operations in different areas.

Even an ETF centered particularly on lithium casts a large web in numerous industries.

On the mining aspect, you could have the “Massive 3” and a bunch of Chinese language firms working to take a big share.

On the whole, the mining aspect appears to be like considerably fascinating from an financial standpoint because of the inelastic demand for uncooked supplies. Nonetheless, we notice that any sort of mining, together with lithium, is mostly extremely cyclical as a consequence of inevitable pricing and demand swings.

As a result of lithium is crucial however not an enormous value driver in battery manufacturing, battery makers are unlikely to considerably scale back their consumption even within the face of upper lithium costs.

Whereas miners can not dictate increased costs alone, they’re prone to profit from increased costs if they arrive about from provide shortages / quicker demand development.

In our view, SQM and Albemarle appear like essentially the most thrilling lithium shares on the mining aspect as a consequence of their premium place in Chile – a place providing the deepest reserves coupled with excessive concentrations and a great surroundings.

On the battery aspect, discovering “pure play” lithium shares is much more difficult. There are many firms out there, however from an funding standpoint, there’s nonetheless a whole lot of uncertainty.

Whereas there very effectively could possibly be many “winners” within the trade over the long run, present traders will doubtless need to cope with substantial earnings volatility and excessive expectations in brief to intermediate time period. That is additional difficult as a result of the battery enterprise is mostly a small piece of a conglomerate firm.

Remaining Ideas

Lithium is right here to remain. There’s a motive that it has gained recognition, particularly within the final decade. It’s a flexible steel that has considerably improved how we work, talk and get round.

Furthermore, future demand seems sturdy because the transfer in the direction of cellular gadgets, renewable vitality, and electrical automobiles seems to be on the upswing (with the potential for a really lengthy tail).

Nonetheless, traders ought to recall this Ben Graham quote:

“Apparent prospects for bodily development in a enterprise don’t translate into apparent income for traders.”

The takeaway is two-fold.

Choosing a development trade, on the whole, is probably not notably troublesome. For example, it’s conceivable that simply earlier than (and even throughout) the ramp-up of trains, cars, planes, and the Web, a possible investor may level to those areas as “development industries.”

And certainly, they might have been right. For instance, an investor pointing to the Web within the mid-1990, for instance, would nonetheless be seeing that development trade play out as we speak.

But there are two issues.

First, selecting a development trade is probably not exceptionally troublesome, however selecting “winners” can take a look at the most effective analyst. Out of the auto or Web, only a handful of “winners” emerged, whereas tons of or 1000’s had been solid apart – as soon as hyped, as soon as with nice expectations, however ultimately for naught.

The second consideration is valuation.

Even when you do occur to choose the “winners,” you continue to need to be involved in regards to the value you pay. As a hypothetical, a safety buying and selling at, say, 40 instances earnings that develop by 10% yearly for a decade and later commerce at, say, 20 instances earnings would supply traders with returns of simply 2.6% per yr.

The consideration is not only, “will an organization develop?” however, extra importantly, “will it develop quick sufficient to justify the present valuation?” Expressed otherwise, will present traders seize their “justifiable share” of funding outcomes? We notice that Albemarle has traded with extraordinarily wealthy valuations in recent times, and whereas the corporate sports activities a terrific development profile, one wonders how a lot that may truly profit shareholders as we speak.

Moreover, whereas lithium seems poised to be in strong demand for the foreseeable future, you also needs to take into account the potential of new applied sciences coming alongside. Demand alone is thrilling however may result in surprising outcomes if it creates sufficient new entrants.

Total we’re upbeat on the steel and its prospects over the intermediate to long run, with the above caveats in thoughts.

Albemarle could possibly be the most effective inventory for revenue traders within the lithium trade. It derives a good portion of its income from lithium, it has stakes in necessary reserve areas all over the world, the dividend payout ratio is modest, and the corporate raises its dividend annually. The alternatives are restricted, given that the majority lithium and/or battery-focused shares are headquartered and traded outdoors the US.

We take into account many different lithium shares too dangerous, as there are various unknowns coupled with super expectations.

Different Dividend Lists

Worth investing is a beneficial course of to mix with dividend investing. The next lists comprise many extra high-quality dividend shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].